With this information given:

please answer the following:

Options : Credit/Debit AND Underapplied/Overapplied

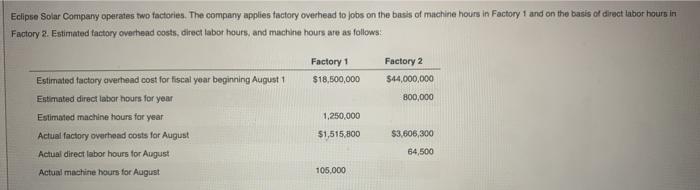

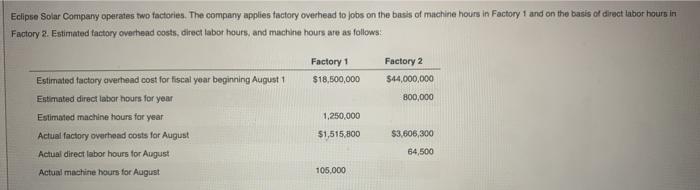

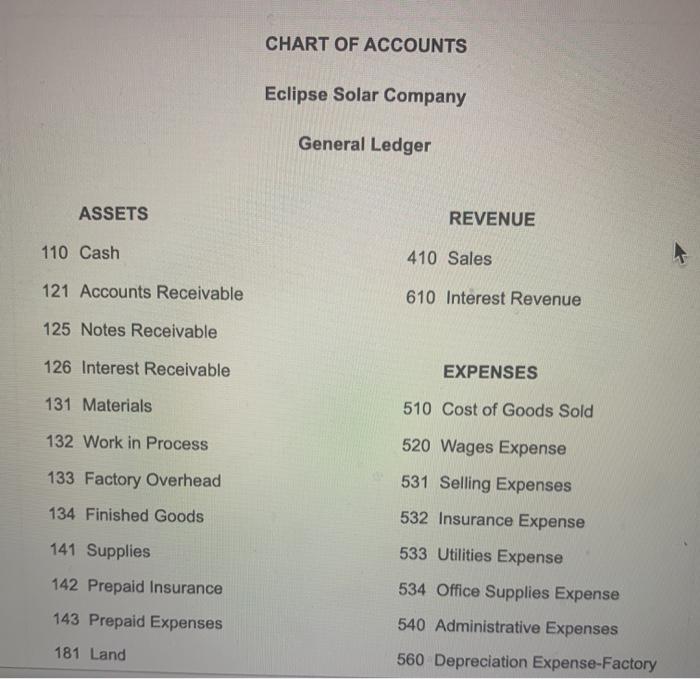

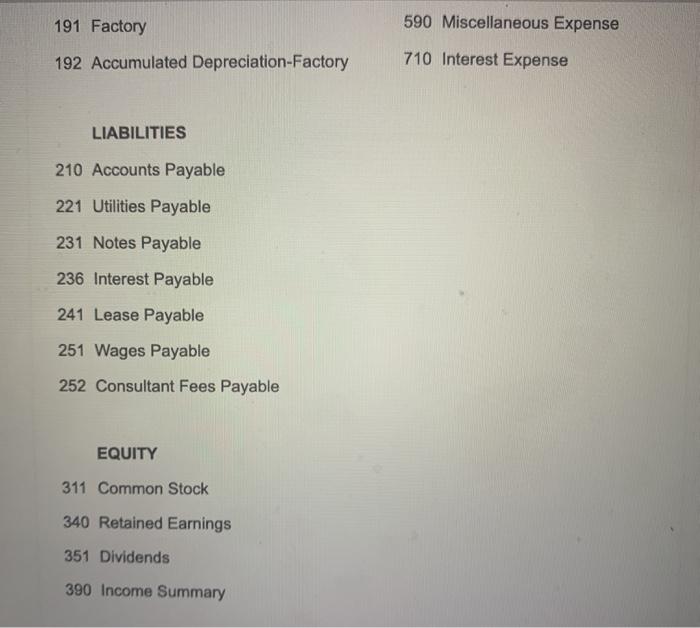

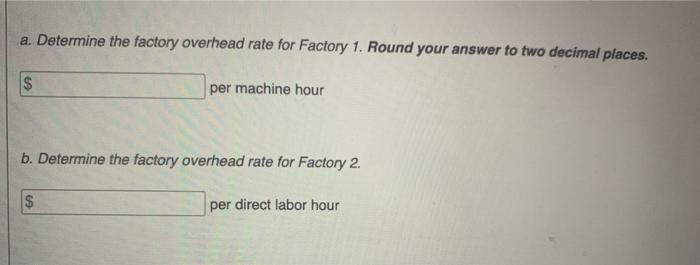

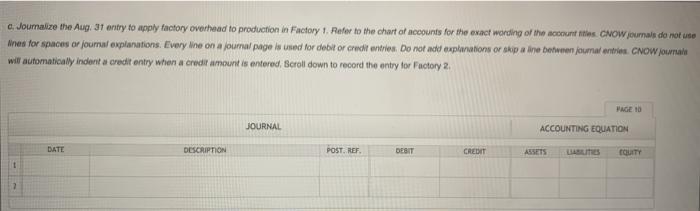

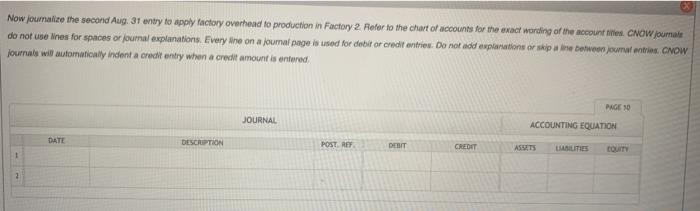

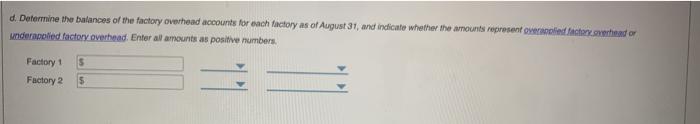

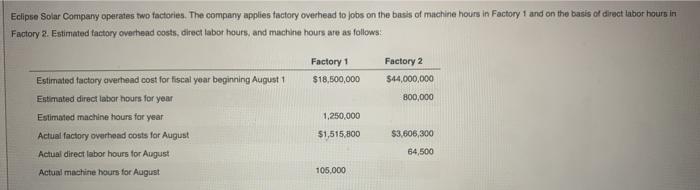

Eclipse Solar Company operates two factories. The company applies factory overhead to jobs on the basis of machine hours in Factory 1 and on the basis of direct labor hours in Factory 2. Estimated factory overhead costs, direct labor hours, and machine hours are as follows: Factory 1 $18,500,000 Factory 2 $44,000,000 800,000 Estimated factory averhond cost for fiscal year beginning August 1 Estimated direct labor hours for your Estimated machine hours for year Actual factory overhead costs for August Actual direct labor hours for August Actual machine hours for August 1.250.000 $1,515,800 $3,606,300 64,500 105,000 CHART OF ACCOUNTS Eclipse Solar Company General Ledger ASSETS REVENUE 110 Cash 410 Sales 121 Accounts Receivable 610 Interest Revenue 125 Notes Receivable 126 Interest Receivable EXPENSES 131 Materials 510 Cost of Goods Sold 132 Work in Process 520 Wages Expense 531 Selling Expenses 133 Factory Overhead 134 Finished Goods 532 Insurance Expense 141 Supplies 142 Prepaid Insurance 533 Utilities Expense 534 Office Supplies Expense 540 Administrative Expenses 560 Depreciation Expense-Factory 143 Prepaid Expenses 181 Land 191 Factory 590 Miscellaneous Expense 192 Accumulated Depreciation-Factory 710 Interest Expense LIABILITIES 210 Accounts