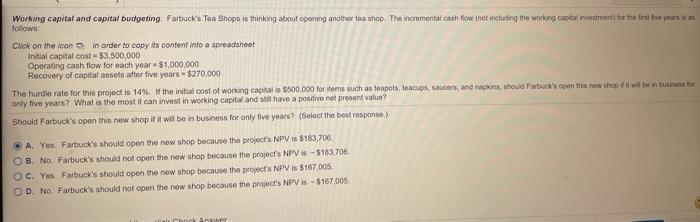

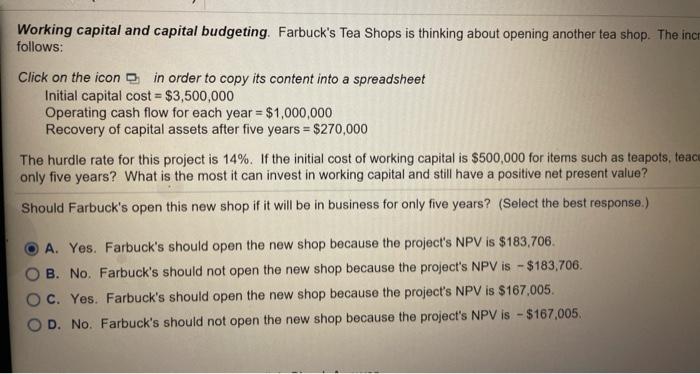

Working capital and capital budgeting Farbuck's Tea Shops is thinking about opening another fea shopThe incremental cash flow (not including the working capital moment for the first five years follows: Click on the icon in order to copy its content into a spreadsheet Initial capital cost-$3,500,000 Operating cash flow for each year - $1,000,000 Recovery of capital assets after five years $270,000 The hurdle rate for this project is 14% if the initial cost of working capital is $500.000 foris such as teapots, teacups, sauces, and napkins, should Parbuck's open this new shop it will be in business for only five years? What is the most it can invest in working capital and still have a positive represent value? Should Farbuck's open this new shop if it will be in business for only five years? (Select the best response A. Yes. Farbuck's should open the new shop because the project's NPV is $183,706 OB. No. Farbuck's should not open the new shop because the project's NPV is - 5183.706 Oc. Yes. Farbuck's should open the now shop because the projects NPV is $167.005 OD. No. Farbuck's should not open the now shop because the project's NPV is - 5167,005 wer Working capital and capital budgeting. Farbuck's Tea Shops is thinking about opening another tea shop. The incr follows: Click on the icon in order to copy its content into a spreadsheet Initial capital cost = $3,500,000 Operating cash flow for each year = $1,000,000 Recovery of capital assets after five years = $270,000 The hurdle rate for this project is 14%. If the initial cost of working capital is $500,000 for items such as teapots, teacu only five years? What is the most it can invest in working capital and still have a positive net present value? Should Farbuck's open this new shop if it will be in business for only five years? (Select the best response.) A. Yes. Farbuck's should open the new shop because the project's NPV is $183,706. B. No. Farbuck's should not open the new shop because the project's NPV is - $183,706. C. Yes. Farbuck's should open the new shop because the project's NPV is $167,005. D. No. Farbuck's should not open the new shop because the project's NPV is - $167.005