Question

work at a job that only pays minimum wage / must demonstrate a financial need / have no other outstanding loans am not / am

work at a job that only pays minimum wage / must demonstrate a financial need / have no other outstanding loans

am not / am

agree to ttutor other persons / not be in default on other person loans / live in the dorms

perkins / plus / stafford

i get my first job in my field of study / after my first semester of study / i get out of school

i get any job after earning my degree / my parents finish paying the loan they took out to fund my undergrad work / i get out of school

government sponsored / mine, not my parents / my parents, not mine

stafford / perkins / parent

a long time ago / recently

changing your name / leaving the country / filling for bankruptcy protection from creditors

does not relieve / relieves

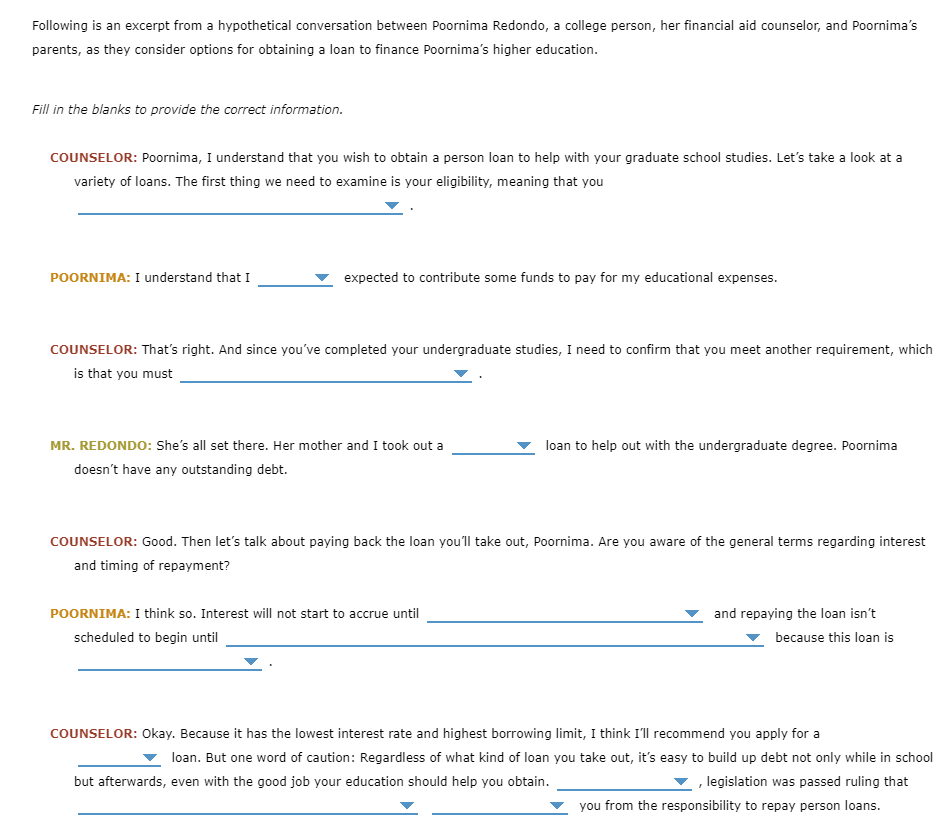

Following is an excerpt from a hypothetical conversation between Poornima Redondo, a college person, her financial aid counselor, and Poornima's parents, as they consider options for obtaining a loan to finance Poornima's higher education. Fill in the blanks to provide the correct information. COUNSELOR: Poornima, I understand that you wish to obtain a person loan to help with your graduate school studies. Let's take a look at a variety of loans. The first thing we need to examine is your eligibility, meaning that you POORNIMA: I understand that I expected to contribute some funds to pay for my educational expenses. COUNSELOR: That's right. And since you've completed your undergraduate studies, I need to confirm that you meet another requirement, which is that you must loan to help out with the undergraduate degree. Poornima MR. REDONDO: She's all set there. Her mother and I took out a doesn't have any outstanding debt. COUNSELOR: Good. Then let's talk about paying back the loan you'll take out, Poornima. Are you aware of the general terms regarding interest and timing of repayment? POORNIMA: I think so. Interest will not start to accrue until scheduled to begin until and repaying the loan isn't because this loan is COUNSELOR: Okay. Because it has the lowest interest rate and highest borrowing limit, I think I'll recommend you apply for a loan. But one word of caution: Regardless of what kind of loan you take out, it's easy to build up debt not only while in school but afterwards, even with the good job your education should help you obtain. legislation was passed ruling that you from the responsibility to repay person loans. Following is an excerpt from a hypothetical conversation between Poornima Redondo, a college person, her financial aid counselor, and Poornima's parents, as they consider options for obtaining a loan to finance Poornima's higher education. Fill in the blanks to provide the correct information. COUNSELOR: Poornima, I understand that you wish to obtain a person loan to help with your graduate school studies. Let's take a look at a variety of loans. The first thing we need to examine is your eligibility, meaning that you POORNIMA: I understand that I expected to contribute some funds to pay for my educational expenses. COUNSELOR: That's right. And since you've completed your undergraduate studies, I need to confirm that you meet another requirement, which is that you must loan to help out with the undergraduate degree. Poornima MR. REDONDO: She's all set there. Her mother and I took out a doesn't have any outstanding debt. COUNSELOR: Good. Then let's talk about paying back the loan you'll take out, Poornima. Are you aware of the general terms regarding interest and timing of repayment? POORNIMA: I think so. Interest will not start to accrue until scheduled to begin until and repaying the loan isn't because this loan is COUNSELOR: Okay. Because it has the lowest interest rate and highest borrowing limit, I think I'll recommend you apply for a loan. But one word of caution: Regardless of what kind of loan you take out, it's easy to build up debt not only while in school but afterwards, even with the good job your education should help you obtain. legislation was passed ruling that you from the responsibility to repay person loansStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started