Working on a group project and I need help with profitability ratios. Any help is appreciated!

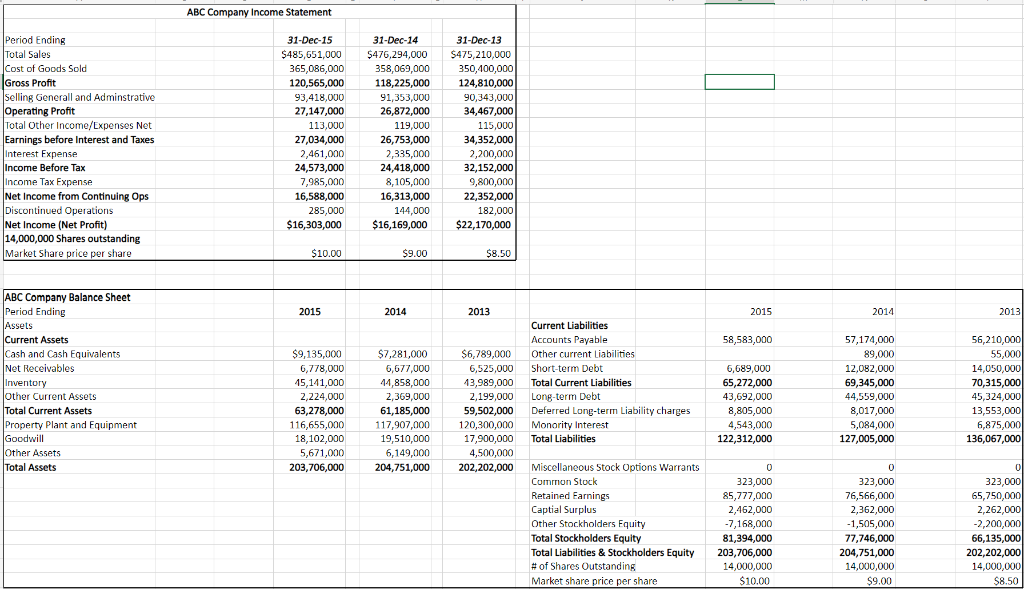

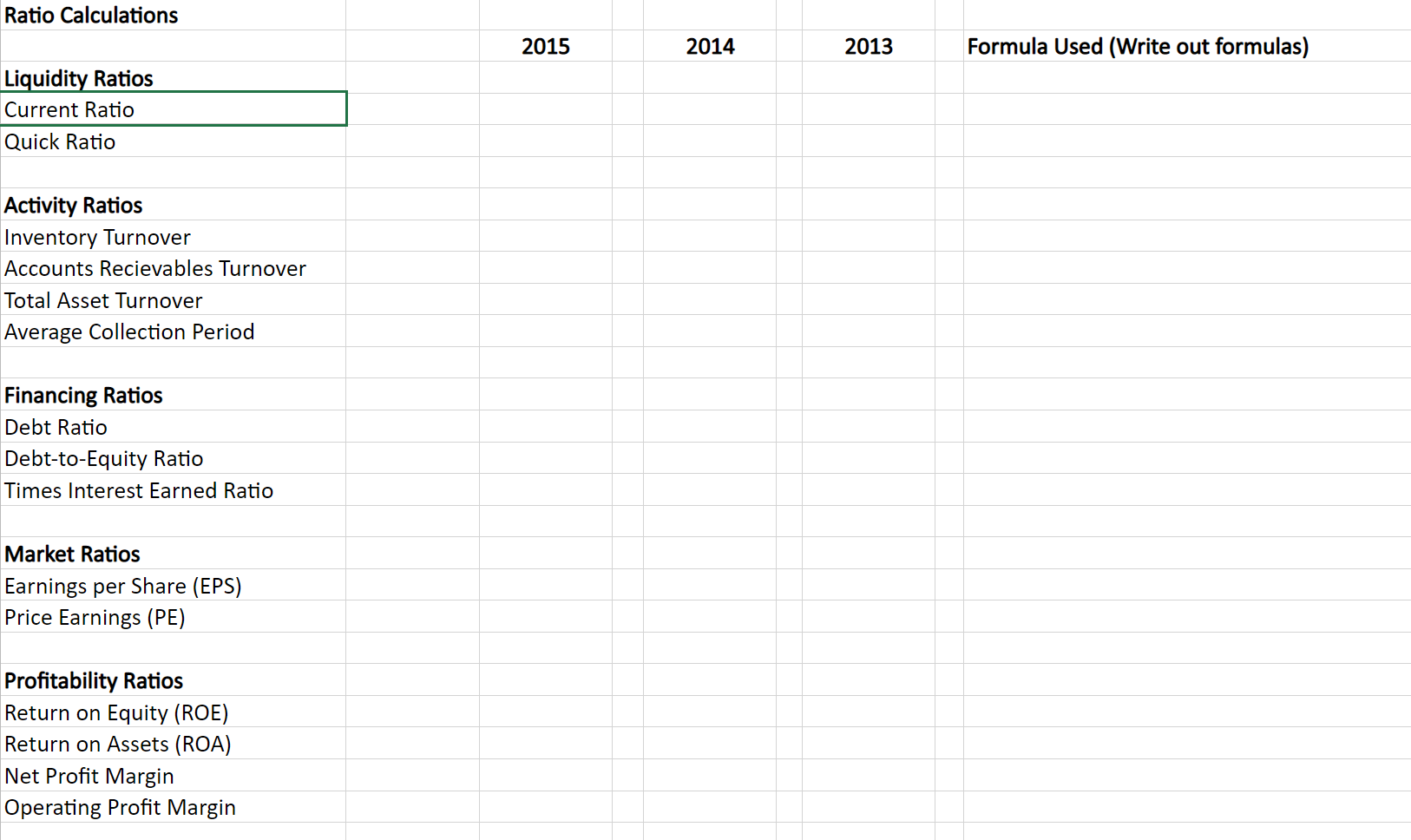

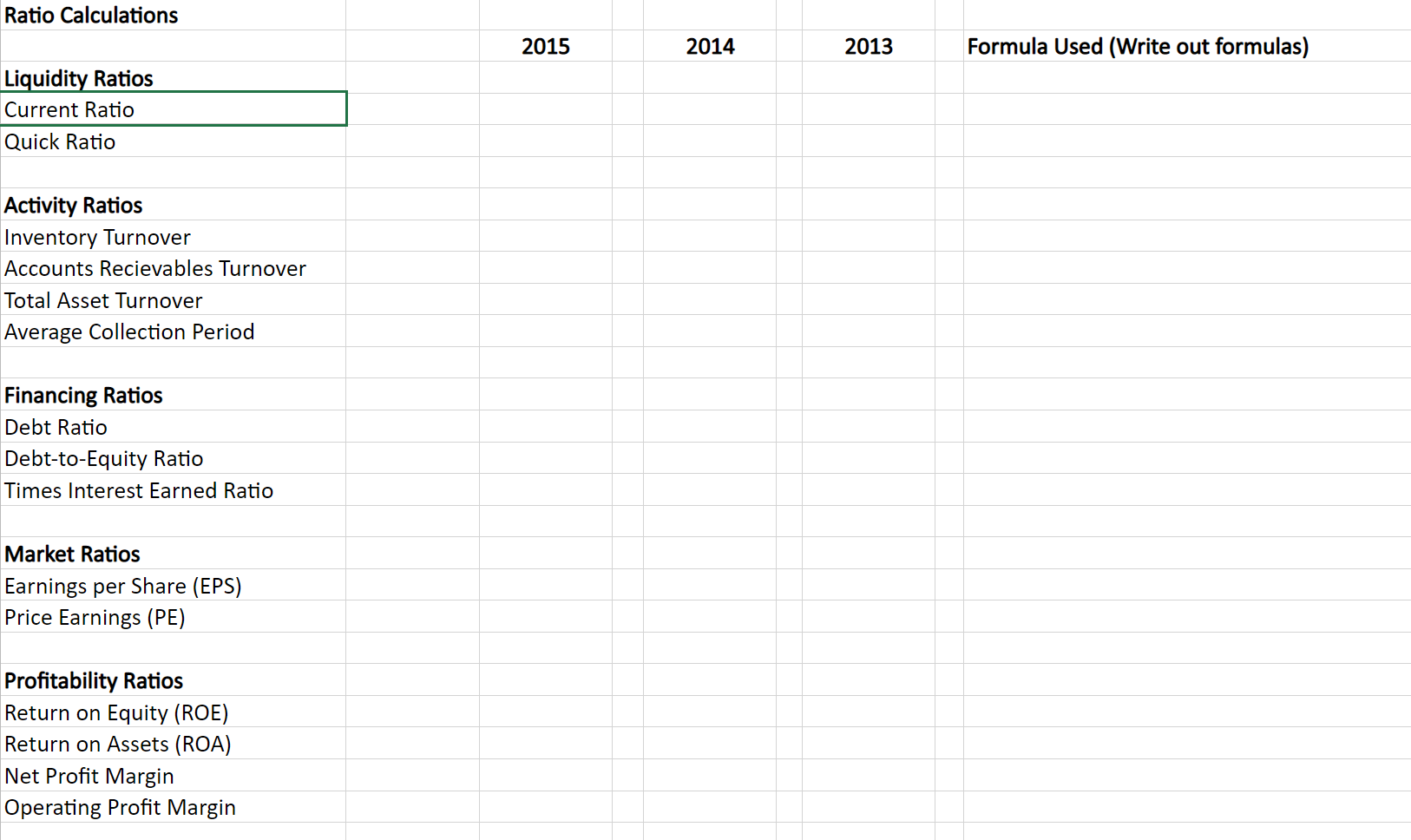

You will calculate ratios for each classification for the 3 years of data (i.e., the current ratio may have been 1.5 the first year, 1.35 the second year, and .75 in the most recent year). It is based on these results that you will measure financial performance, or trends, from one year to the next. It is imperative that the ratios-numbers, and quantitative outcomes, support your analysis.

- Using the data from the Income Statement and Balance Sheet, provide the correct calculation of the liquidity ratios and an assessment of the companys ability to maintain liquidity and the management of current assets and current liabilities. Include the proper assessment of outcomes as positive or negative trends when all ratio outcomes are factored as a group.

Profitability Ratios

- Return on Equity (ROE)

- Return on Assets (ROA)

- Net Profit Margin

- Operating Profit Margin

PART2

In this part of your assignment, you will compose an analytical study reporting your results from Part 1. The CEO of your company is forming a task force to review the financials and present a review for acquisition of ABC Company. Based on ABCs previous 3 years of financials, determine if this would be a good acquisition. You must form the task force to complete the task.

The CEO would like most of the departments to participate in the process. Using each departments area of expertise, what information would each of the following departments contribute to the final decision? Provide a minimum one-paragraph response for each department.

- Finance Department

- Sales Department

- Marketing Department

- Human Resources

- Legal Department

Part 3

After your team has provided their input on the effect the acquisition will have on their department, perform an overall analysis to explain your recommendation to the CEO. Your analysis should include the following:

- Explain how the company is trending based on the year-over-year ratios.

