Answered step by step

Verified Expert Solution

Question

1 Approved Answer

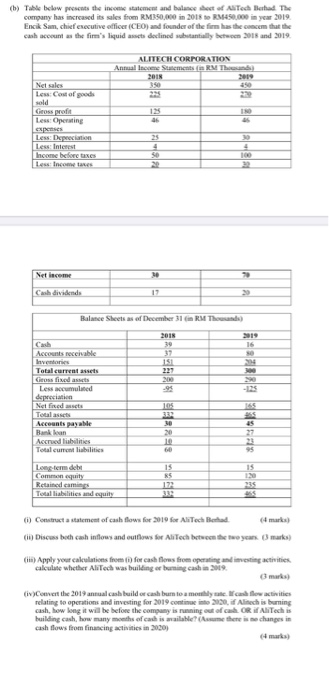

word typing please do not use excel. (i) Construct a statement of cash flows for 2019 for AliTech Berhad. (ii) Discuss both cash inflows and

word typing please do not use excel.

(i) Construct a statement of cash flows for 2019 for AliTech Berhad.

(ii) Discuss both cash inflows and outflows for AliTech between the two years.

(iii) Apply your calculations from (i) for cash flows from operating and investing activities, calculate whether AliTech was building or burning cash in 2019.

(iv)Convert the 2019 annual cash build or cash burn to a monthly rate. If cash flow activities relating to operations and investing for 2019 continue into 2020, if Alitech is burning cash, how long it will be before the company is running out of cash. OR if AliTech is building cash, how many months of cash is available? (Assume there is no changes in cash flows from financing activities in 2020)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started