WITH THE IMAGES POSTED BELOW CAN YOU GIVE ME A DETAILED ANAYSIS OR EXPLAINATION ON HOW THE COMPANY ARIBNB TREATS OR DEAL WITH INTANGIBLE ASSETS/

WITH THE IMAGES POSTED BELOW CAN YOU GIVE ME A DETAILED ANAYSIS OR EXPLAINATION ON HOW THE COMPANY ARIBNB TREATS OR DEAL WITH INTANGIBLE ASSETS/ AMORITIZATION. I JUST NEED A BREIF EXPLAINATION TO WHATS GOING AND HOW THEY DEALT WITH INTANGIBLE ASSETS/ AMORITIZATION BASED OFF THE IMAGES BELOW. I AM NOT LOOKING FOR A PERFECT ANSWER BUT YOUR BEST RESPONSE BASED OFF WHAT YOU SEE AS FAR INTANGIBLE ASSETS/ AMORITIZATION GO.

BASED OFF YOUR OBSERVATION OF THE IMAGES WHAT CAN YOU TELL ME ABOUT HOW THIS COMPANY DEALS WITH INTANGIBLE ASSESTS/AMORITIZATION

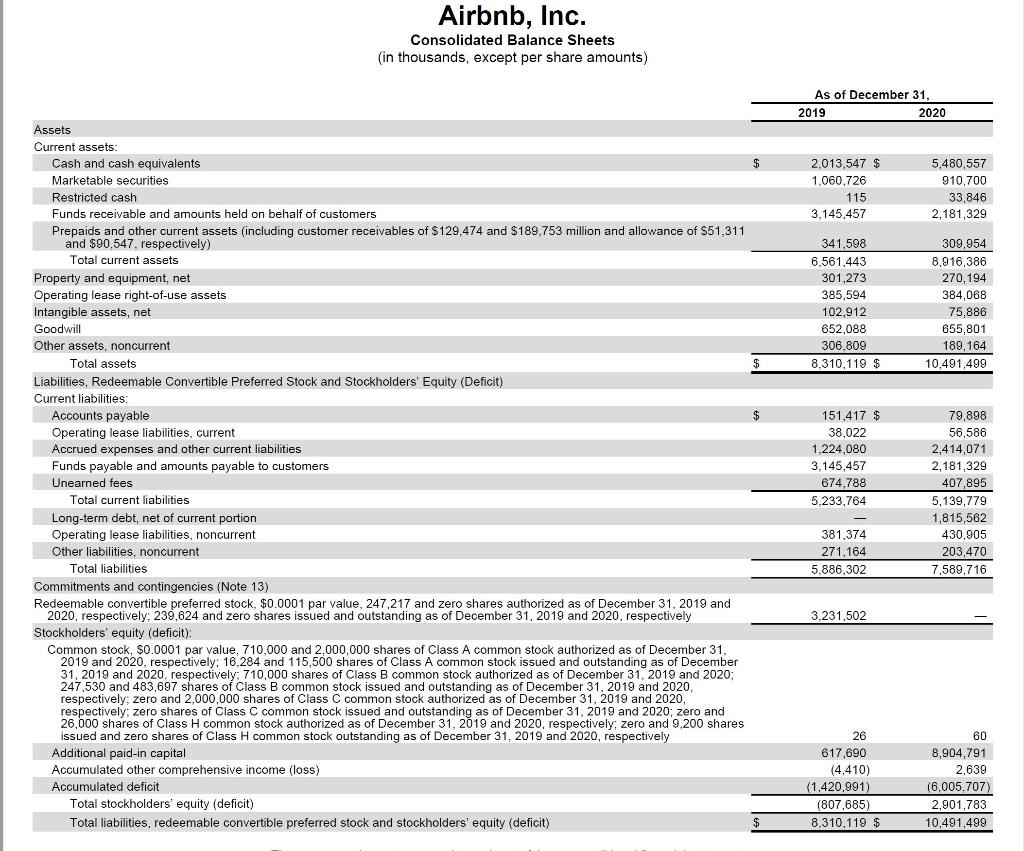

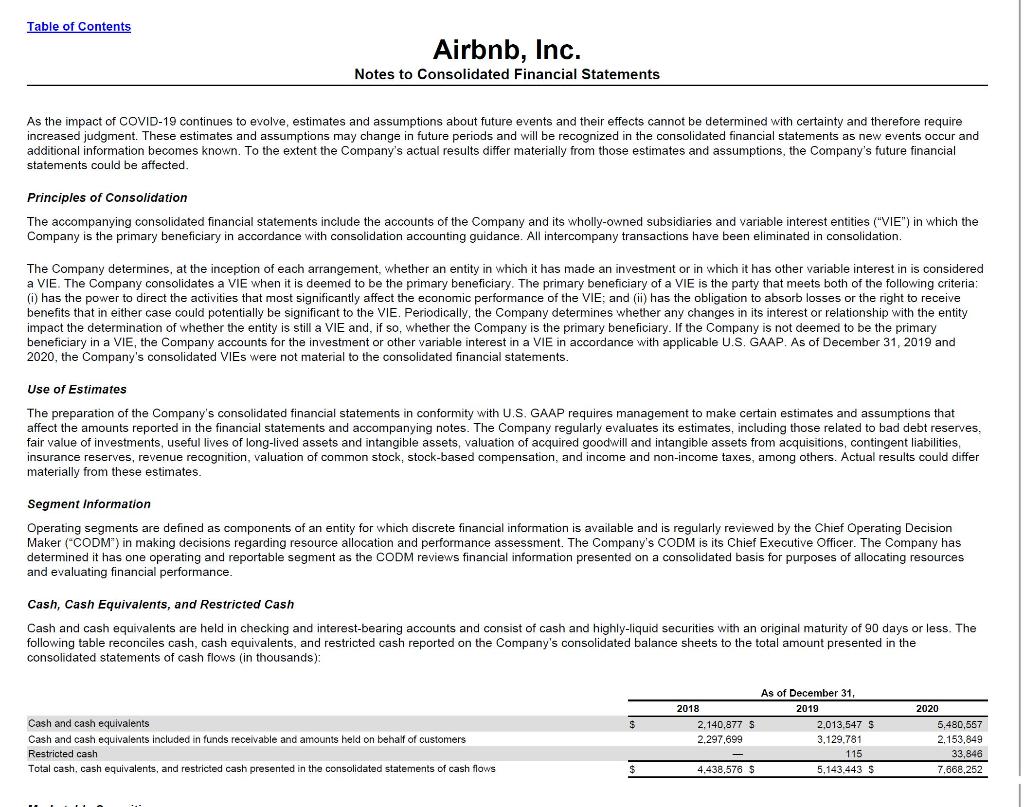

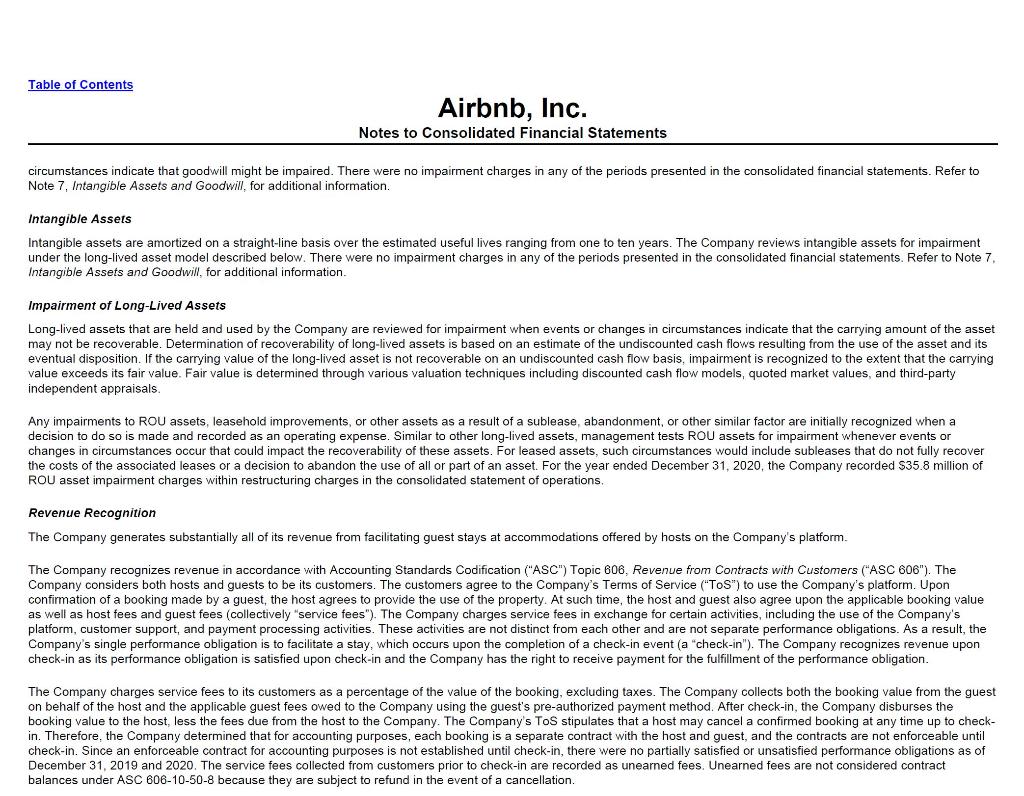

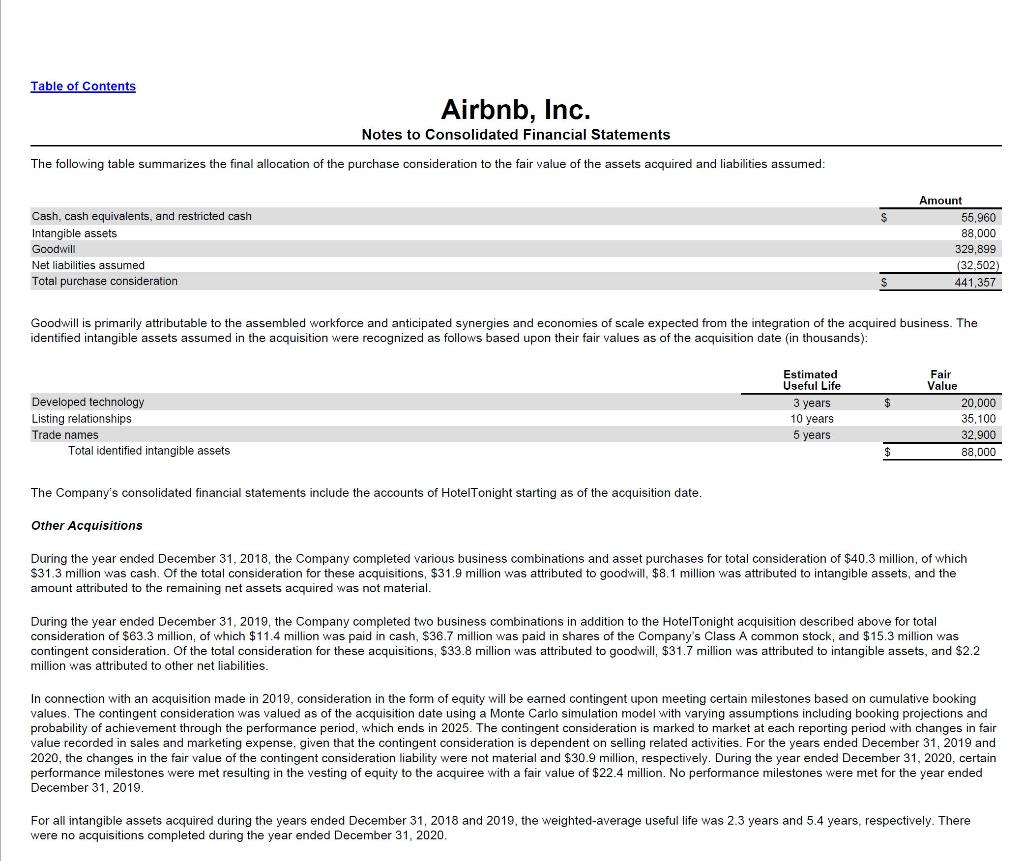

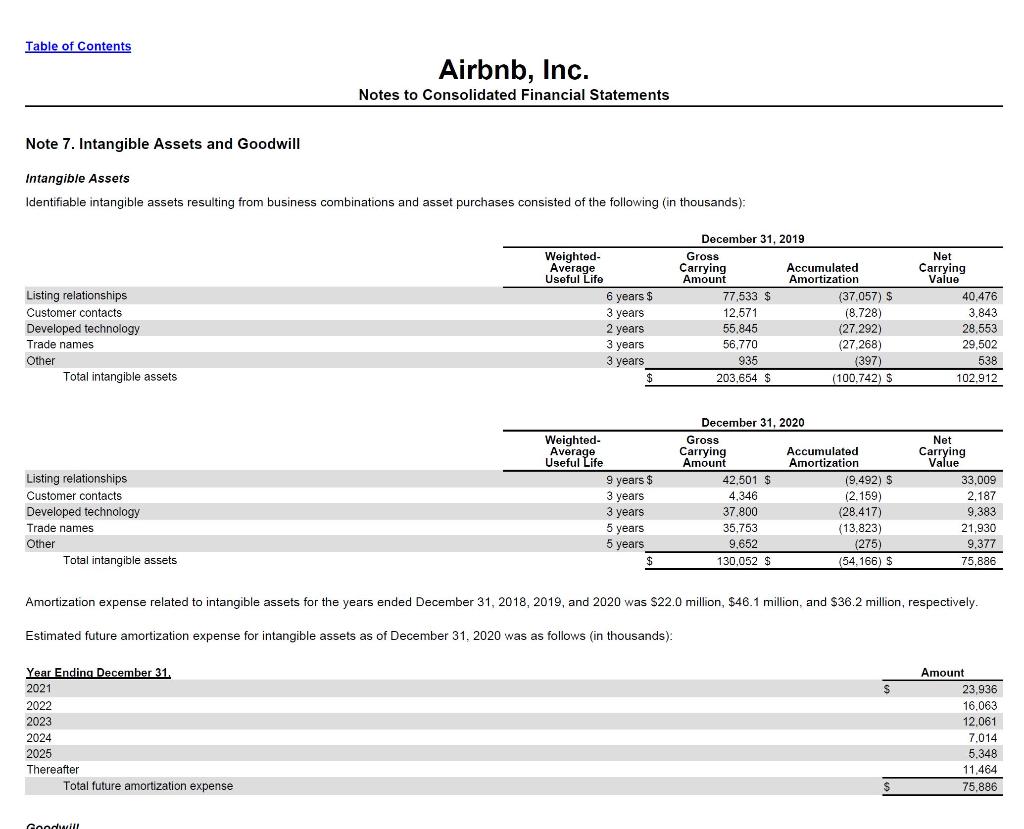

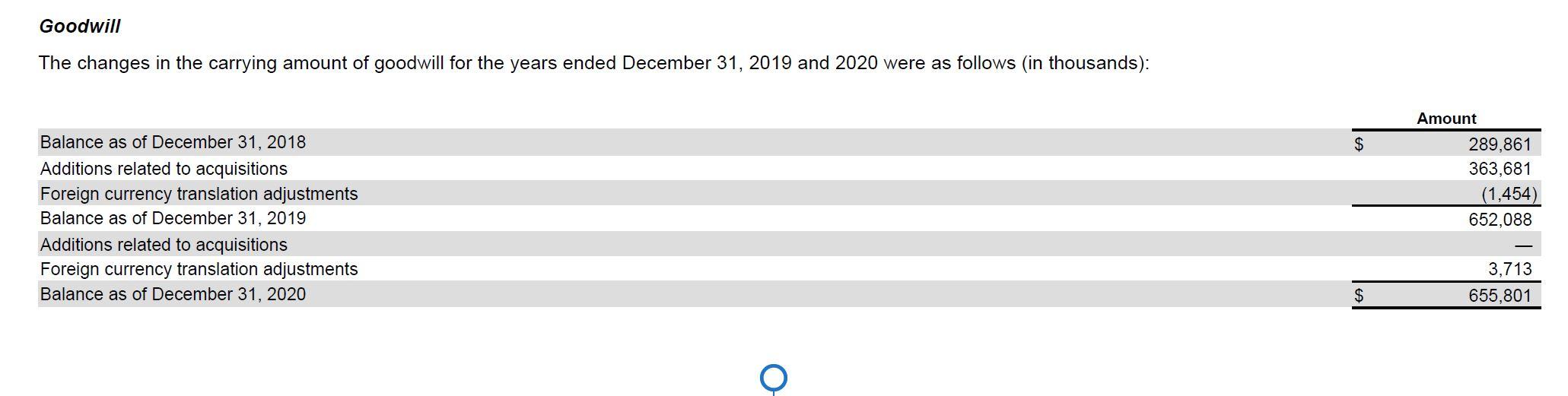

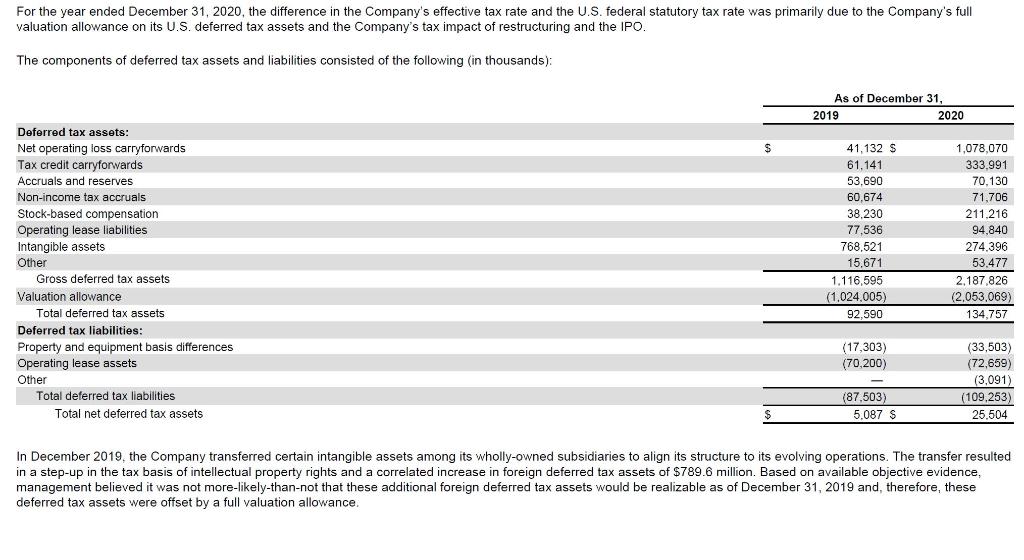

Assets Current assets: Cash and cash equivalents Marketable securities Restricted cash Funds receivable and amounts held on behalf of customers Prepaids and other current assets (including customer receivables of $129,474 and $189,753 million and allowance of $51,311 and $90,547, respectively) Total current assets Airbnb, Inc. Consolidated Balance Sheets (in thousands, except per share amounts) Property and equipment, net Operating lease right-of-use assets Intangible assets, net Goodwill Other assets, noncurrent Total assets Liabilities, Redeemable Convertible Preferred Stock and Stockholders' Equity (Deficit) Current liabilities: Accounts payable Operating lease liabilities, current Accrued expenses and other current liabilities Funds payable and amounts payable to customers Unearned fees Total current liabilities. Long-term debt, net of current portion Operating lease liabilities, noncurrent Other liabilities, noncurrent Total liabilities Commitments and contingencies (Note 13) Redeemable convertible preferred stock, $0.0001 par value, 247,217 and zero shares authorized as of December 31, 2019 and 2020, respectively: 239,624 and zero shares issued and outstanding as of December 31, 2019 and 2020, respectively Stockholders' equity (deficit): Common stock, $0.0001 par value, 710,000 and 2,000,000 shares of Class A common stock authorized as of December 31, 2019 and 2020, respectively; 16,284 and 115,500 shares of Class A common stock issued and outstanding as of December 31, 