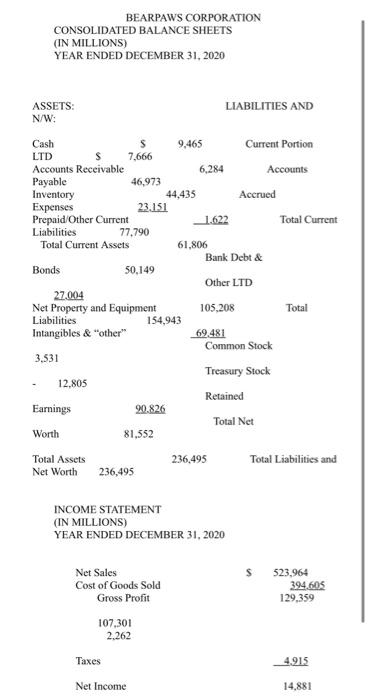

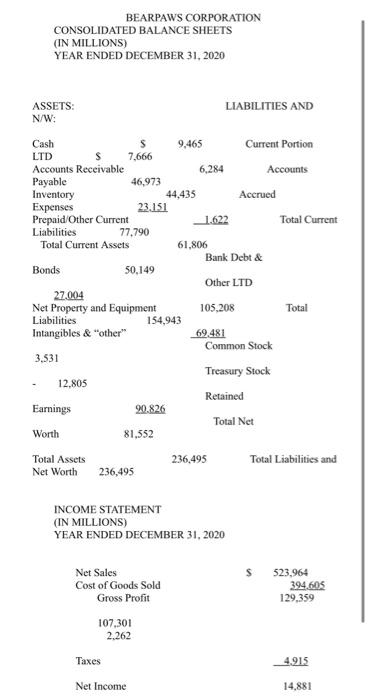

With the info. provided below, answer questions 8-13

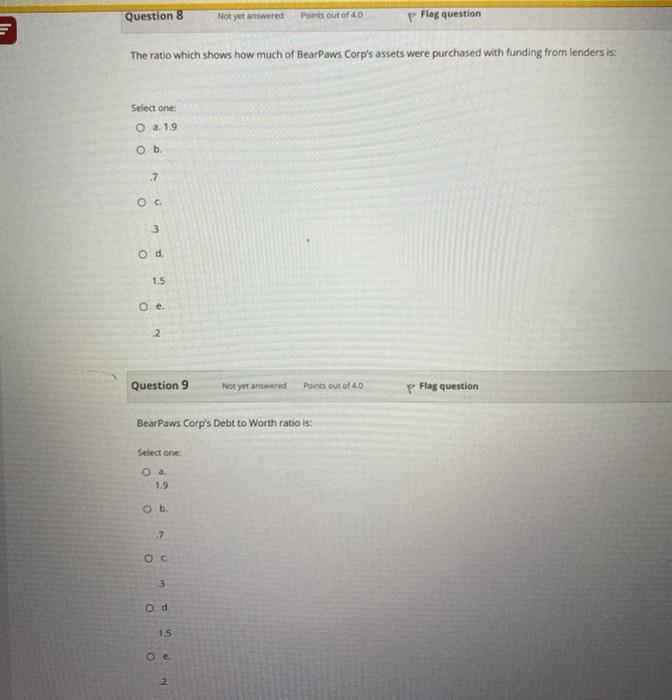

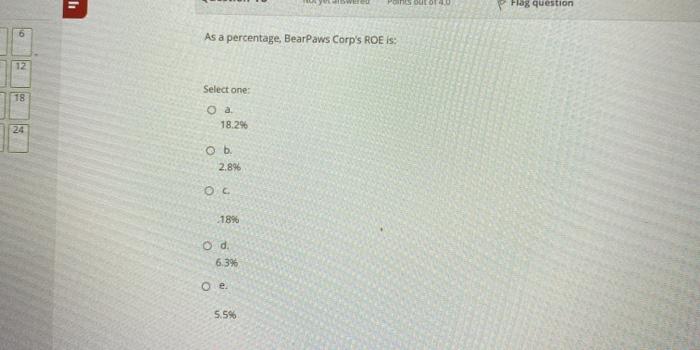

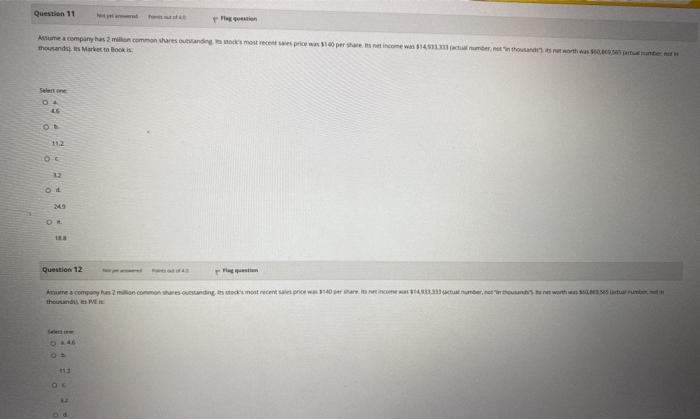

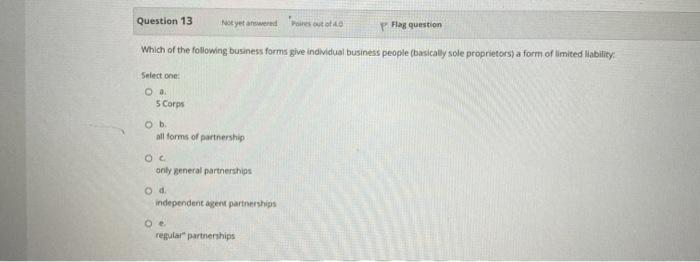

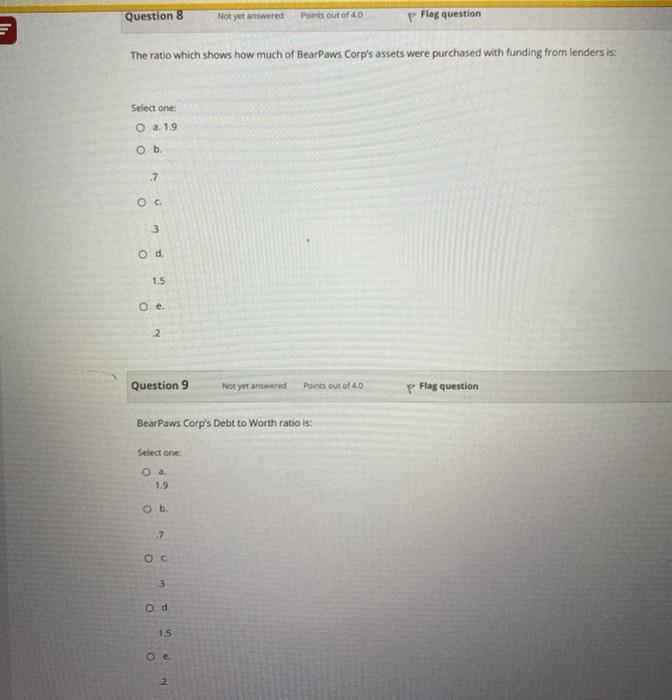

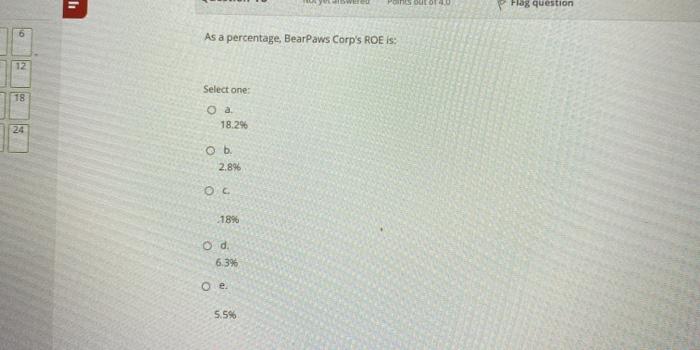

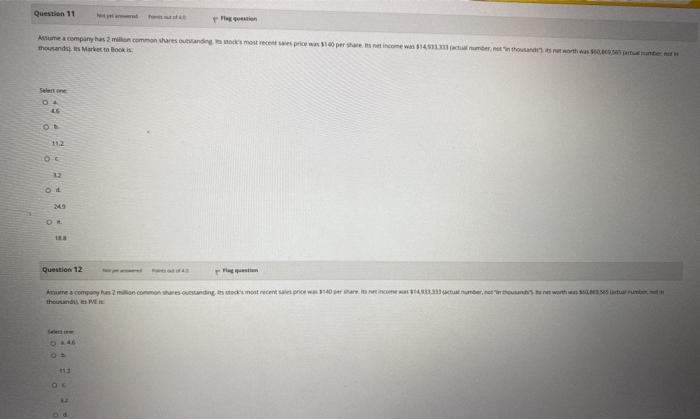

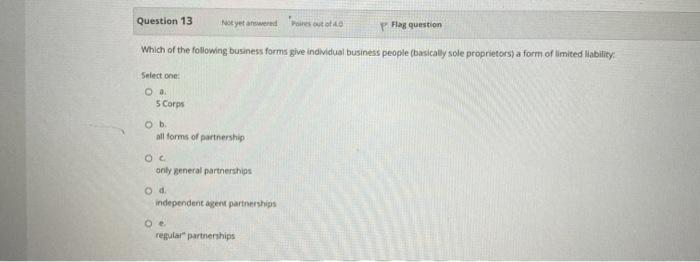

BEARPAWS CORPORATION CONSOLIDATED BALANCE SHEETS (IN MILLIONS) YEAR ENDED DECEMBER 31, 2020 ASSETS: N/W: LIABILITIES AND Cash 9,465 Current Portion LTD 7.666 Accounts Receivable 6,284 Accounts Payable 46,973 Inventory 44,435 Accrued Expenses 23.151 Prepaid Other Current 1.622 Total Current Liabilities 77,790 Total Current Assets 61,806 Bank Debt & Bonds 50,149 Other LTD 27.004 Net Property and Equipment 105.208 Total Liabilities 154.943 Intangibles & "other" 69,481 Common Stock 3.531 Treasury Stock 12.805 Retained Earnings 20.826 Total Net Worth 81,552 Total Assets Net Worth 236,495 Total Liabilities and 236,495 INCOME STATEMENT (IN MILLIONS) YEAR ENDED DECEMBER 31, 2020 523,964 394.605 129,359 Net Sales Cost of Goods Sold Gross Profit 107,301 