Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Working as a senior manager at a fast-growing technology company, Gold Standard Ltd (GST), you hold 5,000 shares of Gold Standard stock (via employee

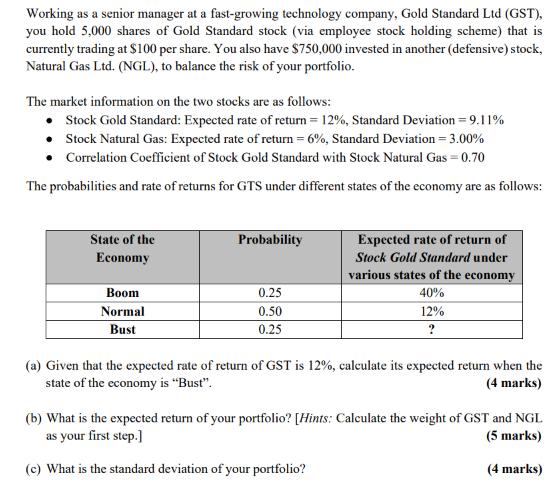

Working as a senior manager at a fast-growing technology company, Gold Standard Ltd (GST), you hold 5,000 shares of Gold Standard stock (via employee stock holding scheme) that is currently trading at $100 per share. You also have $750,000 invested in another (defensive) stock, Natural Gas Ltd. (NGL), to balance the risk of your portfolio. The market information on the two stocks are as follows: Stock Gold Standard: Expected rate of return = 12%, Standard Deviation = 9.11% Stock Natural Gas: Expected rate of return = 6%, Standard Deviation = 3.00% Correlation Coefficient of Stock Gold Standard with Stock Natural Gas = 0.70 The probabilities and rate of returns for GTS under different states of the economy are as follows: State of the Economy Boom Normal Bust Probability 0.25 0.50 0.25 Expected rate of return of Stock Gold Standard under various states of the economy 40% 12% ? (a) Given that the expected rate of return of GST is 12%, calculate its expected return when the state of the economy is "Bust". (4 marks) (b) What is the expected return of your portfolio? [Hints: Calculate the weight of GST and NGL as your first step.] (5 marks) (c) What is the standard deviation of your portfolio? (4 marks)

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the expected return of Gold Standard GST when the state of the economy is Bust we need to use the given probabilities and expected returns for each state of the economy Given Expected r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started