2019 and 2020, respectively: 710,000 shares of Class B common stock authorized as of December 31, 2019 and 2020; 247,530 and 483,697 shares of Class B common stock issued and outstanding as of December 31, 2019 and 2020, respectively; zero and 2,000,000 shares of Class C common stock authorized as of December 31, 2019 and 2020, respectively; zero shares of Class C common stock issued and outstanding as of December 31, 2019 and 2020; zero and 26,000 shares of Class H common stock authorized as of December 31, 2019 and 2020, respectively; zero and 9,200 shares issued and zero shares of Class H common stock outstanding as of December 31, 2019 and 2020, respectively Additional paid-in capital Accumulated other comprehensive income (loss) Accumulated deficit Total stockholders' equity (deficit) Total liabilities, redeemable convertible preferred stock and stockholders' equity (deficit) $ $ $ $ As of December 31, 2019 2,013,547 $ 1,060,726 115 3,145,457 341,598 6.561,443 301,273 385,594 102,912 652,088 306,809 8,310,119 $ 151,417 $ 38,022 1,224,080 3,145,457 674,788 5,233,764 381,374 271,164 5,886,302 3,231,502 26 617,690 (4,410) (1,420,991) (807,685) 8.310,119 $ 2020 5,480,557 910,700 33,846 2,181,329 309,954 8,916,386 270,194 384,068 75,886 655,801 189,164 10,491,499 79,898 56,586 2,414,071 2,181,329 407,895 5,139,779 1,815,562 430,905 203,470 7,589,716 60 8,904,791 2,639 (6,005,707) 2,901,783 10,491,499 Table of Contents Airbnb, Inc. Notes to Consolidated Financial Statements As the impact of COVID-19 continues to evolve, estimates and assumptions about future events and their effects cannot be determined with certainty and therefore require increased judgment. These estimates and assumptions may change in future periods and will be recognized in the consolidated financial statements as new events occur and additional information becomes known. To the extent the Company's actual results differ materially from those estimates and assumptions, the Company's future financial statements could be affected. Principles of Consolidation The accompanying consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries and variable interest entities ("VIE") in which the Company is the primary beneficiary in accordance with consolidation accounting guidance. All intercompany transactions have been eliminated in consolidation. The Company determines, at the inception of each arrangement, whether an entity in which it has made an investment or in which it has other