Answered step by step

Verified Expert Solution

Question

1 Approved Answer

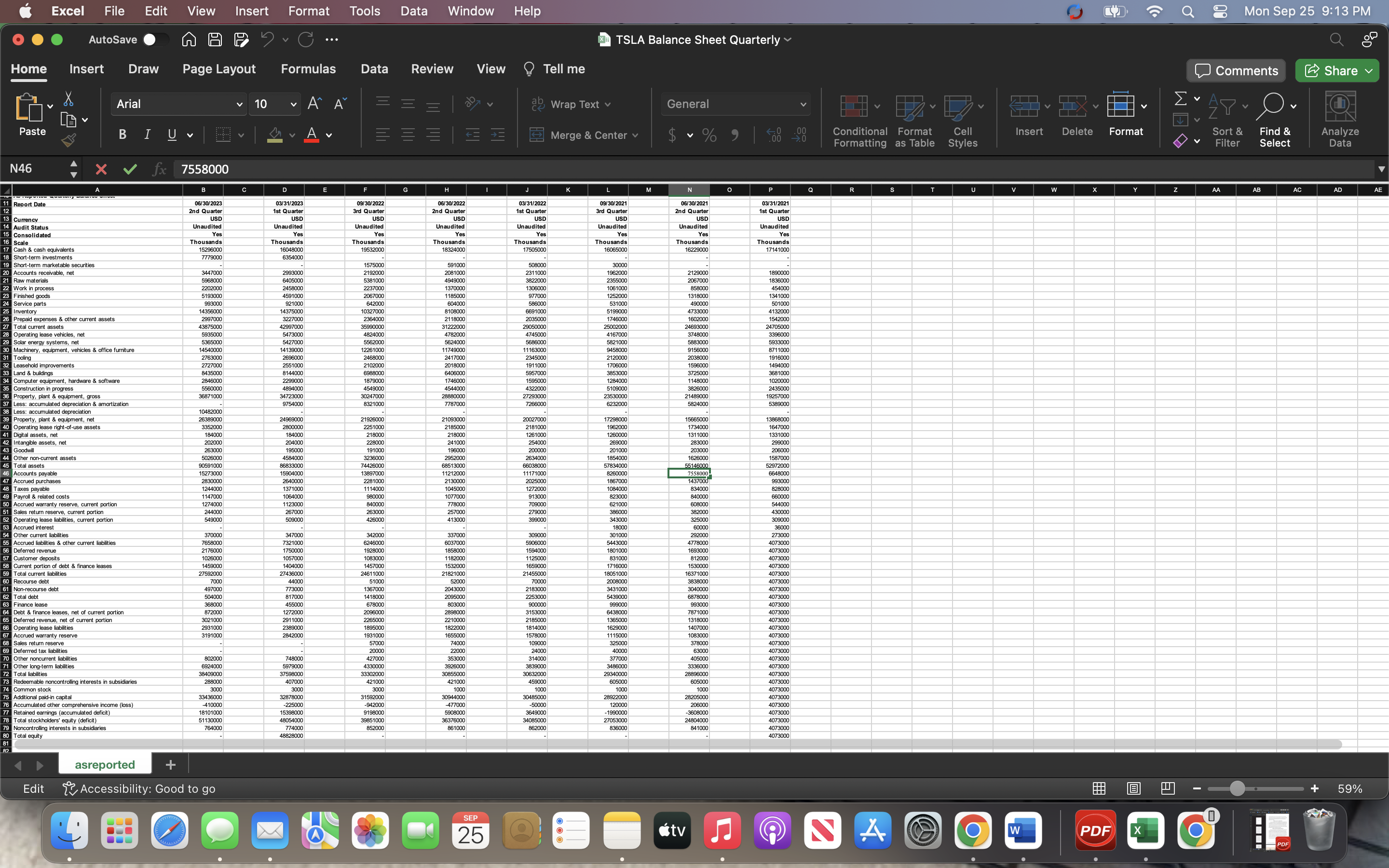

Working Capital Interpretation: Use the correct formula to calculate working capital. Then discuss the business's current financial liquidity position. For example, does the business have

- Working Capital Interpretation: Use the correct formula to calculate working capital. Then discuss the business's current financial liquidity position.

