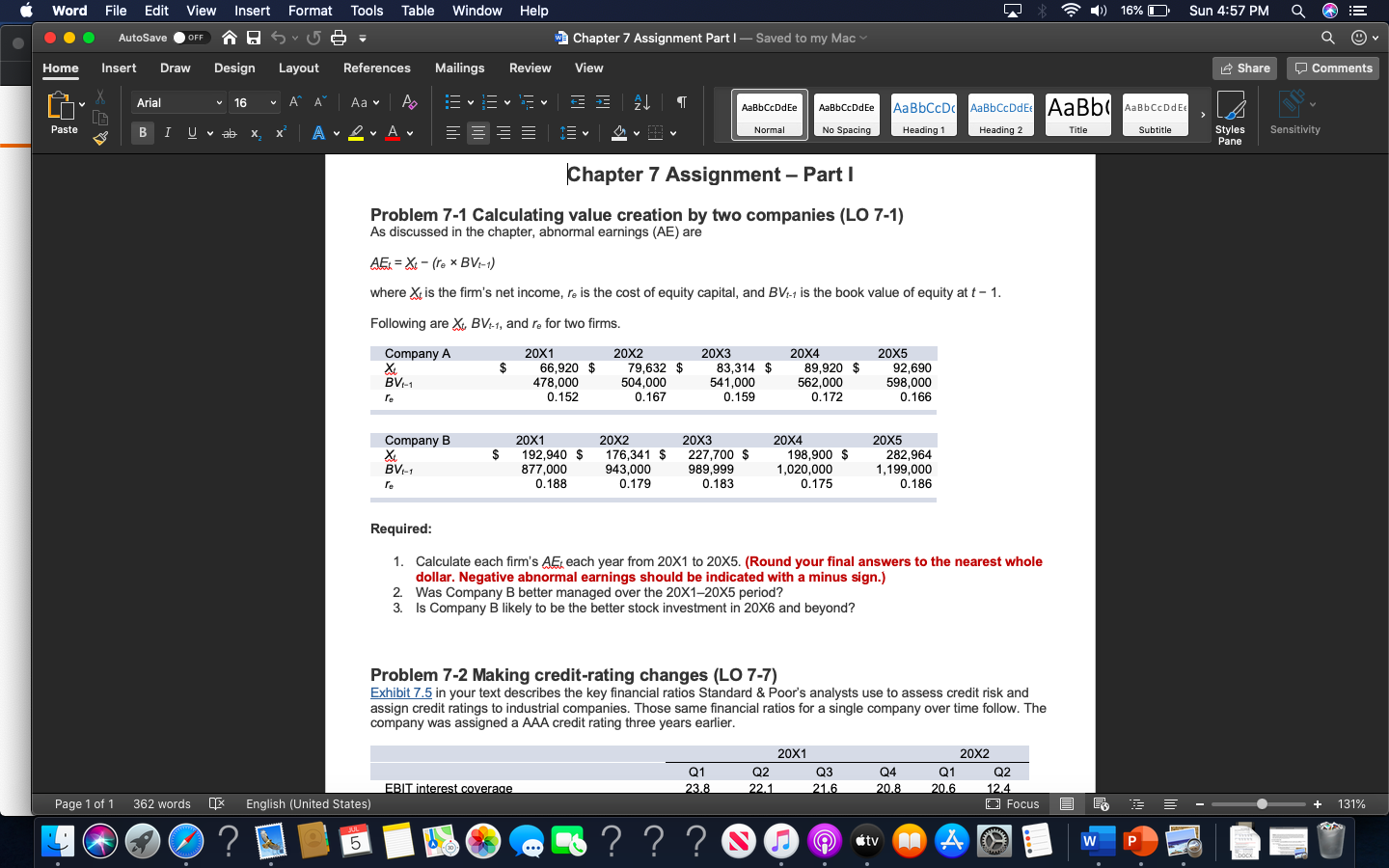

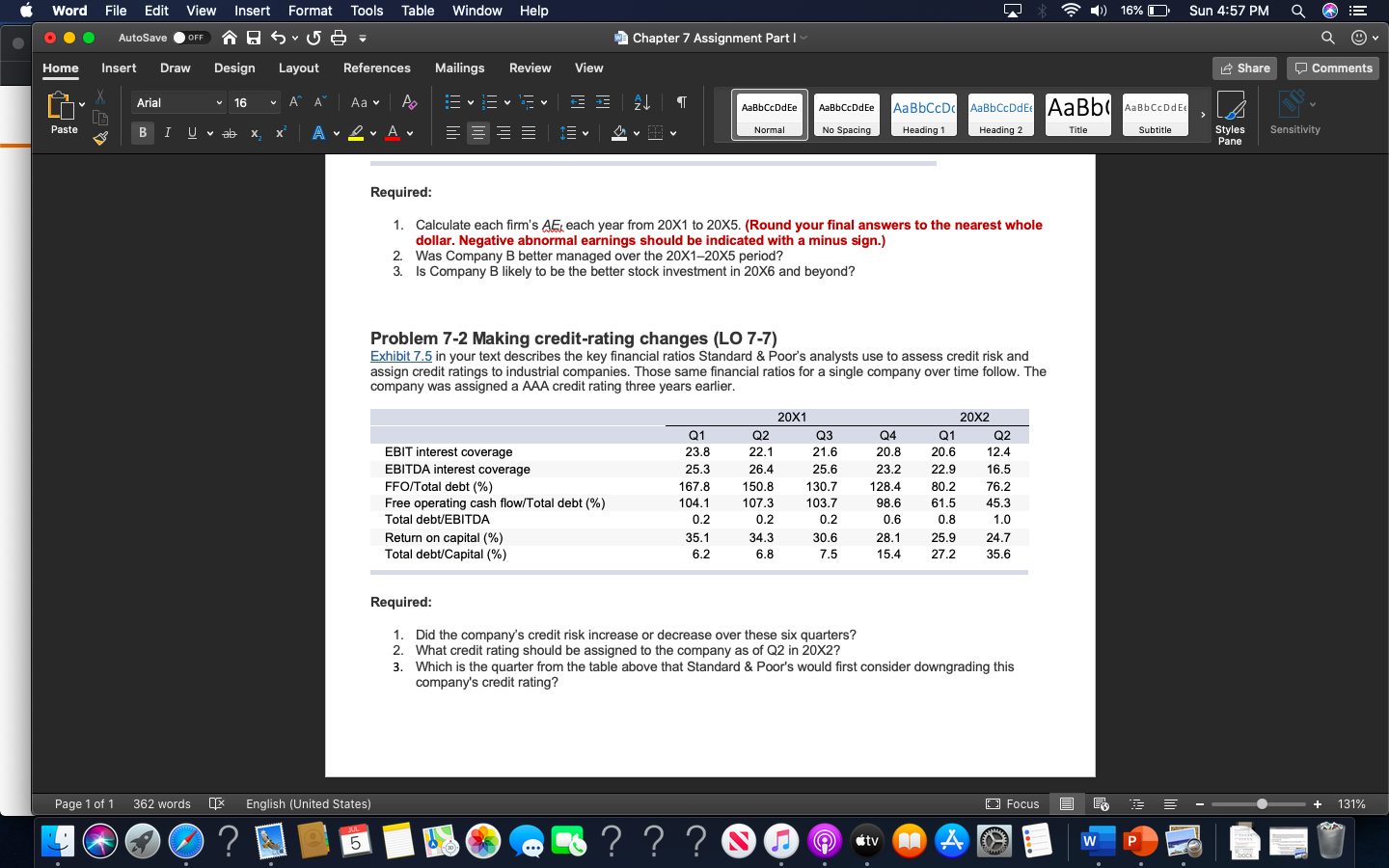

Word File Edit View Insert Format Tools Table Window Help LD 16%O Sun 4:57 PM Q AutoSave OFF Sve w Chapter 7 Assignment Part I Saved to my Mac Q v Home Insert Draw Design Layout References Mailings Review View Share Comments Arial 16 A Aa A vvv AJ T AaBbDdEo AaBbcDdEe AaBbCcD AaBbCcDdEt AaBb AaBb CcDdEt Paste B I U v ab X x Av Av Normal No Spacing Heading 1 = Heading 2 Title Subtitle Styles Pane Sensitivity Chapter 7 Assignment - Part 1 Problem 7-1 Calculating value creation by two companies (LO 7-1) As discussed in the chapter, abnormal earnings (AE) are AE: = Xt (rex BV:-1) where Xt is the firm's net income, re is the cost of equity capital, and BV-1 is the book value of equity at t- 1. Following are X BV:-1, andre for two firms. $ Company A Xc BV-1 re 20X1 66,920 $ 478,000 0.152 20X2 79,632 $ 504,000 0.167 20X3 83,314 $ 541,000 0.159 20X4 89,920 $ 562,000 0.172 20X5 92,690 598.000 0.166 Company B X BV-1 $ 20X1 192,940 $ 877,000 0.188 20X2 176,341 $ 943,000 0.179 20X3 227,700 $ 989,999 0.183 20X4 198,900 $ 1,020,000 0.175 20X5 282,964 1,199,000 0.186 re Required: 1. Calculate each firm's AEt each year from 20x1 to 20X5. (Round your final answers to the nearest whole dollar. Negative abnormal earnings should be indicated with a minus sign.) 2. Was Company B better managed over the 20X1-20X5 period? 3. Is Company B likely to be the better stock investment in 20X6 and beyond? Problem 7-2 Making credit-rating changes (LO 7-7) Exhibit 7.5 in your text describes the key financial ratios Standard & Poor's analysts use to assess credit risk and assign credit ratings to industrial companies. Those same financial ratios for a single company over time follow. The company was assigned a AAA credit rating three years earlier. 