variable interest in is considered a VIE. The Company consolidates a VIE when it is deemed to be the primary beneficiary. The primary beneficiary of a VIE is the party that meets both of the following criteria: (1) has the power to direct the activities that most significantly affect the economic performance of the VIE; and (ii) has the obligation to absorb losses or the right to receive benefits that in either case could potentially be significant to the VIE. Periodically, the Company determines whether any changes in its interest or relationship with the entity impact the determination of whether the entity is still a VIE and, if so, whether the Company is the primary beneficiary. If the Company is not deemed to be the primary beneficiary in a VIE, the Company accounts for the investment or other variable interest in a VIE in accordance with applicable U.S. GAAP. As of December 31, 2019 and 2020, the Company's consolidated VIEs were not material o the consolidated financial statements. Use of Estimates The preparation of the Company's consolidated financial statements conformity with U.S. GAAP requires management to make certain estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. The Company regularly evaluates its estimates, including those related to bad debt reserves, fair value of investments, useful lives of long-lived assets and intangible assets, valuation of acquired goodwill and intangible assets from acquisitions, contingent liabilities, insurance reserves, revenue recognition, valuation of common stock, stock-based compensation, and income and non-income taxes, among others. Actual results could differ materially from these estimates. Segment Information Operating segments are defined as components of an entity for which discrete financial information is available and is regularly reviewed by the Chief Operating Decision Maker ("CODM") in making decisions regarding resource allocation and performance assessment. The Company's CODM is its Chief Executive Officer. The Company has determined it has one operating and reportable segment as the CODM reviews financial information presented on a consolidated basis for purposes of allocating resources and evaluating financial performance. Cash, Cash Equivalents, and Restricted Cash Cash and cash equivalents are held in checking and interest-bearing accounts and consist of cash and highly-liquid securities with an original maturity of 90 days or less. The following table reconciles