word count is 300

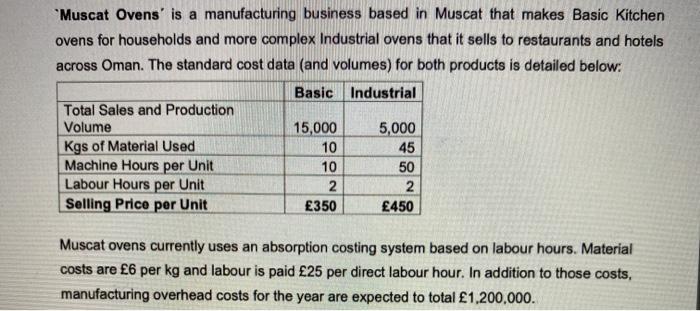

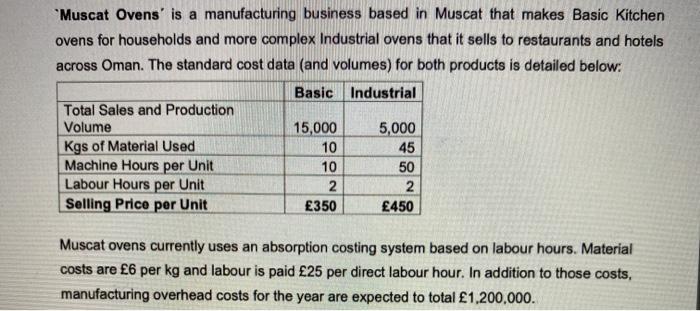

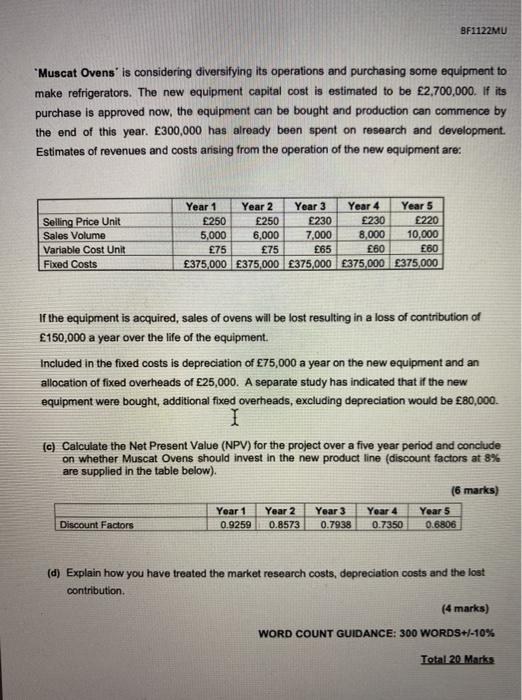

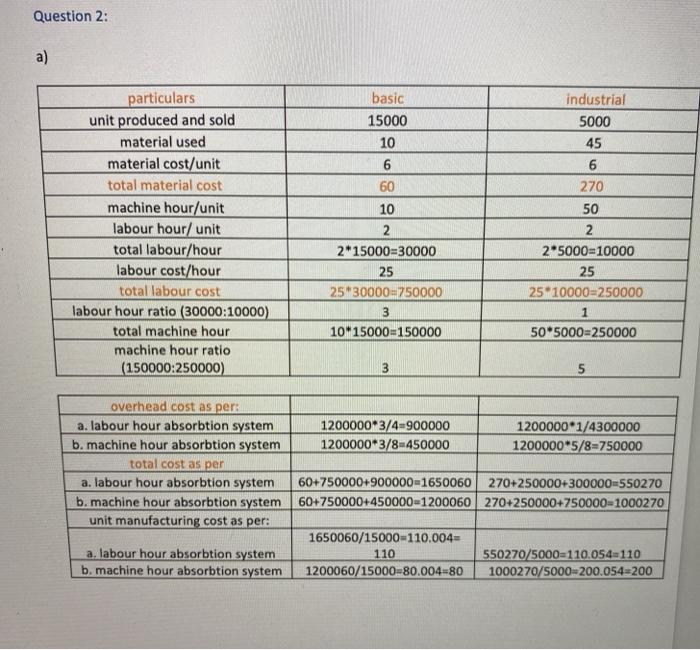

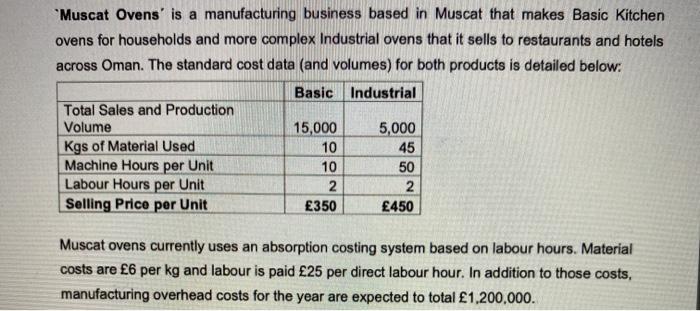

Muscat Ovens' is a manufacturing business based in Muscat that makes Basic Kitchen ovens for households and more complex Industrial ovens that it sells to restaurants and hotels across Oman. The standard cost data (and volumes) for both products is detailed below: Basic Industrial Total Sales and Production Volume 15,000 5,000 Kgs of Material Used 10 45 Machine Hours per Unit 10 50 Labour Hours per Unit 2 2 Selling Price per Unit 350 450 Muscat ovens currently uses an absorption costing system based on labour hours. Material costs are 6 per kg and labour is paid 25 per direct labour hour. In addition to those costs, manufacturing overhead costs for the year are expected to total 1,200,000. BF1122MU "Muscat Ovens' is considering diversifying its operations and purchasing some equipment to make refrigerators. The new equipment capital cost is estimated to be 2,700,000. If its purchase is approved now, the equipment can be bought and production can commence by the end of this year. 300,000 has already been spent on research and development. Estimates of revenues and costs arising from the operation of the new equipment are: Selling Price Unit Sales Volume Variable Cost Unit Fixed Costs Year 1 Year 2 Year 3 Year 4 Year 5 250 250 230 230 220 5,000 6,000 7,000 8,000 10,000 75 75 65 60 E60 375,000 375,000 375,000 375,000 375,000 If the equipment is acquired, sales of ovens will be lost resulting in a loss of contribution of 150,000 a year over the life of the equipment. Included