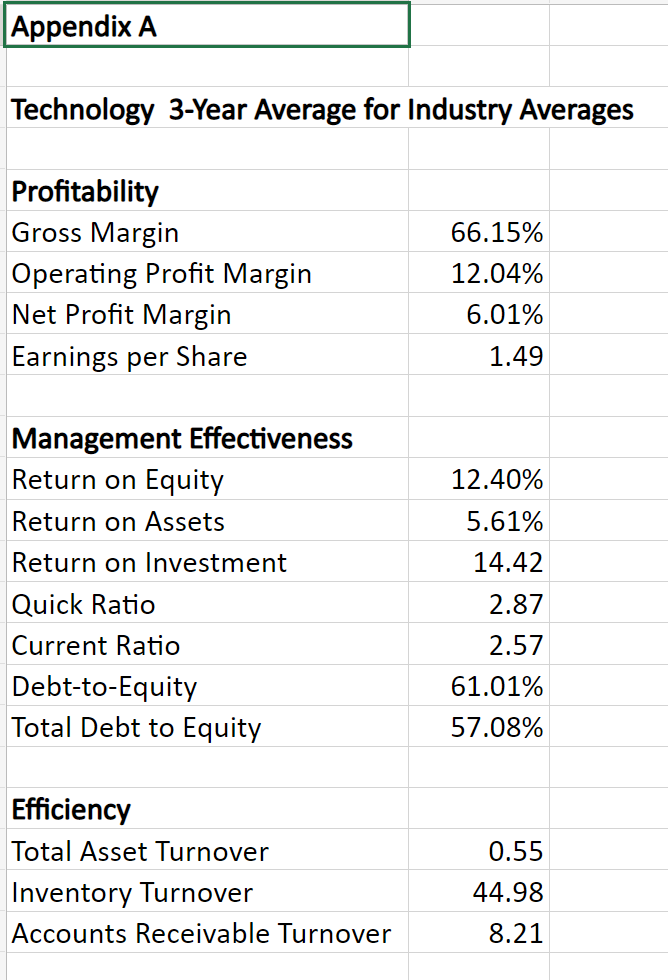

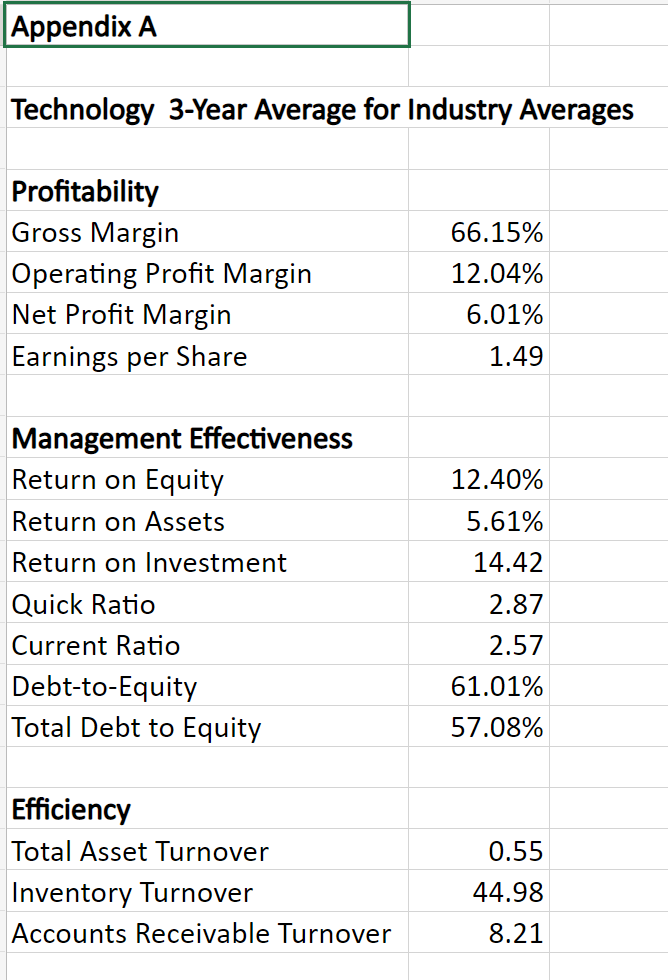

- Compare the company to the industry average in Appendix A in the Excel workbook in areas of profitability, management effectiveness, and efficiency.

- Based on the above, summarize the pros and cons of ABC Company using both the year-over-year ratio analysis from Part 1 and the industry average comparisons from Part 3.

- Provide the teams final recommendation as to whether or not the CEO should invest in ABC Company.

