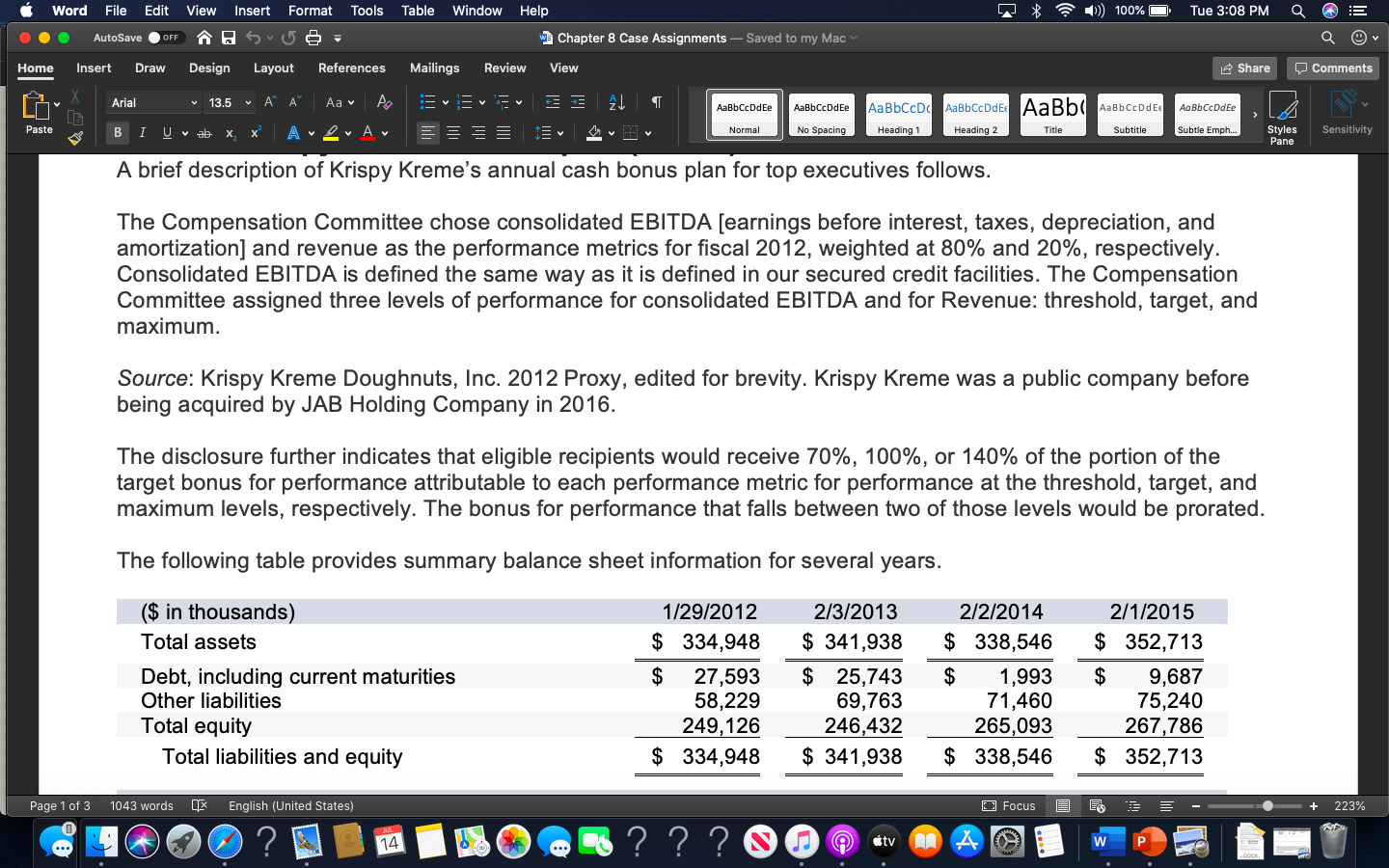

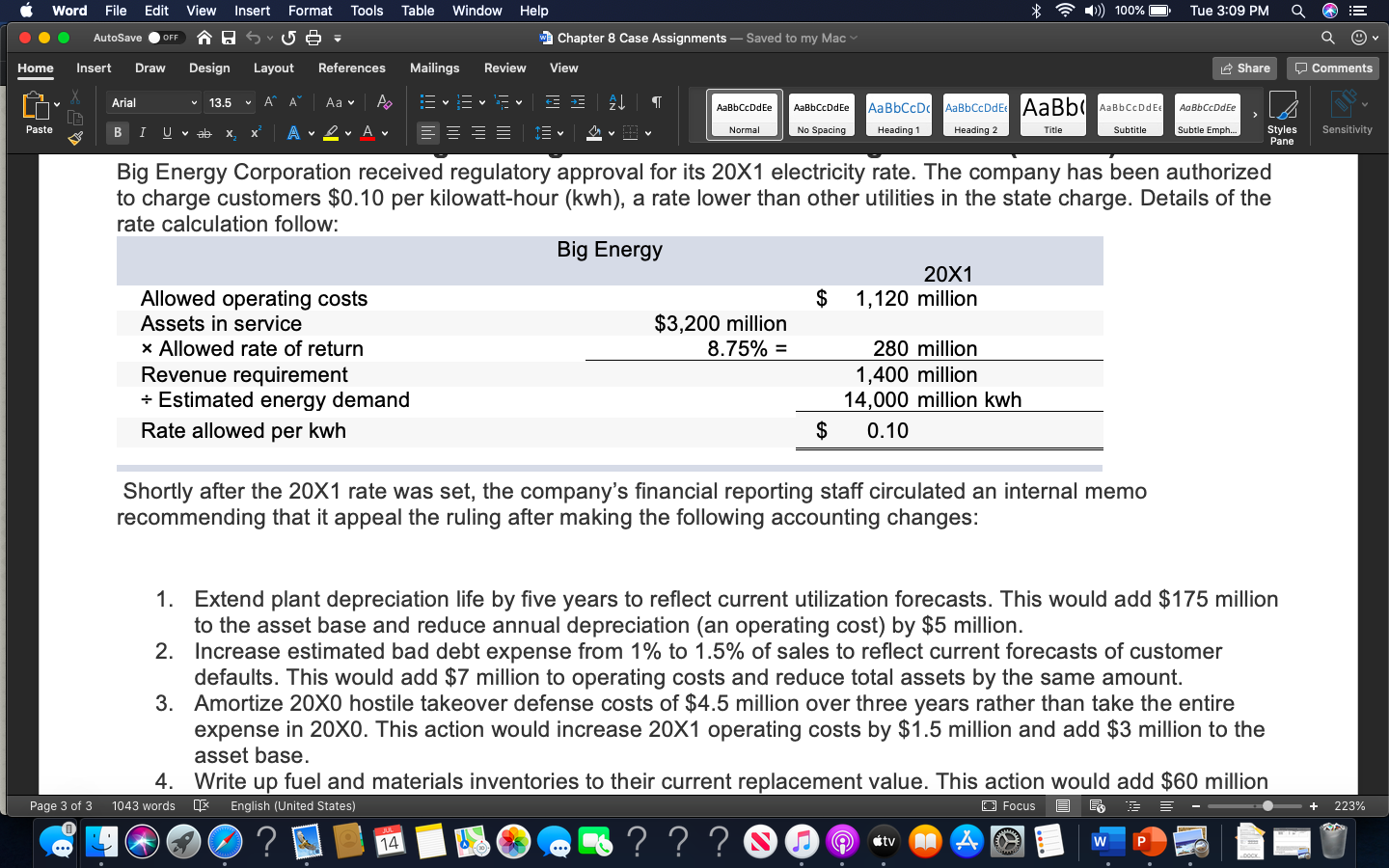

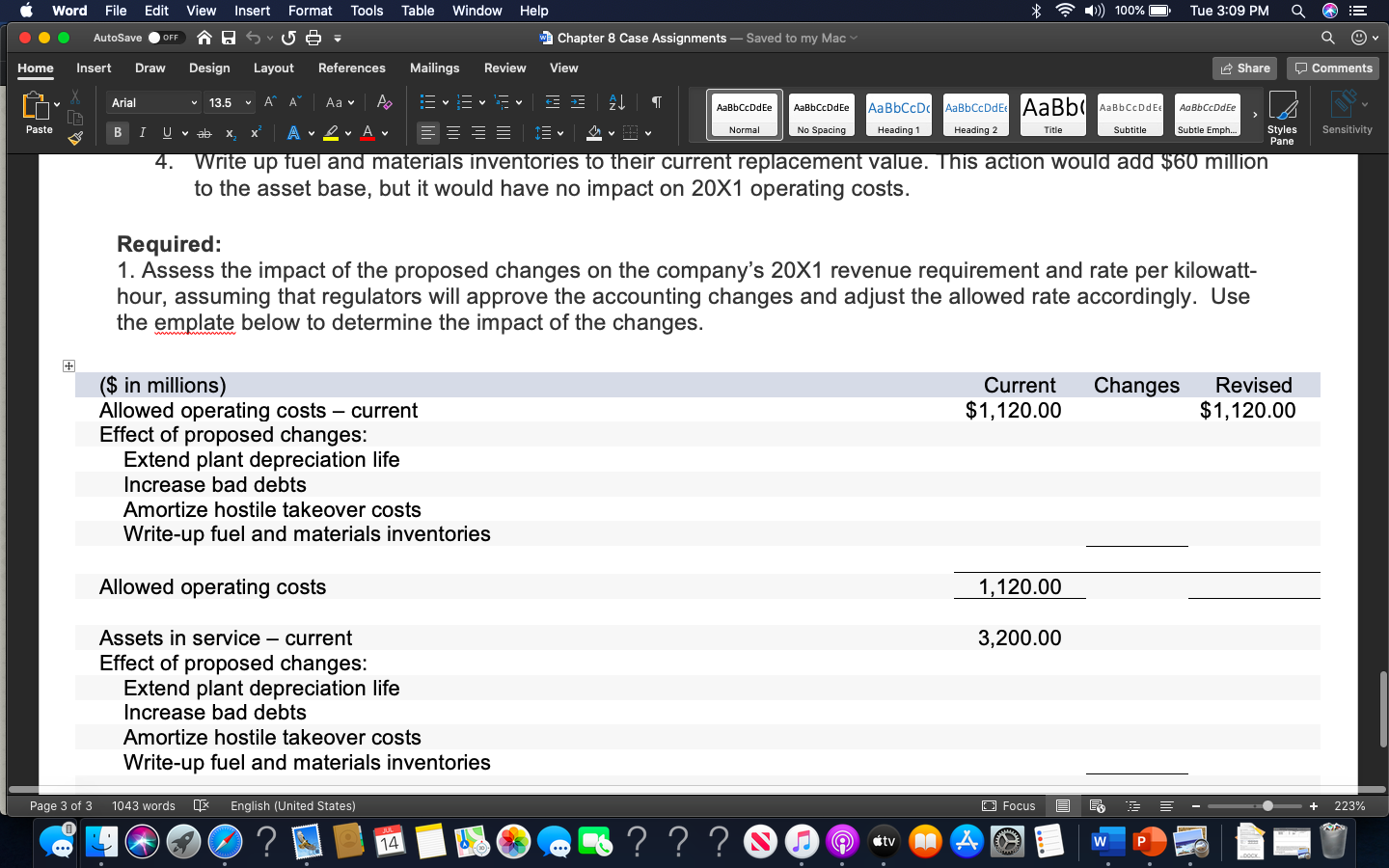

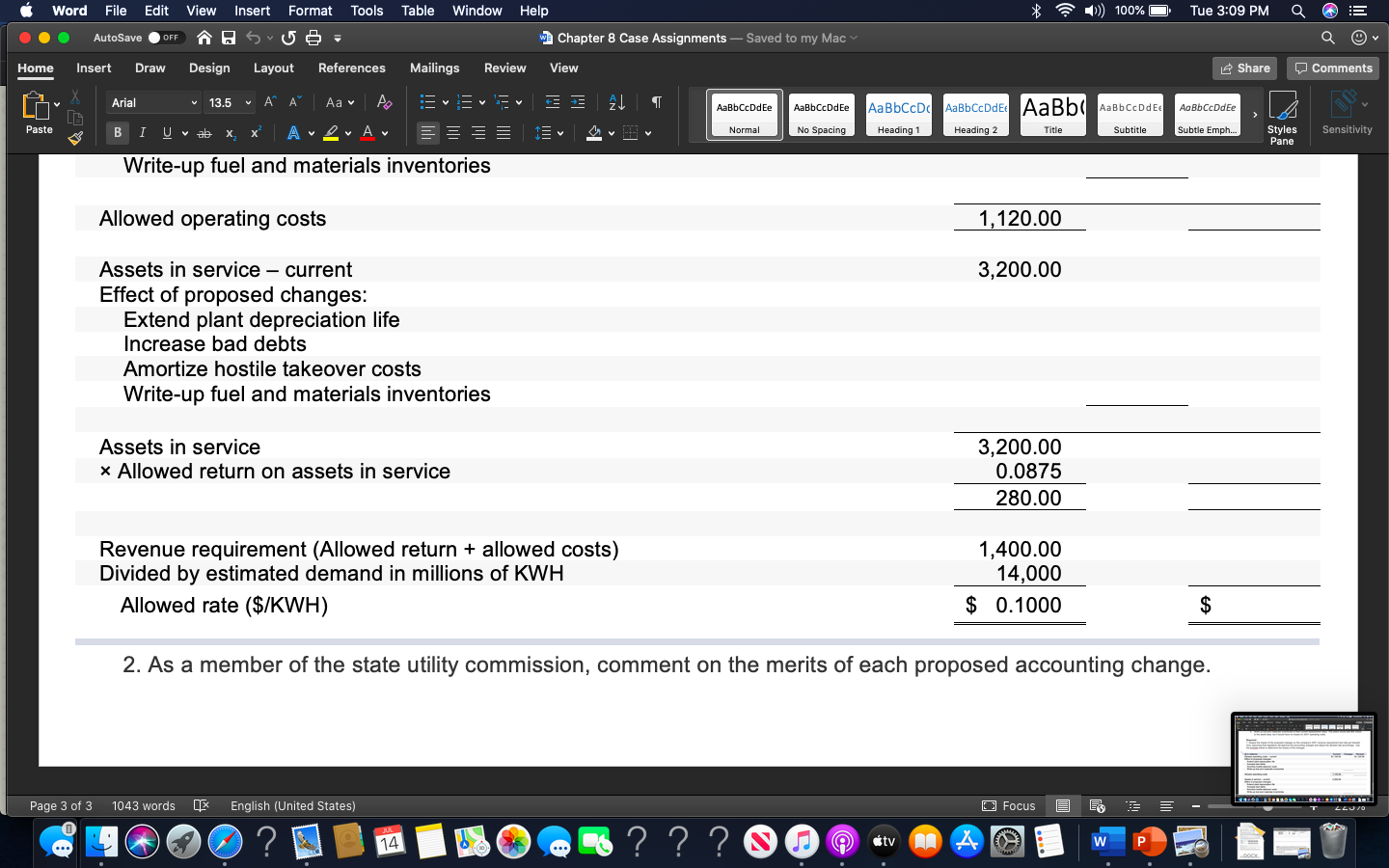

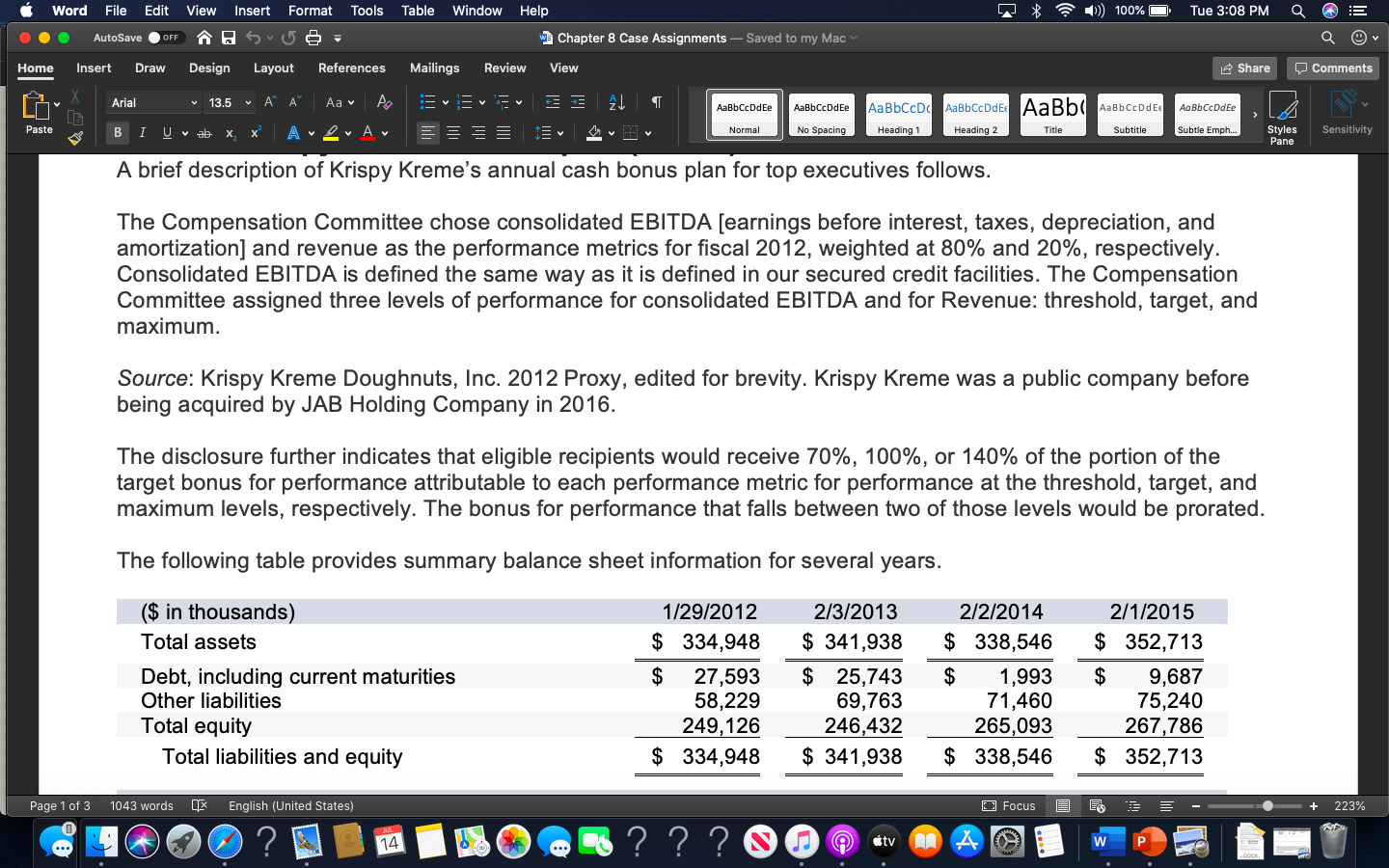

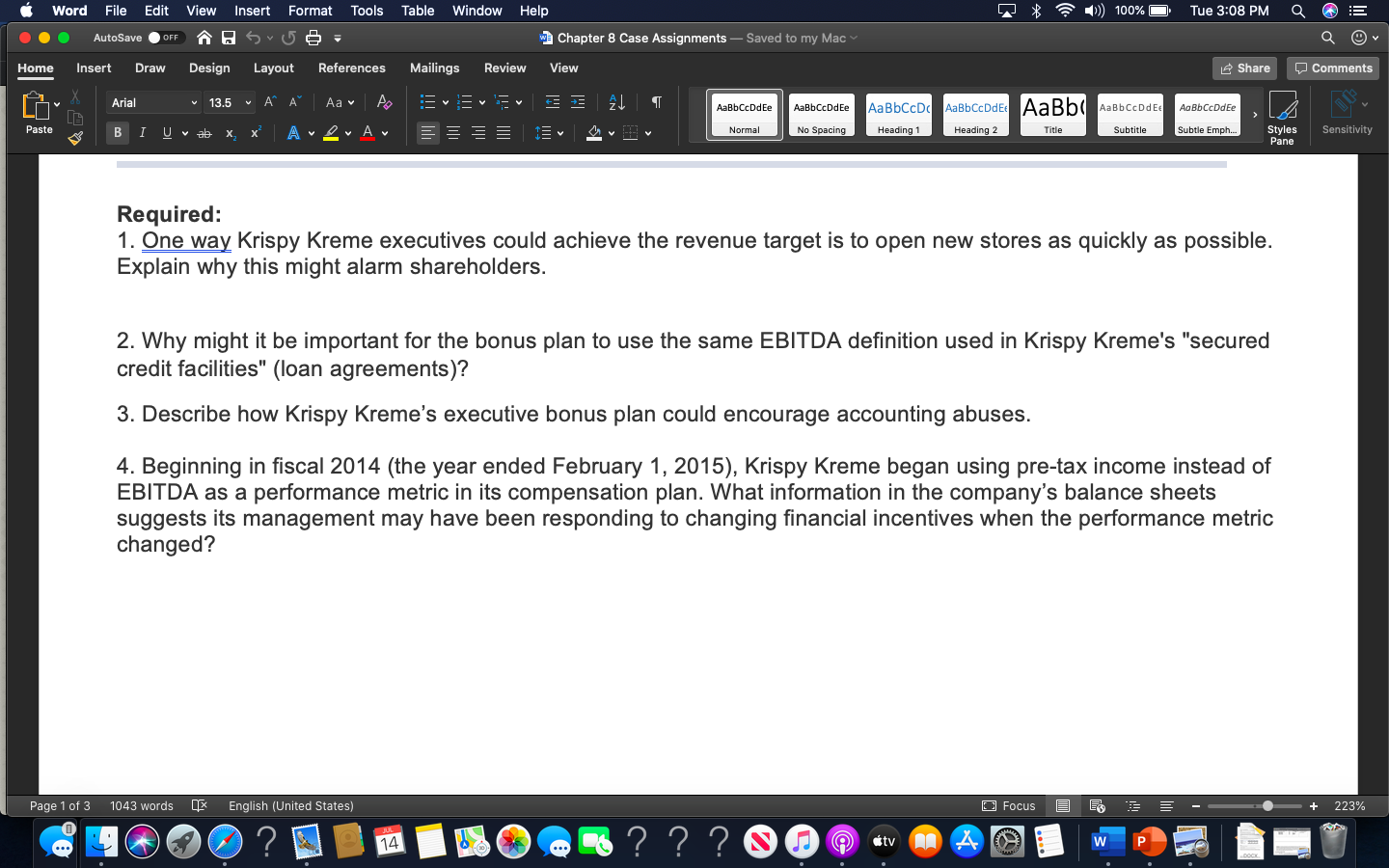

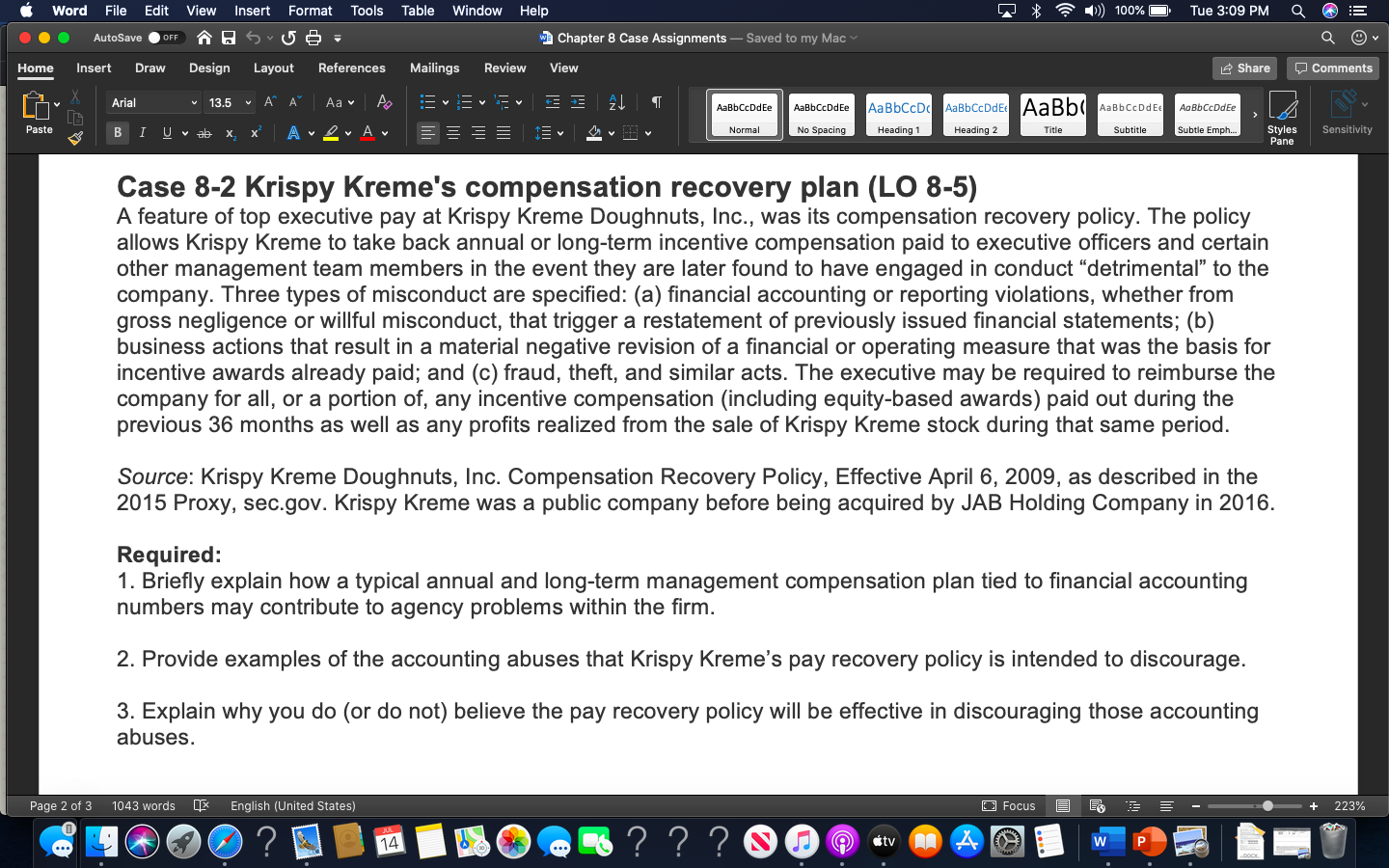

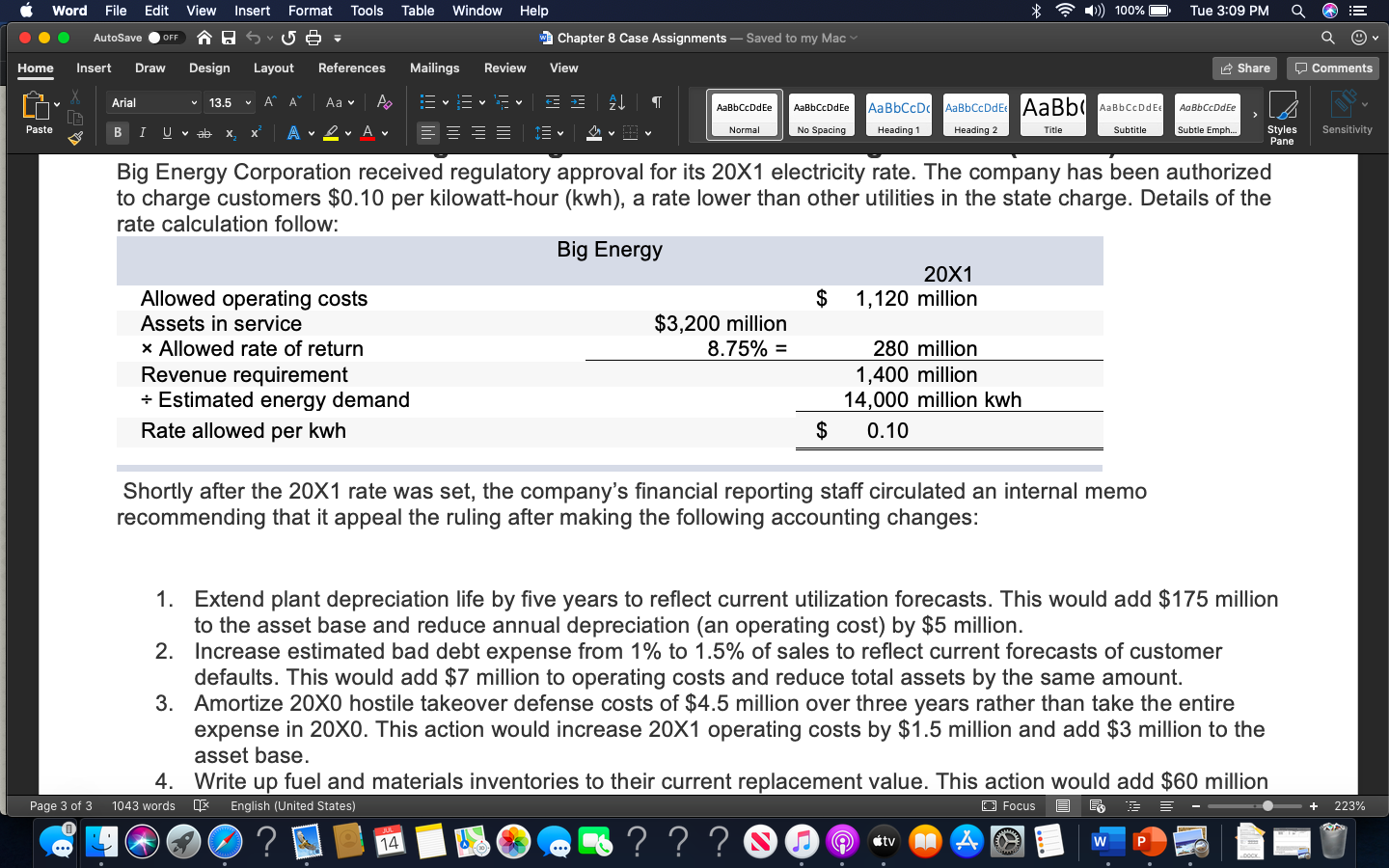

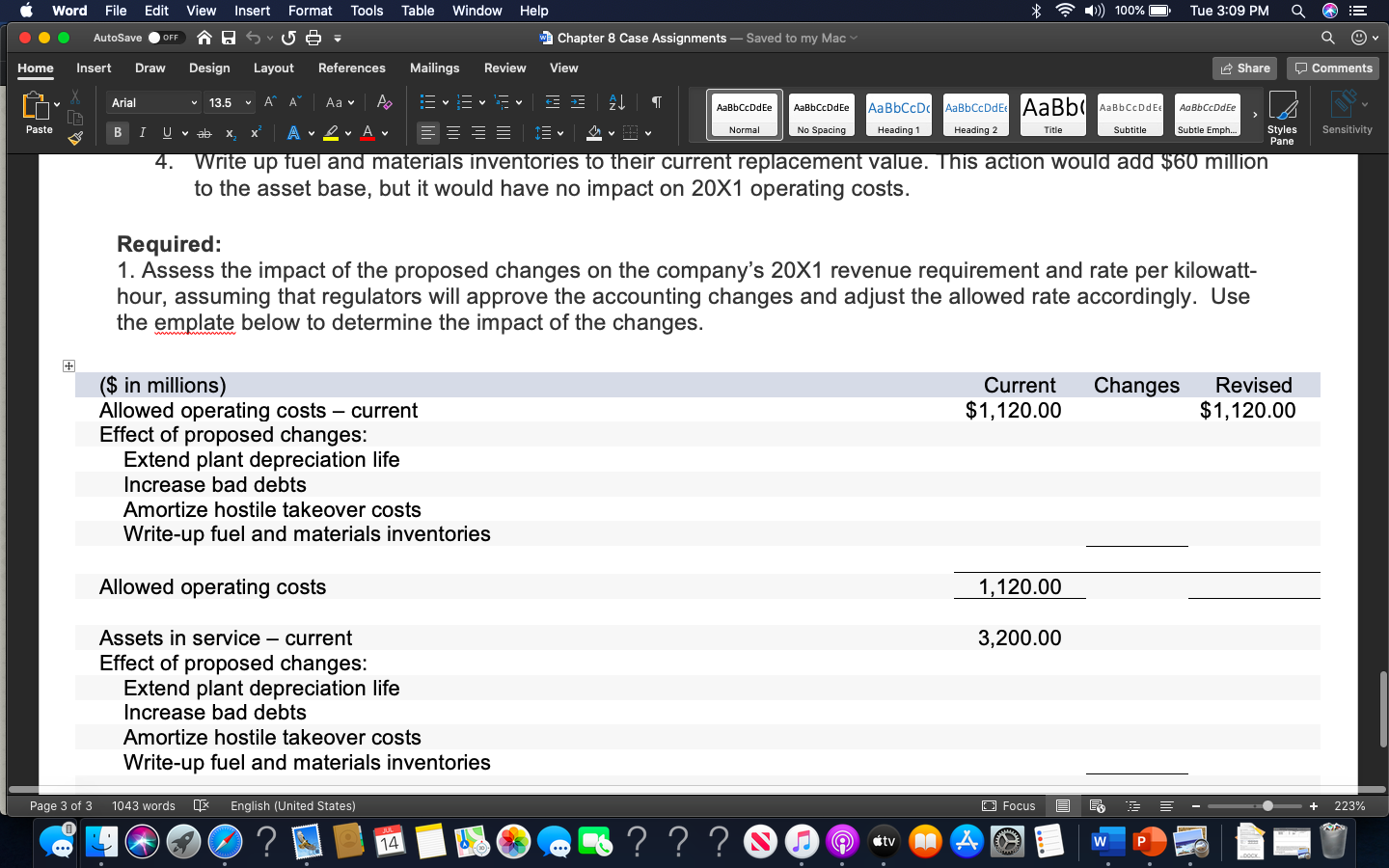

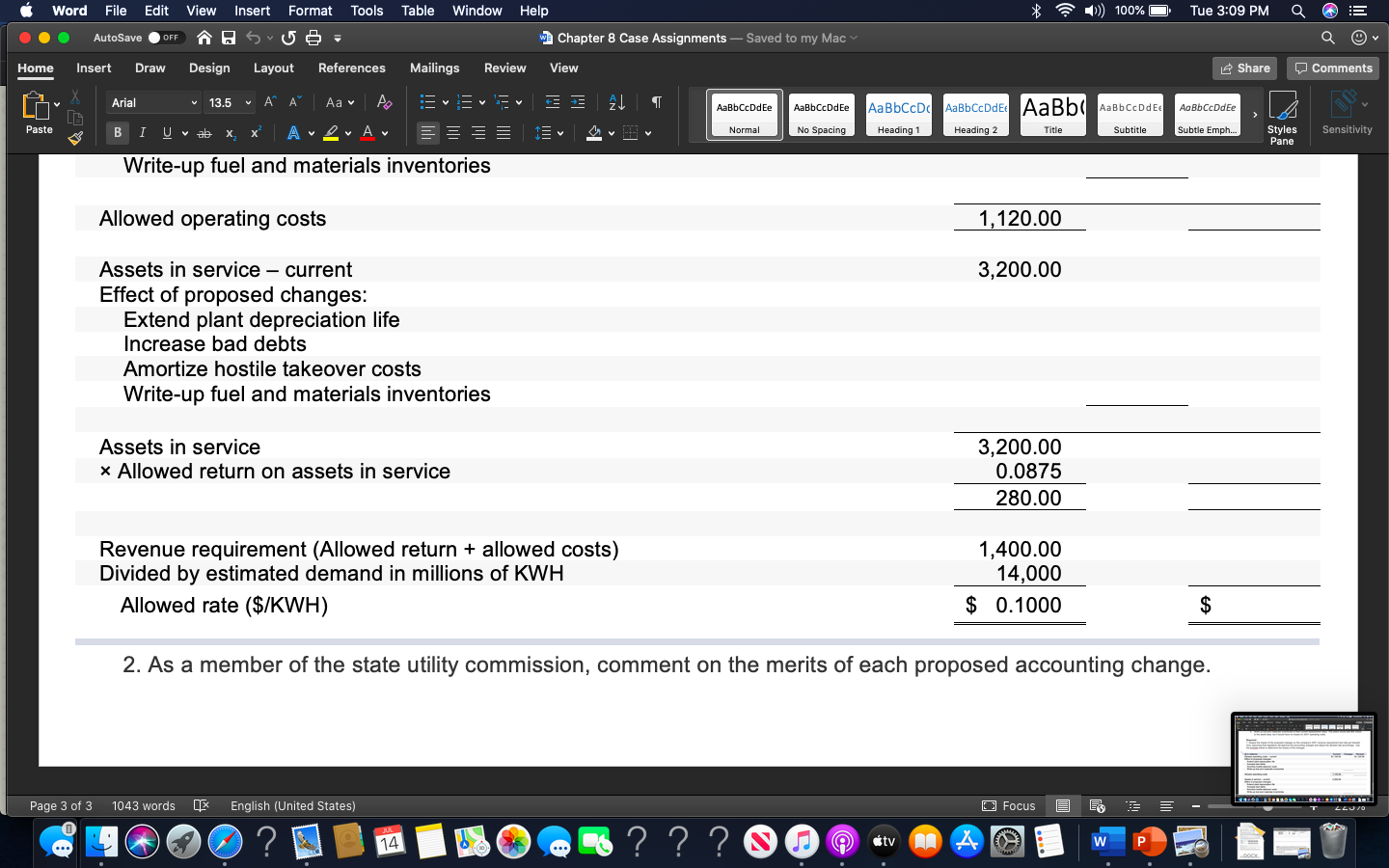

Word File Edit View Insert Format Tools Table Window Help 100% Tue 3:08 PM a AutoSave OFF w Chapter 8 Case Assignments - Saved to my Mac a v Home Insert Draw Design Layout References Mailings Review View A Share Comments Arial 13.5 A Aa v Sve 3 1 T AaBbCcDdEe AaBbcDdE Aa BbCcDc AaBbCcDdEt AaBb AaBb CcDdEt Aa BbCcDdEe Paste B I U v alb X x ALA === Normal No Spacing Heading 1 Heading 2 Title Subtitle Subtle Emph... Styles Pane Sensitivity A brief description of Krispy Kreme's annual cash bonus plan for top executives follows. The Compensation Committee chose consolidated EBITDA [earnings before interest, taxes, depreciation, and amortization] and revenue as the performance metrics for fiscal 2012, weighted at 80% and 20%, respectively. Consolidated EBITDA is defined the same way as it is defined in our secured credit facilities. The Compensation Committee assigned three levels of performance for consolidated EBITDA and for Revenue: threshold, target, and maximum. Source: Krispy Kreme Doughnuts, Inc. 2012 Proxy, edited for brevity. Krispy Kreme was a public company before being acquired by JAB Holding Company in 2016. The disclosure further indicates that eligible recipients would receive 70%, 100%, or 140% of the portion of the target bonus for performance attributable to each performance metric for performance at the threshold, target, and maximum levels, respectively. The bonus for performance that falls between two of those levels would be prorated. The following table provides summary balance sheet information for several years. 2/1/2015 $ 352,713 ($ in thousands) Total assets Debt, including current maturities Other liabilities Total equity Total liabilities and equity 1/29/2012 $ 334,948 $ 27,593 58,229 249,126 $ 334,948 2/3/2013 $ 341,938 $ 25,743 69,763 246,432 $ 341,938 2/2/2014 $ 338,546 $ 1,993 71,460 265,093 $ 338,546 $ 9,687 75,240 267,786 $ 352,713 Page 1 of 3 1043 words QX English (United States) Focus 3 223% 14 ? ? ? tv W P Word File Edit View Insert Format Tools Table Window Help 100% Tue 3:08 PM a OOO AutoSave OFF w Chapter 8 Case Assignments - Saved to my Mac a v Home