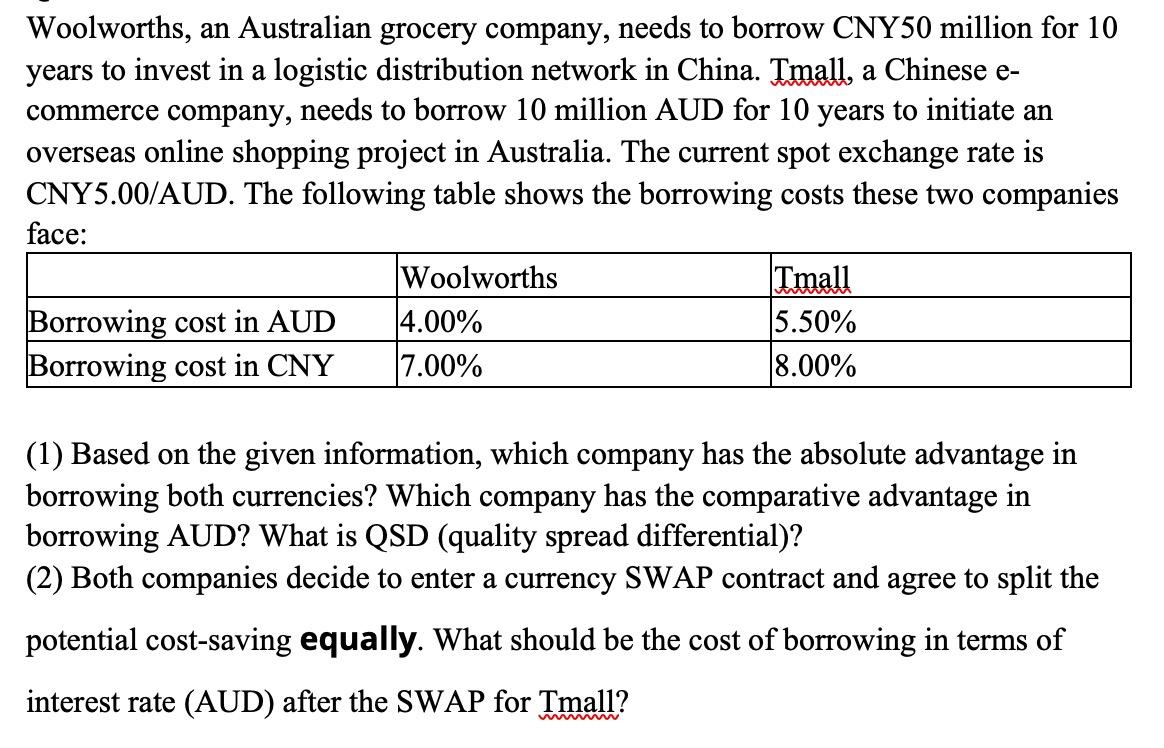

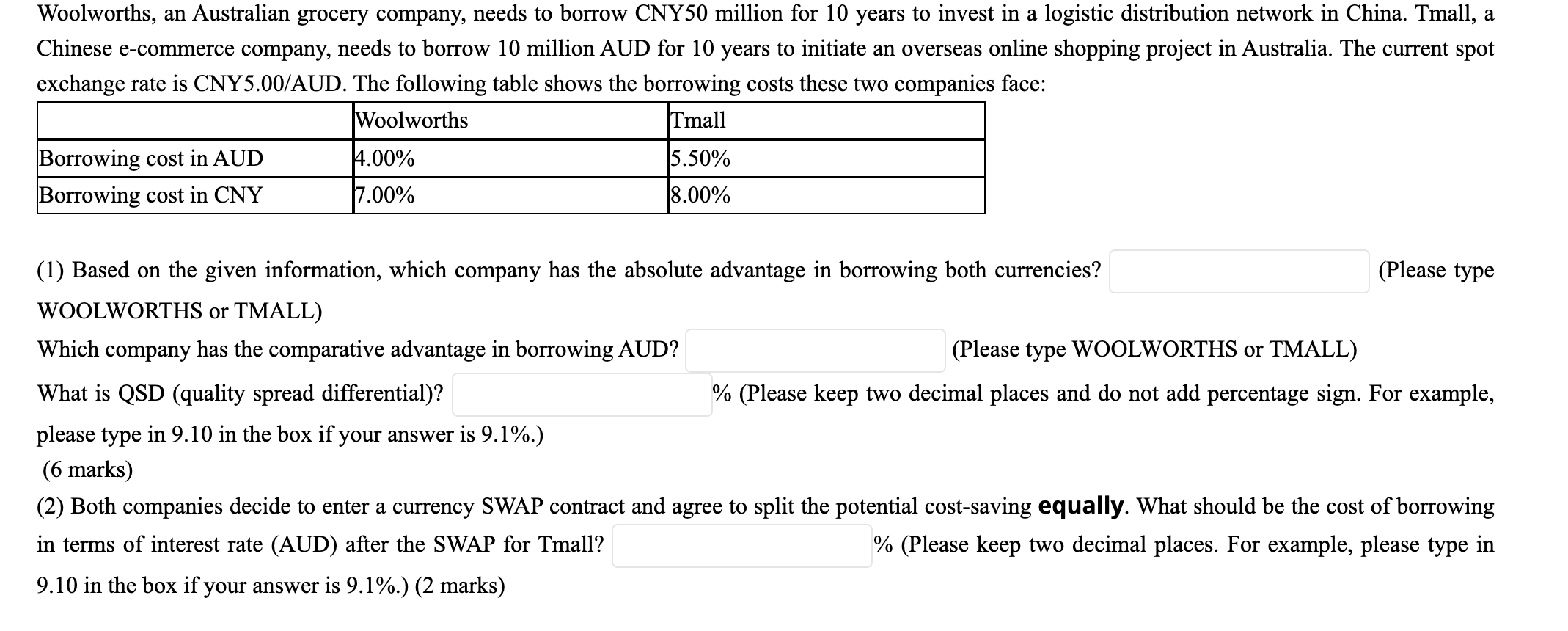

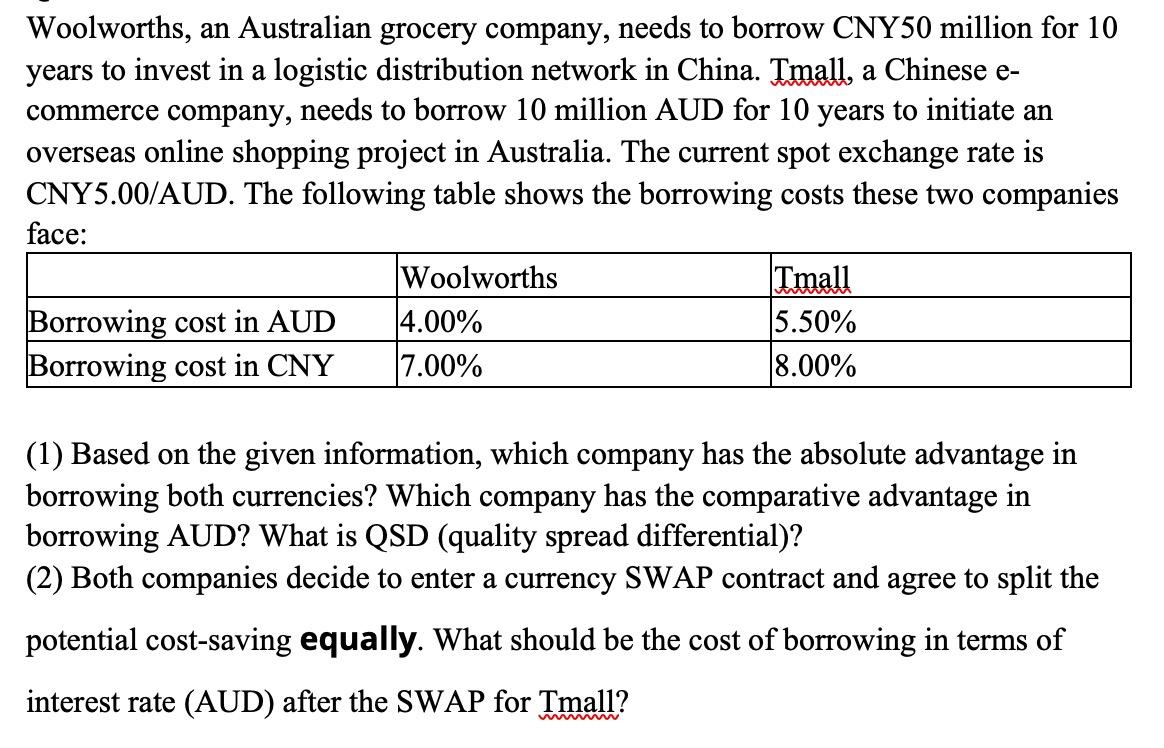

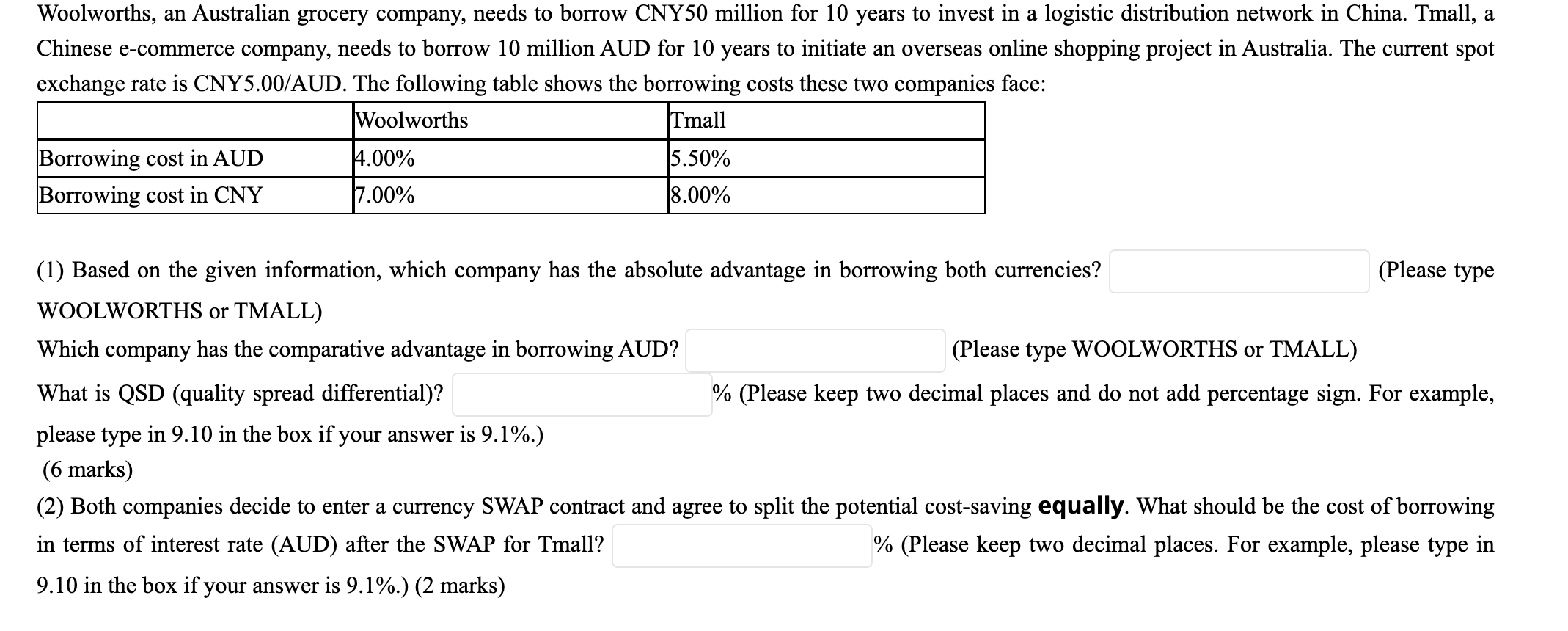

Woolworths, an Australian grocery company, needs to borrow CNY50 million for 10 years to invest in a logistic distribution network in China. Imall, a Chinese e- commerce company, needs to borrow 10 million AUD for 10 years to initiate an overseas online shopping project in Australia. The current spot exchange rate is CNY5.00/AUD. The following table shows the borrowing costs these two companies face: Woolworths Tmall Borrowing cost in AUD 4.00% 5.50% Borrowing cost in CNY 7.00% 8.00% (1) Based on the given information, which company has the absolute advantage in borrowing both currencies? Which company has the comparative advantage in borrowing AUD? What is QSD (quality spread differential)? (2) Both companies decide to enter a currency SWAP contract and agree to split the potential cost-saving equally. What should be the cost of borrowing in terms of interest rate (AUD) after the SWAP for Tmall? Woolworths, an Australian grocery