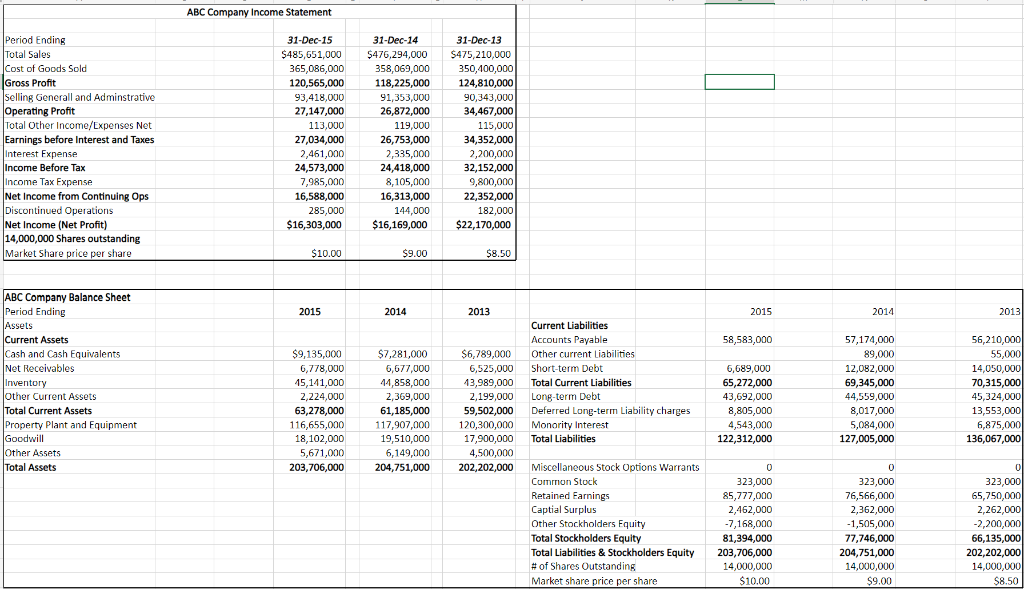

ABC Company Income Statement Period Ending Total Sales Cost of Goods Sold Gross Profit Selling Generall and Adminstrative Operating Profit Total Other Income/Expenses Net Earnings before Interest and Taxes Interest Expense Income Before Tax Income Tax Expense Net Income from Continuing Ops Discontinued Operations Net Income (Net Profit) 14,000,000 Shares outstanding Market share price per share 31-Dec-15 $485,651,000 365 086.000 120,565,000 93,418,000 27,147,000 113,000 27,034,000 2,461,000 24,573,000 7,985,000 16,588,000 285,000 $16,303,000 31-Dec-14 $476,294,000 358,069,000 118,225,000 91,353,000 26,872,000 119,000 26,753,000 2,335,000 31-Dec-13 $475,210,000 350.400.000 124,810,000 90,343,000 34,467,000 115,000 34,352,000 2,200,000 32,152,000 9,800,000 22,352,000 182,000 $22,170,000 24,418,000 8,105,000 16,313,000 144,000 $16,169,000 $10.00 $9.00 $8.50 2015 2014 2013 2015 2014 2013 58,583,000 ABC Company Balance Sheet Period Ending Assets Current Assets Cash and Cash Equivalents Net Receivables Inventory Other Current Assets Total Current Assets Property Plant and Equipment Goodwill Other Assets Total Assets $9,135,000 6,778,000 45,141,000 2,224,000 63,278,000 116,655,000 18,102,000 5,671,000 203,706,000 $7,281,000 6,677,000 41,858,000 2,369,000 61,185,000 117,907,000 19,510,000 6,149,000 204,751,000 $6,789,000 6,525,000 43,989,000 2,199,000 59,502,000 120,300,000 17,900,000 4,500,000 202,202,000 Current Liabilities Accounts Payable Other current Liabilities Short-term Debt Total Current Liabilities Long-term Debt Deferred Long-term Liability charges Monority Interest Total Liabilities 6,689,000 65,272,000 43,692,000 8,805,000 4,543,000 122,312,000 57,174,000 89,000 12,082,000 69,345,000 44,559,000 8,017,000 5,084,000 127,005,000 56,210,000 55,000 14,050,000 70,315,000 45,324,000 13,553,000 6,875,000 136,067,000 Miscellaneous Stock Options Warrants Common Stock Retained Earnings Captial Surplus Other Stockholders Equity Total Stockholders Equity Total Liabilities & Stockholders Equity # of Shares Outstanding Market share price per share 0 323,000 85,777,000 2,462,000 -7,168,000 81,394,000 203,706,000 14,000,000 $10.00 0 323,000 76,566,000 2,362,000 -1,505,000 77,746,000 204,751,000 14,000,000 $9.00 0 323,000 65,750,000 2,262,000 -2,200,000 66,135,000 202,202,000 14,000,000 $8.50 Ratio Calculations 2015 2014 2013 Formula Used (Write out formulas) Liquidity Ratios Current Ratio Quick Ratio Activity Ratios Inventory Turnover Accounts Recievables Turnover Total Asset Turnover Average Collection Period Financing Ratios Debt Ratio Debt-to-Equity Ratio Times Interest Earned Ratio Market Ratios Earnings per Share (EPS) Price Earnings (PE) Profitability Ratios Return on Equity (ROE) Return on Assets (ROA) Net Profit Margin Operating Profit Margin | Appendix A Technology 3-Year Average for Industry Averages Profitability Gross Margin Operating Profit Margin Net Profit Margin Earnings per Share 66.15% 12.04% 6.01% 1.49 12.40% 5.61% 14.42 Management Effectiveness Return on Equity Return on Assets Return on Investment Quick Ratio Current Ratio Debt-to-Equity Total Debt to Equity 2.87 2.57 61.01% 57.08% Efficiency Total Asset Turnover Inventory Turnover Accounts Receivable