With respect toUnder Armourconduct an external analysis using the 5 forces model. To complete the task, you should answer the questions below. Remember to cite reference

1-Read the Live Case Study of Under Armour. Based on what you have read,what is the industry you should focus on to conduct the 5 forces model analysis?Explain your answer. (Live case study of Under Armour will be provided down below)

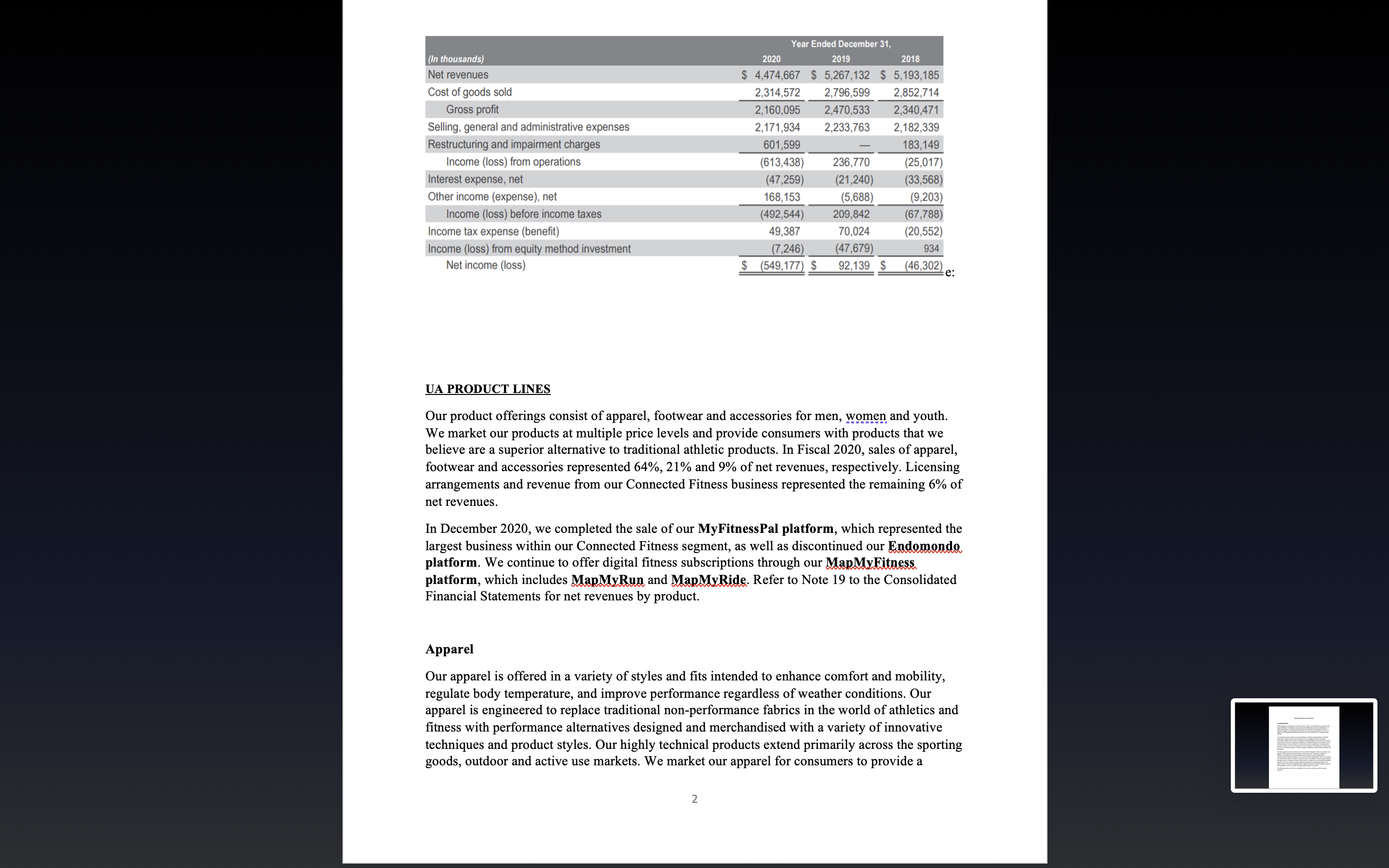

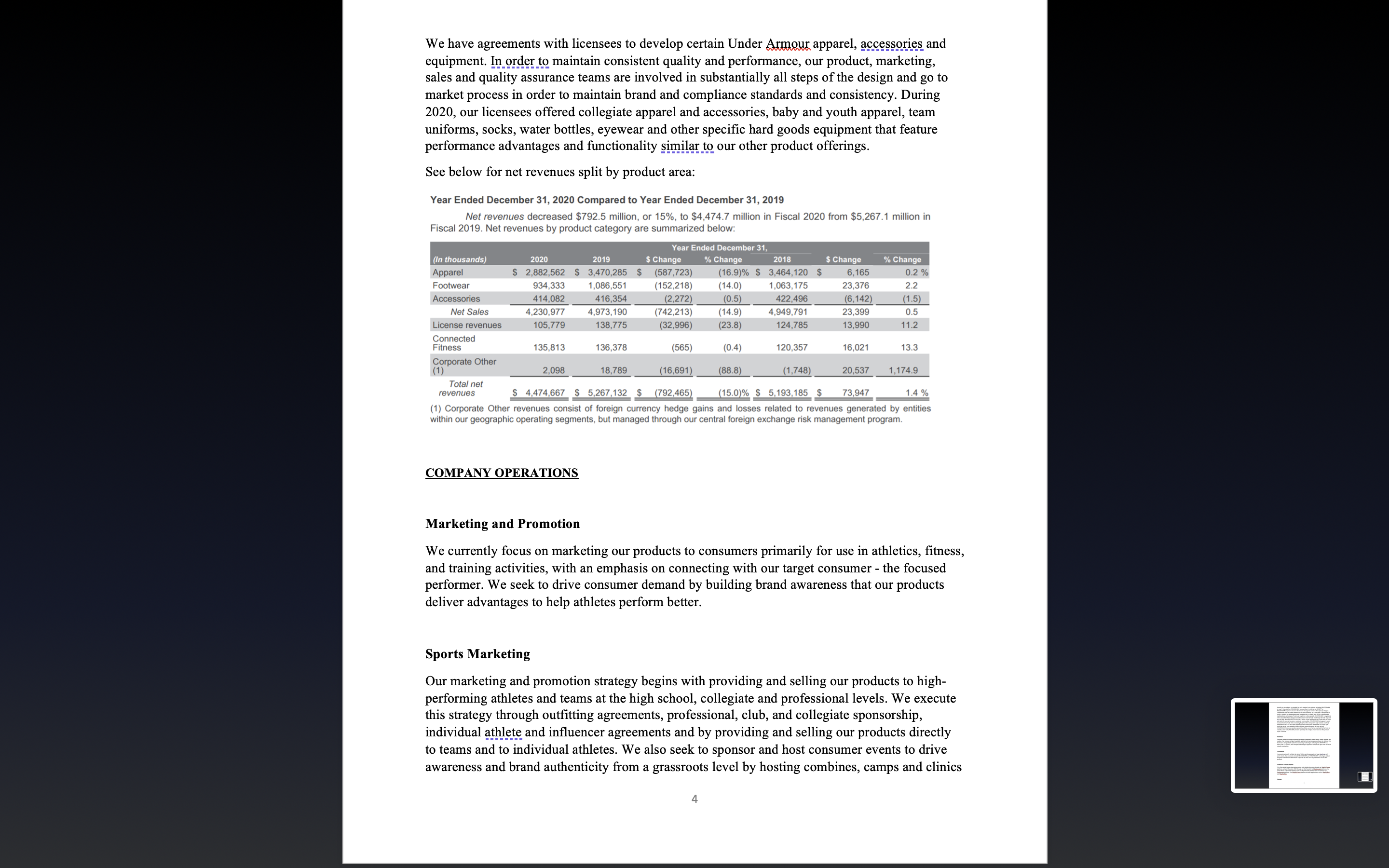

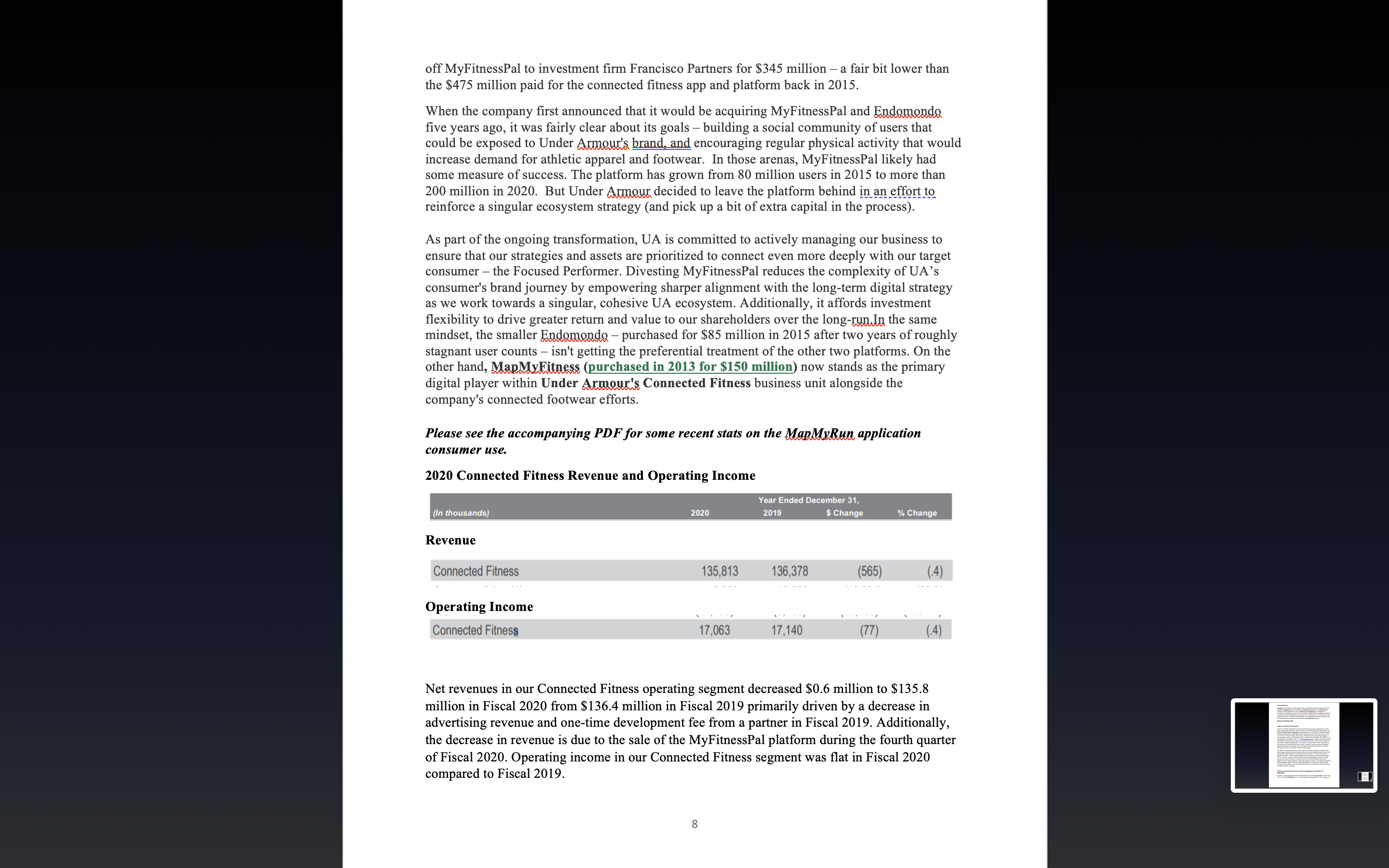

Fall 2021 Live Case Study Under Armour (UA) THE CHALLENGE Fall 2021 Live Case study concentrates on Under Armour's effort to get into the digital fitness app industry. The company has experienced some issues with the three fitness apps it has acquired a few years ago. Only one app - ManMyFitness - from the three is still in UA's portfolio. The executives would like you to evaluate the attractiveness of the digital fitness industry market for UA (1) and to evaluate MapMyFitness app (2). If you think that keeping ManMyFitness platform in the portfolio would benefit the company, develop a strategy to help UA increase its ROI from this app. If you think that UA should drop the app, develop an alternative strategy or suggest another app that would help the company stay current with digital/technological trends. Explain your suggestion and provide specific details on the replacement. The challenge is limited to the North America (USA and Canada) region.Information from UA Executives UA DESCRIPTION Under Whas one mission: to make you better. We have a commitment to innovation that lies at the heart of everything we do, not just for our athletes but also for our teammates. As a global organization, our teams around the world push boundaries and think beyond what is expected Together our teammates are unied by our Values and are grounded in our vision to inspire you with performance solutions you never knew you needed but can't imagine living without Our principal business activities are the development, marketing and distribution of branded performance apparel, footwear and accessories for men, groggy. and youth. The brand's performance apparel and footwear are engineered in many designs and styles for wear in nearly every climate to provide a performance alternative to traditional products. Our products are sold worldwide and are worn by athletes at all levels, from youth to professional, on playing elds around the globe, as well as by consumers with active lifestyles. We generate net revenues from the sale of our products globally to national, regional, independent and specialty wholesalers and distributors We also generate net revenue from the sale of our products through our direct-to-consumer sales channel, which includes our brand and factory house stores and e-commerce websites In addition, we generate net revenues through product licensing as well as digital tness subscriptions and digital advertising on our Connected Fitness applications. Most of our products are sold in North America We plan to continue to grow our