20X1 20X2 Q1 23.8 Q2 22.1 Q3 21.6 Q4 20.8 Q1 20.6 EBIT interest coverage Q2 12.4 O Focus Page 1 of 1 362 words English (United States) E 131% ? ? ? tv A W P Word File Edit View Insert Format Tools Table Window Help LD 16%O Sun 4:57 PM Q AutoSave OFF HS58 Chapter 7 Assignment Part 1 Q v Home Insert Draw Design Layout References Mailings Review View Share Comments Arial 16 A Aa A va A T AaBbcDdE AaBbcDdEe AaBbCcD AaBbCcDdEt AaBb AaBbceDdEt Paste B I U v ab x Normal AVA X No Spacing Heading 1 Heading 2 Title Subtitle Styles Pane Sensitivity Required: 1. Calculate each firm's AE each year from 20x1 to 20X5. (Round your final answers to the nearest whole dollar. Negative abnormal earnings should be indicated with a minus sign.) 2. Was Company B better managed over the 20X1-20X5 period? 3. Is Company B likely to be the better stock investment in 20X6 and beyond? Problem 7-2 Making credit-rating changes (LO 7-7) Exhibit 7.5 in your text describes the key financial ratios Standard & Poor's analysts use to assess credit risk and assign credit ratings to industrial companies. Those same financial ratios for a single company over time follow. The company was assigned a AAA credit rating three years earlier. EBIT interest coverage EBITDA interest coverage FFO/Total debt (%) Free operating cash flow/Total debt (%) Total debt/EBITDA Return on capital (%) Total debt/Capital (%) Q1 23.8 25.3 167.8 104.1 0.2 35.1 6.2 20X1 Q2 Q3 22.1 21.6 26.4 25.6 150.8 130.7 107.3 103.7 0.2 0.2 34.3 30.6 6.8 7.5 Q4 20.8 23.2 128.4 98.6 0.6 28.1 15.4 20X2 Q1 Q2 20.6 12.4 22.9 16.5 80.2 76.2 61.5 45.3 0.8 1.0 25.9 24.7 27.2 35.6 Required: 1. Did the company's credit risk increase or decrease over these six quarters? 2. What credit rating should be assigned to the company as of Q2 in 20X2? 3. Which is the quarter from the table above that Standard & Poor's would first consider downgrading this company's credit rating? Page 1 of 1 362 words English (United States) O Focus E EE 131% O ? 