Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Wooley Ltd. was incorporated several years ago to manufacture rugs for the hotel industry. The company is currently preparing its budget for the next

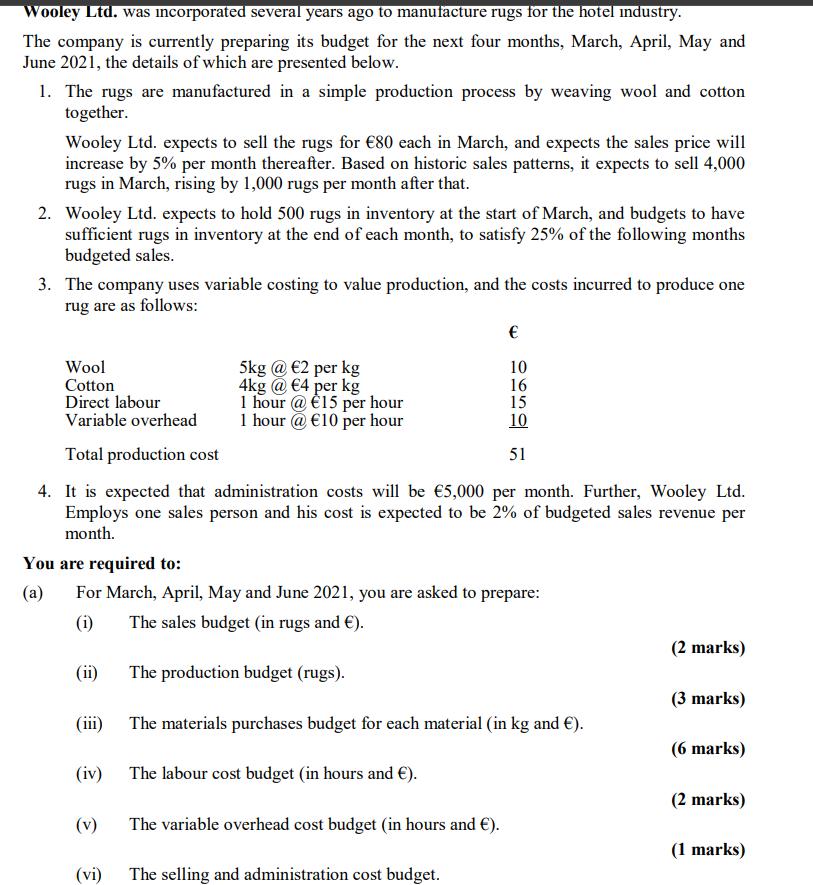

Wooley Ltd. was incorporated several years ago to manufacture rugs for the hotel industry. The company is currently preparing its budget for the next four months, March, April, May and June 2021, the details of which are presented below. 1. The rugs are manufactured in a simple production process by weaving wool and cotton together. Wooley Ltd. expects to sell the rugs for 80 each in March, and expects the sales price will increase by 5% per month thereafter. Based on historic sales patterns, it expects to sell 4,000 rugs in March, rising by 1,000 rugs per month after that. 2. Wooley Ltd. expects to hold 500 rugs in inventory at the start of March, and budgets to have sufficient rugs in inventory at the end of each month, to satisfy 25% of the following months budgeted sales. 3. The company uses variable costing to value production, and the costs incurred to produce one rug are as follows: Wool Cotton Direct labour Variable overhead (iii) (iv) 5kg @ 2 per kg 4kg @ 4 per kg 1 hour @ 15 per hour 1 hour @ 10 per hour Total production cost 4. It is expected that administration costs will be 5,000 per month. Further, Wooley Ltd. Employs one sales person and his cost is expected to be 2% of budgeted sales revenue per month. (v) You are required to: (a) For March, April, May and June 2021, you are asked to prepare: (i) The sales budget (in rugs and ). (ii) The production budget (rugs). The materials purchases budget for each material (in kg and ). The labour cost budget (in hours and ). The variable overhead cost budget (in hours and ). (vi) 10 16 15 10 51 The selling and administration cost budget. (2 marks) (3 marks) (6 marks) (2 marks) (1 marks)

Step by Step Solution

★★★★★

3.54 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the budgets for Wooley Ltd for March April May and June 2021 we will follow the given information and calculations step by step Lets start ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started