Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Without considering the following capital gains and losses, Carley, who is single, has taxable income of $325,000 and a marginal tax rate of 35%.

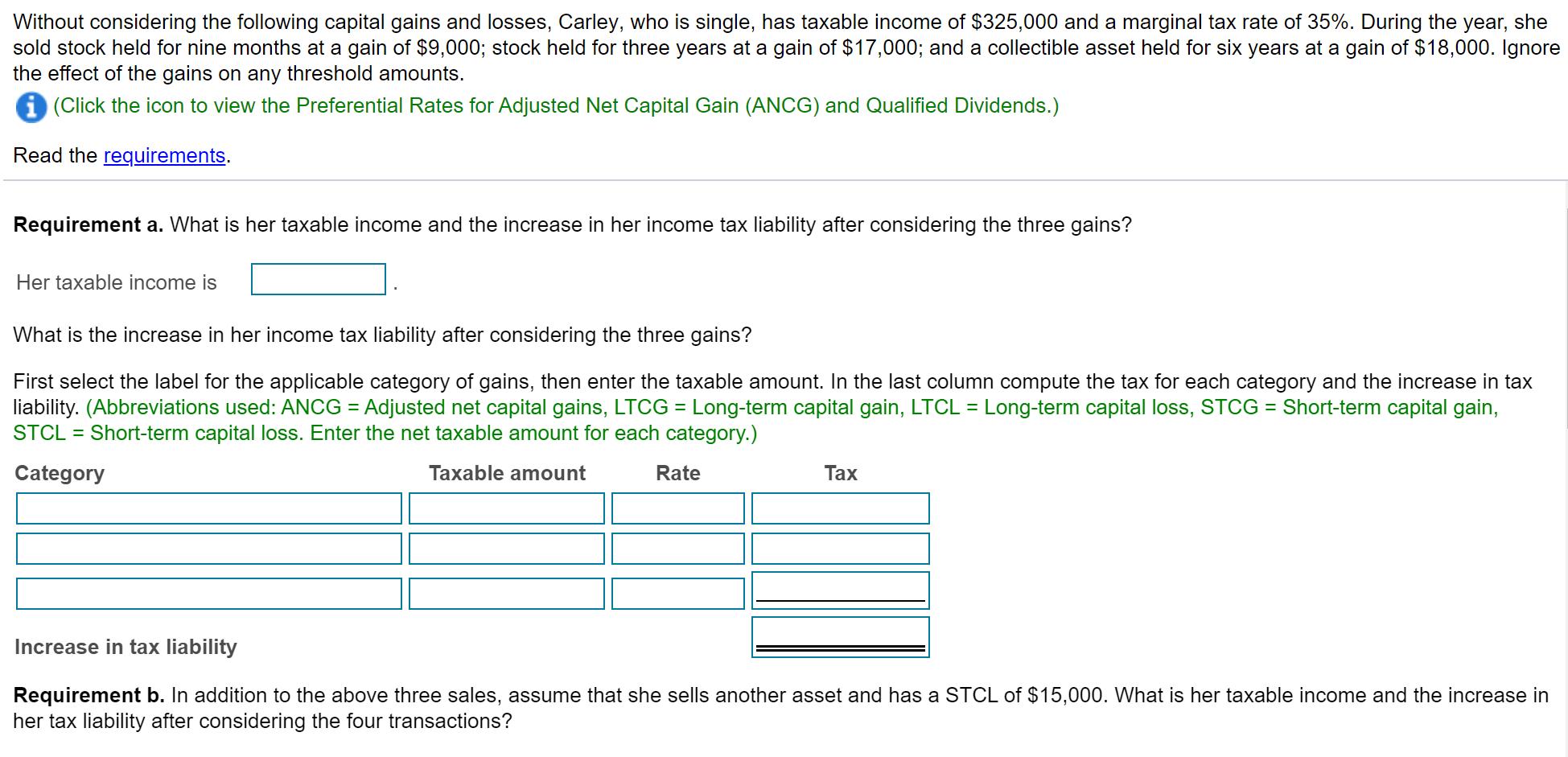

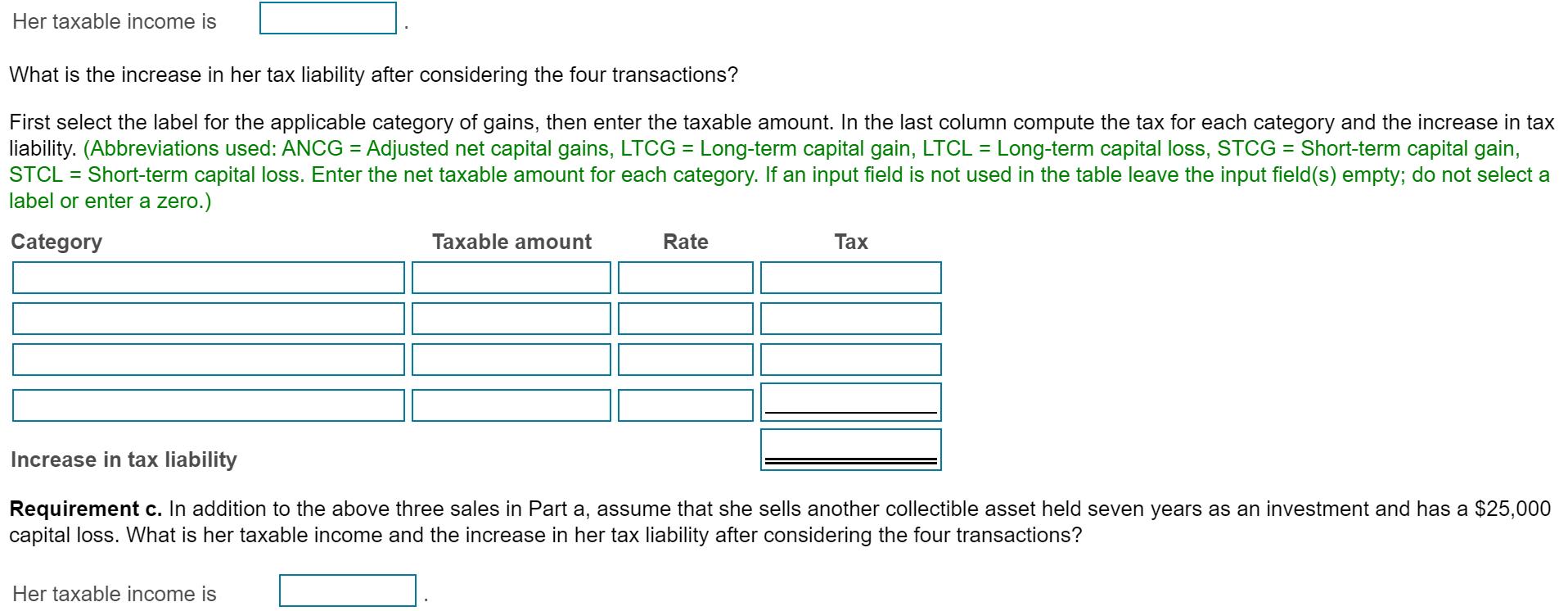

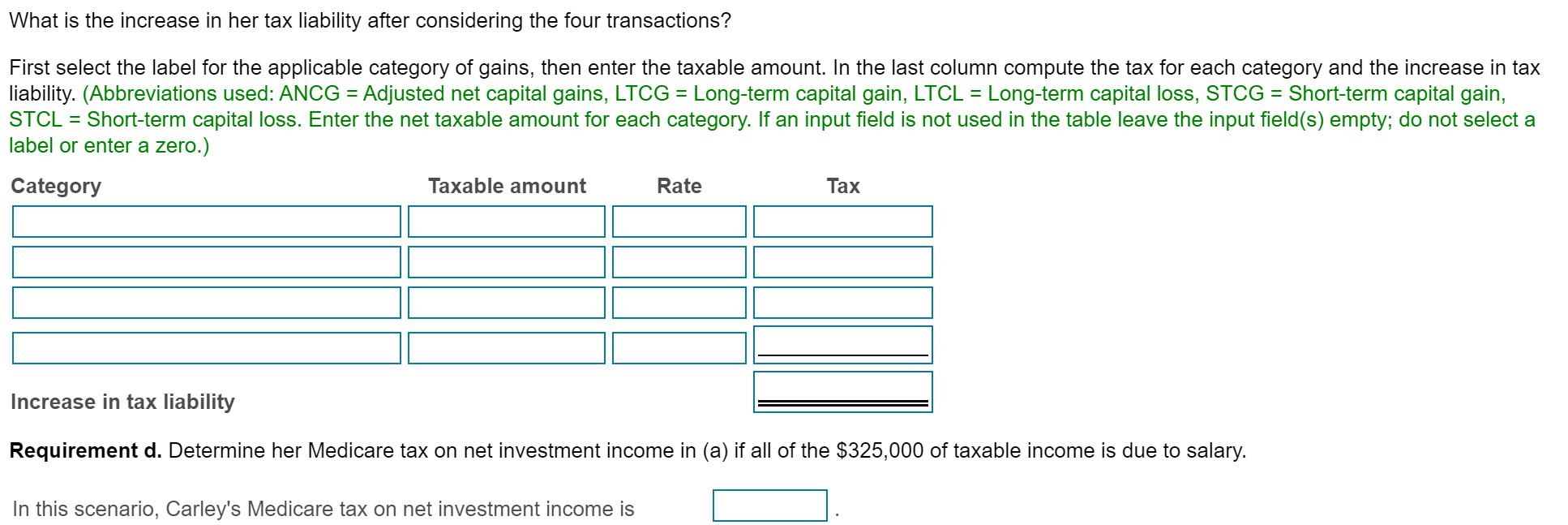

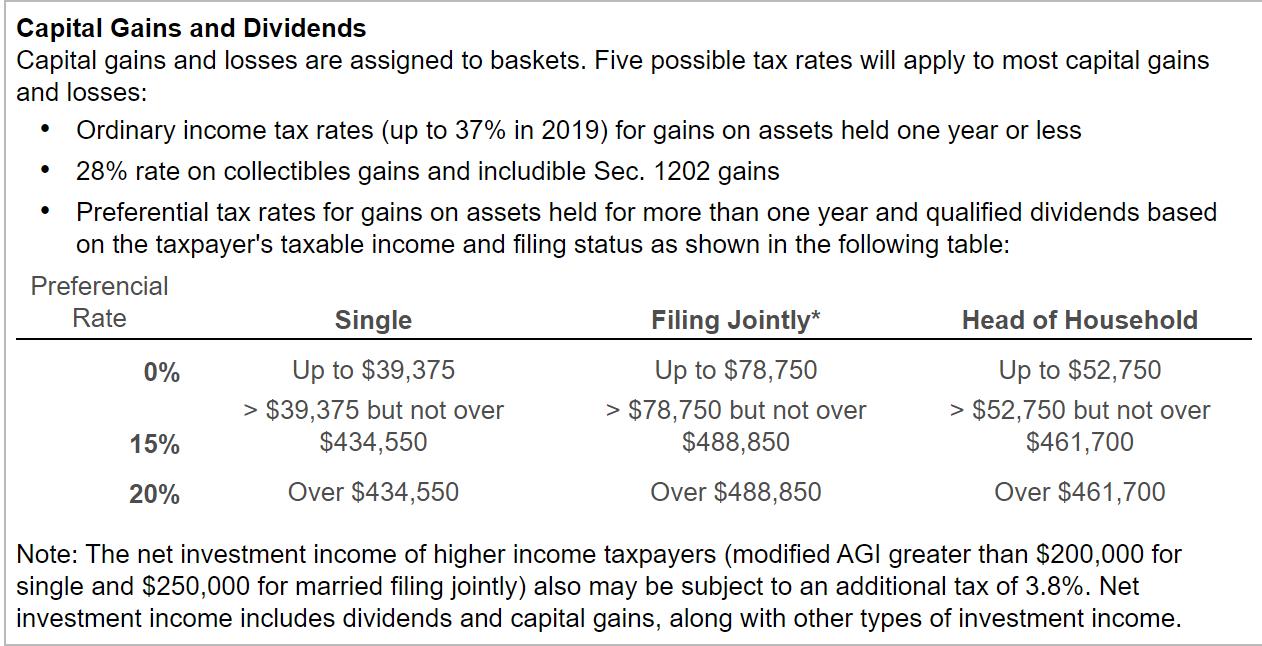

Without considering the following capital gains and losses, Carley, who is single, has taxable income of $325,000 and a marginal tax rate of 35%. During the year, she sold stock held for nine months at a gain of $9,000; stock held for three years at a gain of $17,000; and a collectible asset held for six years at a gain of $18,000. Ignore the effect of the gains on any threshold amounts. i (Click the icon to view the Preferential Rates for Adjusted Net Capital Gain (ANCG) and Qualified Dividends.) Read the requirements. Requirement a. What is her taxable income and the increase in her income tax liability after considering the three gains? Her taxable income is What is the increase in her income tax liability after considering the three gains? First select the label for the applicable category of gains, then enter the taxable amount. In the last column compute the tax for each category and the