with work shown please ( equations plugged in )

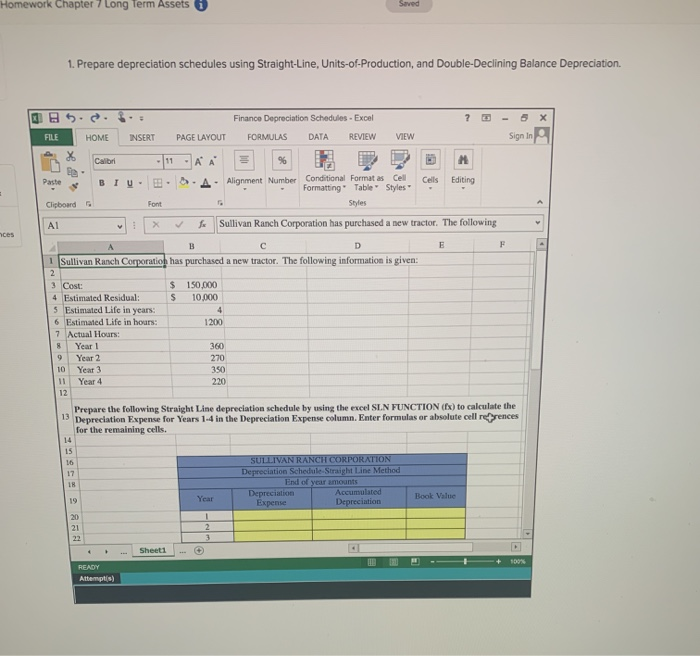

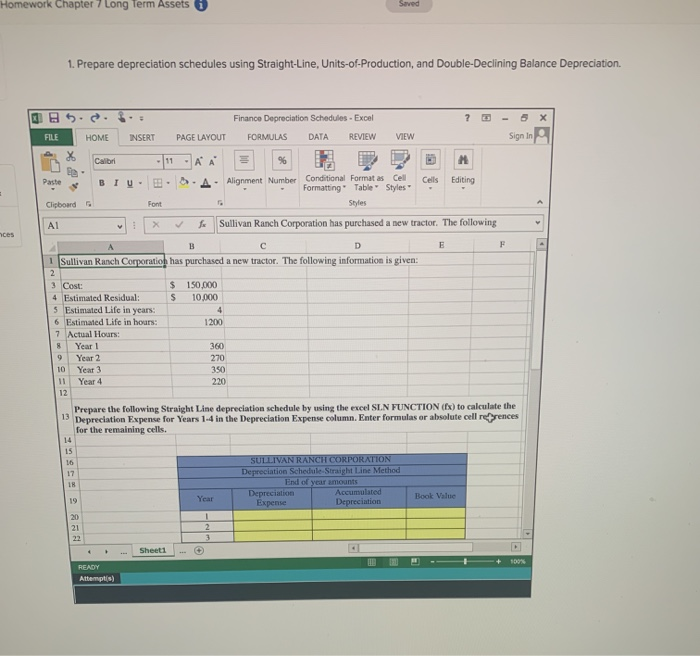

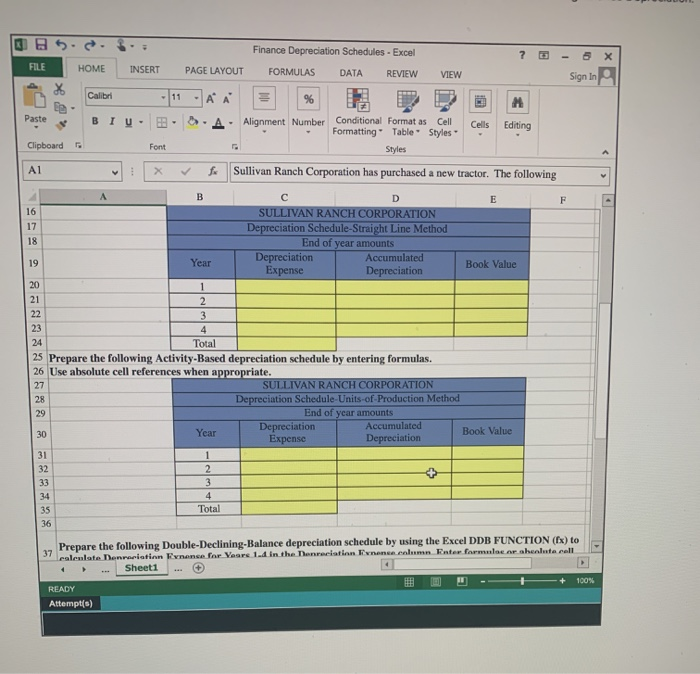

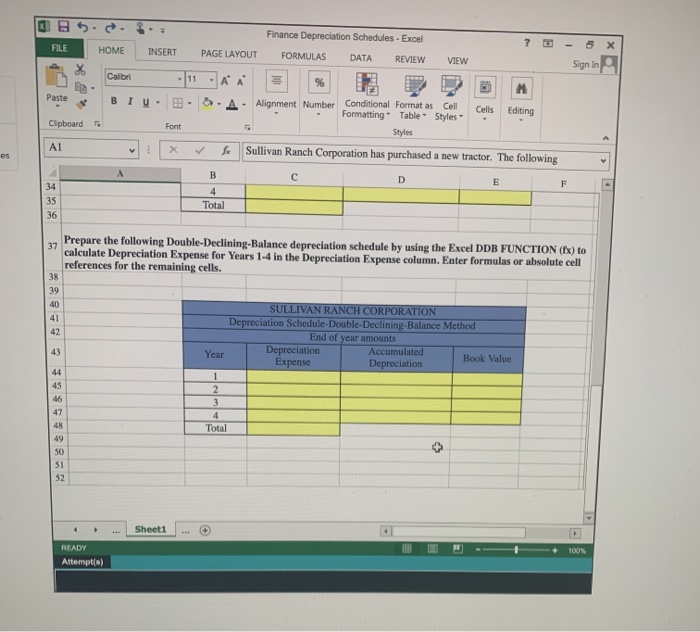

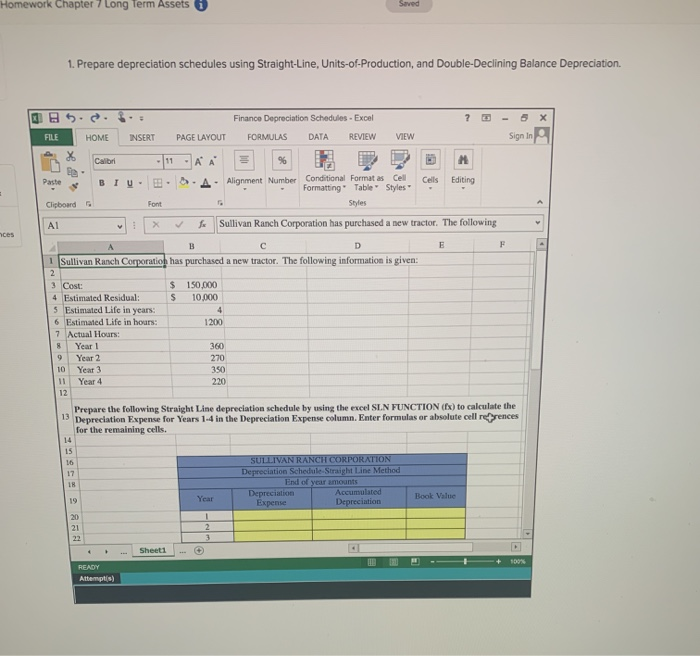

Homework Chapter 7 Long Term Assets Seved 1. Prepare depreciation schedules using Straight-Line, Units-of-Production, and Double-Declining Balance Depreciation. Font hes . 5. Finance Depreciation Schedules - Excel 5 X FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign in Calibri - 11 - A A % M Paste BIU - - Alignment Number Conditional Format as Cell Cells Editing Formatting Table Styles Clipboard Styles > fo Sullivan Ranch Corporation has purchased a new tractor. The following A B D E F 1 Sullivan Ranch Corporatio has purchased a new tractor. The following information is given: 2 3 Cost: $ 150,000 4 Estimated Residual: $ 10.000 5 Estimated Life in years: 4 6 Estimated Life in hours: 1200 7 Actual Hours: 8 Year 1 360 9 Year 2 10 Year 3 Year 4 220 12 Prepare the following Straight Line depreciation schedule by using the excel SIN FUNCTION(Ex) to calculate the 13 Depreciation Expense for Years 1-4 in the Depreciation Expense column. Enter formulas er absolute cell refrences for the remaining cells. 270 350 15 16 17 18 SULLIVAN RANCH CORPORATION Depreciation Schedule Straight Line Method End of year mounts Depreciation Accumulated Expense Depreciation Year Book Value 1 20 21 22 2 3 Sheet1 READY Attemptis) Finance Depreciation Schedules - Excel 7 6 X FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In Calibri 11 -A M Paste BIU- - Cells Editing Alignment Number Conditional Format as Cell Formatting Table Styles Styles Clipboard Font