Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wonderland Corp. will pay a dividend of $3.5 next year. The company plans to maintain a constant growth rate of 5 percent a year

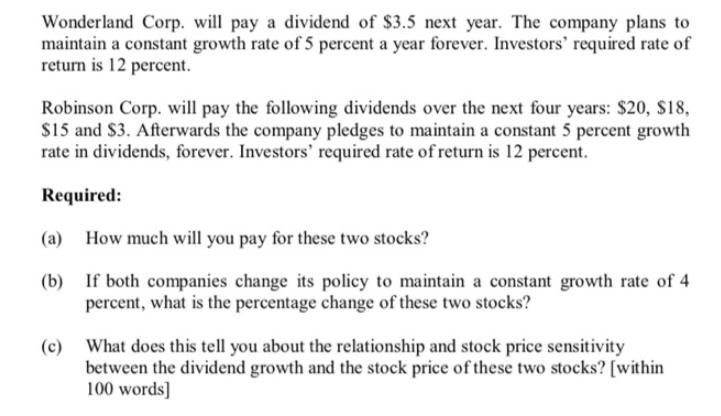

Wonderland Corp. will pay a dividend of $3.5 next year. The company plans to maintain a constant growth rate of 5 percent a year forever. Investors' required rate of return is 12 percent. Robinson Corp. will pay the following dividends over the next four years: $20, $18, $15 and $3. Afterwards the company pledges to maintain a constant 5 percent growth rate in dividends, forever. Investors' required rate of return is 12 percent. Required: (a) How much will you pay for these two stocks? (b) If both companies change its policy to maintain a constant growth rate of 4 percent, what is the percentage change of these two stocks? What does this tell you about the relationship and stock price sensitivity between the dividend growth and the stock price of these two stocks? [within 100 words]

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Calculating the stock prices For Wonderland Corp Dividend next year 350 Growth rate 5 Required rat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started