Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Woody Marionette's presently manufacturers a string that is currently used in the production of Marionette's. Woody is capable of producing 24,000 strings per year. The

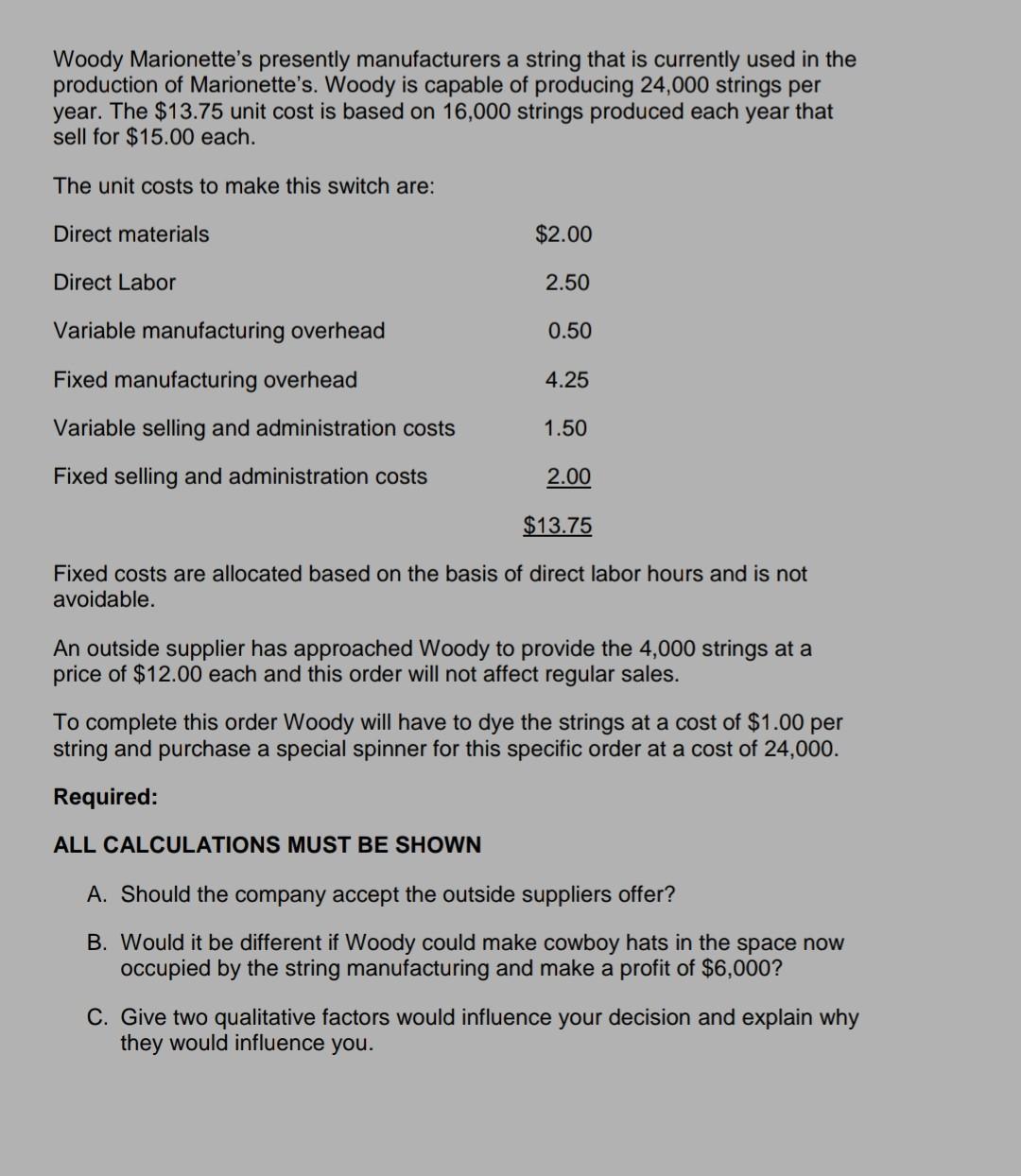

Woody Marionette's presently manufacturers a string that is currently used in the production of Marionette's. Woody is capable of producing 24,000 strings per year. The $13.75 unit cost is based on 16,000 strings produced each year that sell for $15.00 each. The unit costs to make this switch are: Direct materials $2.00 Direct Labor 2.50 Variable manufacturing overhead 0.50 Fixed manufacturing overhead 4.25 Variable selling and administration costs 1.50 Fixed selling and administration costs 2.00 $13.75 Fixed costs are allocated based on the basis of direct labor hours and is not avoidable. An outside supplier has approached Woody to provide the 4,000 strings at a price of $12.00 each and this order will not affect regular sales. To complete this order Woody will have to dye the strings at a cost of $1.00 per string and purchase a special spinner for this specific order at a cost of 24,000. Required: ALL CALCULATIONS MUST BE SHOWN A. Should the company accept the outside suppliers offer? B. Would it be different if Woody could make cowboy hats in the space now occupied by the string manufacturing and make a profit of $6,000? C. Give two qualitative factors would influence your decision and explain why they would influence you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started