Answered step by step

Verified Expert Solution

Question

1 Approved Answer

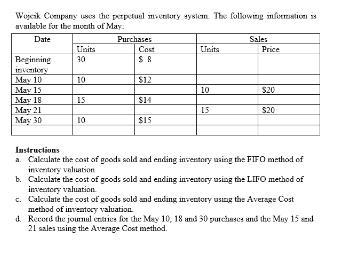

Wojcik Company uses the perpetual inventory system. The following information is available for the mouth of May. Date Beginning inventory May 10 May 15

Wojcik Company uses the perpetual inventory system. The following information is available for the mouth of May. Date Beginning inventory May 10 May 15 May 18 May 21 May 30 Units 30 10 15 10 Purchases Cost $8 $12 $14 $15 Units 10 15 Sales Price $20 $20 Instructions a. Calculate the cost of goods sold and ending inventory using the FIFO method of inventory valuation b. Calculate the cost of goods sold and ending inventory using the LIFO method of inventory valuation c. Calculate the cost of goods sold and ending inventory using the Average Cost method of inventory valuation. d. Record the journal entries for the May 10, 18 and 30 purchases and the May 15 and 21 sales using the Average Cost method. M Gmail H10 1 2 3 4 5 6 7 8 9 8 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Activity 3: Perpetual Inventory X H Oliver Walker U3A3 File Edit View Insert Format Data Tools Extensions Help n 27 100% $ %0.00 123- A Date Fortnite Tracker - F... D21 Homepage - Renfre..... + E fx docs.google.com/spreadsheets/d/1_A_zdjFJG6J5X5N1CDvUymV_mhk2GmY4L5mqVGyafko/edit#gid=667205955 War Legend System 10-May 15-May 15-May 18-May 21-May 21-May 30-May Assignments - Ms. Kolkman EL X B U3 Activity 3 Assi....docx Wojcik Company General Journal Type here to search C Bank Sales Particulars Inventory Bank To record the initial inventory balance Cost of Goods Sold Inventory Inventory Bank Bank Sales Cost of Goods Sold Inventory Arial Inventory Bank D FIFO - General Journal Inventory Error E....docx A 9: Oliver Walker U3A2 - Google Sh X E 10 Debit Last edit was 2 minutes ago $120 $200 $90 $210 $300 $160 TRIOS CASH CUP in... $150 BIS F Page Credit LIFO - $120 $200 $90 $210 $300 $160 $150 Average Oliver Walker U2A....xlsx A G Unit 3 - Google Drive FNCS $19 QUALIFIE... B 8- H Rematch = W X + Oliver Walker U3A3 - Google Sh x +Oliver Walker U2A6 - Updated Course Hero GO J Course Hero 1 K ITF International Tennis... L M X N Homework Help - Q&A from O (??? 0 P X + Share R 4C Mostly cloudy ENG Show all 7:21 PM 2022-03-23 6 O ? + X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started