business over the long term through increased sales of our apparel, footwear and accessories, expansion of our wholesale distribution, growth in our direct-to-consumer sales channel and expansion in international markets Our digital strategy is focused on supporting these long-term objectives, emphasizing the connection and engagement with our consumers through multiple digital touch points. The following table sets forth key components of our results of operations for the periods indicated: Year Ended December 31, {In thousands) 2020 2019 2013 Net revenues 5 4.474.667 3 5,267,132 5 5,193,185 Cost of goods sold 2, 4,572 2.796.599 2,852,714 Gross prot 2,160,095 2,470,533 2,340,471 Selling. general and administrative expenses 2,171,934 2.233.763 2,182,339 Restructuring and impeinnent charges 801,599 183,149 Income (loss) from operations (613,438) 236.770 (25,017) Interest expense. net (47.259) (21,240) (33,588) Other income (expense), net 168,153 (5.688) (9,203) Income (loss) before income taxes (492.544) 209,842 (67,788) Income tax expense (benet) 49, 387 70.024 (20,552) Income (loss) from equity method investment (7,246) (47,679) 934 Net income (loss) $ 549,177 $ 9 139 5 46,302 e: UA PRODUCT LINES Our product offerings consist of apparel, footwear and accessories for men, won-ten and youth. We market our products at multiple price levels and provide consumers with products that we believe are a superior alternative to traditional athletic products. In Fiscal 2020, sales of apparel, footwear and accessories represented 64%, 21% and 9% of net revenues, respectively, Licensing arrangements and revenue from our Connected Fitness business represented the remaining 6% of net revenues. In December 2020, we completed the sale of our MyFitnessPal platform, which represented the largest business within our Connected Fitness segment, as well as discontinued our W platform. We continue to offer digital tness subscriptions through our W platform, which includes MW and W. Refer to Note 19 to the Consolidated Financial Statements for net revenues by product. Apparel Our apparel is offered in a variety of styles and ts intended to enhance comfort and mobility, regulate body temperature, and improve performance regardless of weather conditions. Our apparel is engineered to replace traditional non-performance fabrics in the world of athletics and tness with performance alternatives designed and merchandised with a variety of innovative techniques and product styles. Our highly technical products extend primarily across the sporting goods, outdoor and active use markets. We market our apparel for consumers to provide a benefit you never knew you needed, but can't imagine living without, including HEATGEAR to wear 2 when it is hot COLDGEAR to wear when it is cold, or our RUSHTM or RECOVERTM designed to increase blood ow. Our apparel comes in three primary fit types: compression (tight fit), tted (athletic fit) and loose (relaxed). HEATGEAR is designed to be worn in warm to hot temperatures under equipment or as a single layer. While a sweat-soaked traditional