Answered step by step

Verified Expert Solution

Question

1 Approved Answer

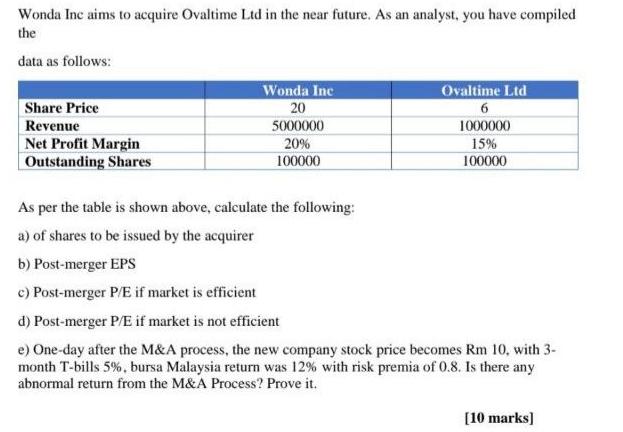

Wonda Inc aims to acquire Ovaltime Ltd in the near future. As an analyst, you have compiled the data as follows: Share Price Revenue

Wonda Inc aims to acquire Ovaltime Ltd in the near future. As an analyst, you have compiled the data as follows: Share Price Revenue Net Profit Margin Outstanding Shares Wonda Inc 20 Ovaltime Ltd 6 5000000 1000000 20% 100000 15% 100000 As per the table is shown above, calculate the following: a) of shares to be issued by the acquirer b) Post-merger EPS c) Post-merger P/E if market is efficient d) Post-merger P/E if market is not efficient e) One-day after the M&A process, the new company stock price becomes Rm 10, with 3- month T-bills 5%, bursa Malaysia return was 12% with risk premia of 0.8. Is there any abnormal return from the M&A Process? Prove it. [10 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Number of shares to be issued by the acquirer To calculate the number of shares to be issued by th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started