company, needs to borrow CNY50 million for 10 years to invest in a logistic distribution network in China. Tmall, a Chinese e-commerce company, needs to borrow 10 million AUD for 10 years to initiate an overseas online shopping project in Australia. The current spot exchange rate is CNY5.00/AUD. The following table shows the borrowing costs these two companies face: Woolworths Tmall Borrowing cost in AUD 4.00% 5.50% Borrowing cost in CNY 7.00% 18.00% (1) Based on the given information, which company has the absolute advantage in borrowing both currencies? (Please type WOOLWORTHS or TMALL) Which company has the comparative advantage in borrowing AUD? (Please type WOOLWORTHS or TMALL) What is QSD (quality spread differential)? % (Please keep two decimal places and do not add percentage sign. For example, please type in 9.10 in the box if your answer is 9.1%.) (6 marks) (2) Both companies decide to enter a currency SWAP contract and agree to split the potential cost-saving equally. What should be the cost of borrowing in terms of interest rate (AUD) after the SWAP for Tmall? % (Please keep two decimal places. For example, please type in 9.10 in the box if your answer is 9.1%.) (2 marks) Woolworths, an Australian grocery company, needs to borrow CNY50 million for 10 years to invest in a logistic distribution network in China. Imall, a Chinese e- commerce company, needs to borrow 10 million AUD for 10 years to initiate an overseas online shopping project in Australia. The current spot exchange rate is CNY5.00/AUD. The following table shows the borrowing costs these two companies face: Woolworths Tmall Borrowing cost in AUD 4.00% 5.50% Borrowing cost in CNY 7.00% 8.00% (1) Based on the given information, which company has the absolute advantage in borrowing both currencies? Which company has the comparative advantage in borrowing AUD? What is QSD (quality spread differential)? (2) Both companies decide to enter a currency SWAP contract and agree to split the potential cost-saving equally. What should be the cost of borrowing in terms of interest rate (AUD) after the SWAP for Tmall? Woolworths, an Australian grocery company, needs to borrow CNY50 million for 10 years to invest in a logistic distribution network in China. Tmall, a Chinese e-commerce company, needs to borrow 10 million AUD for 10 years to initiate an overseas online shopping project in Australia. The current spot exchange rate is CNY5.00/AUD. The following table shows the borrowing costs these two companies face: Woolworths Tmall Borrowing cost in AUD 4.00% 5.50% Borrowing cost in CNY 7.00% 18.00% (1) Based on the given information, which company has the absolute advantage in borrowing both currencies? (Please type WOOLWORTHS or TMALL) Which company has the comparative advantage in borrowing AUD? (Please type WOOLWORTHS or TMALL) What is QSD (quality spread differential)? % (Please keep two decimal places and do not add percentage sign. For example, please type in 9.10 in the box if your answer is 9.1%.) (6 marks) (2) Both companies decide to enter a currency SWAP contract and agree to split the potential cost-saving equally. What should be the cost of borrowing in terms of interest rate (AUD) after the SWAP for Tmall? % (Please keep two decimal places. For example, please type in 9.10 in the box if your answer is 9.1%.) (2 marks)