- For example, does the business have enough working capital ready to address bills to suppliers? Will there be potential cash inflow at the end of the year?

Excel File Edit View Insert Format Tools Data Window Help AutoSave C TSLA Balance Sheet Quarterly Home Insert Draw Page Layout Formulas Data Review View Tell me G Paste X Arial 10 A A = = = | 20 Wrap Text General BI U A = = = = = Merge & Center % .00 Conditional Format Formatting as Table Cell Styles N46 fx 7558000 ( > Insert Delete Format 01 WE Mon Sep 25 9:13 PM Comments Sort & Filter Find & Select Share Analyze Data A B D E F G H I J K L M N P Q R S T U V W X Y Z AA AB AC AD AE 12 11 Report Date 13 Currency 14 Audit Status 15 Consolidated 16 Scale 17 Cash & cash equivalents 18 Short-term investments 19 Short-term marketable securities 20 Accounts receivable, net 20 ACCO 21 Raw materials 21 Naw mal 22 Work process 23 Finished goods 24 Service parts Inventory 06/30/2023 03/31/2023 09/30/2022 06/30/2022 03/31/2022 09/30/2021 06/30/2021 03/31/2021 2nd Quarter USD Unaudited Yes 1st Quarter USD Unaudited Yes 3rd Quarter USD Unaudited Yes 2nd Quarter USD Unaudited Yes 1st Quarter USD Unaudited Yes 3rd Quarter USD Unaudited Yes 2nd Quarter USD Unaudited Yes 1st Quarter USD Unaudited Yes Thousands Thousands 15296000 16048000 Thousands 19532000 Thousands 18324000 Thousands 17505000 Thousands 16065000 Thousands 16229000 Thousands 17141000 7779000 6354000 1575000 591000 508000 30000 3447000 2993000 2192000 2081000 2311000 1962000 2129000 1890000 5968000 6405000 5381000 4949000 3822000 2355000 2067000 1836000 2202000 2458000 2237000 1370000 1306000 1061000 858000 454000 5193000 4591000 2067000 1185000 977000 1252000 1318000 1341000 993000 921000 642000 604000 586000 531000 004000 14356000 14375000 10327000 8108000 6691000 5199000 4733000 Prepaid expenses & other current assets 2997000 27 Total current assets 43875000 3227000 42997000 2364000 2118000 2035000 1746000 1602000 490000 501000 4132000 1542000 35990000 31222000 29050000 25002000 24693000 24705000 28 Operating lease vehicles, net 5935000 5473000 4824000 4782000 4745000 4167000 3748000 3396000 4107000 29 Solar energy systems, net 5365000 5427000 5562000 5624000 5686000 5821000 5883000 5933000 30 Machinery, equipment, vehicles & office furniture 14540000 14139000 12261000 11749000 11163000 9458000 9156000 8711000 Tooling 2763000 2696000 2468000 2417000 2345000 2120000 2038000 1916000 2120000 2050000 32 Leasehold improvements 2727000 2551000 2102000 2018000 1911000 1706000 1596000 1494000 2951000 33 Land & buildings 8435000 8144000 6988000 6406000 5957000 3853000 3725000 3681000 34 Computer equipment, hardware & software 2846000 2299000 1879000 1746000 1595000 1284000 1148000 1020000 35 Construction in progress 5560000 4894000 4549000 4544000 4322000 5109000 3826000 2435000 36 Property, plant equipment, gross 36871000 34723000 30247000 28880000 27293000 23530000 21489000 19257000 37 Less: accumulated depreciation & amortization 9754000 8321000 7787000 7266000 6232000 5824000 5389000 38 Less: accumulated depreciation 10482000 39 Property, plant equipment, net 26389000 24969000 21926000 21093000 20027000 17298000 15665000 13868000 40 Operating lease right-of-use assets 41 Digital assets, net 42 Intangible assets, net. 43 Goodwill 44 Other non-current assets 45 Total assets 46 Accounts payable 47 Accrued purchases 3352000 2800000 2251000 2185000 2181000 1962000 1734000 1647000 184000 184000 218000 218000 1261000 1260000 1311000 1331000 1201000 104000 