non-performance T-shirt can weigh two to three pounds, HEATGEAR is engineered with a microber blend designed to wick moisture from the body which helps the body stay cool, dry and light. We offer HEATGEAR in a variety of tops and bottoms in a broad array of colors and styles for wear in the gym or outside in warm weather. COLDGEAR is designed to wick moisture from the body while circulating body heat from hot spots to help maintain core body temperature. Our COLDGEAR apparel provides both dryness and warmth in a single light layer that can be worn beneath a jersey, uniform, protective gear or ski-vest, and our COLDGEAR outerwear products protect the athlete, as well as the coach and the fan from the outside in. Our COLDGEAR products generally sell at higher prices than our other product styles. Footwear Footwear Footwear primarily includes products for running, basketball, cleated sports, slides, training, and outdoor. Our footwear is light, breathable, and built with performance attributes for athletes Our footwear is designed with under-foot cushioning technologies including UA HOVRTM, UA Micro G, UA Flown\We have agreements with licensees to develop certain Under Armour apparel, accessories and equipment. In order to maintain consistent quality and performance, our product, marketing, ales and quality assurance teams are involved in substantially all steps of the design and go to market process in order to maintain brand and compliance standards and consistency. During 020, our licensees offered collegiate apparel and accessories, baby and youth apparel, team uniforms, socks, water bottles, eyewear and other specific hard goods equipment that feature performance advantages and functionality similar to our other product offerings. See below for net revenues split by product area: Year Ended December 31, 2020 Compared to Year Ended December 31, 2019 Net revenues decreased $792.5 million, or 15%, to $4,474.7 million in Fiscal 2020 from $5,267.1 million in Fiscal 2019. Net revenues by product category are summarized below: Year Ended December 3 (In thousands) 2020 2019 $ Change % Change 2018 $ Change % Change Apparel $ 2,882,562 $ 3,470,285 $ (587,723) (16.9)% $ 3,464,120 $ 6,165 0.2% Footwear 934,333 1,086,551 152,218) (14.0) 1,063,175 23,376 2.2 Accessories 414,082 416,354 (2,272) (0.5) 422,496 (6,142) (1.5) Net Sales 4,230,977 4,973, 190 742,213) (14.9 4,949,791 23,399 0.5 License revenues 105,779 138,775 (32,996) (23.8) 124,785 13,990 11.2 Connected Fitness 135,813 136,378 (565) (0.4) 120,357 16,021 13.3 Corporate Other (1) 2,098 18,789 (16,691) (88.8) (1,748) 20,537 1,174.9 Total ne revenues $ 4,474.667 $ 5,267.132 $ (792,465) (15.0)% $ 5,193,185 $ 73,947 (1) Corporate Other revenues consist of foreign currency hedge gains and losses related to revenues generated by entities within our geographic operating segments, but managed through our central foreign exchange risk management program. COMPANY OPERATIONS Marketing and Promotion We currently focus on marketing our products to consumers primarily for use in athletics, fitness, and training