Answered step by step

Verified Expert Solution

Question

1 Approved Answer

work (modified) - FIN X Ch13 Homework (modified) + newconnect.mheducation.com/flow/connect.html Batman Begins by... B The Ultimate Begin... A Weekly Gym Rout... Drop Shipping and...

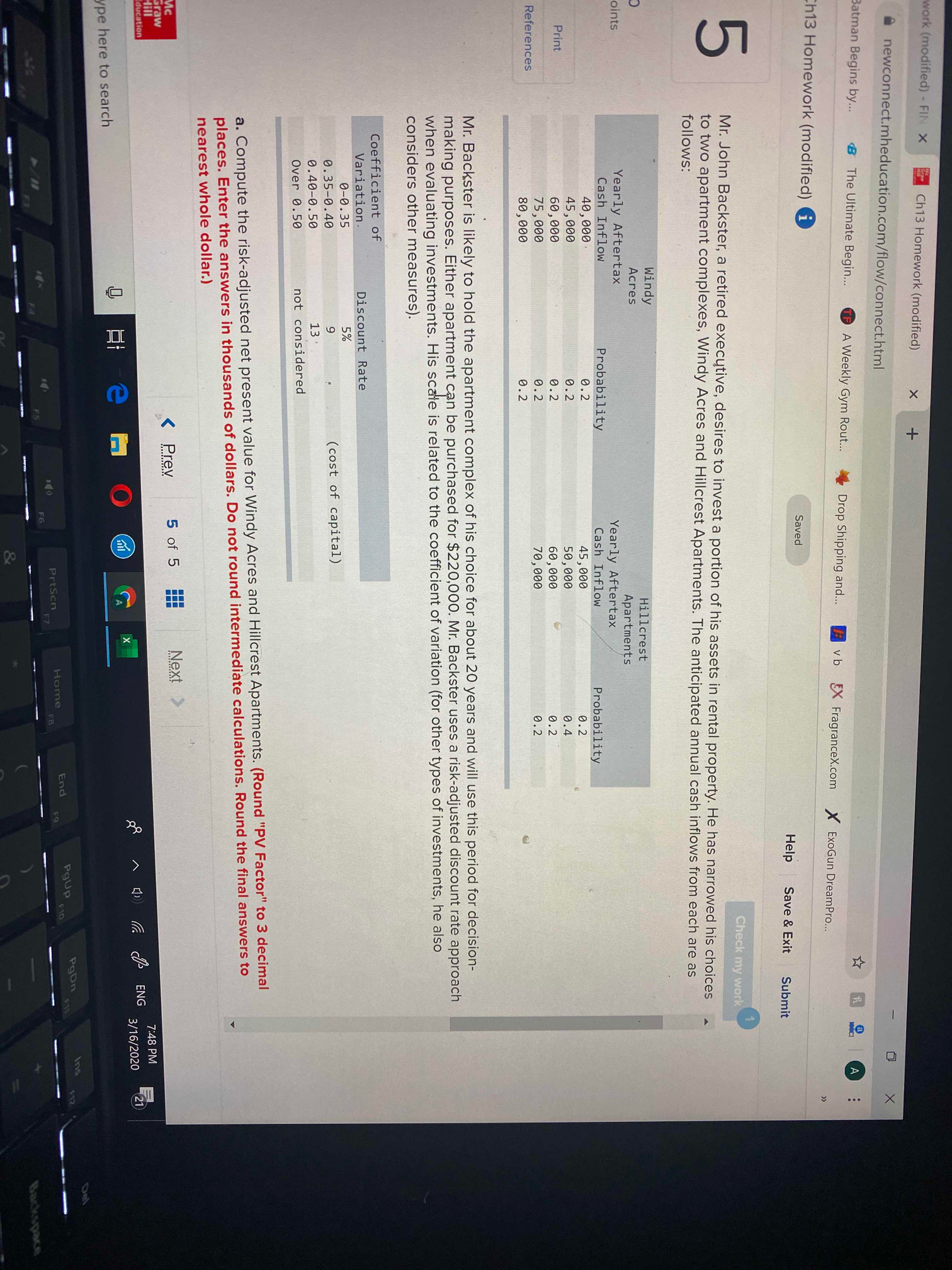

work (modified) - FIN X Ch13 Homework (modified) + newconnect.mheducation.com/flow/connect.html Batman Begins by... B The Ultimate Begin... A Weekly Gym Rout... Drop Shipping and... vb EX FragranceX.com ExoGun DreamPro.... Ch13 Homework (modified) i Saved Help Save & Exit Submit 5 Check my work Mr. John Backster, a retired executive, desires to invest a portion of his assets in rental property. He has narrowed his choices to two apartment complexes, Windy Acres and Hillcrest Apartments. The anticipated annual cash inflows from each are as follows: oints Print References Mc Graw Hill Education Windy Acres Hillcrest Apartments Yearly Aftertax Yearly Aftertax Cash Inflow Probability Cash Inflow Probability 40,000 45,000 60,000 75,000 80,000 0.2 45,000 0.2 0.2 50,000 0.4 0.2 60,000 0.2 0.2 70,000 0.2 0.2 Mr. Backster is likely to hold the apartment complex of his choice for about 20 years and will use this period for decision- making purposes. Either apartment can be purchased for $220,000. Mr. Backster uses a risk-adjusted discount rate approach when evaluating investments. His scale is related to the coefficient of variation (for other types of investments, he also considers other measures). Coefficient of Variation. 0-0.35 0.35-0.40 0.40-0.50 Over 0.50 Discount Rate 5% 9 (cost of capital) 13 not considered a. Compute the risk-adjusted net present value for Windy Acres and Hillcrest Apartments. (Round "PV Factor" to 3 decimal places. Enter the answers in thousands of dollars. Do not round intermediate calculations. Round the final answers to nearest whole dollar.) ype here to search I Prev 5 of 5 Next 89 a A x ENG 7:48 PM 3/16/2020 21 PrtScn Home End PgUp PgDn Ins F12 F10 F9 F6 F7 FB Del Backspace

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started