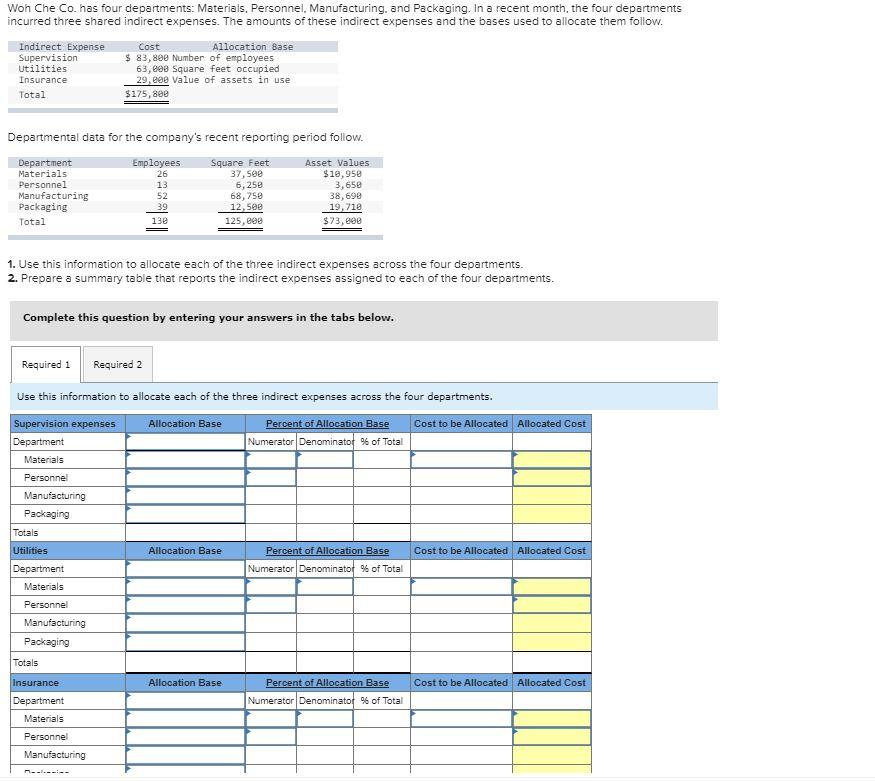

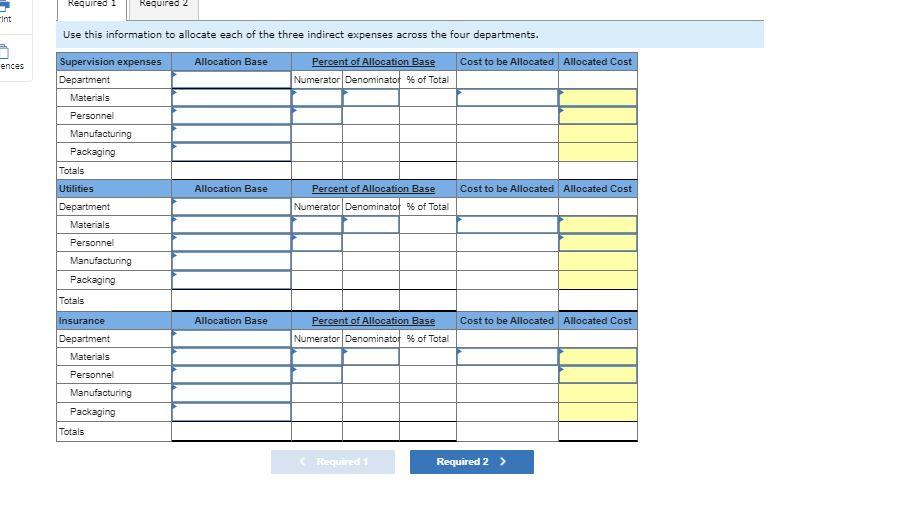

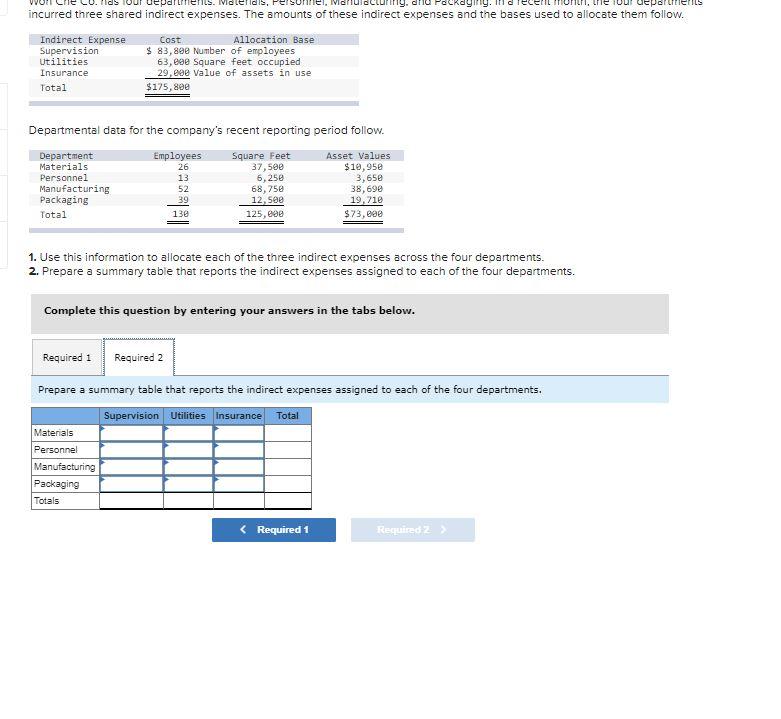

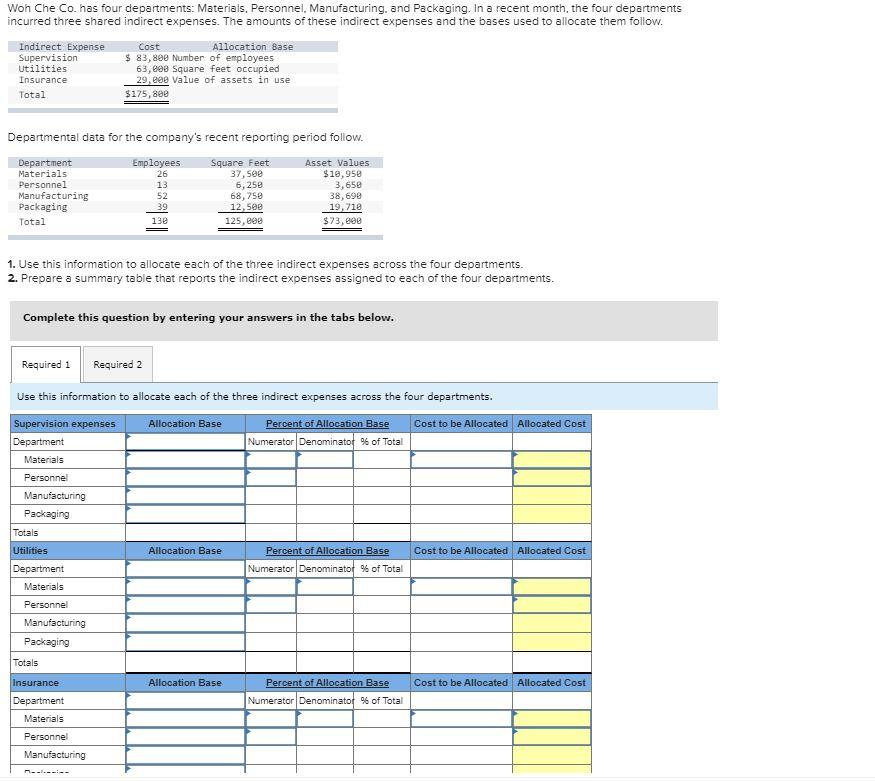

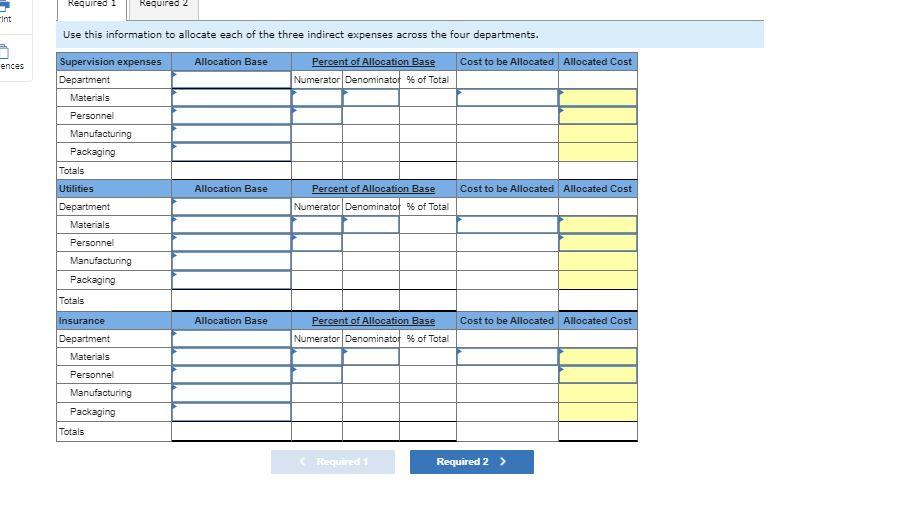

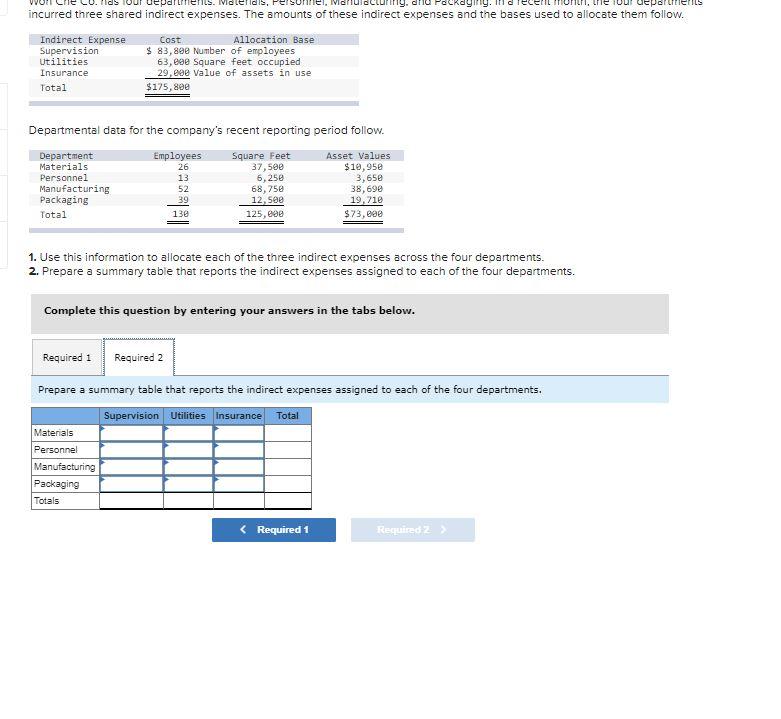

Woh Che Co has four departments: Materials, Personnel. Manufacturing, and Packaging. In a recent month, the four departments incurred three shared indirect expenses. The amounts of these indirect expenses and the bases used to allocate them follow. Indirect Expense Cost Allocation Base Supervision $ 83, 8ee Number of employees Utilities 63,800 square feet occupied Insurance 29,808 value of assets in use Total $175,800 Departmental data for the company's recent reporting period follow. Department Materials Personnel Manufacturing Packaging Total Employees 26 13 52 39 138 Square Feet 37,500 6,25 68,750 12,500 125, eee Asset Values $19,95 3,650 38,690 19,710 $73,800 1. Use this information to allocate each of the three indirect expenses across the four departments. 2. Prepare a summary table that reports the indirect expenses assigned to each of the four departments. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Use this information to allocate each of the three indirect expenses across the four departments. Supervision expenses Allocation Base Percent of Allocation Base Cost to be Allocated Allocated Cost Department Numerator Denominato % of Total Materials Personnel Manufacturing Packaging Totals Utilities Allocation Base Percent of Allocation Base Cost to be Allocated Allocated Cost Department Numerator Denominator % of Total Materials Personnel Manufacturing Packaging Totals Insurance Allocation Base Cost to be Allocated Allocated Cost Percent of Allocation Base Numerator Denominator % of Total Department Materials Personnel Manufacturing Required 1 Required 2 int Use this information to allocate each of the three indirect expenses across the four departments. ences Allocation Base Cost to be Allocated Allocated Cost Supervision expenses Department Materials Percent of Allocation Base Numerator Denominatot % of Total Personnel Manufacturing Packaging Totals Utilities Allocation Base Cost to be Allocated Allocated Cost Percent of Allocation Base Numerator Denominato % of Total Department Materials Personnel Manufacturing Packaging Totals Insurance Allocation Base Cost to be Allocated Allocated Cost Percent of Allocation Base Numerator Denominator % of Total Department Materials Personnel Manufacturing Packaging Totals Required Required 2 > renes. Ieleridis, drid incurred three shared indirect expenses. The amounts of these indirect expenses and the bases used to allocate them follow. Indirect Expense Supervision Utilities Insurance Total Cost Allocation Base $ 83, 8ee Number of employees 63,coe Square feet occupied 29,208 value of assets in use $175,800 Departmental data for the company's recent reporting period follow. Department Materials Personnel Manufacturing Packaging Total Employees 26 13 52 39 138 Square Feet 37,500 6,250 68,750 12,500 125,000 Asset Values $19,95 3,652 38,690 19,710 $73, eae 1. Use this information to allocate each of the three indirect expenses across the four departments. 2. Prepare a summary table that reports the indirect expenses assigned to each of the four departments. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a summary table that reports the indirect expenses assigned to each of the four departments. Supervision Utilities Insurance Total Materials Personnel Manufacturing Packaging Totals