cash, cash equivalents, and restricted cash reported on the Company's consolidated balance sheets to the total amount presented in the consolidated statements of cash flows (in thousands): Cash and cash equivalents Cash and cash equivalents included in funds receivable and amounts held on behalf of customers Restricted cash Total cash, cash equivalents, and restricted cash presented in the consolidated statements of cash flows 2018 2,140,877 $ 2,297,699 4.438,576 S As of December 31, 2019 2,013,547 $ 3,129,781 115 5,143,443 S 2020 5,480,557 2,153,849 33,846 7,668,252 Table of Contents Airbnb, Inc. Notes to Consolidated Financial Statements circumstances indicate that goodwill might be impaired. There were no impairment charges in any of the periods presented in the consolidated financial statements. Refer to Note 7, Intangible Assets and Goodwill, for additional information. Intangible Assets Intangible assets are amortized on a straight-line basis over the estimated useful lives ranging from one to ten years. The Company reviews intangible assets for impairment under the long-lived asset model described below. There were no impairment charges in any of the periods presented in the consolidated financial statements. Refer to Note 7, Intangible Assets and Goodwill, for additional information. Impairment of Long-Lived Assets Long-lived assets that are held and used by the Company are reviewed for impairment when events or changes in circumstances indicate that the carrying amount of the asset may not be recoverable. Determination of recoverability of long-lived assets is based on an estimate of the undiscounted cash flows resulting from the use of the asset and its eventual disposition. If the carrying value of the long-lived asset is not recoverable on an undiscounted cash flow basis, impairment is recognized to the extent that the carrying value exceeds its fair value. Fair value is determined through various valuation techniques including discounted cash flow models, quoted market values, and third-party independent appraisals. Any impairments to ROU assets, leasehold improvements, or other assets as a result of a sublease, abandonment, or other similar factor are initially recognized when a decision to do so is made and recorded as an operating expense. Similar to other long-lived assets, management tests ROU assets for impairment whenever events or changes in circumstances occur that could impact the recoverability of these assets. For leased