Question

With the uncertain outlook for inflation, you recognize that yields to maturity might fall or rise rapidly and unexpectedly. You want to estimate now

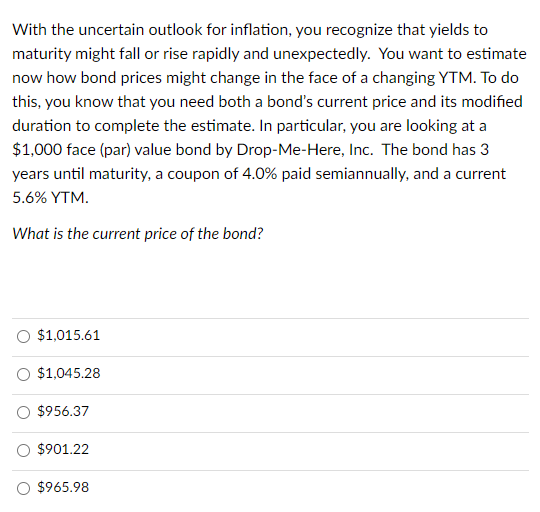

With the uncertain outlook for inflation, you recognize that yields to maturity might fall or rise rapidly and unexpectedly. You want to estimate now how bond prices might change in the face of a changing YTM. To do this, you know that you need both a bond's current price and its modified duration to complete the estimate. In particular, you are looking at a $1,000 face (par) value bond by Drop-Me-Here, Inc. The bond has 3 years until maturity, a coupon of 4.0% paid semiannually, and a current 5.6% YTM. What is the current price of the bond? $1,015.61 $1,045.28 $956.37 $901.22 $965.98

Step by Step Solution

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Linear Algebra

Authors: Jim Hefferon

1st Edition

978-0982406212, 0982406215

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App