activities, with an emphasis on connecting with our target consumer - the focused performer. We seek to drive consumer demand by building brand awareness that our products deliver advantages to help athletes perform better. Sports Marketing Our marketing and promotion strategy begins with providing and selling our products to high- performing athletes and teams at the high school, collegiate and professional levels. We execute this strategy through outfitting agreements, professional, club, and collegiate sponsorship, individual athlete and influencer agreements and by providing and selling our products directly to teams and to individual athletes. We also seek to sponsor and host consumer events to drive awareness and brand authenticity from a grassroots level by hosting combines, camps and clinicsfor young athletes in many sports. As a result, our products are seen on the field and on the court, and by various consumer audiences through the internet, television, magazines and live at sporting events. This exposure to consumers helps us establish on-field authenticity as consumers can see our products being worn by high-performing athletes. We are the official outfitter of athletic teams in several high-profile collegiate conferences as well as multiple professional sport organizations supporting the athletes on and off the field. We sponsor and sell our products to international sports teams, which helps to drive brand awareness in various countries and regions around the world. Media We feature our products in a variety of national digital, broadcast, and print media outlets. We also utilize social and mobile media to engage consumers and promote connectivity with our brand and our products while engaging with our consumer throughout their performance journey. For example, in the first quarter of Fiscal 2020 we launched a new brand campaign, "The Only Way Is Through", which was introduced during a Performance Summit with over 180 social media influencers and was re-activated through brand authentic moments across the calendar year. Additionally, during the initial wave of the COVID-19 pandemic, we transitioned our campaign from "The Only Way is Through" to "Through This Together" that provided consumers with at home workout solutions across various digital platforms. Retail Presentation The primary goal of our retail marketing strategy is to increase brand floor space dedicated to our products within our major retail accounts. The design and funding of Under Armour point of sale displays and concept shops within our major retail accounts has been a key initiative for securing prime floor space, educating the consumer and creating an exciting environment for the consumer to experience our brand. Under Armour point of sale displays and concept shops enhance our brand's presentation within our major retail accounts with a shop-in-shop approach, using dedicated floor space exclusively for our products, including flooring, lighting, walls, displays and images. Sales and Distribution The majority of our sales are generated through wholesale