With the following information:

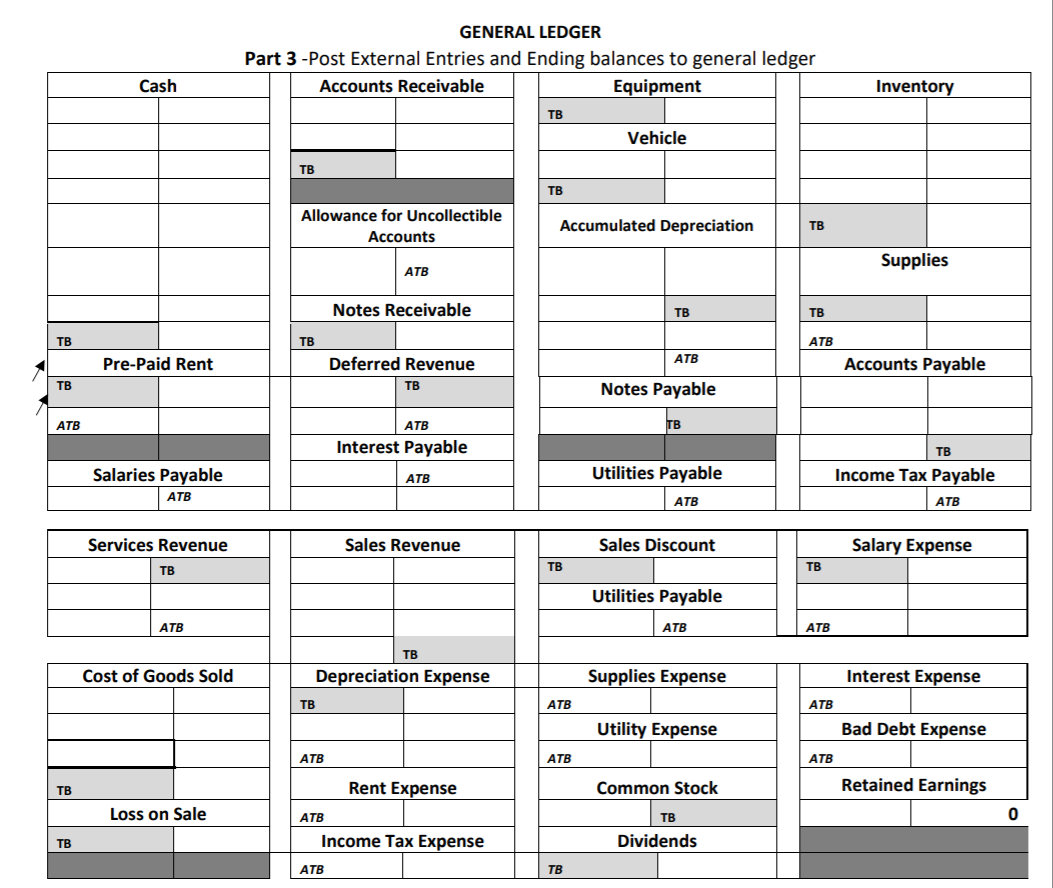

Please fill out the table below:

