Answered step by step

Verified Expert Solution

Question

1 Approved Answer

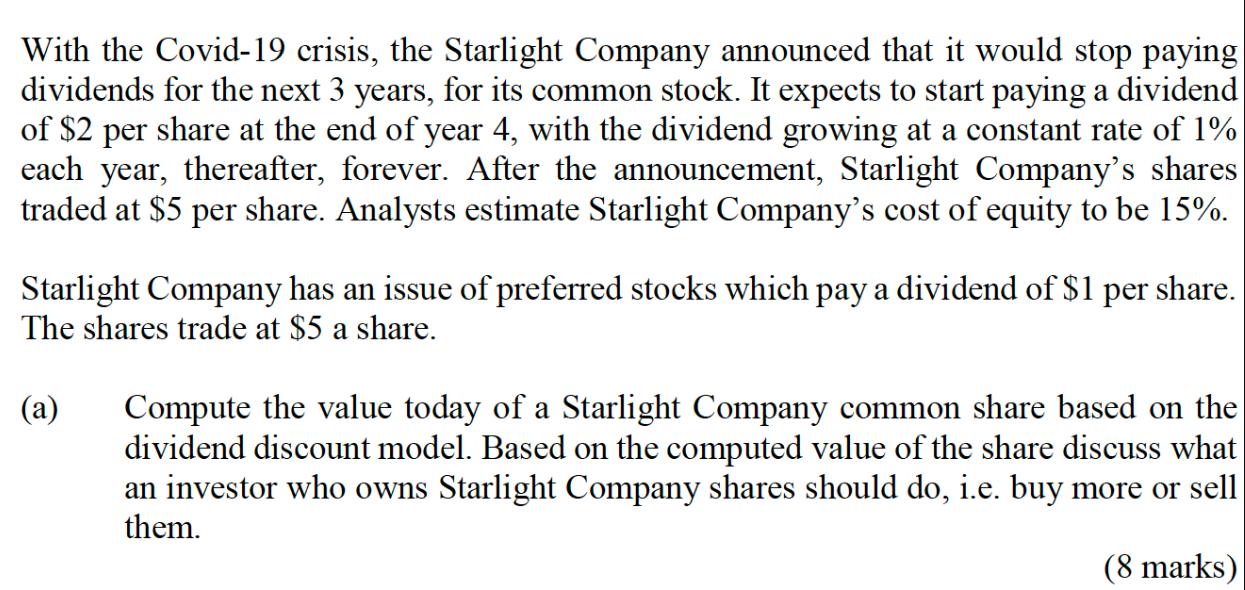

With the Covid-19 crisis, the Starlight Company announced that it would stop paying dividends for the next 3 years, for its common stock. It

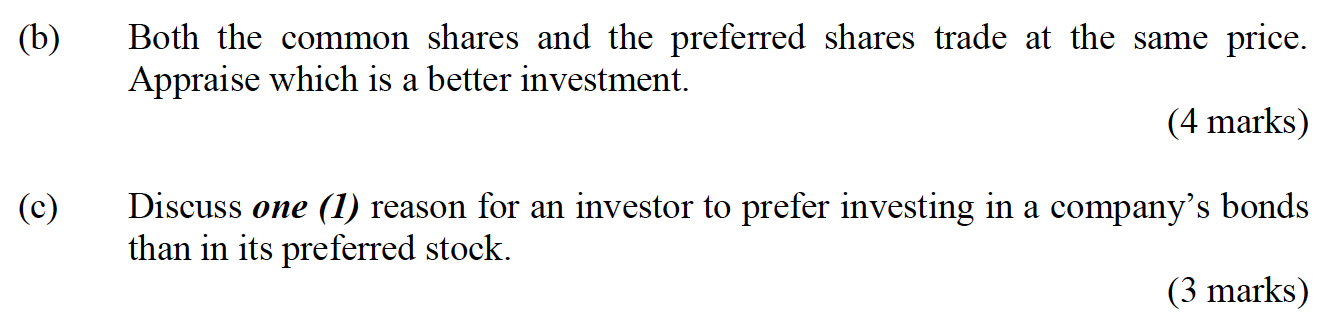

With the Covid-19 crisis, the Starlight Company announced that it would stop paying dividends for the next 3 years, for its common stock. It expects to start paying a dividend of $2 per share at the end of year 4, with the dividend growing at a constant rate of 1% each year, thereafter, forever. After the announcement, Starlight Company's shares traded at $5 per share. Analysts estimate Starlight Company's cost of equity to be 15%. Starlight Company has an issue of preferred stocks which pay a dividend of $1 per share. The shares trade at $5 a share. (a) Compute the value today of a Starlight Company common share based on the dividend discount model. Based on the computed value of the share discuss what an investor who owns Starlight Company shares should do, i.e. buy more or sell them. (8 marks) (b) (c) Both the common shares and the preferred shares trade at the same price. Appraise which is a better investment. (4 marks) Discuss one (1) reason for an investor to prefer investing in a company's bonds than in its preferred stock. (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To compute the value of a Starlight Company common share based on the dividend discount model we need to use the following formula P D1 r g Where P ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started