Turnover 0.55 44.98 8.21 ABC Company Income Statement Period Ending Total Sales Cost of Goods Sold Gross Profit Selling Generall and Adminstrative Operating Profit Total Other Income/Expenses Net Earnings before Interest and Taxes Interest Expense Income Before Tax Income Tax Expense Net Income from Continuing Ops Discontinued Operations Net Income (Net Profit) 14,000,000 Shares outstanding Market share price per share 31-Dec-15 $485,651,000 365 086.000 120,565,000 93,418,000 27,147,000 113,000 27,034,000 2,461,000 24,573,000 7,985,000 16,588,000 285,000 $16,303,000 31-Dec-14 $476,294,000 358,069,000 118,225,000 91,353,000 26,872,000 119,000 26,753,000 2,335,000 31-Dec-13 $475,210,000 350.400.000 124,810,000 90,343,000 34,467,000 115,000 34,352,000 2,200,000 32,152,000 9,800,000 22,352,000 182,000 $22,170,000 24,418,000 8,105,000 16,313,000 144,000 $16,169,000 $10.00 $9.00 $8.50 2015 2014 2013 2015 2014 2013 58,583,000 ABC Company Balance Sheet Period Ending Assets Current Assets Cash and Cash Equivalents Net Receivables Inventory Other Current Assets Total Current Assets Property Plant and Equipment Goodwill Other Assets Total Assets $9,135,000 6,778,000 45,141,000 2,224,000 63,278,000 116,655,000 18,102,000 5,671,000 203,706,000 $7,281,000 6,677,000 41,858,000 2,369,000 61,185,000 117,907,000 19,510,000 6,149,000 204,751,000 $6,789,000 6,525,000 43,989,000 2,199,000 59,502,000 120,300,000 17,900,000 4,500,000 202,202,000 Current Liabilities Accounts Payable Other current Liabilities Short-term Debt Total Current Liabilities Long-term Debt Deferred Long-term Liability charges Monority Interest Total Liabilities 6,689,000 65,272,000 43,692,000 8,805,000 4,543,000 122,312,000 57,174,000 89,000 12,082,000 69,345,000 44,559,000 8,017,000 5,084,000 127,005,000 56,210,000 55,000 14,050,000 70,315,000 45,324,000 13,553,000 6,875,000 136,067,000 Miscellaneous Stock Options Warrants Common Stock Retained Earnings Captial Surplus Other Stockholders Equity Total Stockholders Equity Total Liabilities & Stockholders Equity # of Shares Outstanding Market share price per share 0 323,000 85,777,000 2,462,000 -7,168,000 81,394,000 203,706,000 14,000,000 $10.00 0 323,000 76,566,000 2,362,000 -1,505,000 77,746,000 204,751,000 14,000,000 $9.00 0 323,000 65,750,000 2,262,000 -2,200,000 66,135,000 202,202,000 14,000,000 $8.50 Ratio Calculations 2015 2014 2013 Formula Used (Write out formulas) Liquidity Ratios Current Ratio Quick Ratio Activity Ratios Inventory Turnover Accounts Recievables Turnover Total Asset Turnover Average Collection Period Financing Ratios Debt Ratio Debt-to-Equity Ratio Times Interest Earned Ratio Market Ratios Earnings per Share (EPS) Price Earnings (PE) Profitability Ratios Return on Equity (ROE) Return on Assets (ROA) Net Profit Margin Operating Profit Margin | Appendix A Technology 3-Year Average for Industry Averages Profitability Gross Margin Operating Profit Margin Net Profit Margin Earnings per Share 66.15% 12.04% 6.01% 1.49 12.40% 5.61% 14.42 Management Effectiveness Return on Equity Return on Assets Return on Investment Quick Ratio Current Ratio Debt-to-Equity Total Debt to Equity 2.87 2.57 61.01% 57.08% Efficiency Total Asset Turnover Inventory Turnover Accounts Receivable Turnover 0.55 44.98 8.21