202000 204000 228000 241000 254000 269000 283000 299000 241000 205000 263000 195000 191000 196000 200000 201000 203000 206000 5026000 4584000 3236000 2952000 2634000 1854000 1626000 1587000 90591000 86833000 74426000 68513000 66038000 57834000 55146000 52972000 15273000 15904000 13897000 11212000 11171000 8260000 7558000 6648000 2830000 2640000 2281000 2130000 2025000 1867000 1437000 993000 2040000 to Taxes payable 1244000 1371000 1114000 1045000 1272000 1084000 834000 828000 49 Payroll & related costs 1147000 1064000 980000 1077000 913000 823000 840000 660000 50 SU Accrued warranty reserve, current portion 1274000 1123000 840000 778000 709000 621000 608000 544000 ST Sales 51 Sales return reserve, current portion 244000 267000 263000 257000 279000 386000 382000 430000 52 Operating lease liabilities, current portion 549000 509000 426000 413000 399000 343000 325000 309000 18000 60000 36000 53 Accrued interest 54 Other current liabilities 370000 347000 342000 337000 309000 301000 292000 273000 55 Accrued liabilities & other current liabilities 7658000 7321000 6246000 6037000 5906000 5443000 4778000 4073000 56 Deferred revenue 2176000 1750000 1928000 1858000 1594000 1801000 1693000 4073000 57 Customer deposits 1026000 1057000 1083000 1182000 1125000 831000 812000 4073000 58 Current portion of debt finance leases 1459000 1404000 1457000 1532000 1659000 1716000 1530000 4073000 1404000 59 Total current liabilities 27592000 27436000 24611000 21821000 21455000 18051000 16371000 4073000 60 Recourse debt 7000 44000 51000 52000 70000 2008000 3838000 4073000 61 Non-recourse debt 497000 773000 1367000 2043000 2183000 3431000 3040000 4073000 62 Total debt 504000 817000 1418000 2095000 2253000 5439000 6878000 4073000 63 Finance lease 368000 455000 678000 803000 900000 999000 993000 4073000 64 Debt & finance leases, net of current portion 872000 1272000 2096000 2898000 3153000 6438000 7871000 4073000 65 Deferred revenue, net of current portion 3021000 2911000 2265000 2210000 2185000 1365000 1318000 4073000 66 Operating lease liabilities Operat 67 Accrued warranty reserve 68 Sales return reserve 69 Deferrred tax liabilities. 70 Other noncurrent liabilities Other noncurre 2931000 2389000 1895000 1822000 1814000 1629000 1407000 4073000 3191000 2842000 1931000 1655000 1578000 1115000 1083000 4073000 57000 74000 109000 325000 378000 4073000 20000 22000 24000 40000 63000 4073000 802000 748000 427000 353000 314000 377000 405000 4073000 71 Other long-term liabilities 6924000 5979000 4330000 3926000 3839000 3486000 3336000 4073000 72 Total liabilities 38409000 37598000 33302000 30855000 30632000 29340000 28896000 4073000 73 Redeemable noncontrolling interests in subsidiaries 288000 74 Common stock 3000 407000 3000 421000 3000 421000 1000 459000 1000 605000 1000 605000 4073000 1000 4073000 75 Additional paid-in capital 33436000 32878000 31592000 30944000 30485000 28922000 28205000 4073000 76 Accumulated other comprehensive income (loss) -410000 -225000 -942000 -477000 -50000 120000 206000 4073000 77 Retained earnings (accumulated deficit) 18101000 15398000 9198000 5908000 3649000 -1990000 -3608000 4073000 78 Total stockholders' equity (deficit) 51130000 48054000 39851000 36376000 34085000 27053000 24804000 4073000 79 Noncontrolling interests in subsidiaries 764000 774000 852000 861000 862000 836000 841000 4073000 4073000 80 Total equity 48828000 81 82 Edit asreported Accessibility: Good to go SEP 25 tv A W PDF X PDF + 59%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started