5 ? ? ? ctv w P Word File Edit View Insert Format Tools Table Window Help LD 16%O Sun 4:57 PM Q AutoSave OFF Sve w Chapter 7 Assignment Part I Saved to my Mac Q v Home Insert Draw Design Layout References Mailings Review View Share Comments Arial 16 A Aa A vvv AJ T AaBbDdEo AaBbcDdEe AaBbCcD AaBbCcDdEt AaBb AaBb CcDdEt Paste B I U v ab X x Av Av Normal No Spacing Heading 1 = Heading 2 Title Subtitle Styles Pane Sensitivity Chapter 7 Assignment - Part 1 Problem 7-1 Calculating value creation by two companies (LO 7-1) As discussed in the chapter, abnormal earnings (AE) are AE: = Xt (rex BV:-1) where Xt is the firm's net income, re is the cost of equity capital, and BV-1 is the book value of equity at t- 1. Following are X BV:-1, andre for two firms. $ Company A Xc BV-1 re 20X1 66,920 $ 478,000 0.152 20X2 79,632 $ 504,000 0.167 20X3 83,314 $ 541,000 0.159 20X4 89,920 $ 562,000 0.172 20X5 92,690 598.000 0.166 Company B X BV-1 $ 20X1 192,940 $ 877,000 0.188 20X2 176,341 $ 943,000 0.179 20X3 227,700 $ 989,999 0.183 20X4 198,900 $ 1,020,000 0.175 20X5 282,964 1,199,000 0.186 re Required: 1. Calculate each firm's AEt each year from 20x1 to 20X5. (Round your final answers to the nearest whole dollar. Negative abnormal earnings should be indicated with a minus sign.) 2. Was Company B better managed over the 20X1-20X5 period? 3. Is Company B likely to be the better stock investment in 20X6 and beyond? Problem 7-2 Making credit-rating changes (LO 7-7) Exhibit 7.5 in your text describes the key financial ratios Standard & Poor's analysts use to assess credit risk and assign credit ratings to industrial companies. Those same financial ratios for a single company over time follow. The company was assigned a AAA credit rating three years earlier. 