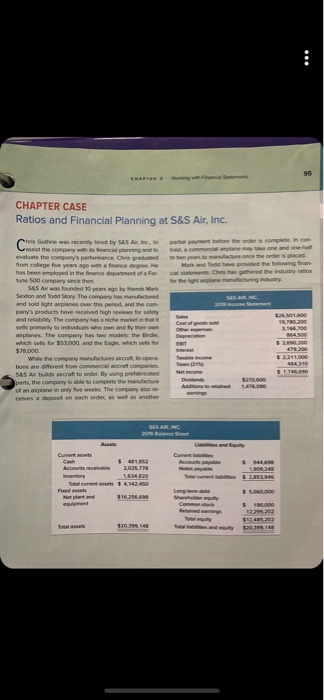

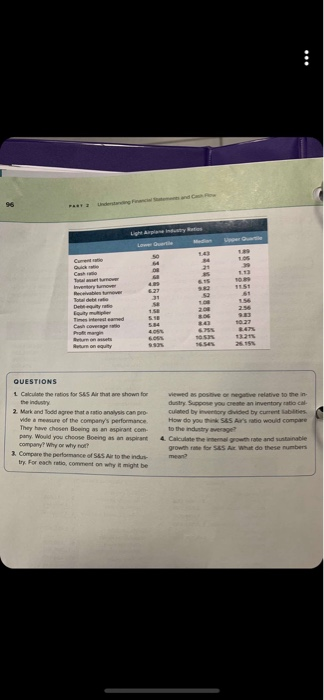

Woing w Fcal S CHAPTER 3 CHAPTER CASE Ratios and Financial Planning at S&S Air, Inc. partial peyment before the order is complete. In con ast a commencial arplane may tke one and one half s Guthrie was recenty hred by SAS A, Inc. to sist the company with its financial pienning and to evaluate the company's pertormance. Chris gradusted from ris o two ye manulacture once the order is placed Mark and Todd hve provided the following fnan- cial statemenes Chris has gpathered the industry ratios for the light arplane manufacturing industry college five years ago with a finance degree. He has been employed in the finance depatment of a For tune 500 company since then SAS Air was founded 10 yeers age by iends Mark Sexton and Todd Story The company has manufectured and sold light airplanes over this period, and the com tement 20 peny's products have recelved high neviews for satety S26.s01s00 18.780200 Sales and reliability. The company has aniche market in thet sells primarily to individuals whe own and ty their own Cost of good airplanes. The company has two models the Bede, which sels for $53.000, and the Eagle, which sels for 4500 Deprecitn $2.690.200 479.200 S78.000. teret $2211,000 484.310 whde the comparny manutactures aircraft, s opera tions are different from commercial aircraft companies. $1.746.0 Netncome SAS Air builds aircrat to order. By using pretabricated pans, the company is atle to complete the manutacture of an airplane in only five weeks. The company aoe 146.00 eaing celves a depost en each order, as well as another SES AR INC. 20 eet Cuent Accout p e Cument asets Cash 944. 190248 Accounta necelvable 2.025.77 untu Inventory $2as3.946 $442450 Total cument ensets Long erm e Sharhoeruty Common c S S060.000 Fied assets Net plart and egment S16.2566 190.000 ineding 12.222 T ty $20.399,48 Toal asset T and ty S20 1 Rew s and C Uetaning Financial Ste Light pla indty tios Mdian per Quale Lwe Quertile 143 24 21 Curenttie Qui e Cash o Talaet ove Inventery tumover eclvables tumever $32 31 Total deb retio Detety rete Euty muter Times teesteamed Cash coverage Prot mangn 154 256 1027 47% 132 26 843 4.0 eum on assets 1654 Reum on euity QUESTIONS 1 Calculate the ratios for SAS Air that are shown for viewed as positive or negative relative to the in- dustry. Suppose you create an inventory ratio cal culated by inventory divided by curent labilities How do youthik SAS Ars ao woud compare to the industry verage the industry 2. Mark and fodd agree that a ratio analysis can pro vide a meure of the company's performance. They have chosen Boeing as an aspirant com- pany. Would you choose Boeing as an aspirat company Why or why not? 3. Compare the perfomance of S4S Air to the indus try For each ratio, comment on why it might be 4. Calculate the intemal growth rate and suntainable growth rate for SaS A What do these numbers mean Woing w Fcal S CHAPTER 3 CHAPTER CASE Ratios and Financial Planning at S&S Air, Inc. partial peyment before the order is complete. In con ast a commencial arplane may tke one and one half s Guthrie was recenty hred by SAS A, Inc. to sist the company with its financial pienning and to evaluate the company's pertormance. Chris gradusted from ris o two ye manulacture once the order is placed Mark and Todd hve provided the following fnan- cial statemenes Chris has gpathered the industry ratios for the light arplane manufacturing industry college five years ago with a finance degree. He has been employed in the finance depatment of a For tune 500 company since then SAS Air was founded 10 yeers age by iends Mark Sexton and Todd Story The company has manufectured and sold light airplanes over this period, and the com tement 20 peny's products have recelved high neviews for satety S26.s01s00 18.780200 Sales and reliability. The company has aniche market in thet sells primarily to individuals whe own and ty their own Cost of good airplanes. The company has two models the Bede, which sels for $53.000, and the Eagle, which sels for 4500 Deprecitn $2.690.200 479.200 S78.000. teret $2211,000 484.310 whde the comparny manutactures aircraft, s opera tions are different from commercial aircraft companies. $1.746.0 Netncome SAS Air builds aircrat to order. By using pretabricated pans, the company is atle to complete the manutacture of an airplane in only five weeks. The company aoe 146.00 eaing celves a depost en each order, as well as another SES AR INC. 20 eet Cuent Accout p e Cument asets Cash 944. 190248 Accounta necelvable 2.025.77 untu Inventory $2as3.946 $442450 Total cument ensets Long erm e Sharhoeruty Common c S S060.000 Fied assets Net plart and egment S16.2566 190.000 ineding 12.222 T ty $20.399,48 Toal asset T and ty S20 1 Rew s and C Uetaning Financial Ste Light pla indty tios Mdian per Quale Lwe Quertile 143 24 21 Curenttie Qui e Cash o Talaet ove Inventery tumover eclvables tumever $32 31 Total deb retio Detety rete Euty muter Times teesteamed Cash coverage Prot mangn 154 256 1027 47% 132 26 843 4.0 eum on assets 1654 Reum on euity QUESTIONS 1 Calculate the ratios for SAS Air that are shown for viewed as positive or negative relative to the in- dustry. Suppose you create an inventory ratio cal culated by inventory divided by curent labilities How do youthik SAS Ars ao woud compare to the industry verage the industry 2. Mark and fodd agree that a ratio analysis can pro vide a meure of the company's performance. They have chosen Boeing as an aspirant com- pany. Would you choose Boeing as an aspirat company Why or why not? 3. Compare the perfomance of S4S Air to the indus try For each ratio, comment on why it might be 4. Calculate the intemal growth rate and suntainable growth rate for SaS A What do these numbers mean