Answered step by step

Verified Expert Solution

Question

1 Approved Answer

WNR Inc. is an oil and gas exploration company that is currently operating two active oil fields with a market value of $200 million each.

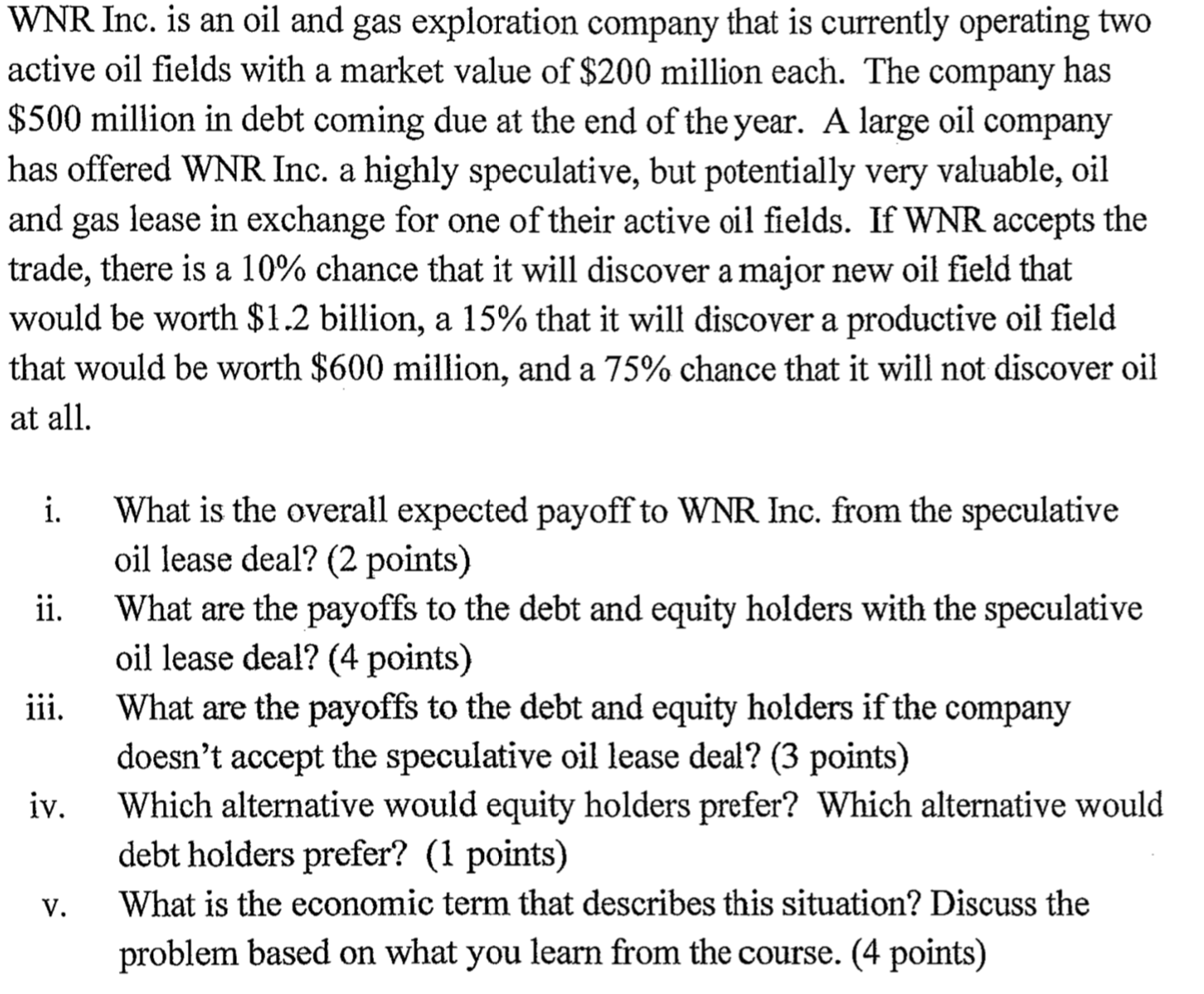

WNR Inc. is an oil and gas exploration company that is currently operating two active oil fields with a market value of $200 million each. The company has $500 million in debt coming due at the end of the year. A large oil company has offered WNR Inc. a highly speculative, but potentially very valuable, oil and gas lease in exchange for one of their active oil fields. If WNR accepts the trade, there is a 10% chance that it will discover a major new oil field that would be worth $1.2 billion, a 15% that it will discover a productive oil field that would be worth $600 million, and a 75% chance that it will not discover oil at all. i. What is the overall expected payoff to WNR Inc. from the speculative oil lease deal? ( 2 points) ii. What are the payoffs to the debt and equity holders with the speculative oil lease deal? (4 points) iii. What are the payoffs to the debt and equity holders if the company doesn't accept the speculative oil lease deal? (3 points) iv. Which alternative would equity holders prefer? Which alternative would debt holders prefer? (1 points) v. What is the economic term that describes this situation? Discuss the problem based on what you learn from the course. (4 points)

WNR Inc. is an oil and gas exploration company that is currently operating two active oil fields with a market value of $200 million each. The company has $500 million in debt coming due at the end of the year. A large oil company has offered WNR Inc. a highly speculative, but potentially very valuable, oil and gas lease in exchange for one of their active oil fields. If WNR accepts the trade, there is a 10% chance that it will discover a major new oil field that would be worth $1.2 billion, a 15% that it will discover a productive oil field that would be worth $600 million, and a 75% chance that it will not discover oil at all. i. What is the overall expected payoff to WNR Inc. from the speculative oil lease deal? ( 2 points) ii. What are the payoffs to the debt and equity holders with the speculative oil lease deal? (4 points) iii. What are the payoffs to the debt and equity holders if the company doesn't accept the speculative oil lease deal? (3 points) iv. Which alternative would equity holders prefer? Which alternative would debt holders prefer? (1 points) v. What is the economic term that describes this situation? Discuss the problem based on what you learn from the course. (4 points) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started