Answered step by step

Verified Expert Solution

Question

1 Approved Answer

work sheet a: Works sheet b--form 1: Work sheet b-form 2: Work sheet b-form 3: Question C: Evaluate the company's financial results, and comment on

work sheet a:

Works sheet b--form 1:

Work sheet b-form 2:

Work sheet b-form 3:

Question C:

| Evaluate the company's financial results, and comment on the dividend. |

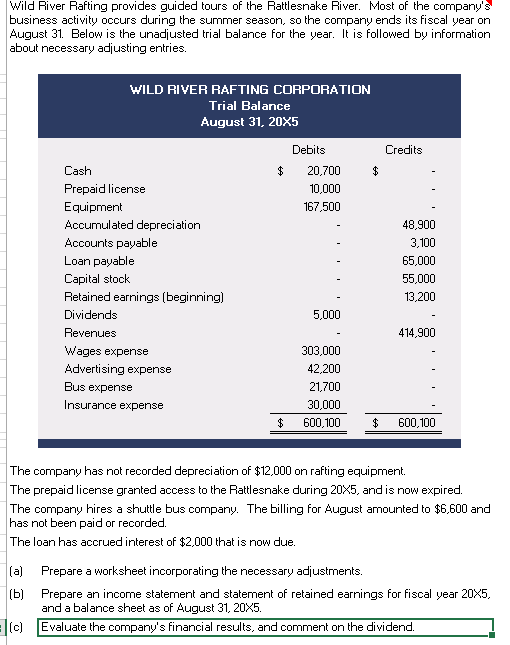

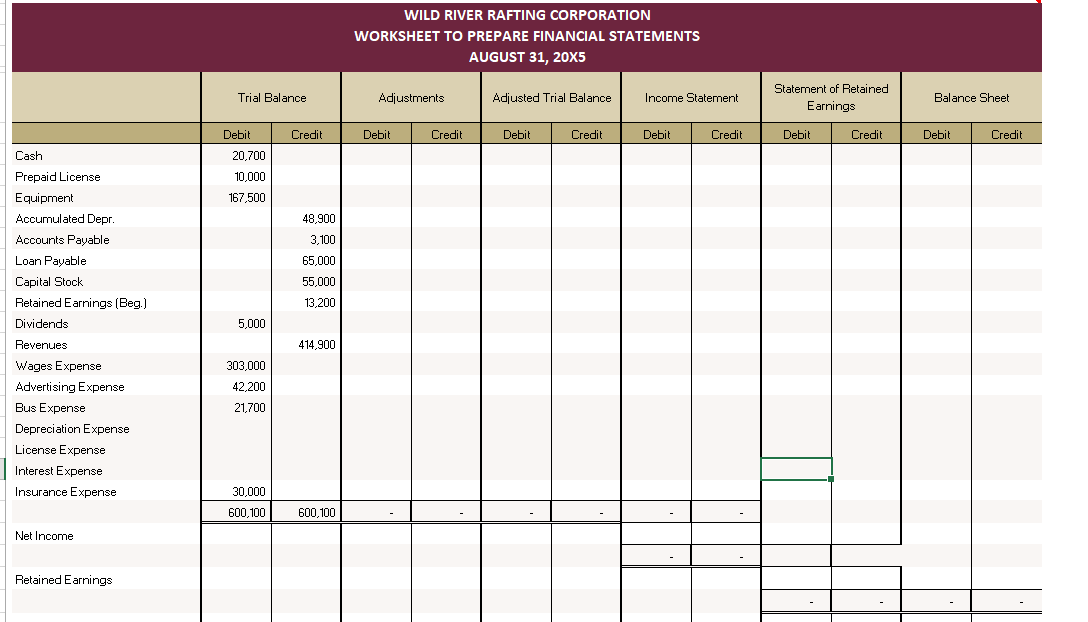

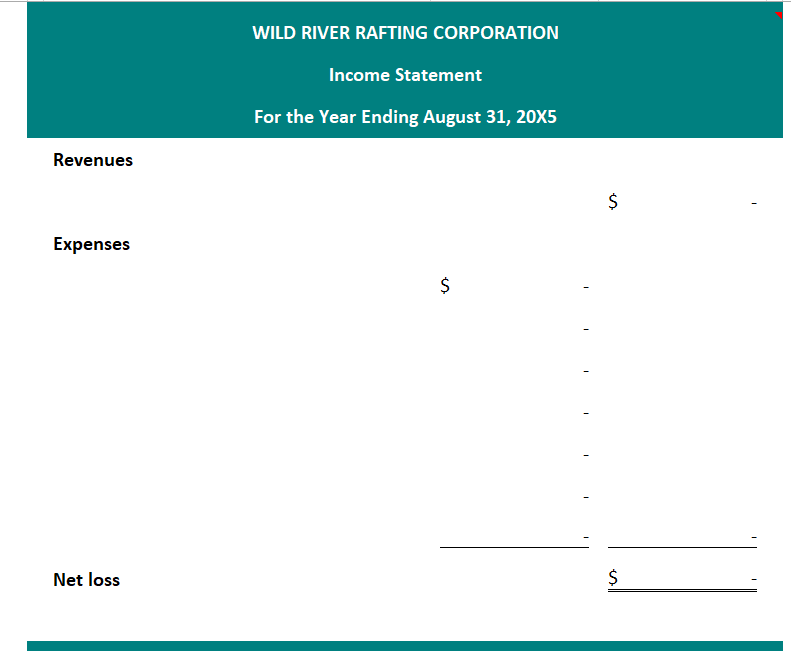

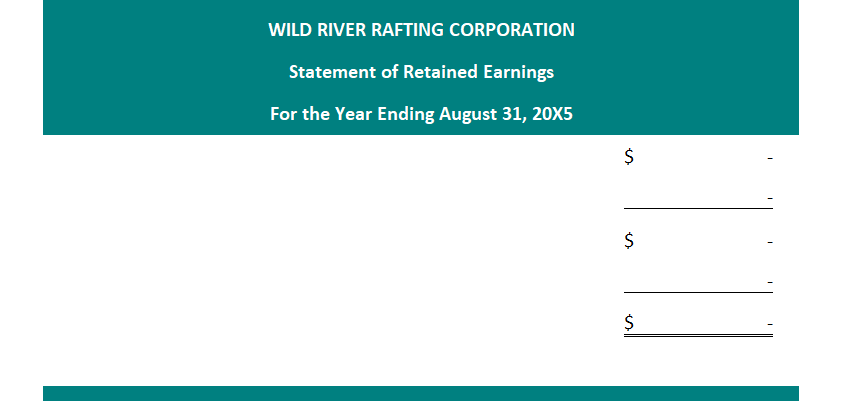

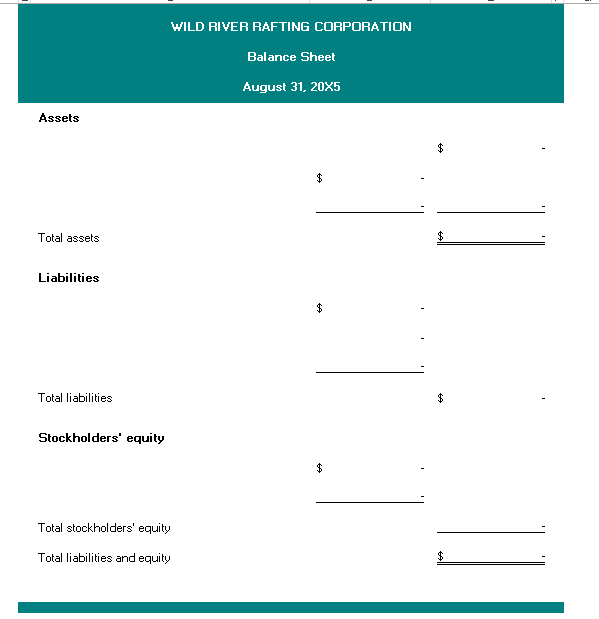

Wild River Rafting provides guided tours of the Rattlesnake River. Most of the company's business activity occurs during the summer season, so the company ends its fiscal year on August 31. Below is the unadjusted trial balance for the year. It is followed by information about necessary adjusting entries. The company has not recorded depreciation of $12,000 on rafting equipment. The prepaid license granted access to the Rattlesnake during 205, and is now expired. The company hires a shuttle bus company. The billing for August amounted to $6,600 and has not been paid or recorded. The loan has accrued interest of $2,000 that is now due. [a] Prepare a worksheet incorporating the necessary adjustments. (b) Prepare an income statement and statement of retained earnings for fiscal year 20x5. (c) Evaluate the company's financial results, and comment on the dividend. WILD RIVER RAFTING CORPORATION WORKSHEET TO PREPARE FINANCIAL STATEMENTS AUGUST 31, 205 WILD RIVER RAFTING CORPORATION Income Statement For the Year Ending August 31, 205 Revenues $ Expenses S Net loss WILD RIVER RAFTING CORPORATION Statement of Retained Earnings For the Year Ending August 31, 20X5 $ $ WILD RIVER RAFTING CORPORATIDN Balance Sheet August 31, 205 Assets Total assets $$ Liabilities Total liabilities $ Stockholders' equity Total stockholders' equity Total liabilities and equity $$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started