Answered step by step

Verified Expert Solution

Question

1 Approved Answer

with the process please Bullock Gold Mining Seth Bullock, the owner of Bullock Gold Mining, is evaluating a new gold mine in South Dakota Dan

with the process please

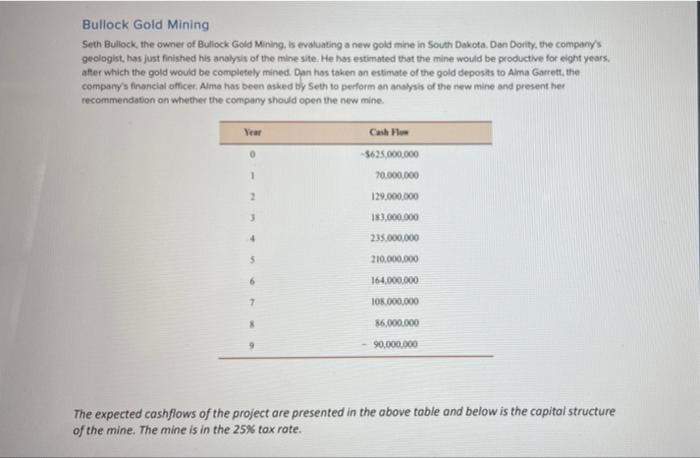

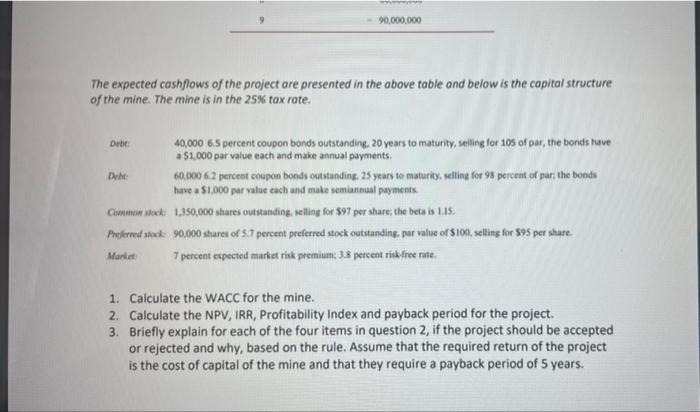

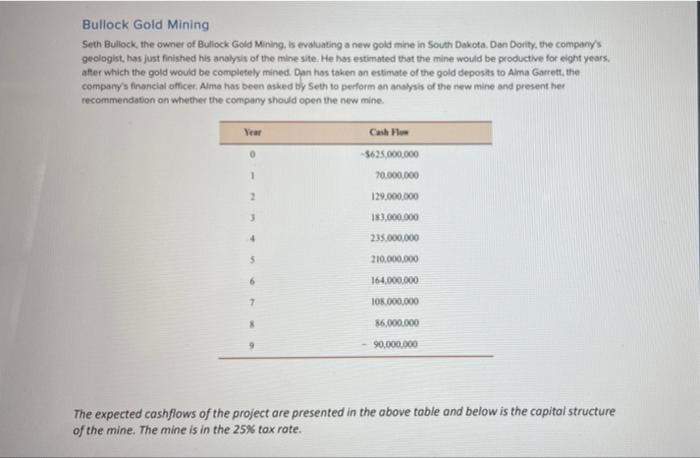

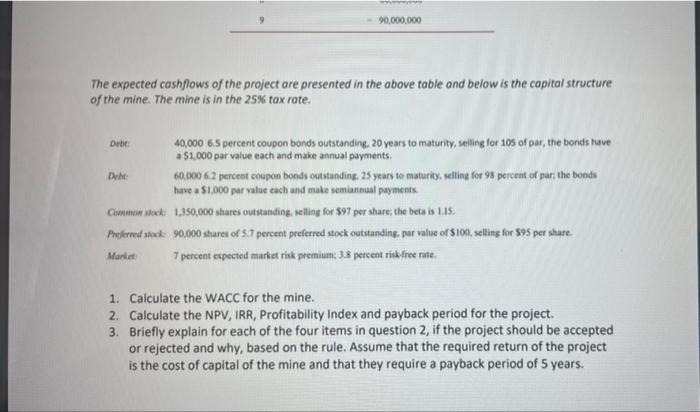

Bullock Gold Mining Seth Bullock, the owner of Bullock Gold Mining, is evaluating a new gold mine in South Dakota Dan Dority, the company's geologist has just finished his analysis of the mine site. He has estimated that the mine would be productive for eight years, after which the gold would be completely mined. Dan has taken an estimate of the gold deposits to Alma Garrett, the company's financial officer Aime has been asked by Seth to perform an analysis of the new mine and present her recommendation on whether the company should open the new mine. Sear Cash Flow 0 1 2 3 70.000.000 129.000.000 183.000.000 235.000.000 210.000.000 164.000.000 108.000.000 86.000.000 90.000.000 6 7 The expected cashflows of the project are presented in the above table and below is the capital structure of the mine. The mine is in the 25% tox rate. 90.000.000 The expected cashflows of the project are presented in the above table and below is the capital structure of the mine. The mine is in the 25% tax rate. Debe 40,000 6.5 percent coupon bonds outstanding, 20 years to maturity, selling for 105 of par, the bonds have a $1,000 par value each and make annual payments. Drht 60.000 6.2 percent coupon bonds outstanding, 25 years to maturity, selline for 98 percent of par, the bonds have a $1.000 par value each and make semiannual payments. Common stock 1.350.000 shares outstanding, selling for $97 per share the beta is laas. Preferred stock: 90,000 shares of 5.7 percent preferred stock outstanding, per value of $109, selling for 595 per share 7 percent expected market risk premium: 3.8 percent risk free rute, Market 1. Calculate the WACC for the mine. 2. Calculate the NPV, IRR, Profitability Index and payback period for the project. 3. Briefly explain for each of the four items in question 2, if the project should be accepted or rejected and why, based on the rule. Assume that the required return of the project is the cost of capital of the mine and that they require a payback period of 5 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started