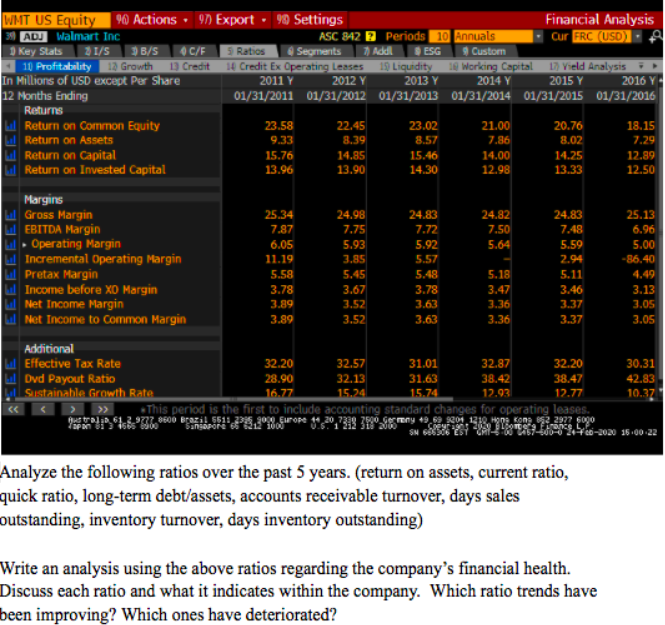

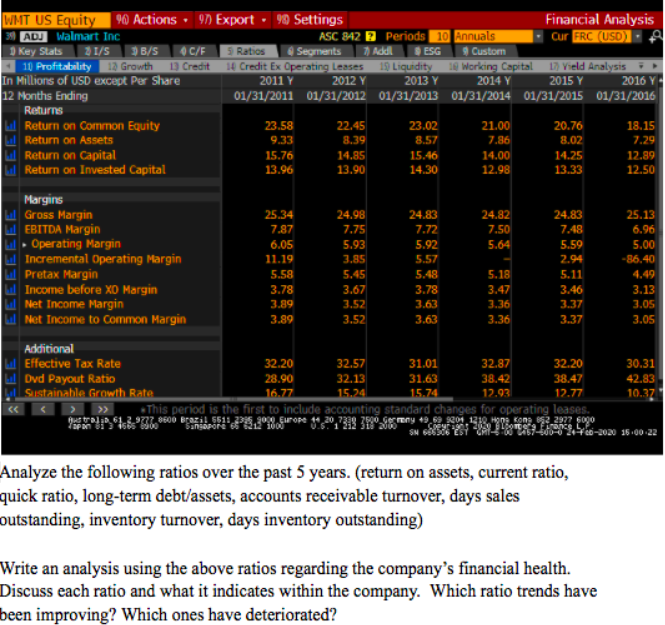

WMT US Equity90 Actions. 97 Export. 90 Settings Financial Analysis 31 ADU Walmart Inc ASC 842 Periods 10 Annuals 1. Cur FRC (USD) Key Stats 21/ S 3B/S C/E Ratios segments Add ESG Custom 10 Profitability 19 Growth by Credit Credit Ex Operating Leases 19 Liquidity Working Capital Yield Analysis In Millions of USD except Per Share 2011 Y 2012 Y 2013 Y 2014 Y 2015 Y 2016 Y 12 Months Ending 01/31/2011 01/31/2012 01/31/2013 01/31/2014 01/31/2015 01/31/2016 Returns Return on Common Equity 23.58 22.45 23.02 21.00 20.76 18.15 Ll Return on Assets 9.33 8.39 8.57 7.86 8.02 7.29 Return on Capital 15.76 14.85 15.46 14.00 14.25 12.89 Return on invested Capital 13.96 13.90 14.30 12.98 13.33 12.50 25.13 6.96 24.98 7.75 5.93 3.85 24.82 7.50 5.64 Margins Ll Gross Margin W EBITDA Margin Operating Margin Incremental Operating Margin Pretax Margin Income before XD Margin Net Income Margin W Net Income to Common Margin 24.83 7.72 5.92 5.57 5.48 3.78 5.00 25.34 7.87 6.05 11.19 5.58 3.78 3.89 3.89 24.83 7.48 5.59 2.94 5.11 3.46 -86.40 5.18 3.47 3.36 3.36 3.13 3.05 3.05 Additional Effective Tax Rate 32.20 32.57 31.01 32.87 32.20 30.31 Dvd Payout Ratio 28.90 32.13 31.63 38.42 38.47 42.83 Sustainable Growth Rate 16.77 15.24 15.74 12.93 12.77 10.37 This period is the first to include accounting standard changes for operating leases. VHER 12 00 Brazil2 4.298.gurore 4.29.319 38 -2020 16.00.22 Analyze the following ratios over the past 5 years. (return on assets, current ratio, quick ratio, long-term debt/assets, accounts receivable turnover, days sales outstanding, inventory turnover, days inventory outstanding) Write an analysis using the above ratios regarding the company's financial health. Discuss each ratio and what it indicates within the company. Which ratio trends have been improving? Which ones have deteriorated? WMT US Equity90 Actions. 97 Export. 90 Settings Financial Analysis 31 ADU Walmart Inc ASC 842 Periods 10 Annuals 1. Cur FRC (USD) Key Stats 21/ S 3B/S C/E Ratios segments Add ESG Custom 10 Profitability 19 Growth by Credit Credit Ex Operating Leases 19 Liquidity Working Capital Yield Analysis In Millions of USD except Per Share 2011 Y 2012 Y 2013 Y 2014 Y 2015 Y 2016 Y 12 Months Ending 01/31/2011 01/31/2012 01/31/2013 01/31/2014 01/31/2015 01/31/2016 Returns Return on Common Equity 23.58 22.45 23.02 21.00 20.76 18.15 Ll Return on Assets 9.33 8.39 8.57 7.86 8.02 7.29 Return on Capital 15.76 14.85 15.46 14.00 14.25 12.89 Return on invested Capital 13.96 13.90 14.30 12.98 13.33 12.50 25.13 6.96 24.98 7.75 5.93 3.85 24.82 7.50 5.64 Margins Ll Gross Margin W EBITDA Margin Operating Margin Incremental Operating Margin Pretax Margin Income before XD Margin Net Income Margin W Net Income to Common Margin 24.83 7.72 5.92 5.57 5.48 3.78 5.00 25.34 7.87 6.05 11.19 5.58 3.78 3.89 3.89 24.83 7.48 5.59 2.94 5.11 3.46 -86.40 5.18 3.47 3.36 3.36 3.13 3.05 3.05 Additional Effective Tax Rate 32.20 32.57 31.01 32.87 32.20 30.31 Dvd Payout Ratio 28.90 32.13 31.63 38.42 38.47 42.83 Sustainable Growth Rate 16.77 15.24 15.74 12.93 12.77 10.37 This period is the first to include accounting standard changes for operating leases. VHER 12 00 Brazil2 4.298.gurore 4.29.319 38 -2020 16.00.22 Analyze the following ratios over the past 5 years. (return on assets, current ratio, quick ratio, long-term debt/assets, accounts receivable turnover, days sales outstanding, inventory turnover, days inventory outstanding) Write an analysis using the above ratios regarding the company's financial health. Discuss each ratio and what it indicates within the company. Which ratio trends have been improving? Which ones have deteriorated