Answered step by step

Verified Expert Solution

Question

1 Approved Answer

With this case, we review the cash flow of several restaurant companies. The restaurant companies reviewed and the year-end dates are as follows: Yum Brands,

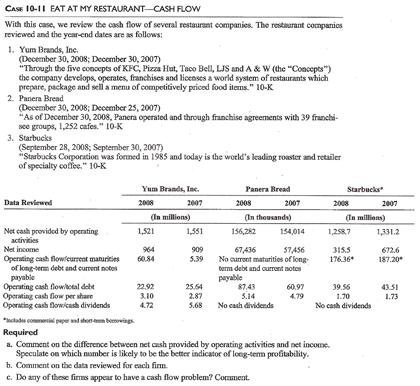

With this case, we review the cash flow of several restaurant companies. The restaurant companies reviewed and the year-end dates are as follows: Yum Brands, Inc. (December 30, 2008; December 30, 2007) "Through the five concepts of KFC, Pizza Hut, Taco Bell, LJS and A & W (the "Concepts" the company develops, operates, franchises and licenses a world system of restaurants which prepare, package and sell a menu of competitively priced food items." 10-K. Panera Bread (December 30, 2008; December 25, 2007) "As of December 30, 2008, Panera operated and through franchise agreements with 39 franchisee groups, 1,252 cafes." 10-K Starbucks (September 28, 2008; September 30, 2007) "Starbucks Corporation was formed in 1985 and today is the world's leading roaster and retailer of specialty coffee." 10-K Required Comment on the difference between net cash provided by operating activities and net income. Speculate on which number is likely to be the better indicate of long-term profitability. Comment on the data reviewed for each firm. Do any of these firms appear to have a cash flow problem? Comment. With this case, we review the cash flow of several restaurant companies. The restaurant companies reviewed and the year-end dates are as follows: Yum Brands, Inc. (December 30, 2008; December 30, 2007) "Through the five concepts of KFC, Pizza Hut, Taco Bell, LJS and A & W (the "Concepts" the company develops, operates, franchises and licenses a world system of restaurants which prepare, package and sell a menu of competitively priced food items." 10-K. Panera Bread (December 30, 2008; December 25, 2007) "As of December 30, 2008, Panera operated and through franchise agreements with 39 franchisee groups, 1,252 cafes." 10-K Starbucks (September 28, 2008; September 30, 2007) "Starbucks Corporation was formed in 1985 and today is the world's leading roaster and retailer of specialty coffee." 10-K Required Comment on the difference between net cash provided by operating activities and net income. Speculate on which number is likely to be the better indicate of long-term profitability. Comment on the data reviewed for each firm. Do any of these firms appear to have a cash flow problem? Comment

With this case, we review the cash flow of several restaurant companies. The restaurant companies reviewed and the year-end dates are as follows: Yum Brands, Inc. (December 30, 2008; December 30, 2007) "Through the five concepts of KFC, Pizza Hut, Taco Bell, LJS and A & W (the "Concepts" the company develops, operates, franchises and licenses a world system of restaurants which prepare, package and sell a menu of competitively priced food items." 10-K. Panera Bread (December 30, 2008; December 25, 2007) "As of December 30, 2008, Panera operated and through franchise agreements with 39 franchisee groups, 1,252 cafes." 10-K Starbucks (September 28, 2008; September 30, 2007) "Starbucks Corporation was formed in 1985 and today is the world's leading roaster and retailer of specialty coffee." 10-K Required Comment on the difference between net cash provided by operating activities and net income. Speculate on which number is likely to be the better indicate of long-term profitability. Comment on the data reviewed for each firm. Do any of these firms appear to have a cash flow problem? Comment. With this case, we review the cash flow of several restaurant companies. The restaurant companies reviewed and the year-end dates are as follows: Yum Brands, Inc. (December 30, 2008; December 30, 2007) "Through the five concepts of KFC, Pizza Hut, Taco Bell, LJS and A & W (the "Concepts" the company develops, operates, franchises and licenses a world system of restaurants which prepare, package and sell a menu of competitively priced food items." 10-K. Panera Bread (December 30, 2008; December 25, 2007) "As of December 30, 2008, Panera operated and through franchise agreements with 39 franchisee groups, 1,252 cafes." 10-K Starbucks (September 28, 2008; September 30, 2007) "Starbucks Corporation was formed in 1985 and today is the world's leading roaster and retailer of specialty coffee." 10-K Required Comment on the difference between net cash provided by operating activities and net income. Speculate on which number is likely to be the better indicate of long-term profitability. Comment on the data reviewed for each firm. Do any of these firms appear to have a cash flow problem? Comment Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started