Payable 221 Utilities Payable 231 Notes Payable 236 Interest Payable 241 Lease Payable 251 Wages Payable 252 Consultant Fees Payable EQUITY 311 Common Stock 340 Retained Earnings 351 Dividends 390 Income Summary a. Determine the factory overhead rate for Factory 1. Round your answer to two decimal places. $ per machine hour b. Determine the factory overhead rate for Factory 2. $ per direct labor hour c. Joumalize the Aug. 37 entry to apply factory overhead to production in Factory 1. Refer to the chart of accounts for the exact wording of the account to CNOW journal do not use Nnes for spaces or journal explanations. Every line on a journal page is used for debitor credit unters. Do not add explorations or skip a in between jumal entries. CNOW Journal will automatically indent a credt entry when a credit amount is entered. Scroll down to record the entry for Factory 2, PAGE 10 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEST CREDIT ASSETS LES COUNTY 1 Now journalize the second Aug. 31 entry to apply factory overhead to production in Factory 2 Refer to the chart of accounts for the exact wording of the account is CNOW Journal do not use Ines for spaces or journal explanations. Every Nine on a journal page is used for debitor credit entries. Do not add explanations or paine between jelentros. CNOW journals will automatically indent a credit entry when a credit amount is entered PAGE 10 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST REY DERIT CREDIT ASSETS LABILITIES COUNTY d. Determine the balances of the factory overhead accounts for each factory as of August 31, and indicate whether the amounts represent and factoreshead or undergoed factory overhead. Enter al amounts as positive numbers. 5 Factory 1 Factory 2 5