Answered step by step

Verified Expert Solution

Question

1 Approved Answer

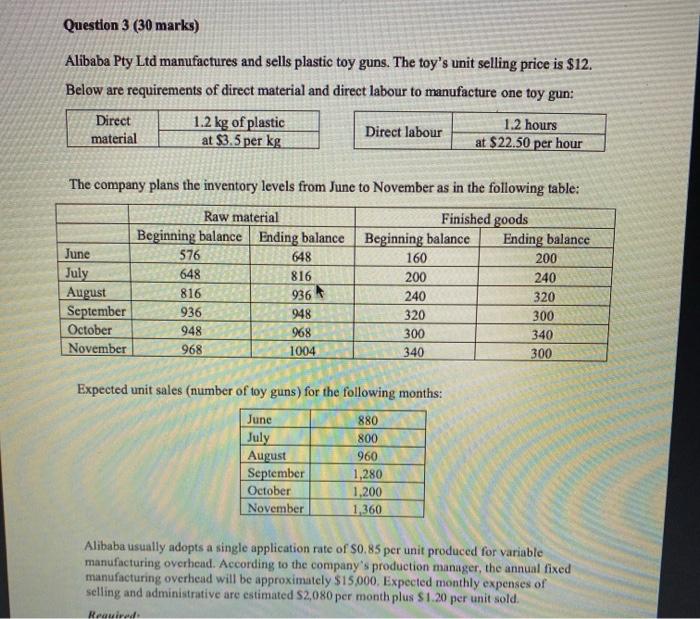

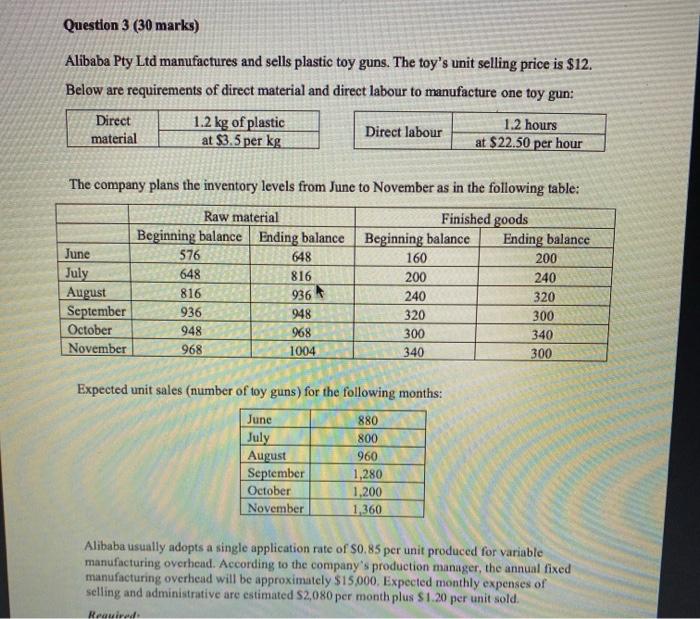

with working out please Question 3 (30 marks) Alibaba Pty Ltd manufactures and sells plastic toy guns. The toy's unit selling price is $12. Below

with working out please

Question 3 (30 marks) Alibaba Pty Ltd manufactures and sells plastic toy guns. The toy's unit selling price is $12. Below are requirements of direct material and direct labour to manufacture one toy gun: Direct material June July August September October November 1.2 kg of plastic at $3.5 per kg The company plans the inventory levels from June to November as in the following table: Finished goods Raw material Beginning balance Ending balance 576 648 816 936 948 968 Required: Direct labour 648 816 936 948 968 1004 Beginning balance Expected unit sales (number of toy guns) for the following months: June 880 July 800 August September October November 160 200 240 320 300 340 960 1,280 1,200 1,360 1.2 hours at $22.50 per hour Ending balance 200 240 320 300 340 300 Alibaba usually adopts a single application rate of $0.85 per unit produced for variable manufacturing overhead. According to the company's production manager, the annual fixed manufacturing overhead will be approximately $15,000. Expected monthly expenses of selling and administrative are estimated $2,080 per month plus $1.20 per unit sold. Required: Part 1. Prepare the following for Alibaba for the third quarter (July, August, and September). Include each month as well as the third quarter total for each budget. a. Sales budget. (5 marks] Click or tap here to enter text. b. Production budget. (5 marks] Click or tap here to enter text. c. Direct materials purchases budget in units and dollar amount. (5 marks] Click or tap here to enter text. d. Direct labor budget in hours and dollar amount. (5 marks] Click or tap here to enter text. e. Manufacturing overhead budget. (5 marks) Click or tap here to enter text

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started