Insert Draw Design Layout References Mailings Review View Share Comments Arial 13.5 A I AaBbDdEe AaBbCcDdEe Aa BbCcDC AaBbCcDdEt AaBb AaBbceDdEt AaBbCcDdEe A Aa v A EES ALA Paste B I U vab X x Normal No Spacing Heading 1 Heading 2 Title Subtitle Subtle Emph... Styles Pane Sensitivity Required: 1. One way Krispy Kreme executives could achieve the revenue target is to open new stores as quickly as possible. Explain why this might alarm shareholders. 2. Why might it be important for the bonus plan to use the same EBITDA definition used in Krispy Kreme's "secured credit facilities" (loan agreements)? 3. Describe how Krispy Kreme's executive bonus plan could encourage accounting abuses. 4. Beginning in fiscal 2014 (the year ended February 1, 2015), Krispy Kreme began using pre-tax income instead of EBITDA as a performance metric in its compensation plan. What information in the company's balance sheets suggests its management may have been responding to changing financial incentives when the performance metric changed? Page 1 of 3 1043 words EX English (United States) Focus 3 223% 14 26 ? ? ? ? tv W Word File Edit View Insert Format Tools Table Window Help 100% Tue 3:09 PM a OOO AutoSave OFF w Chapter 8 Case Assignments - Saved to my Mac a v Home Insert Draw Design Layout References Mailings Review View Share Comments Arial 13.5 A A Aa v I AaBbDdEe AaBbDdEP Aa BbCcDc AaBbCcDdEt AaBb AaBb CeDdEt AaBbCcDdEe Paste B I U v ab X x ALA Normal No Spacing Heading 1 Heading 2 Title Subtitle Subtle Emph... Styles Pane Sensitivity Case 8-2 Krispy Kreme's compensation recovery plan (LO 8-5) A feature of top executive pay at Krispy Kreme Doughnuts, Inc., was its compensation recovery policy. The policy allows Krispy Kreme to take back annual or long-term incentive compensation paid to executive officers and certain other management team members in the event they are later found to have engaged in conduct "detrimental to the company. Three types of misconduct are specified: (a) financial accounting or reporting violations, whether from gross negligence or willful misconduct, that trigger a restatement of previously issued financial statements; (b) business actions that result in a material negative revision of a financial or operating measure that was the basis for incentive awards already paid; and (c) fraud, theft, and similar acts. The executive may be required to reimburse the company for all, or a portion of, any incentive compensation (including equity-based awards) paid out during the previous 36 months as well