Answered step by step

Verified Expert Solution

Question

1 Approved Answer

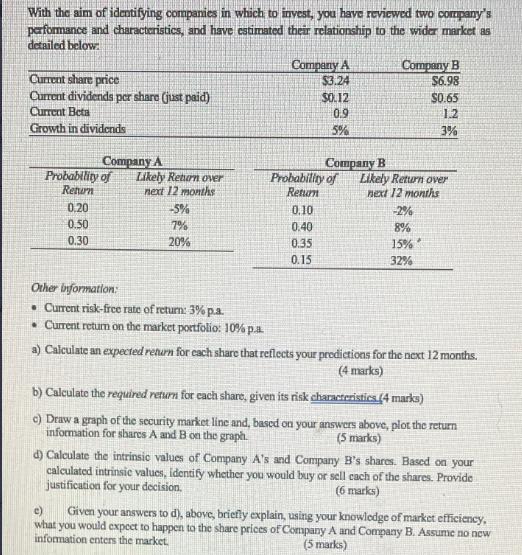

With the aim of identifying companies in which to invest, you have reviewed two company's performance and characteristics, and have estimated their relationship to

With the aim of identifying companies in which to invest, you have reviewed two company's performance and characteristics, and have estimated their relationship to the wider market as detailed below: Current share price Current dividends per share (just paid) Current Beta Growth in dividends Company A Probability of Likely Return over Return next 12 months 0,20 0.50 0.30 -5% 7% 20% Other information: . Current risk-free rate of return: 3% p.a. . Current return on the market portfolio: 10% p.a. Company A $3.24 $0.12 0.9 5% 0.10 0.40 0.35 0.15 Company B $6.98 $0.65 1.2 Company B Probability of Likely Return over Return next 12 months 3% -2% 8% 15% 32% Calculate an expected return for each share that reflects your predictions for the next 12 months. (4 marks) b) Calculate the required return for each share, given its risk characteristics (4 marks) c) Draw a graph of the security market line and, based on your answers above, plot the return information for shares A and B on the graph. (5 marks) d) Calculate the intrinsic values of Company A's and Company B's shares. Based on your calculated intrinsic values, identify whether you would buy or sell cach of the shares. Provide justification for your decision. (6 marks) c) Given your answers to d), above, briefly explain, using your knowledge of market efficiency, what you would expect to happen to the share prices of Company A and Company B. Assume no new information enters the market. (5 marks)

Step by Step Solution

★★★★★

3.29 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

It seems that youve presented a finance problem that involves comparing the current share prices dividends and risk beta of two companies Company A and Company B To address each of the parts listed in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started