Answered step by step

Verified Expert Solution

Question

1 Approved Answer

With the lifting of almost all the COVID-19 restrictions, many economists expect the food and beverage sector to recover and grow dramatically. (a) Your

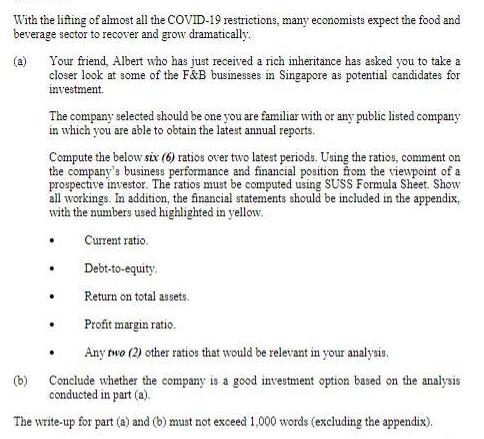

With the lifting of almost all the COVID-19 restrictions, many economists expect the food and beverage sector to recover and grow dramatically. (a) Your friend, Albert who has just received a rich inheritance has asked you to take a closer look at some of the F&B businesses in Singapore as potential candidates for investment. (b) The company selected should be one you are familiar with or any public listed company in which you are able to obtain the latest annual reports. Compute the below six (6) ratios over two latest periods. Using the ratios, comment on the company's business performance and financial position from the viewpoint of a prospective investor. The ratios must be computed using SUSS Formula Sheet. Show all workings. In addition, the financial statements should be included in the appendix, with the numbers used highlighted in yellow. Current ratio. . Debt-to-equity. Return on total assets. Profit margin ratio. Any two (2) other ratios that would be relevant in your analysis. Conclude whether the company is a good investment option based on the analysis conducted in part (a). The write-up for part (a) and (b) must not exceed 1,000 words (excluding the appendix). . .

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a For this analysis I have chosen to look at the financial statements of Jumbo Group Limited a public listed company in Singapore that operates in the food and beverage sector I have obtained the comp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started