as any profits realized from the sale of Krispy Kreme stock during that same period. Source: Krispy Kreme Doughnuts, Inc. Compensation Recovery Policy, Effective April 6, 2009, as described in the 2015 Proxy, sec.gov. Krispy Kreme was a public company before being acquired by JAB Holding Company in 2016. Required: 1. Briefly explain how a typical annual and long-term management compensation plan tied to financial accounting numbers may contribute to agency problems within the firm. 2. Provide examples of the accounting abuses that Krispy Kreme's pay recovery policy is intended to discourage. 3. Explain why you do (or do not) believe the pay recovery policy will be effective in discouraging those accounting abuses. Page 2 of 3 1043 words English (United States) Focus 3 223% 14 ? ? ? ? tv W P Word File Edit View Insert Format Tools Table Window Help 100% Tue 3:09 PM a OOO AutoSave OFF w Chapter 8 Case Assignments - Saved to my Mac Q v Home Insert Draw Design Layout References Mailings Review View Share Comments Arial 13.5 A ve T. AaBbCcDdEe AaBbDdEe Aa BbCcDc AaBbCcDdEt AaBb AaBbceDdEx AaBbDcDdEe A Aa . ALA Paste B I Normal U v ab X x E No Spacing Heading 1 Heading 2 Title Subtitle Subtle Emph. Styles Pane Sensitivity Big Energy Corporation received regulatory approval for its 20X1 electricity rate. The company has been authorized to charge customers $0.10 per kilowatt-hour (kwh), a rate lower than other utilities in the state charge. Details of the rate calculation follow: Big Energy 20X1 Allowed operating costs $ 1,120 million Assets in service $3,200 million * Allowed rate of return 8.75% = 280 million Revenue requirement 1,400 million - Estimated energy demand 14,000 million kwh Rate allowed per kwh $ 0.10 Shortly after the 20X1 rate was set, the company's financial reporting staff circulated an internal memo recommending that it appeal the ruling after making the following accounting changes: 1. Extend plant depreciation life by five years to reflect current utilization forecasts. This would add $175 million to the asset base and reduce annual depreciation (an operating cost) by $5 million. 2. Increase estimated bad debt expense from 1% to 1.5% of sales to reflect current forecasts of customer defaults. This would add $7 million to operating costs and reduce total assets by the same amount. 