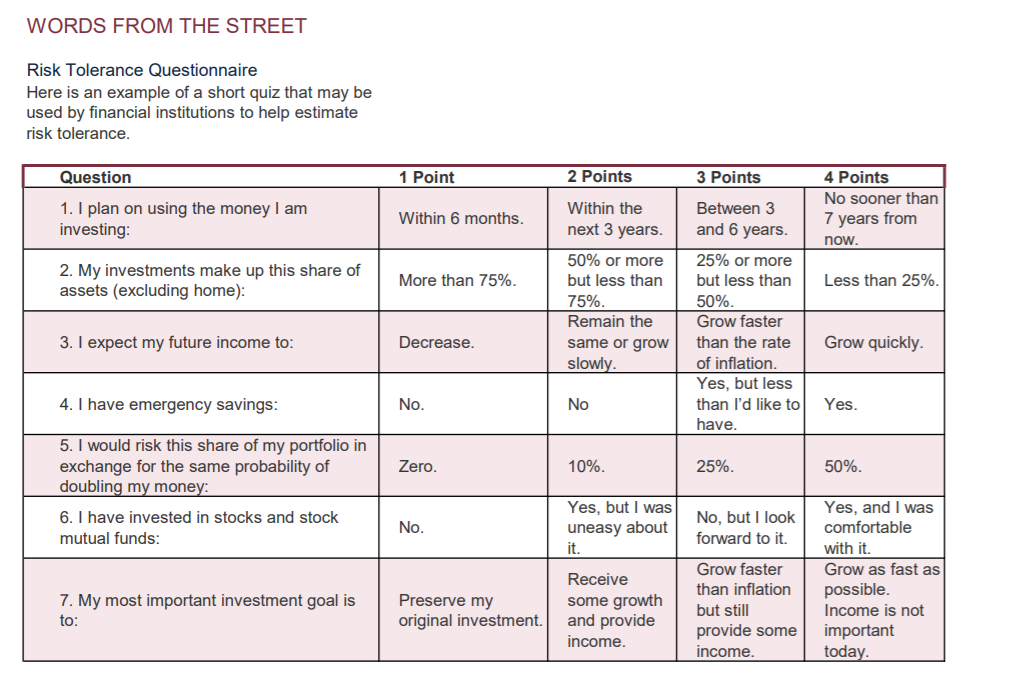

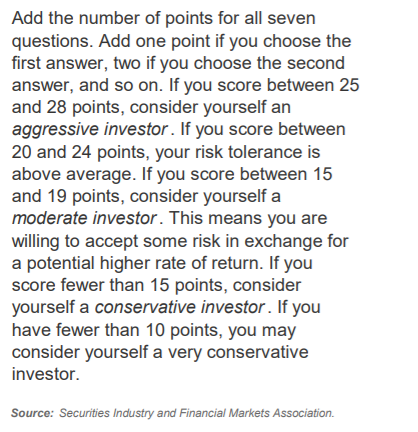

WORDS FROM THE STREET Risk Tolerance Questionnaire Here is an example of a short quiz that may be used by financial institutions to help estimate risk tolerance. Question 1 Point 2 Points 3 Points 1. I plan on using the money I am investing: 4 Points No sooner than 7 years from now. Within the next 3 years. Within 6 months. 2. My investments make up this share of assets (excluding home): More than 75%. Less than 25%. 50% or more but less than 75% Remain the same or grow slowly. Between 3 and 6 years. 25% or more but less than 50% Grow faster than the rate of inflation. Yes, but less than I'd like to have. 3. I expect my future income to: Decrease. Grow quickly. 4. I have emergency savings: No. No Yes. Zero. 10%. 25%. 50%. 5. I would risk this share of my portfolio in exchange for the same probability of doubling my money: 6. I have invested in stocks and stock mutual funds: No. Yes, but I was uneasy about it. No, but I look forward to it. 7. My most important investment goal is to: Yes, and I was comfortable with it. Grow as fast as possible. Income is not important today. Receive some growth and provide income. Preserve my original investment. Grow faster than inflation but still provide some income. Add the number of points for all seven questions. Add one point if you choose the first answer, two if you choose the second answer, and so on. If you score between 25 and 28 points, consider yourself an aggressive investor. If you score between 20 and 24 points, your risk tolerance is above average. If you score between 15 and 19 points, consider yourself a moderate investor. This means you are willing to accept some risk in exchange for a potential higher rate of return. If you score fewer than 15 points, consider yourself a conservative investor. If you have fewer than 10 points, you may consider yourself a very conservative investor. Source: Securities Industry and Financial Markets Association. WORDS FROM THE STREET Risk Tolerance Questionnaire Here is an example of a short quiz that may be used by financial institutions to help estimate risk tolerance. Question 1 Point 2 Points 3 Points 1. I plan on using the money I am investing: 4 Points No sooner than 7 years from now. Within the next 3 years. Within 6 months. 2. My investments make up this share of assets (excluding home): More than 75%. Less than 25%. 50% or more but less than 75% Remain the same or grow slowly. Between 3 and 6 years. 25% or more but less than 50% Grow faster than the rate of inflation. Yes, but less than I'd like to have. 3. I expect my future income to: Decrease. Grow quickly. 4. I have emergency savings: No. No Yes. Zero. 10%. 25%. 50%. 5. I would risk this share of my portfolio in exchange for the same probability of doubling my money: 6. I have invested in stocks and stock mutual funds: No. Yes, but I was uneasy about it. No, but I look forward to it. 7. My most important investment goal is to: Yes, and I was comfortable with it. Grow as fast as possible. Income is not important today. Receive some growth and provide income. Preserve my original investment. Grow faster than inflation but still provide some income. Add the number of points for all seven questions. Add one point if you choose the first answer, two if you choose the second answer, and so on. If you score between 25 and 28 points, consider yourself an aggressive investor. If you score between 20 and 24 points, your risk tolerance is above average. If you score between 15 and 19 points, consider yourself a moderate investor. This means you are willing to accept some risk in exchange for a potential higher rate of return. If you score fewer than 15 points, consider yourself a conservative investor. If you have fewer than 10 points, you may consider yourself a very conservative investor. Source: Securities Industry and Financial Markets Association