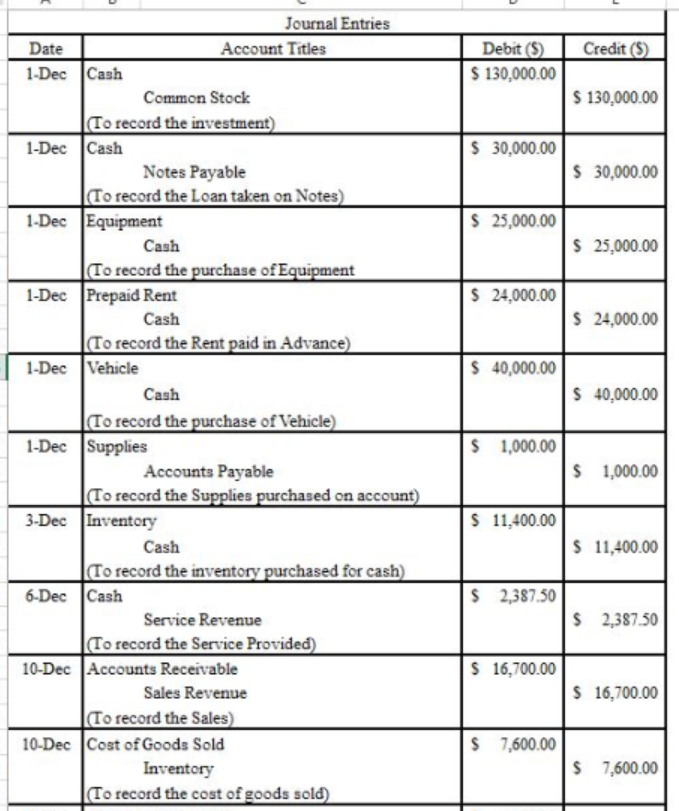

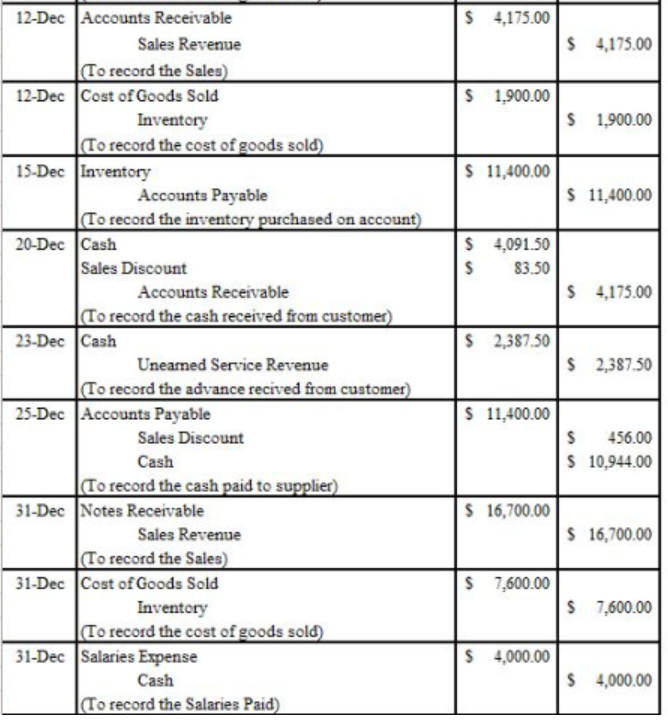

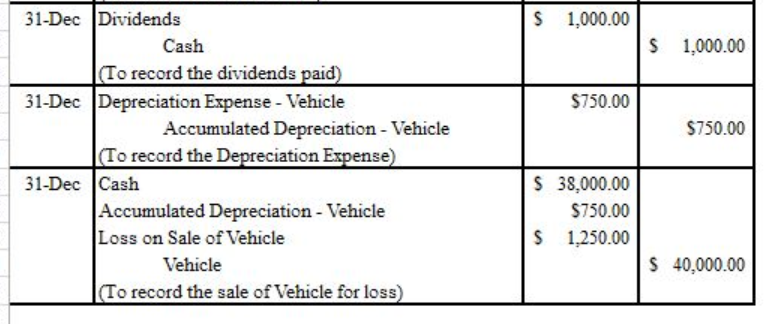

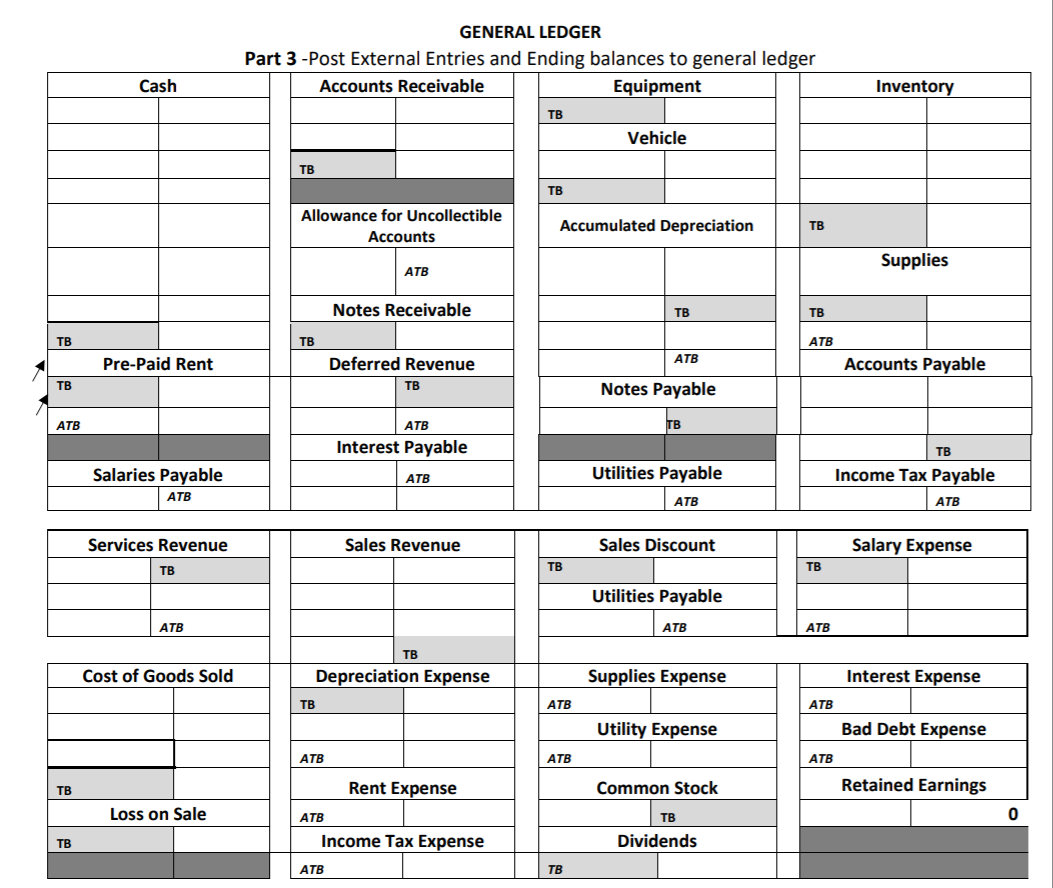

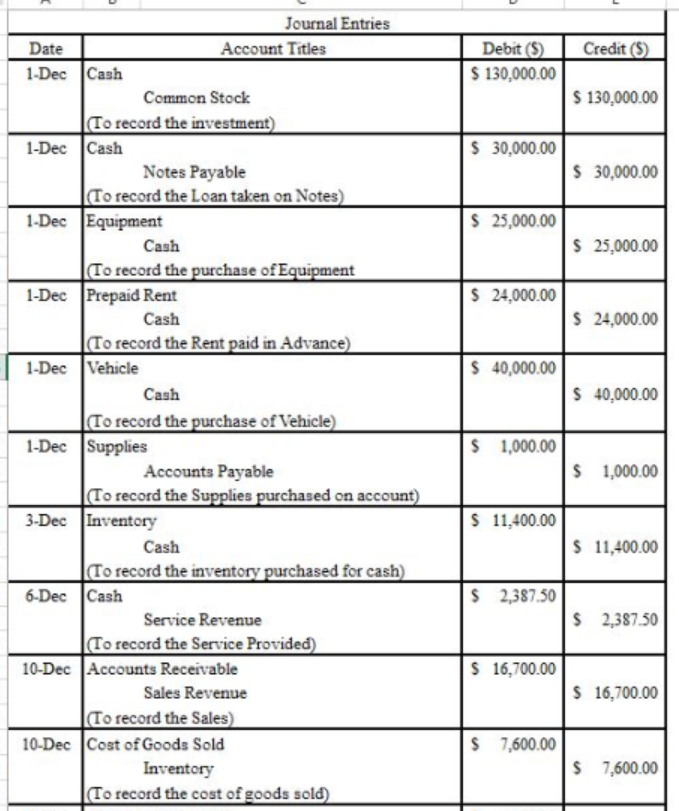

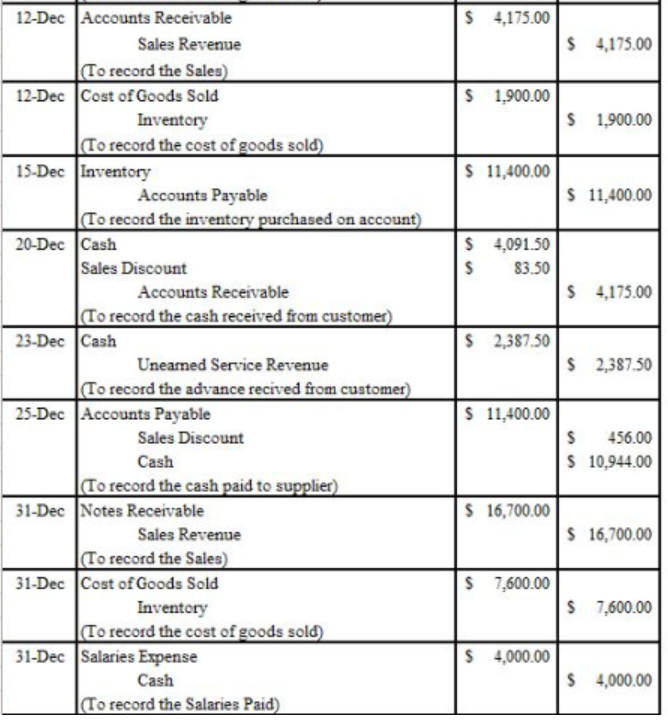

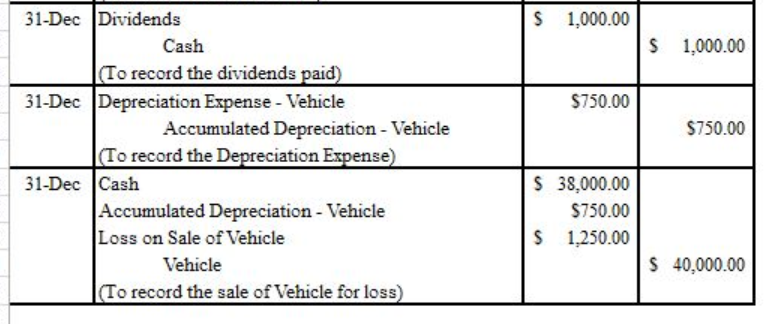

Journal Entries Account Titles Debit (S) Credit (S) Date 1-Dec Cash $130,000.00 $ 130,000.00 Common Stock To record the investment) 1-Dec Cash $ 30,000.00 $ 30,000.00 Notes Payable To record the Loan taken on Notes) 1-Dec Equipment $ 25,000.00 $ 25,000.00 Cash To record the purchase of Equipment 1-Dec Prepaid Rent $ 24,000.00 $ 24,000.00 Cash To record the Rent paid in Advance) 1-Dec Vehicle $ 40,000.00 $ 40,000.00 Cash To record the purchase of Vehicle) 1-Dec Supplies S 1,000.00 $ 1,000.00 Accounts Payable To record the Supplies purchased on account) 3-Dec Inventory $ 11,400.00 $ 11,400.00 Cash To record the inventory purchased for cash) 6-Dec Cash $ 2,387.50 $ 2,387.50 Service Revenue (To record the Service Provided) 10-Dec Accounts Receivable S 