Answered step by step

Verified Expert Solution

Question

1 Approved Answer

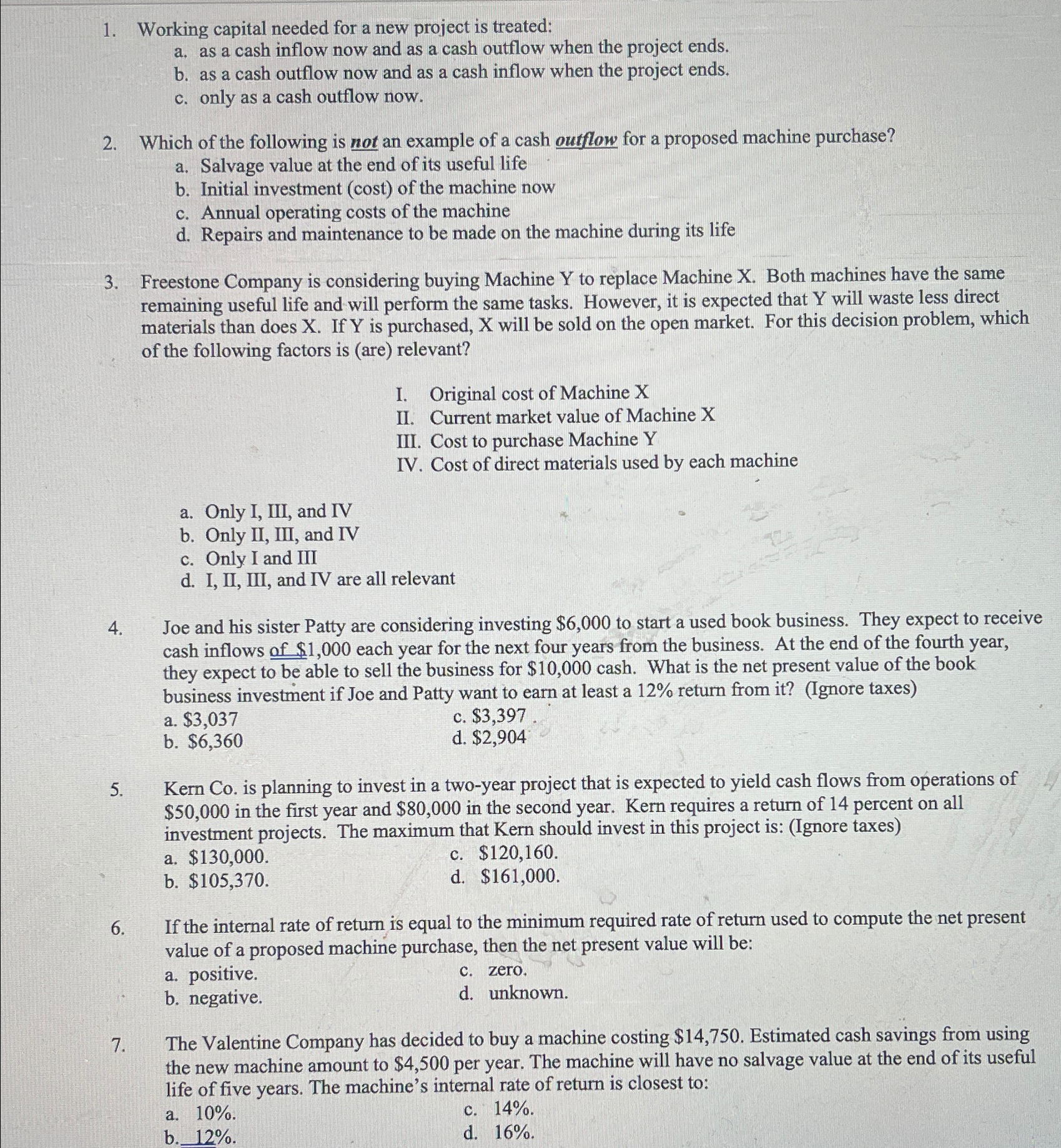

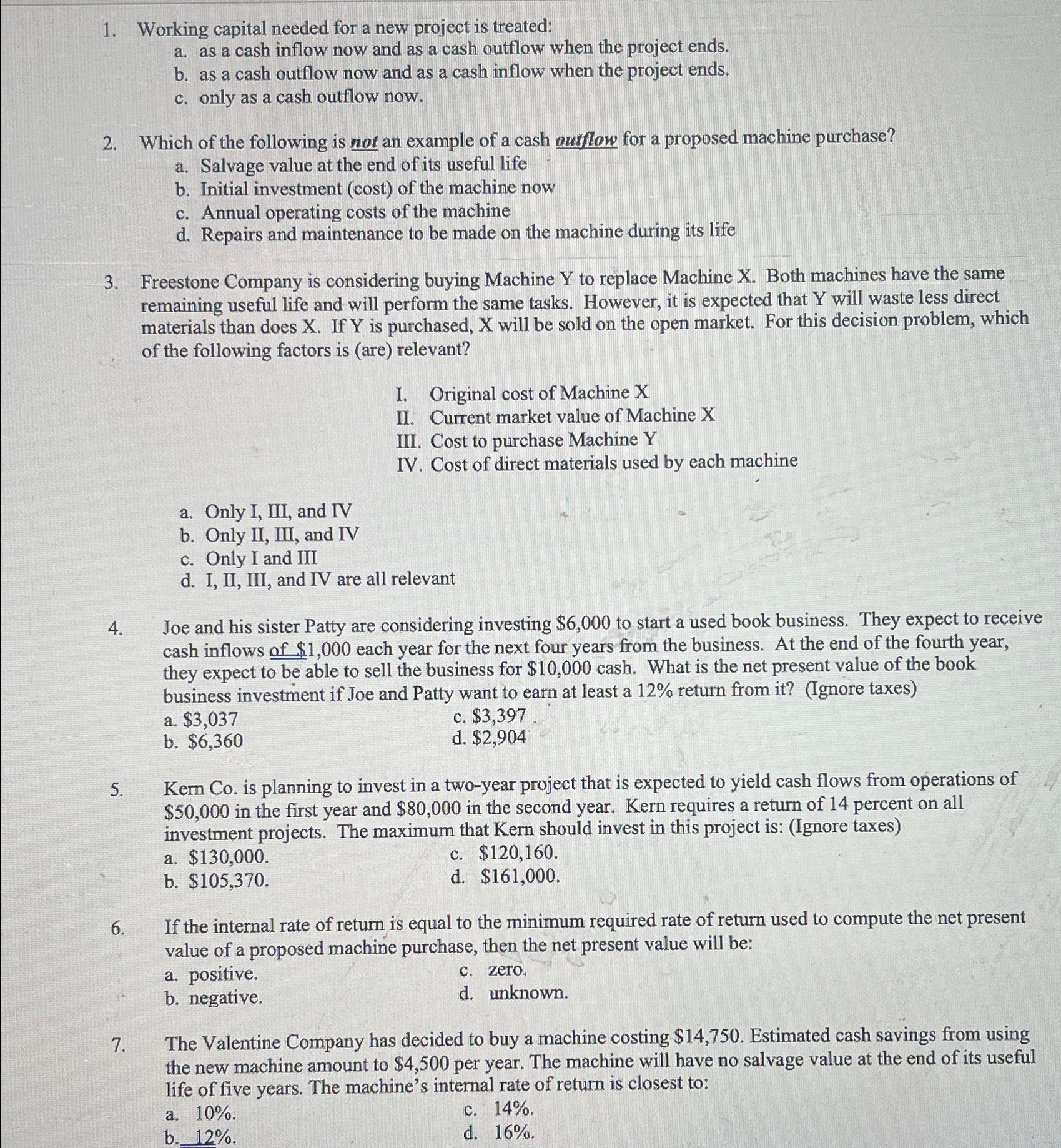

Working capital needed for a new project is treated: a . as a cash inflow now and as a cash outflow when the project ends.

Working capital needed for a new project is treated:

a as a cash inflow now and as a cash outflow when the project ends.

b as a cash outflow now and as a cash inflow when the project ends.

c only as a cash outflow now.

Which of the following is not an example of a cash outflow for a proposed machine purchase?

a Salvage value at the end of its useful life

b Initial investment cost of the machine now

c Annual operating costs of the machine

d Repairs and maintenance to be made on the machine during its life

Freestone Company is considering buying Machine to replace Machine X Both machines have the same remaining useful life and will perform the same tasks. However, it is expected that will waste less direct materials than does If is purchased, will be sold on the open market. For this decision problem, which of the following factors is are relevant?

I. Original cost of Machine

II Current market value of Machine

III. Cost to purchase Machine Y

IV Cost of direct materials used by each machine

a Only I, III, and IV

b Only II III, and IV

c Only I and III

d I, II III, and IV are all relevant

Joe and his sister Patty are considering investing $ to start a used book business. They expect to receive cash inflows of $ each year for the next four years from the business. At the end of the fourth year, they expect to be able to sell the business for $ cash. What is the net present value of the book business investment if Joe and Patty want to earn at least a return from itIgnore taxes

a $

c $

b $

d $

Kern Co is planning to invest in a twoyear project that is expected to yield cash flows from operations of $ in the first year and $ in the second year. Kern requires a return of percent on all investment projects. The maximum that Kern should invest in this project is: Ignore taxes

a $

c $

b $

d $

If the internal rate of return is equal to the minimum required rate of return used to compute the net present value of a proposed machine purchase, then the net present value will be:

a positive.

c zero.

b negative.

d unknown.

The Valentine Company has decided to buy a machine costing $ Estimated cash savings from using the new machine amount to $ per year. The machine will have no salvage value at the end of its useful life of five years. The machine's internal rate of return is closest to:

a

c

b

d

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started