Answered step by step

Verified Expert Solution

Question

1 Approved Answer

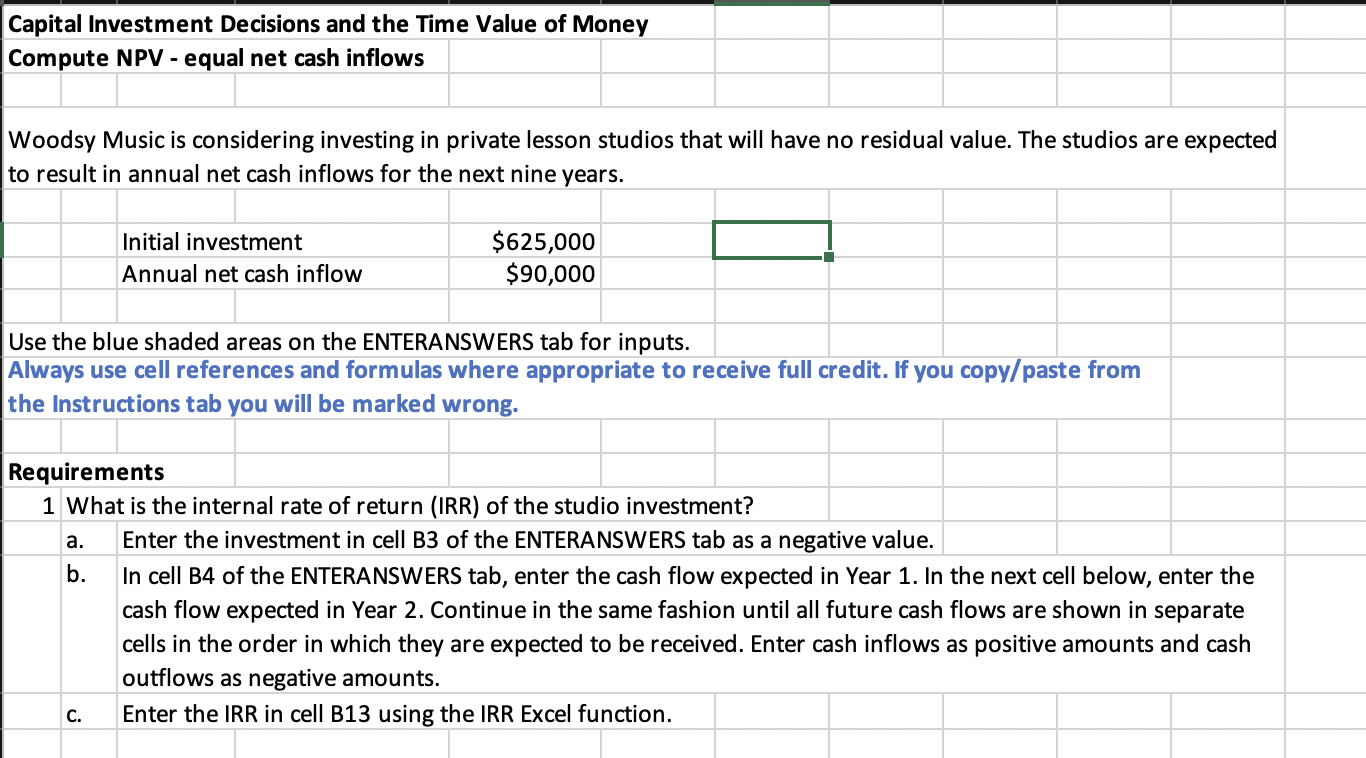

Woodsy Music is considering investing in private lesson studios that will have no residual value. The studios are expected to result in annual net cash

Woodsy Music is considering investing in private lesson studios that will have no residual value. The studios are expected to result in annual net cash inflows for the next nine years.

Initial investment -> 625000

Annual net cash inflow -> 90000

What is the internal rate of return (IRR) of the studio investment?

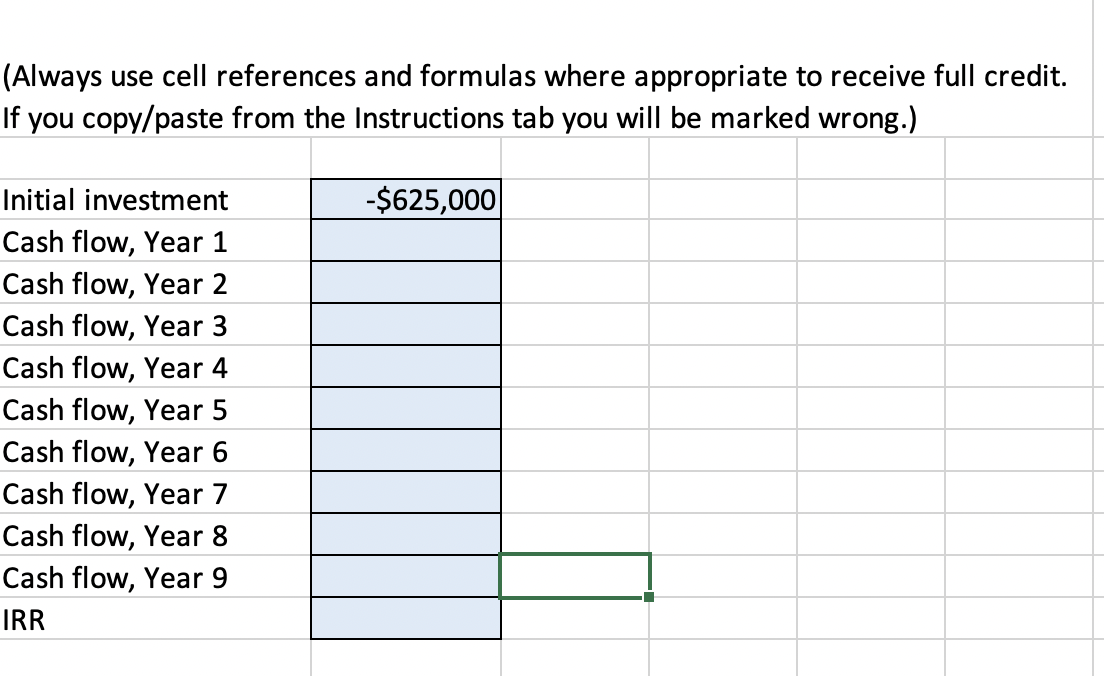

Woodsy Music is considering investing in private lesson studios that will have no residual value. The studios are expected to result in annual net cash inflows for the next nine years. Use the blue shaded areas on the ENTERANSWERS tab for inputs. Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions tab you will be marked wrong. Rel 1 What is the internal rate of return (IRR) of the studio investment? a. Enter the investment in cell B3 of the ENTERANSWERS tab as a negative value. b. In cell B4 of the ENTERANSWERS tab, enter the cash flow expected in Year 1 . In the next cell below, enter the cash flow expected in Year 2. Continue in the same fashion until all future cash flows are shown in separate cells in the order in which they are expected to be received. Enter cash inflows as positive amounts and cash outflows as negative amounts. c. Enter the IRR in cell B13 using the IRR Excel function. (Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions tab you will be marked wrong.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started