20X1 20X2 Q1 23.8 Q2 22.1 Q3 21.6 Q4 20.8 Q1 20.6 EBIT interest coverage Q2 12.4 O Focus Page 1 of 1 362 words English (United States) E 131% ? ? ? tv A W P Word File Edit View Insert Format Tools Table Window Help LD 16%O Sun 4:57 PM Q AutoSave OFF HS58 Chapter 7 Assignment Part 1 Q v Home Insert Draw Design Layout References Mailings Review View Share Comments Arial 16 A Aa A va A T AaBbcDdE AaBbcDdEe AaBbCcD AaBbCcDdEt AaBb AaBbceDdEt Paste B I U v ab x Normal AVA X No Spacing Heading 1 Heading 2 Title Subtitle Styles Pane Sensitivity Required: 1. Calculate each firm's AE each year from 20x1 to 20X5. (Round your final answers to the nearest whole dollar. Negative abnormal earnings should be indicated with a minus sign.) 2. Was Company B better managed over the 20X1-20X5 period? 3. Is Company B likely to be the better stock investment in 20X6 and beyond? Problem 7-2 Making credit-rating changes (LO 7-7) Exhibit 7.5 in your text describes the key financial ratios Standard & Poor's analysts use to assess credit risk and assign credit ratings to industrial companies. Those same financial ratios for a single company over time follow. The company was assigned a AAA credit rating three years earlier. EBIT interest coverage EBITDA interest coverage FFO/Total debt (%) Free operating cash flow/Total debt (%) Total debt/EBITDA Return on capital (%) Total debt/Capital (%) Q1 23.8 25.3 167.8 104.1 0.2 35.1 6.2 20X1 Q2 Q3 22.1 21.6 26.4 25.6 150.8 130.7 107.3 103.7 0.2 0.2 34.3 30.6 6.8 7.5 Q4 20.8 23.2 128.4 98.6 0.6 28.1 15.4 20X2 Q1 Q2 20.6 12.4 22.9 16.5 80.2 76.2 61.5 45.3 0.8 1.0 25.9 24.7 27.2 35.6 Required: 1. Did the company's credit risk increase or decrease over these six quarters? 2. What credit rating should be assigned to the company as of Q2 in 20X2? 3. Which is the quarter from the table above that Standard & Poor's would first consider downgrading this company's credit rating? Page 1 of 1 362 words English (United States) O Focus E EE 131% O ? 5 ? ? ? ctv w P