Answered step by step

Verified Expert Solution

Question

1 Approved Answer

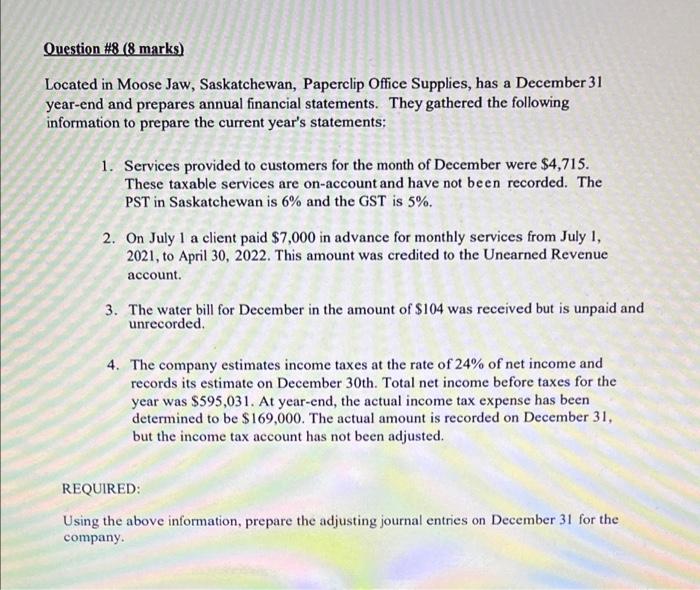

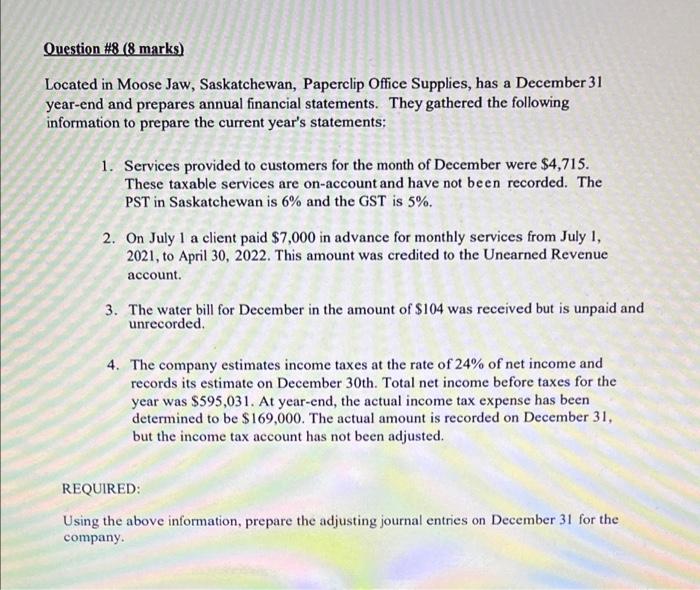

wokring note please Question #8 (8 marks) Located in Moose Jaw, Saskatchewan, Paperclip Office Supplies, has a December 31 year-end and prepares annual financial statements.

wokring note please

Question #8 (8 marks) Located in Moose Jaw, Saskatchewan, Paperclip Office Supplies, has a December 31 year-end and prepares annual financial statements. They gathered the following information to prepare the current year's statements: 1. Services provided to customers for the month of December were $4,715. These taxable services are on-account and have not been recorded. The PST in Saskatchewan is 6% and the GST is 5%. 2. On July 1 a client paid $7,000 in advance for monthly services from July 1, 2021, to April 30, 2022. This amount was credited to the Unearned Revenue account. 3. The water bill for December in the amount of $104 was received but is unpaid and unrecorded 4. The company estimates income taxes at the rate of 24% of net income and records its estimate on December 30th. Total net income before taxes for the year was $595,031. At year-end, the actual income tax expense has been determined to be $169,000. The actual amount is recorded on December 31, but the income tax account has not been adjusted. REQUIRED: Using the above information, prepare the adjusting journal entries on December 31 for the company

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started