channels, which include national and regional sporting goods chains, independent and specialty retailers, department store chains, mono-branded Under Armour, retail stores in certain international markets, institutional athletic departments and leagues and teams. In various countries where we do not have direct sales operations, we sell our products to independent distributors or we engage licensees to sell our products. We also sell our products directly to consumers through our own network of brand and factory house stores and through e-commerce websites globally. Factory house store products are specifically designed for sale in our factory house stores and serve an important role in our overall inventory management by allowing us to sell a portion of excess, discontinued and out-of-season products, while maintaining the pricing integrity of our brand in our other distribution channels. Through our brand house stores, consumers experience the premium full expression of our brand while having broader access to our performance products. In Fiscal 2020, sales through our wholesale, direct-to-consumer . g and Connected Fitness channels represented 53%, 41%, 2% and 3% of net rev , respectively. We believe the trend toward performance products is global and plan to continue to introduce our products and simple merchandising story to athletes throughout the world. We plan to continue to grow our business over the long term in part through continued expansion in new and established international markets. We are introducing our performance products and services outside of North America in a manner consistent with our past brand-building strategy, thereby providing us with product exposure to broad audiences of potential consumers. Our primary business operates in four geographic segments: (1) North America, comprising the United States and Canada, (2) Europe, the Middle East and Africa ("EMEA"), (3) Asia-Pacic, and (4) Latin America. Each of these geographic segments operate predominantly in one industry: the development, marketing and distribution of branded performance apparel, footwear and accessories. We also operate our Connected Fitness business as a separate segment, Despite these multiple business lines, this case concentrates only on the digital tness apps and is limited to the North America region. North America We sell our apparel, footwear" and accessories in North America through our wholesale and direct-to consumer channels. Net revenues generated from the sales of our products in the United States were $2.7 billion and $3.4 billion for Fiscal 2020 and 2019, respectively. Our direct-to- consumer sales are generated through our brand and factory house stores and e-commerce website. As of December 31, 2020, we had 176 factory house stores in North America primarily located in outlet centers throughout the United States and Canada. As of December 31, 2020, we had 18 brand house stores in North America throughout the United States and Canada. Consumers can purchase our products directly from our e-commerce website, www,underarmour.com. In