assets, such circumstances would include subleases that do not fully recover the costs of the associated leases or a decision to abandon the use of all or part of an asset. For the year ended December 31, 2020, the Company recorded $35.8 million of ROU asset impairment charges within restructuring charges in the consolidated statement of operations. Revenue Recognition The Company generates substantially all of its revenue from facilitating guest stays at accommodations offered by hosts on the Company's platform. The Company recognizes revenue in accordance with Accounting Standards Codification ("ASC") Topic 606, Revenue from Contracts with Customers ("ASC 606"). The Company considers both hosts and guests to be its customers. The customers agree to the Company's Terms of Service ("ToS") to use the Company's platform. Upon confirmation of a booking made by a guest, the host agrees to provide the use of the property. At such time, the host and guest also agree upon the applicable booking value as well as host fees and guest fees (collectively "service fees"). The Company charges service fees in exchange for certain activities, including the use of the Company's platform, customer support, and payment processing activities. These activities are not distinct from each other and are not separate performance obligations. As a result, the Company's single performance obligation is to facilitate a stay, which occurs upon the completion of a check-in event (a "check-in"). The Company recognizes revenue upon check-in as its performance obligation is satisfied upon check-in and the Company has the right to receive payment for the fulfillment of the performance obligation. The Company charges service fees to its customers as a percentage of the value of the booking, excluding taxes. The Company collects both the booking value from the guest on behalf of the host and the applicable guest fees owed to the Company using the guest's pre-authorized payment method. After check-in, the Company disburses the booking value to the host, less the fees due from the host to the Company. The Company's ToS stipulates that a host may cancel a confirmed booking at any time up to check- in. Therefore, the Company determined that for accounting purposes, each booking is a separate contract with the host and guest, and the contracts are not enforceable until check-in. Since an enforceable contract for accounting purposes is not established until check-in, there were no partially