2.262 Taxes 4.915 Net Income 14,881 Question 8 Not yet answered Points out of 40 P Flag question The ratio which shows how much of BearPaws Corp's assets were purchased with funding from lenders is: Select one: O a. 1.9 0 b. .7 OC 3 O d. 1.5 O e. 2 Question 9 Not yet answered Points out of 40 p Flag question BearPaws Corp's Debt to Worth ratio is: Select one O a. 1.9 Ob. 7 OC 3 od 1,5 2 Question 11 Asume a company has a common shares and most recent pri 100 perse Inicowa 14 methods to ste thousands Market Books O 112 12 M Question 12 then Question 13 No yet arend Paires out of Flag question Which of the following business forms give individual business people (basically sole proprietors) a form of limited liability: Select one O 5 Corps O. all forms of partnership Oc only general partnerships independent agent partnerships regular partnerships BEARPAWS CORPORATION CONSOLIDATED BALANCE SHEETS (IN MILLIONS) YEAR ENDED DECEMBER 31, 2020 ASSETS: N/W: LIABILITIES AND Cash 9,465 Current Portion LTD 7.666 Accounts Receivable 6,284 Accounts Payable 46,973 Inventory 44,435 Accrued Expenses 23.151 Prepaid Other Current 1.622 Total Current Liabilities 77,790 Total Current Assets 61,806 Bank Debt & Bonds 50,149 Other LTD 27.004 