in the fixed costs is depreciation of 75,000 a year on the new equipment and an allocation of fixed overheads of 25,000. A separate study has indicated that if the new equipment were bought, additional fixed overheads, excluding depreciation would be 80,000 I (C) Calculate the Net Present Value (NPV) for the project over a five year period and conclude on whether Muscat Ovens should invest in the new product line (discount factors at 8% are supplied in the table below). (6 marks) Year 4 0.7350 Year 1 0.9259 Year 2 0.8573 Year 3 0.7938 Year 5 0.6806 Discount Factors (d) Explain how you have treated the market research costs, depreciation costs and the lost contribution (4 marks) WORD COUNT GUIDANCE: 300 WORDS+-10% Total 20 Marks Question 2: a) particulars unit produced and sold material used material cost/unit total material cost machine hour/unit labour hour/ unit total labour/hour labour cost/hour total labour cost labour hour ratio (30000:10000) total machine hour machine hour ratio (150000:250000) basic 15000 10 6 60 10 2 2*15000=30000 25 25"30000-750000 3 10*15000=150000 industrial 5000 45 6 270 50 2 2*5000=10000 25 25 10000=250000 1 50*5000=250000 3 5 1200000*3/4.900000 1200000*3/8-450000 1200000 1/4300000 1200000*5/8=750000 overhead cost as per: a. labour hour absorbtion system b. machine hour absorbtion system total cost as per a. labour hour absorbtion system b. machine hour absorbtion system unit manufacturing cost as per: 60+750000 900000-1650060 270+250000+300000=550270 60+750000+450000-1200060 270+250000+750000-1000270 a. labour hour absorbtion system b. machine hour absorbtion system 1650060/15000-110.004= 110 1200060/15000=80.004=80 550270/5000-110.054-110 1000270/S000-200.054-200