Answered step by step

Verified Expert Solution

Question

1 Approved Answer

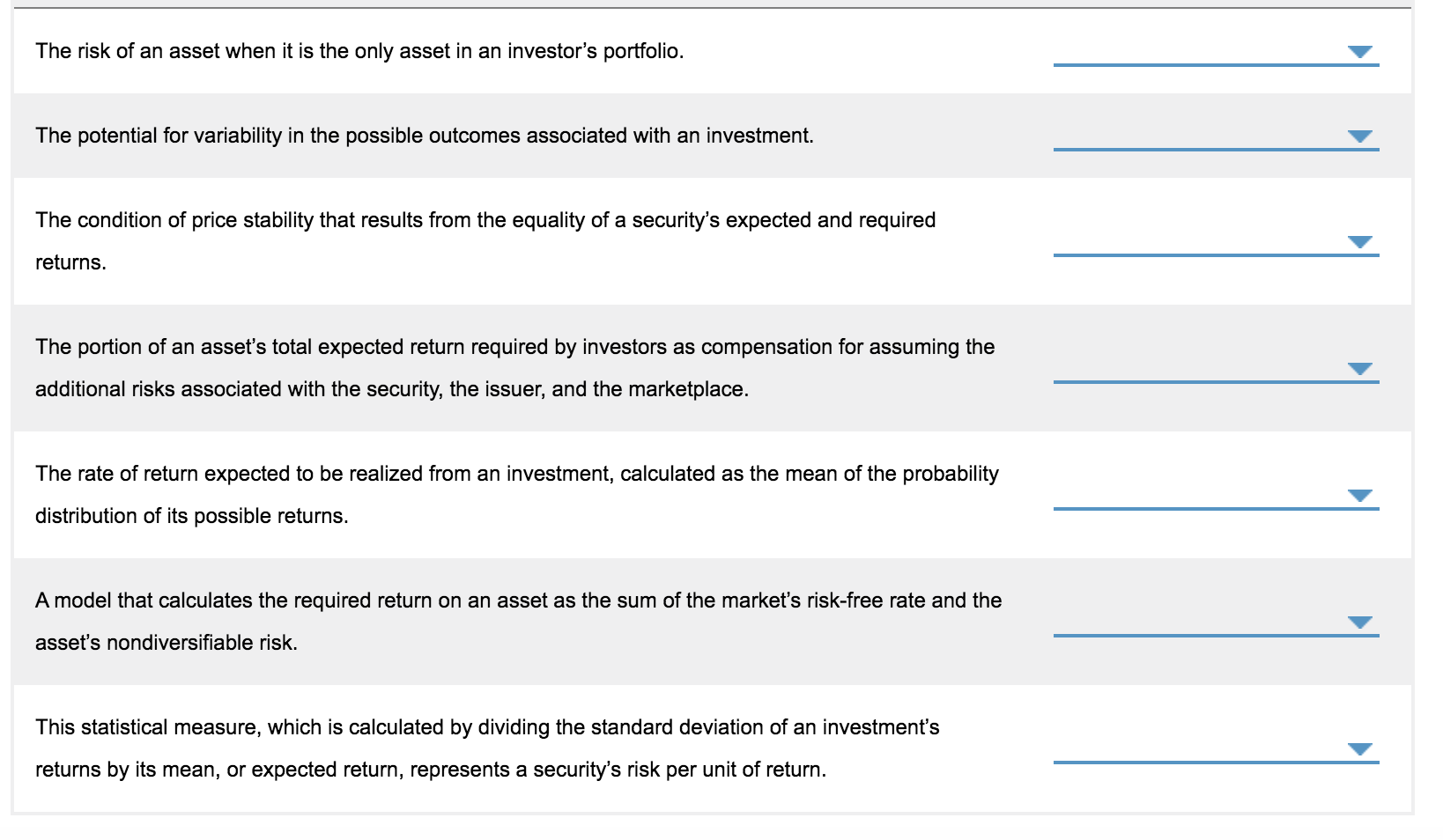

Word Bank: Beta coefficient Capital Asset Pricing Model Coefficient of variation Diversification Equilibrium Expected rate of return Market risk Risk Risk premium Stand-alone risk The

Word Bank:

Beta coefficient

Capital Asset Pricing Model

Coefficient of variation

Diversification

Equilibrium

Expected rate of return

Market risk

Risk

Risk premium

Stand-alone risk

The risk of an asset when it is the only asset in an investor's portfolio. The potential for variability in the possible outcomes associated with an investment. The condition of price stability that results from the equality of a security's expected and required returns. The portion of an asset's total expected return required by investors as compensation for assuming the additional risks associated with the security, the issuer, and the marketplace. The rate of return expected to be realized from an investment, calculated as the mean of the probability distribution of its possible returns. A model that calculates the required return on an asset as the sum of the market's risk-free rate and the asset's nondiversifiable risk. This statistical measure, which is calculated by dividing the standard deviation of an investment's returns by its mean, or expected return, represents a security's risk per unit of returnStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started