increase in tax liability. (Abbreviations used: ANCG = Adjusted net capital gains, LTCG = Long-term capital gain, LTCL = Long-term capital loss, STCG = Short-term capital gain, STCL = Short-term capital loss. Enter the net taxable amount for each category.) Category Taxable amount Rate Tax Increase in tax liability Requirement b. In addition to the above three sales, assume that she sells another asset and has a STCL of $15,000. What is her taxable income and the increase in her tax liability after considering the four transactions? Her taxable income is What is the increase in her tax liability after considering the four transactions? First select the label for the applicable category of gains, then enter the taxable amount. In the last column compute the tax for each category and the increase in tax liability. (Abbreviations used: ANCG = Adjusted net capital gains, LTCG = Long-term capital gain, LTCL = Long-term capital loss, STCG = Short-term capital gain, STCL = Short-term capital loss. Enter the net taxable amount for each category. If an input field is not used in the table leave the input field(s) empty; do not select a label or enter a zero.) Category Taxable amount Rate Tax Increase in tax liability Requirement c. In addition to the above three sales in Part a, assume that she sells another collectible asset held seven years as an investment and has a $25,000 capital loss. What is her taxable income and the increase in her tax liability after considering the four transactions? Her taxable income is What is the increase in her tax liability after considering the four transactions? First select the label for the applicable category of gains, then enter the taxable amount. In the last column compute the tax for each category and the increase in tax liability. (Abbreviations used: ANCG = Adjusted net capital gains, LTCG = Long-term capital gain, LTCL = Long-term capital loss, STCG = Short-term capital gain, STCL = Short-term capital loss. Enter the net taxable amount for each category. If an input field is not used in the table leave the input field(s) empty; do not select a label or enter a zero.) Category Taxable amount Rate Tax Increase in tax liability Requirement d. Determine her Medicare tax on net investment income in (a) if all of the $325,000 of taxable income is due to salary. In this scenario, Carley's Medicare tax on net investment income is Capital Gains and Dividends Capital gains and losses are assigned to baskets. Five possible tax rates will apply to most capital gains and losses: Ordinary income tax rates (up to 37% in 2019) for gains on assets held one year or less 28% rate on collectibles gains and includible Sec. 1202 gains . Preferential tax rates for gains on assets held for more than one year and qualified dividends based on the taxpayer's taxable income and filing status as shown in the following table: Preferencial Filing Jointly* Head of Household Rate 0% Single Up to $39,375 Up to $78,750 15% > $39,375 but not over $434,550 > $78,750 but not over $488,850 20% Over $434,550 Over $488,850 Up to $52,750 > $52,750 but not over $461,700 Over $461,700 Note: The net investment income of higher income taxpayers (modified AGI greater than $200,000 for single and $250,000 for married filing jointly) also may be subject to an additional tax of 3.8%. Net investment income includes dividends and capital gains, along with other types of investment income.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i Requirement a Her taxable income is 325000 9000 17000 18000 369000 Increase in her income tax liability after considering the three gains For the st...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

661e79591ae91_881638.pdf

180 KBs PDF File

661e79591ae91_881638.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started