16,700.00 $ 16,700.00 Sales Revenue To record the Sales) 10-Dec Cost of Goods Sold S 7,600.00 $ 7,600.00 Inventory To record the cost of goods sold) 12-Dec Accounts Receivable $ 4,175.00 $ 4,175.00 Sales Revenue To record the Sales) 12-Dec Cost of Goods Sold Inventory To record the cost of goods sold) 15-Dec Inventory $1,900.00 $ 1,900.00 $ 11,400.00 S 11,400.00 Accounts Payable To record the inventory purchased on account 20-Dec Cash Sales Discount $ 4,091.50 83.50 $ 4,175.00 Accounts Receivable To record the cash received from customer) 23-Dec Cash $ 2,387.50 S 2,387.50 Uneamed Service Revenue |To record the advance recived from customer) 25-Dec Accounts Payable $11,400.00 Sales Discount 456.00 $ 10,944.00 Cash To record the cash paid to supplier) 31-Dec Notes Receivable $16,700.00 $ 16,700.00 Sales Revenue To record the Sales) 31-Dec Cost of Goods Sold Inventory To record the cost of goods sold) 31-Dec Salaries Expense $ 7,600.00 $ 7,600.00 $ 4,000.00 $ 4,000.00 Cash |(To record the Salaries Paid) 31-Dec Dividends S 1,000.00 S 1,000.00 Cash (To record the dividends paid) 31-Dec Depreciation Expense - Vehicle $750.00 Accumulated Depreciation Vehicle To record the Depreciation Expense) 31-Dec Cash Accumulated Depreciation- Vehicle Loss on Sale of Vehicle $750.00 S 38,000.00 $750.00 S 1,250.00 S 40,000.00 Vehicle To record the sale of Vehicle for loss) GENERAL LEDGER Part 3 -Post External Entries and Ending balances to general ledger Cash Equipment Accounts Receivable Inventory Vehicle TB TB Allowance for Uncollectible Accumulated Depreciation Accounts Supplies ATB Notes Receivable TB TB ATB ATB Accounts Payable Deferred Revenue Pre-Paid Rent TB Notes Payable TB ATB ATB Interest Payable Utilities Payable Salaries Payable Income Tax Payable ATB ATB ATB ATB Salary Expense Services Revenue Sales Revenue Sales Discount TB TB Utilities Payable ATB ATB ATB Depreciation Expense Supplies Expense Cost of Goods Sold Interest Expense ATB Utility Expense Bad Debt Expense ATB ATB ATB Retained Earnings Rent Expense Common Stock TB Loss on Sale 0 ATB Income Tax Expense Dividends ATB