Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Turner Corporation is considering the replacement of some equipment by a more efficient, technologically advanced model. The new equipment costs $100,000, but the vendor

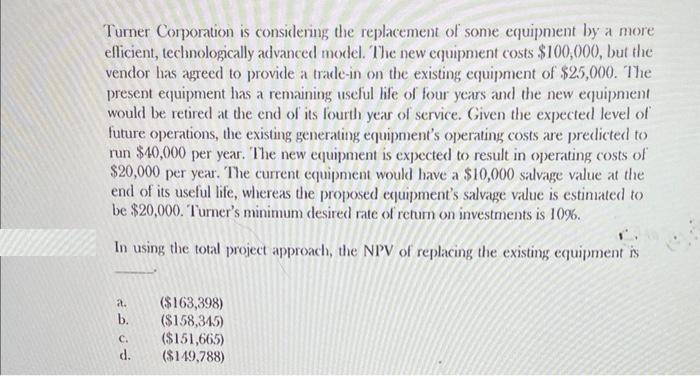

Turner Corporation is considering the replacement of some equipment by a more efficient, technologically advanced model. The new equipment costs $100,000, but the vendor has agreed to provide a trade-in on the existing equipment of $25,000. The present equipment has a remaining useful life of four years and the new equipment would be retired at the end of its fourth year of service. Given the expected level of future operations, the existing generating equipment's operating costs are predicted to run $40,000 per year. The new equipment is expected to result in operating costs of $20,000 per year. The current equipment would have a $10,000 salvage value at the end of its useful life, whereas the proposed equipment's salvage value is estimated to be $20,000. Turner's minimum desired rate of return on investments is 10%. In using the total project approach, the NPV of replacing the existing equipment is a. b. C. d. ($163,398) ($158,345) ($151,665) ($149,788)

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

2 Step By Step Step 1 Expected cash flows from depreciation must be ad...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started