Net Property and Equipment 105.208 Total Liabilities 154.943 Intangibles & "other" 69,481 Common Stock 3.531 Treasury Stock 12.805 Retained Earnings 20.826 Total Net Worth 81,552 Total Assets Net Worth 236,495 Total Liabilities and 236,495 INCOME STATEMENT (IN MILLIONS) YEAR ENDED DECEMBER 31, 2020 523,964 394.605 129,359 Net Sales Cost of Goods Sold Gross Profit 107,301 2.262 Taxes 4.915 Net Income 14,881 Question 8 Not yet answered Points out of 40 P Flag question The ratio which shows how much of BearPaws Corp's assets were purchased with funding from lenders is: Select one: O a. 1.9 0 b. .7 OC 3 O d. 1.5 O e. 2 Question 9 Not yet answered Points out of 40 p Flag question BearPaws Corp's Debt to Worth ratio is: Select one O a. 1.9 Ob. 7 OC 3 od 1,5 2 Question 11 Asume a company has a common shares and most recent pri 100 perse Inicowa 14 methods to ste thousands Market Books O 112 12 M Question 12 then Question 13 No yet arend Paires out of Flag question Which of the following business forms give individual business people (basically sole proprietors) a form of limited liability: Select one O 5 Corps O. all forms of partnership Oc only general partnerships independent agent partnerships regular partnerships