Word Count: There are two question - Each question should be answered with no less than 300 words please

(Please Define, explain, justify and be critical in your answers) - Thank you very much :)

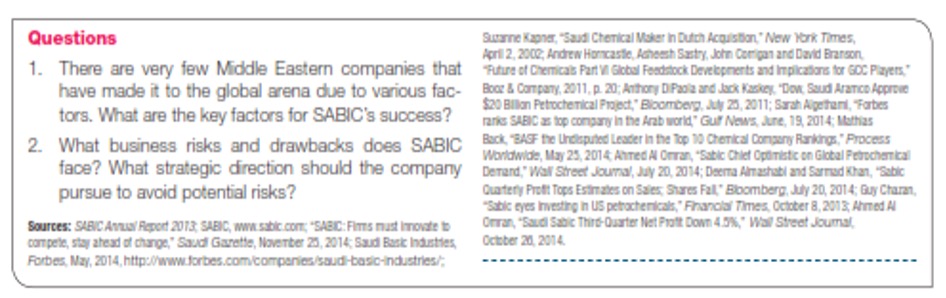

Questions Suranne Kapner, "Saudi Chemical Maker In Dutch Acquisition," New York Times, April 2, 2002, Andrew Homcastle, Ahoosh Sastry, John Corrigan and David Branson, 1. There are very few Middle Eastern companies that "Future of Cherrica's Part VI Global Feedstock Developments and Implications for GDC Players," have made it to the global arena due to various fac- Boot & Company, 2011, p. 20; Anthony DiPaola and Jack Kaskey, "Dow, Saud Aramco Approve tors. What are the key factors for SABIC's success? $20 Billion Petrochemical Project," Bloomberg, July 23, 2011; Sarah Algetand, "Forbes ranks SABIC as top company in the Arab world," Gul News, June, 19, 2014; Mathias 2. What business risks and drawbacks does SABIC Back, "BASF the Uncleputed Leader In the Top 10 Chemical Company Rankings," Process Worldwide, May 25, 2014 Ahmed Al Omran, "Sabic Chief Optimistic on Global Petrochemical face? What strategic direction should the company Demand," Wall Street Journal, July 20, 2014; Deerna Almashabl and Sarrad Khan, "Sabic pursue to avoid potential risks? Quarterly Profit Tops Estimates on Sales, Shares Fall," Bloomberg, July 20, 2014; Guy Charan, "Sable eyes Investing In US petrochemicals," Financial Times, October 8, 2013, Ahmed Al Sources: SABIC Annual Report 2073, SABIC, www.sabic.com; "SABC: Firms must Innovate to Omran, "Sauci Sabic Third-Quarter Net Proit Down 45%," Wall Street Journal compete, stay ahead of change," Saudi Garatte, November 20, 2014; Saud Bask Industries, October 20, 2014. Forbes, May, 2014, http:/www.forbes.com/companies/saudi-basic-Industries/;Marketing Excellence and storage facilities to better serve its key markets worldwide. SABIC has established technology centers > > SABIC that serve as satellite research and development units. Recently, it has expanded its business into China with the Saudi Basic Industries Corporation (SABIC) is a building of new petrochemical plants. petrochemical company headquartered in Riyadh, Saudi The feedstock (raw material) used in the petrochemi Arabia. It was set up in 1976 by the Saudi government cal industry has historically been a source of competitive to add value to the country's natural resources. The in- advantage for SABIC. The latter has enjoyed low-cost dustrial model consisted of capturing crude oil-related gas feedstock, such as methane, ethane, propane, bu- gases and to delivering them as raw material to manu- tane, light naphtha, and other natural gas liquids from facture various industrial commodities. A chain of basic ARAMCO, a prominent Saudi oil company. It has also industries were located next to these natural resources benefited, and continues to do so, from land leased from to contribute to downstream industrial diversification in the Saudi government at no cost. However, there is a Saudi Arabia. Throughout the 1980s, SABIC was head- growing gas shortage in the Gulf region, a fact that may quartered in Al-Jubail city. The latter consequently wit- inevitably cut into SABIC's margins and reduce its overall nessed an intense and empowering transformation from cost advantage. a small fishing village on the Arabian Sea into a modern Although each business unit has adopted its own industrial hub. While SABIC built the basic industries, the business strategy, SABIC pursues a cost-leadership Royal Commission put in place the necessary infrastruc strategy. Exceptionally, SABIC has not been successful in ture. SABIC is majority owned by the Saudi government espouseng a cost-leadership strategy for the metals busi- (70 percent) along with private investors from Saudi and ness unit. Hence, the company focuses on the quality other GCC countries (30 percent). of its steel products and the adoption of a differentiation SABIC is the fourth largest petrochemical company strategy. Historically speaking, SABIC was able to make it in the world, based on turnover. The industry leader is to the global arena thanks to its cost-leadership strategy. the German BASF, followed by the U.S. Dow and the However, due to keen competition in recent years, SABIC Dutch LyondellBasell. SABIC is the largest company in has begun shifting to differentiation. Regarding its fertil- the Middle East with a market capitalization of $94.4 izers, as SABIC provides for mainly Saudi farmers who billion (2014). SABIC's total assets were valued at $33 benefit from government subsidies, the company adopts billion and sales reached $50.4 billion in May, 2014. The a focused cost-leadership strategy. company employs 40,000 employees in 45 countries. At present, with strong competition from other global It has accumulated 9,000 patent portfolio filings. SABIC petrochemical companies, other factors have become is the world leader in the production of MTBE, ethylene an absolute must for success in this industry. To do glycol, and fertilizers, and the second largest producer of so, SABIC has established a state-of-the-art industrial methanol (2013). complex for research and development in Riyadh, Saudi SABIC consists of six strategic business units that Arabia. The complex consists of research and technol- manufacture four different products: chemicals, fertiliz ogy innovation-related activities and services destined to ers, metals, and plastics. The chemicals represent over enhance SABIC's capabilities. This industrial complex has 60 percent of the company total production by value. also allowed SABIC to reach a competitive advantage by SABIC's manufacturing network in Saudi Arabia com- maximizing product quality for its customers. For growth prises 18 technology and innovation centers that employ prospects, SABIC is aware that it can no longer solely rely 1,400 scientists. on its abundant feedstock. Also, innovation has turned At the international stage, SABIC's global presence out to be a key success factor. The company banks on has grown steadily over the years. The company is part- the capability of transforming feedstock into solutions for ner in three regional ventures in Bahrain. In 2002, SABIC its customers. Europe Petrochemical (SEP) was established after the Recently, ARAMCO and a few other key petrochemi acquisition of the petrochemical business from the Dutch cal players, such as Dow Chemical Co., have begun the group DSM. SEP has two major manufacturing com- process of building petrochemical plants in Saudi Arabia. plexes in Geleen in the Netherlands and Gelsenkirchen This increased competition in the raw materials industry in Germany. The global network of the company in- may result in SABIC further limiting the cost advantages it cludes strategically located offices, distribution centers. has had for decades