satisfied or unsatisfied performance obligations as of December 31, 2019 and 2020. The service fees collected from customers prior to check-in are recorded as unearned fees. Unearned fees are not considered contract balances under ASC 606-10-50-8 because they are subject to refund in the event of cancellation. Table of Contents Airbnb, Inc. Notes to Consolidated Financial Statements The following table summarizes the final allocation of the purchase consideration to the fair value of the assets acquired and liabilities assumed: Cash, cash equivalents, and restricted cash Intangible assets Goodwill Net liabilities assumed Total purchase consideration Developed technology Listing relationships Trade names Total identified intangible assets Goodwill is primarily attributable to the assembled workforce and anticipated synergies and economies of scale expected from the integration of the acquired business. The identified intangible assets assumed in the acquisition were recognized as follows based upon their fair values as of the acquisition date (in thousands): Estimated Useful Life $ 3 years. 10 years 5 years Amount $ 55,960 88.000 329,899 (32,502) 441,357 Fair Value 20,000 35,100 32,900 88,000 The Company's consolidated financial statements include the accounts of HotelTonight starting as of the acquisition date. Other Acquisitions During the year ended December 31, 2018, the Company completed various business combinations and asset purchases for total consideration of $40.3 million, of which $31.3 million was cash. Of the total consideration for these acquisitions, $31.9 million was attributed to goodwill, $8.1 million was attributed intangible assets, and the amount attributed to the remaining net assets acquired was not material. During the year ended December 31, 2019, the Company completed two business combinations in addition to the HotelTonight acquisition described above for total consideration of $63.3 million, of which $11.4 million was paid in cash, $36.7 million was paid in shares of the Company's Class A common stock, and $15.3 million was contingent consideration. Of the total consideration for these acquisitions, $33.8 million was attributed to goodwill, $31.7 million was attributed to intangible assets, and $2.2 million was attributed to other net liabilities. In connection with an acquisition made in 2019, consideration in the form of equity will be earned contingent upon meeting certain milestones based on cumulative booking values. The