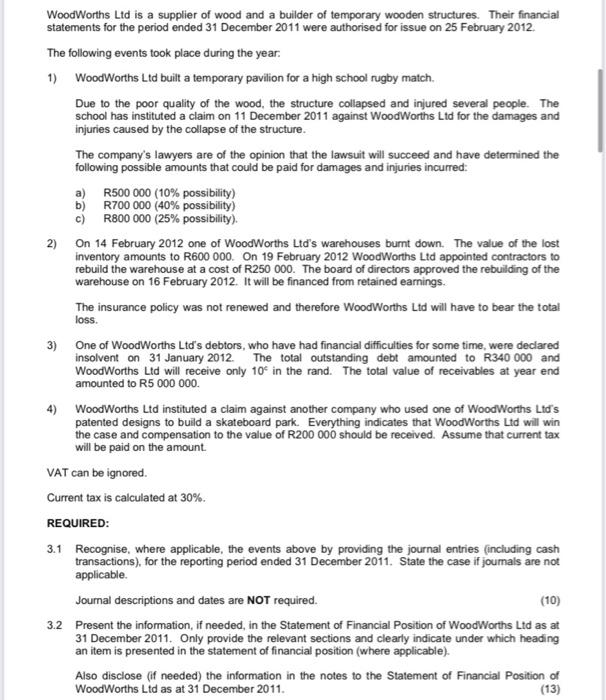

WoodWorths Ltd is a supplier of wood and a builder of temporary wooden structures. Their financial statements for the period ended 31 December 2011 were authorised for issue on 25 February 2012 The following events took place during the year. 1) WoodWorths Ltd built a temporary pavilion for a high school rugby match. Due to the poor quality of the wood, the structure collapsed and injured several people. The school has instituted a claim on 11 December 2011 against WoodWorths Ltd for the damages and injuries caused by the collapse of the structure. The company's lawyers are of the opinion that the lawsuit will succeed and have determined the following possible amounts that could be paid for damages and injuries incurred: a) R500 000 (10% possibility) b) R700 000 (40% possibility) c) R800 000 (25% possibility). 2) On 14 February 2012 one of WoodWorths Ltd's warehouses burnt down. The value of the lost inventory amounts to R600 000. On 19 February 2012 WoodWorths Lid appointed contractors to rebuild the warehouse at a cost of R250 000. The board of directors approved the rebuilding of the warehouse on 16 February 2012. It will be financed from retained earnings. The insurance policy was not renewed and therefore WoodWorths Lid will have to bear the total loss. 3) One of WoodWorths Ltd's debtors, who have had financial difficulties for some time, were declared insolvent on 31 January 2012. The total outstanding debt amounted to R340 000 and WoodWorths Ltd will receive only 10 in the rand. The total value of receivables at year end amounted to R5 000 000 4) WoodWorths Ltd instituted a claim against another company who used one of WoodWorths Lid's patented designs to build a skateboard park. Everything indicates that WoodWorths Ltd will win the case and compensation to the value of R200 000 should be received. Assume that current tax will be paid on the amount VAT can be ignored. Current tax is calculated at 30%. REQUIRED: 3.1 Recognise, where applicable, the events above by providing the journal entries (including cash transactions) for the reporting period ended 31 December 2011. State the case if joumals are not applicable Journal descriptions and dates are NOT required. (10) 3.2 Present the information, if needed in the Statement of Financial Position of WoodWorths Ltd as at 31 December 2011. Only provide the relevant sections and clearly indicate under which heading an item is presented in the statement of financial position (where applicable). Also disclose (if needed) the information in the notes to the Statement of Financial Position of WoodWorths Ltd as at 31 December 2011. (13)