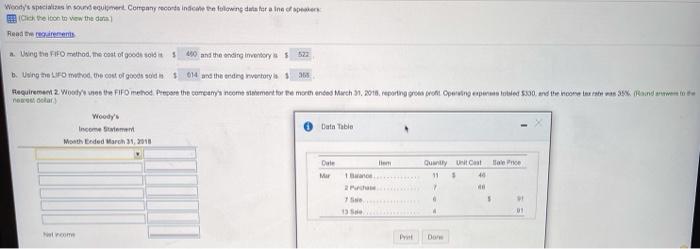

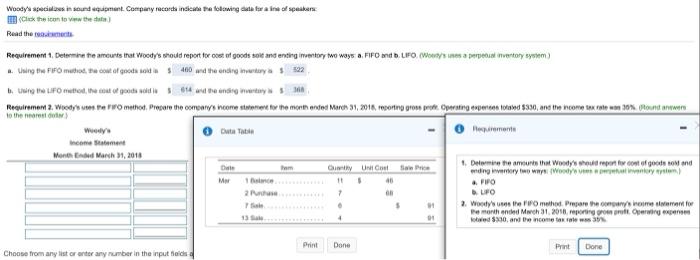

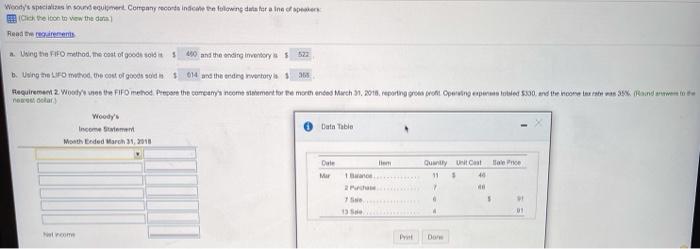

Woody's species in der Company record inte foliowing data for a no Click to to view the doma Read errents 2. Using the FIFO method. The cost of goods sold 5 400 and the ending Inventory S522 b. Uning the Lord, the cost of goods od 014 and the ending vertory Requireme2. Woody on the FIFO metod Prepare the company's come statement for the more and Mich 1. 2018. reporting role of Operations lote 5:00 and the income tax st 38 Rander Woody's Income Month Eeded March 31, 2018 Dan Table Bater Dule Mur Qually at 11 $ 40 1 135 4 01 em Woody's species in soundment Company records indicate towing for a line of speakers Ce the icon to view the Read the Requirement 1, Determine the amounts that woody's should report for otet of goods sole and ending mentory two ways a FIFO mdb LIFO (W/s a perpetual invertory system) Using the FF methode con of goods to $400 and the ending to a $ 522 Fatto com o good to 64 ways Requiremom 2. Wides. Ve Po method, Piacere the only one text to the month onded March 31, 2016. fortro eros et Operating experiene losed 5330, and the come tax este wen 30%. Rount own to the name Wedly Herem non Statement Mon March 31, 2018 Die Gay Un Cut SP 1. Del the amounts that Woody's should reportion of goods and ending tory was Woody Mw 5 . PO UFO 3. Woody method. Prepare the meant for e month and Mwch 31, 2016.pring rond Operating expense bed $390, and the income tax rates 11 2 7 e $ 1 13 4 Print Done Pet Done Choose from any listorantee any number in the input fois Woody's species in der Company record inte foliowing data for a no Click to to view the doma Read errents 2. Using the FIFO method. The cost of goods sold 5 400 and the ending Inventory S522 b. Uning the Lord, the cost of goods od 014 and the ending vertory Requireme2. Woody on the FIFO metod Prepare the company's come statement for the more and Mich 1. 2018. reporting role of Operations lote 5:00 and the income tax st 38 Rander Woody's Income Month Eeded March 31, 2018 Dan Table Bater Dule Mur Qually at 11 $ 40 1 135 4 01 em Woody's species in soundment Company records indicate towing for a line of speakers Ce the icon to view the Read the Requirement 1, Determine the amounts that woody's should report for otet of goods sole and ending mentory two ways a FIFO mdb LIFO (W/s a perpetual invertory system) Using the FF methode con of goods to $400 and the ending to a $ 522 Fatto com o good to 64 ways Requiremom 2. Wides. Ve Po method, Piacere the only one text to the month onded March 31, 2016. fortro eros et Operating experiene losed 5330, and the come tax este wen 30%. Rount own to the name Wedly Herem non Statement Mon March 31, 2018 Die Gay Un Cut SP 1. Del the amounts that Woody's should reportion of goods and ending tory was Woody Mw 5 . PO UFO 3. Woody method. Prepare the meant for e month and Mwch 31, 2016.pring rond Operating expense bed $390, and the income tax rates 11 2 7 e $ 1 13 4 Print Done Pet Done Choose from any listorantee any number in the input fois