A1 fa Sullivan Ranch Corporation has purchased a new tractor. The following F 4 A B D E 16 SULLIVAN RANCH CORPORATION 17 Depreciation Schedule-Straight Line Method 18 End of year amounts 19 Year Depreciation Accumulated Book Value Expense Depreciation 20 21 2 22 3 23 4 24 Total 25 Prepare the following Activity-Based depreciation schedule by entering formulas. 26 Use absolute cell references when appropriate. 27 SULLIVAN RANCH CORPORATION 28 Depreciation Schedule-Units-of-Production Method 29 End of year amounts Depreciation Year Accumulated 30 Book Value Expense Depreciation 31 32 2 33 3 4 35 Total 36 37 Prepare the following Double-Declining-Balance depreciation schedule by using the Excel DDB FUNCTION (Ex) to calentate Denraristinn Expense for Vesre 1.4 in the Tenreciation Enonce column Enter formulac ar ahenluta cell Sheet1 100% READY Attempt() Q5 Finance Depreciation Schedules - Excel 7 FILE 5 HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW % Sign in Calibri -11 % Paste BIU- A. Alignment Number Conditional Format as Cell Formatting Table Styles Styles Cells Editing Clipboard Font A1 X es Sullivan Ranch Corporation has purchased a new tractor. The following A B D E F 34 35 36 4 Total 37 Prepare the following Double-Declining-Balance depreciation schedule by using the Excel DDB FUNCTION (fx) to calculate Depreciation Expense for Years 1-4 in the Depreciation Expense column. Enter formulas or absolute cell references for the remaining cells. 38 39 40 41 42 SULLIVAN RANCH CORPORATION Depreciation Schedule-Double-Declining Balance Method End of year amounts Year Depreciation Accumulated Book Value Expense Depreciation 43 1 44 45 46 47 2 3 4 Total 48 49 50 SI 52 Sheet1 100N READY Attempte)