addition, we earn licensing revenue in North America based on our licensees' sale of collegiate apparel and accessories, as well as sales of other licensed products, We distribute th_e_!r_r_a_j_qr_i_q_qf our products sold to our North American wholesale customers and our own retail stores and e-commerce businesses from distribution facilities we lease and operate in California, Maryland and Tennessee. In addition, we distribute our products in North America Florida. In some instances, we arrange to have products shipped from the factories that manufacture our products directly to customer-designated facilities. Connected Fitness WFiscal 2020, we offered digital tness subscriptions, along with digital advertising through our Wham MyFitnessPal and Wplatfoms' Our moms platform includes applications, such as W and MW We engage this community by developing innovative services and other digital solutions to impact how athletes and fitness-minded individuals train, perform and lives As noted above, in December 2020, we completed the sale of our MyFitnessPal platform, which represented the largest business within our Connected Fitness segment and discontinued our mm platform. DIGITAL FITNESS APPS Original Acquisitions and Intention In 2015, UA laid the groundwork for the Connected Fitness business, assembling the world's largest digital health and tness community across three mobile application platforms that were acquired: W W and MyFitnessPal. UA ended 2015 with approximately 160 million registered users that logged nearly 8 billion meals and 2 billion activities over the course of 2015. With an average of more than 100 thousand new users joining m we have positioned ourselves at the epicenter of the consumer's active lifestyle. As a result, we are becoming part of the athlete's life, 24/7. mm; to tness and nutrition, we are individually interacting with our consumer, turning their data into a call to action in support of our mission to make all athletes betterl The vision is to use this data to create a single view of the consumer that combines global point-of-sale, e-commerce, and transactional information through a single sign-on capability. We can then match this information with our Connected Fitness data to create a truly unique consumer insight engine. UA efforts in Connected Fitness not only provide us with better information to help us make better business decisions and build better products, but help athletes make better choices in their own personal health and tness, to ultimately enrich their lives. To be clear, this was not a technology initiative This is a digital transformation, and therefore a business transformation for UAl The View is that the Connected Fitness business hasth-eua-b-ili-tylth enhance all of the growth drivers that we laid out 15 years ago and are still our growth drivers today: men's apparel, women's apparel, footwear, international, direct-to-consumer, The intent of purchasing and developing the apps was that the deeper understanding of our consumer gained through Connected Fitness informs our business decisions across our growth drivers, ultimately leading to selling more shirts and shoes. 