Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Woody Limited, a furniture manufacturer, was afraid that the wood price would increase and consequently its gross profit margin would be lowered. To hedge

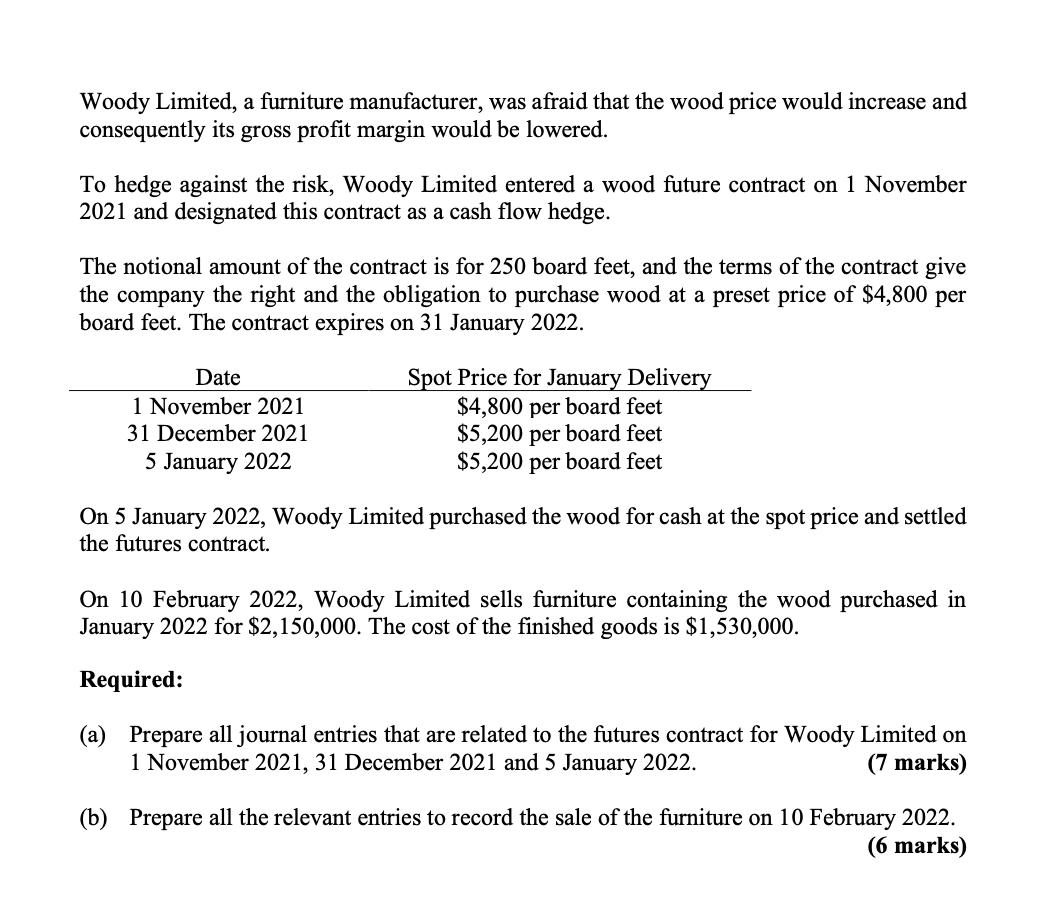

Woody Limited, a furniture manufacturer, was afraid that the wood price would increase and consequently its gross profit margin would be lowered. To hedge against the risk, Woody Limited entered a wood future contract on 1 November 2021 and designated this contract as a cash flow hedge. The notional amount of the contract is for 250 board feet, and the terms of the contract give the company the right and the obligation to purchase wood at a preset price of $4,800 per board feet. The contract expires on 31 January 2022. Date 1 November 2021 31 December 2021 5 January 2022 Spot Price for January Delivery $4,800 per board feet $5,200 per board feet $5,200 per board feet On 5 January 2022, Woody Limited purchased the wood for cash at the spot price and settled the futures contract. On 10 February 2022, Woody Limited sells furniture containing the wood purchased in January 2022 for $2,150,000. The cost of the finished goods is $1,530,000. Required: (a) Prepare all journal entries that are related to the futures contract for Woody Limited on 1 November 2021, 31 December 2021 and 5 January 2022. (7 marks) (b) Prepare all the relevant entries to record the sale of the furniture on 10 February 2022. (6 marks)

Step by Step Solution

★★★★★

3.32 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 A Journal Entries Date Description Debit in Credit in 1112021 Purchases 1200000 To Accounts P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started