3. Amortize 20X0 hostile takeover defense costs of $4.5 million over three years rather than take the entire expense in 20X0. This action would increase 20X1 operating costs by $1.5 million and add $3 million to the asset base. 4. Write up fuel and materials inventories to their current replacement value. This action would add $60 million Page 3 of 3 1043 words x English (United States) O Focus 3 223% 14 ? ? ? tv W Word File Edit View Insert Format Tools Table Window Help 100% Tue 3:09 PM a AutoSave OFF w Chapter 8 Case Assignments - Saved to my Mac Q v Home Insert Draw Design Layout References Mailings Review View Share Comments Arial 13.5 A A Aav A T AaBbDdEe AaBb CcDdfe Aa BbCcD Aa Bb CcDdEe Paste B ae X Normal No Spacing Heading 1 Heading 2 Title Subtitle Subtle Emph... Styles Pane Sensitivity AaBbCcDdEt AaBb AaBbceDdEt I U APA 4. Write up fuel and materials inventories to their current replacement value. This action would add $60 million to the asset base, but it would have no impact on 20X1 operating costs. Required: 1. Assess the impact of the proposed changes on the company's 20X1 revenue requirement and rate per kilowatt- hour, assuming that regulators will approve the accounting changes and adjust the allowed rate accordingly. Use the emplate below to determine the impact of the changes. Changes Current $1,120.00 Revised $1,120.00 ($ in millions) Allowed operating costs - current Effect of proposed changes: Extend plant depreciation life Increase bad debts Amortize hostile takeover costs Write-up fuel and materials inventories Allowed operating costs 1,120.00 3,200.00 Assets in service - current Effect of proposed changes: Extend plant depreciation life Increase bad debts Amortize hostile takeover costs Write-up fuel and materials inventories Page 3 of 3 1043 words English (United States) O Focus 223% 14 ? ? ? ? tv W P Word File Edit View Insert Format Tools Table Window Help 100% Tue 3:09 PM a OOO AutoSave OFF w Chapter 8 Case Assignments - Saved to my Mac Q Home Insert Draw Design Layout References Mailings Review View A Share Comments Arial 13.5 A A A I AaBbCcDdEe AaBbcDdEe Aa BbCcD secondo AaBbCcDdEe AaBbCcDdEt AaBb AaBbceDdEx Paste B I X x e Normal No Spacing Heading 1 Heading 2 Title Subtitle Subtle Emph... Styles Pane Sensitivity U v ab ALA Write-up fuel and materials inventories Allowed operating costs 1,120.00 3,200.00 Assets in service - current Effect of proposed changes: Extend plant depreciation life Increase bad debts Amortize hostile takeover costs Write-up fuel and materials inventories Assets in service * Allowed return on assets in service 3,200.00 0.0875 280.00 Revenue requirement (Allowed return + allowed costs) Divided by estimated demand in millions of KWH Allowed rate ($/KWH) 1,400.00 14,000 $ 0.1000 $ 2. As a member of the state utility commission, comment on the merits of each proposed accounting change. Page 3 of 3 1043 words English (United States) Focus E 14 ? ? ? tv W Word File Edit View Insert Format Tools Table Window Help 100% Tue 3:08 PM a AutoSave OFF w Chapter 8 Case Assignments - Saved to my Mac a v Home Insert Draw Design Layout References Mailings Review View A Share Comments Arial 13.5 A Aa v Sve 3 1 T AaBbCcDdEe AaBbcDdE Aa BbCcDc AaBbCcDdEt AaBb AaBb CcDdEt Aa BbCcDdEe Paste B I U v alb X x ALA === Normal No Spacing Heading 1 Heading 2 Title Subtitle Subtle Emph... Styles Pane Sensitivity A brief description of Krispy Kreme's annual cash bonus plan for top executives follows. The Compensation Committee chose consolidated EBITDA [earnings before interest, taxes, depreciation, and amortization] and revenue as the performance metrics for fiscal 2012, weighted at 80% and 20%, respectively. Consolidated EBITDA is defined the same way as it is defined in our secured credit facilities. The Compensation Committee assigned three levels of performance for consolidated EBITDA and for Revenue: threshold, target, and maximum. Source: Krispy Kreme Doughnuts, Inc. 2012 Proxy, edited for brevity. Krispy Kreme was a public company before being acquired by JAB Holding Company in 2016. The disclosure further indicates that eligible recipients would receive 70%, 100%, or 140% of the portion of the target bonus for performance attributable to each performance metric for performance at the threshold, target, and maximum levels, respectively. The bonus for performance that falls between two of those levels would be prorated. The following table provides summary balance sheet information for several years. 2/1/2015 $ 352,713 ($ in thousands) Total assets Debt, including current maturities Other liabilities Total equity Total liabilities and equity 1/29/2012 $ 334,948 $ 27,593 58,229 249,126 $ 334,948 2/3/2013 $ 341,938 $ 25,743 69,763 246,432 $ 341,938 2/2/2014 $ 338,546 $ 1,993 71,460 265,093 $ 338,546 $ 9,687 75,240 267,786 $ 352,713 Page 1 of 3 1043 words QX English (United States) Focus 3 223% 14 ? ? ? tv W P Word File Edit View Insert Format Tools Table Window Help 100% Tue 3:08 PM a OOO AutoSave OFF w Chapter 8 Case Assignments - Saved to my Mac a v Home Insert Draw Design Layout References Mailings Review View Share Comments Arial 13.5 A I AaBbDdEe AaBbCcDdEe Aa BbCcDC AaBbCcDdEt AaBb AaBbceDdEt AaBbCcDdEe A Aa v A EES ALA Paste B I U vab X x Normal No Spacing Heading 1 Heading 2 Title Subtitle Subtle Emph... Styles Pane Sensitivity Required: 1. One way Krispy Kreme executives could achieve the revenue target is to open new stores as quickly as possible. Explain why this might alarm shareholders. 