2020 Divestment g MyFitnessPal, Closing of W Recommitment To mm In 2020, UA [I] to divest MyFitnessPal and shut down Why end-of-year 2021, leaving on y W as UA's digital application going forward. Under Msold off MyFitnessPal to investment firm Francisco Partners for $345 million a fair bit lower than the $475 million paid for the connected fitness app and platform back in 2015' When the company first announced that it would be acquiring MyFitnessPal and WW9 ve years ago, it was fairly clear about its goals building a social community of users that could be exposed to Under Wm encouraging regular physical activity that would increase demand for athletic apparel and footwear. In those arenas, MyFitnessPal likely had some measure of success The platform has grown from 80 million users in 2015 to more than 200 million in 2020. But Under mdecided to leave the platform behind ii_1__a_ti effort _t_o_ reinforce a singular ecosystem strategy (and pick up a bit of extra capital in the process} As part of the ongoing transformation, UA is committed to actively managing our business to ensure that our strategies and assets are prioritized to connect even more deeply with our target consumer the Focused Performer, Divesting MyFitnessPal reduces the complexity of UA's consumer's brand journey by empowering sharper alignment with the long-term digital strategy as we work towards a singular, cohesive UA ecosystem, Additionally, it affords investment exibility to drive greater return and value to our shareholders over the long-W the same mindset, the smaller W purchased for $85 million in 2015 after two years of roughly stagnant user counts isn't getting the preferential treatment of the other two platforms On the other hand, W (purchased in 2013 for $150 million) now stands as the primary digital player within Under W Connected Fitness business unit alongside the company's connected footwear efforts. Please see the accompanying PDFfar some recent stats an the m application consumer use. 2020 Connected Fitness Revenue and Operating Income Year Ended December 31, {in thousands} 2m 2019 x Change /. Chang- Revenue Connected Fitness 135,813 136,378 (565) (.4) Operating Income Connected Fines: V17,063' 17,140, V (771 i (.41 Net revenues in our Connected Fitness operating segment decreased $016 million to $13518 million in Fiscal 2020 from $136.4 million in Fiscal 2019 primarily driven by a decrease in advertising revenue and one-time development fee 'om a partner in Fiscal 2019' Additionally, the decrease in revenue is due to the sale of the MyFilnessPal platform during the fourth quarter of Fiscal 2020' Operating income in our Connected Fitness segment was at in Fiscal 2020 compared to Fiscal 2019' Table 1 - Five Forces Model Name of Force Definition of Force Strength of force Explanation (with citations) (with citation if Scale 1 to 5 applicable) 1= very low and 5 = very high Threat of new entrants Bargaining power of buyers Bargaining power of suppliers Threat of substitutes Rivalry