contingent consideration was valued as of the acquisition date using a Monte Carlo simulation model with varying assumptions including booking projections and probability of achievement through the performance period, which ends in 2025. The contingent consideration is marked to market at each reporting period with changes in fair value recorded in sales and marketing expense, given that the contingent consideration is dependent on selling related activities. For the years ended December 31, 2019 and 2020, the changes in the fair value of the contingent consideration liability were not material and $30.9 million, respectively. During the year ended December 31, 2020, certain performance milestones were met resulting in the vesting of equity to the acquiree with a fair value of $22.4 million. No performance milestones were met for the year ended December 31, 2019. For all intangible assets acquired during the years ended December 31, 2018 and 2019, the weighted-average useful life was 2.3 years and 5.4 years, respectively. There were no acquisitions completed during the year ended December 31, 2020. Table of Contents Note 7. Intangible Assets and Goodwill Intangible Assets Identifiable intangible assets resulting from business combinations and asset purchases consisted of the following (in thousands): Listing relationships Customer contacts. Developed technology Trade names Other Total intangible assets Listing relationships Customer contacts Developed technology Trade names Other Total intangible assets. Year Ending December 31. 2021 2022 2023 2024 2025 Thereafter Airbnb, Inc. Notes to Consolidated Financial Statements Total future amortization expense Goodwill Weighted- Average Useful Life Weighted- Average Useful Life 6 years $ 3 years 2 years 3 years 3 years $ 9 years $ 3 years 3 years 5 years 5 years $ December 31, 2019 Gross Carrying Amount 77,533 $ 12,571 55,845 56,770 935 203,654 $ December 31, 2020 Gross Carrying Amount 42,501 $ 4,346 Accumulated Amortization 37,800 35,753 9,652 130,052 $ (37,057) S (8.728) (27,292) (27,268) (397) (100,742) $ Accumulated Amortization (9.492) S (2.159) (28.417) (13,823) (275) (54,166) $ Net Carrying Value 40,476 3.843 28,553 29,502 538 102,912 Amortization expense related to intangible assets for the years ended December 31, 2018, 2019, and 2020 was $22.0 million, $46.1 million, and $36.2 million, respectively. Estimated future amortization expense for intangible assets as of December 31, 2020 was as follows (in thousands): Net Carrying Value 33,009 2,187 9,383 21,930 9,377 75,886 Amount 23,936 16.063 12,061 7,014 5.348 11,464 75,886 Goodwill The changes in the carrying amount of goodwill for the years ended December 31, 2019 and 2020 were as follows (in thousands): Balance as of December 31, 2018 Additions related to acquisitions Foreign currency translation adjustments Balance as of December 31, 2019 Additions related to acquisitions Foreign currency translation adjustments Balance as of December 31, 2020 $ $ Amount 289,861 363,681 (1,454) 652,088 3,713 655,801 For the year ended December 31, 2020, the difference in the Company's effective tax rate and the U.S. federal statutory tax rate was primarily due to the Company's full valuation allowance on its U.S. deferred tax assets and the Company's tax impact of restructuring and the IPO. The components of deferred tax assets and liabilities consisted of the following (in thousands): Deferred tax assets: Net operating loss carryforwards Tax credit carryforwards Accruals and reserves. Non-income tax accruals Stock-based compensation Operating lease liabilities. Intangible assets Other Gross deferred tax assets Valuation allowance Total deferred tax assets Deferred tax liabilities: Property and equipment basis differences Operating lease assets Other Total deferred tax liabilities Total net deferred tax assets $ As of December 31, 2019 41,132 $ 61,141 53,690 60,674 38,230 77,536 768,521 15,671 1,116,595 (1,024,005) 92,590 (17,303) (70,200) (87,503) 5,087 $ 2020 1,078,070 333,991 70,130 71,706 211,216 94,840 274.396 53.477 2,187,826 (2,053,069) 134,757 (33,503) (72,659) (3,091) (109,253) 25.504 In December 2019, the Company transferred certain intangible assets among its wholly-owned subsidiaries to align its structure to its evolving operations. The transfer resulted in a step-up in the tax basis of intellectual property rights and a correlated increase in foreign deferred tax assets of $789.6 million. Based on available objective evidence, management believed it was not more-likely-than-not that these additional foreign deferred tax assets would be realizable as of December 31, 2019 and, therefore, these deferred tax assets were offset by a full valuation allowance.

Step by Step Solution

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Intangible assets are amortized on a straightline basis over the estimated useful lives ranging from ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started