2. Why might it be important for the bonus plan to use the same EBITDA definition used in Krispy Kreme's "secured credit facilities" (loan agreements)? 3. Describe how Krispy Kreme's executive bonus plan could encourage accounting abuses. 4. Beginning in fiscal 2014 (the year ended February 1, 2015), Krispy Kreme began using pre-tax income instead of EBITDA as a performance metric in its compensation plan. What information in the company's balance sheets suggests its management may have been responding to changing financial incentives when the performance metric changed? Page 1 of 3 1043 words EX English (United States) Focus 3 223% 14 26 ? ? ? ? tv W Word File Edit View Insert Format Tools Table Window Help 100% Tue 3:09 PM a OOO AutoSave OFF w Chapter 8 Case Assignments - Saved to my Mac a v Home Insert Draw Design Layout References Mailings Review View Share Comments Arial 13.5 A A Aa v I AaBbDdEe AaBbDdEP Aa BbCcDc AaBbCcDdEt AaBb AaBb CeDdEt AaBbCcDdEe Paste B I U v ab X x ALA Normal No Spacing Heading 1 Heading 2 Title Subtitle Subtle Emph... Styles Pane Sensitivity Case 8-2 Krispy Kreme's compensation recovery plan (LO 8-5) A feature of top executive pay at Krispy Kreme Doughnuts, Inc., was its compensation recovery policy. The policy allows Krispy Kreme to take back annual or long-term incentive compensation paid to executive officers and certain other management team members in the event they are later found to have engaged in conduct "detrimental to the company. Three types of misconduct are specified: (a) financial accounting or reporting violations, whether from gross negligence or willful misconduct, that trigger a restatement of previously issued financial statements; (b) business actions that result in a material negative revision of a financial or operating measure that was the basis for incentive awards already paid; and (c) fraud, theft, and similar acts. The executive may be required to reimburse the company for all, or a portion of, any incentive compensation (including equity-based awards) paid out during the previous 36 months as well as any profits realized from the sale of Krispy Kreme stock during that same period. Source: Krispy Kreme Doughnuts, Inc. Compensation Recovery Policy, Effective April 6, 2009, as described in the 2015 