Answered step by step

Verified Expert Solution

Question

1 Approved Answer

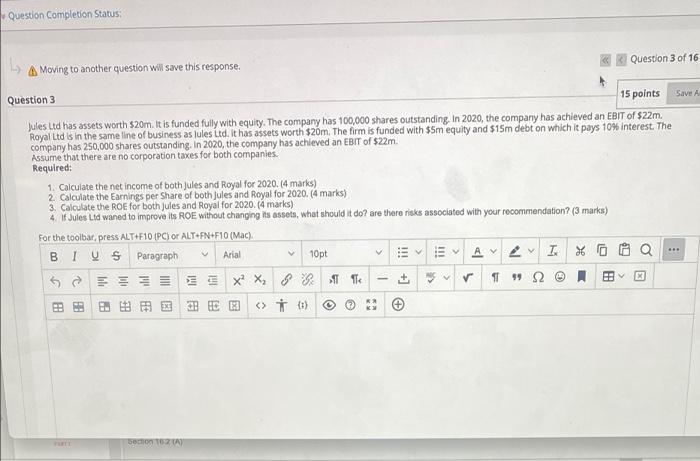

with the working out please Question Completion Status: L Moving to another question will save this response. Question 3 of 16 Question 3 15 points

with the working out please

Question Completion Status: L Moving to another question will save this response. Question 3 of 16 Question 3 15 points Save A Jules Ltd has assets worth $20m. It is funded fully with equity. The company has 100,000 shares outstanding. In 2020, the company has achieved an EBIT of $22m. Royal Ltd is in the same line of business as lules Ltd. It has assets worth $20m. The firm is funded with $5m equity and $15m debt on which it pays 10% interest. The company has 250,000 shares outstanding. In 2020, the company has achieved an EBIT of $22m. Assume that there are no corporation taxes for both companies. Required: 1. Calculate the net income of both Jules and Royal for 2020. (4 marks) 2. Calculate the Earnings per Share of both Jules and Royal for 2020. (4 marks) 3. Calculate the ROE for both Jules and Royal for 2020. (4 marks) 4. If Jules Ltd waned to improve its ROE without changing its assets, what should it do? are there risks associated with your recommendation? (3 marks) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BIUS Paragraph Arial V 10pt V AVV I. X 88 99 88 C PARTE Section 162 (A) PA FA B X X B (:) O > !!! T +] * + !!! T FR Y O

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started