Proxy, sec.gov. Krispy Kreme was a public company before being acquired by JAB Holding Company in 2016. Required: 1. Briefly explain how a typical annual and long-term management compensation plan tied to financial accounting numbers may contribute to agency problems within the firm. 2. Provide examples of the accounting abuses that Krispy Kreme's pay recovery policy is intended to discourage. 3. Explain why you do (or do not) believe the pay recovery policy will be effective in discouraging those accounting abuses. Page 2 of 3 1043 words English (United States) Focus 3 223% 14 ? ? ? ? tv W P Word File Edit View Insert Format Tools Table Window Help 100% Tue 3:09 PM a OOO AutoSave OFF w Chapter 8 Case Assignments - Saved to my Mac Q v Home Insert Draw Design Layout References Mailings Review View Share Comments Arial 13.5 A ve T. AaBbCcDdEe AaBbDdEe Aa BbCcDc AaBbCcDdEt AaBb AaBbceDdEx AaBbDcDdEe A Aa . ALA Paste B I Normal U v ab X x E No Spacing Heading 1 Heading 2 Title Subtitle Subtle Emph. Styles Pane Sensitivity Big Energy Corporation received regulatory approval for its 20X1 electricity rate. The company has been authorized to charge customers $0.10 per kilowatt-hour (kwh), a rate lower than other utilities in the state charge. Details of the rate calculation follow: Big Energy 20X1 Allowed operating costs $ 1,120 million Assets in service $3,200 million * Allowed rate of return 8.75% = 280 million Revenue requirement 1,400 million - Estimated energy demand 14,000 million kwh Rate allowed per kwh $ 0.10 Shortly after the 20X1 rate was set, the company's financial reporting staff circulated an internal memo recommending that it appeal the ruling after making the following accounting changes: 1. Extend plant depreciation life by five years to reflect current utilization forecasts. This would add $175 million to the asset base and reduce annual depreciation (an operating cost) by $5 million. 2. Increase estimated bad debt expense from 1% to 1.5% of sales to reflect current forecasts of customer defaults. This would add $7 million to operating costs and reduce total assets by the same amount. 3. Amortize 20X0 hostile takeover defense costs of $4.5 million over three years rather than take the entire expense in 20X0. This action would increase 20X1 operating costs by $1.5 million and add $3 million to the asset base. 4. Write up fuel and materials inventories to their current replacement value. This action would add $60 million Page 3 of 3 1043 words x English (United States) O Focus 3 223% 14 ? ? ? tv W Word File Edit View Insert Format Tools Table Window Help 100% Tue 3:09 PM a AutoSave OFF w Chapter 8 Case Assignments - Saved to my Mac Q v Home Insert Draw Design Layout References Mailings Review View Share Comments Arial 13.5 A A Aav A T AaBbDdEe AaBb CcDdfe Aa BbCcD Aa Bb CcDdEe Paste B ae X Normal No Spacing Heading 1 Heading 2 Title Subtitle Subtle Emph... Styles Pane Sensitivity AaBbCcDdEt AaBb AaBbceDdEt I U APA 4. Write up fuel and materials inventories to their current replacement value. This action would add $60 million to the asset base, but it would have no impact on 20X1 operating costs. Required: 1. Assess the impact of the proposed changes on the company's 20X1 revenue requirement and rate per kilowatt- hour, assuming that regulators will approve the accounting changes and adjust the allowed rate accordingly. Use the emplate below to determine the impact of the changes. Changes Current $1,120.00 Revised $1,120.00 ($ in millions) Allowed operating costs - current Effect of proposed changes: Extend plant depreciation life Increase bad debts Amortize hostile takeover costs Write-up fuel and materials inventories Allowed operating costs 1,120.00 3,200.00 Assets in service - current Effect of proposed changes: Extend plant depreciation life Increase bad debts Amortize hostile takeover costs Write-up fuel and materials inventories Page 3 of 3 1043 words English (United States) O Focus 223% 14 ? ? ? ? tv W P Word File Edit View Insert Format Tools Table Window Help 100% Tue 3:09 PM a OOO AutoSave OFF w Chapter 8 Case Assignments - Saved to my Mac Q Home Insert Draw Design Layout References Mailings Review View A Share Comments Arial 13.5 A A A I AaBbCcDdEe AaBbcDdEe Aa BbCcD secondo AaBbCcDdEe AaBbCcDdEt AaBb AaBbceDdEx Paste B I X x e Normal No Spacing Heading 1 Heading 2 Title Subtitle Subtle Emph... Styles Pane Sensitivity U v ab ALA Write-up fuel and materials inventories Allowed operating costs 1,120.00 3,200.00 Assets in service - current Effect of proposed changes: Extend plant depreciation life Increase bad debts Amortize hostile takeover costs Write-up fuel and materials inventories Assets in service * Allowed return on assets in service 3,200.00 0.0875 280.00 Revenue requirement (Allowed return + allowed costs) Divided by estimated demand in millions of KWH Allowed rate ($/KWH) 1,400.00 14,000 $ 0.1000 $ 2. As a member of the state utility commission, comment on the merits of each proposed accounting change. Page 3 of 3 1043 words English (United States) Focus E 14 ? ? ? tv W