Answered step by step

Verified Expert Solution

Question

1 Approved Answer

working through required 1,2,3 b. What differences (if any) do you observe between the format of LVMH's consolidated cash flow state- ment under IRS and

working through required 1,2,3

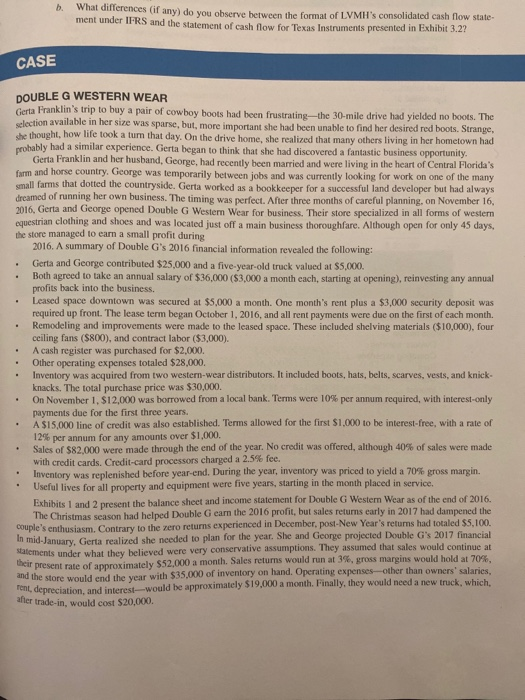

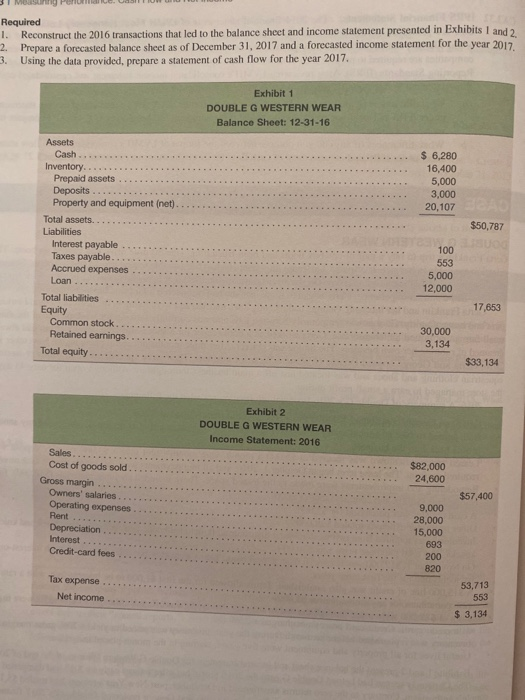

b. What differences (if any) do you observe between the format of LVMH's consolidated cash flow state- ment under IRS and the statement of cash flow for Texas Instruments presented in Exhibit 3.2? CASE DOUBLE G WESTERN WEAR Gerta Franklin's trip to buy a pair of cowboy boots had been frustrating the 30-mile drive had yielded no boots. The election available in her size was sparse, but, more important she had been unable to find her desired red boots. Strange, he thought, how life took a turn that day. On the drive home, she realized that many others living in her hometown had robably had a similar experience. Gerta began to think that she had discovered a fantastic business opportunity Gerta Franklin and her husband, George, had recently been married and were living in the heart of Central Florida's farm and horse country, George was temporarily between jobs and was currently looking for work on one of the many mall farms that dotted the countryside. Gerta worked as a bookkeeper for a successful land developer but had always dreamed of running her own business. The timing was perfect. After three months of careful planning, on November 16, 2016, Gerta and George opened Double G Western Wear for business. Their store specialized in all forms of western nuestrian clothing and shoes and was located just off a main business thoroughfare. Although open for only 45 days. the store managed to earn a small profit during 2016. A summary of Double G's 2016 financial information revealed the following: . Gerta and George contributed $25,000 and a five-year-old truck valued at $5,000. Both agreed to take an annual salary of $36,000 ($3,000 a month each, starting at opening), reinvesting any annual profits back into the business. Leased space downtown was secured at $5,000 a month. One month's rent plus a $3,000 security deposit was required up front. The lease term began October 1, 2016, and all rent payments were due on the first of each month. Remodeling and improvements were made to the leased space. These included shelving materials ($10,000), four ceiling fans ($800), and contract labor ($3.000). A cash register was purchased for $2,000. Other operating expenses totaled $28,000. Inventory was acquired from two western-wear distributors. It included boots, hats, belts, scarves, vests, and knick- knacks. The total purchase price was $30,000. On November 1, $12,000 was borrowed from a local bank. Terms were 10% per annum required, with interest-only payments due for the first three years. A $15.000 line of credit was also established. Terms allowed for the first $1.0XXO to be interest-free with a rate of 12% per annum for any amounts over $1,000. Sales of $82,000 were made through the end of the year. No credit was offered, although 40% of sales were made with credit cards. Credit card processors charged a 2.5% fee. Inventory was replenished before year-end. During the year, inventory was priced to yield a 70% gross margin. Useful lives for all property and equipment were five years, starting in the month placed in service, Exhibits 1 and 2 present the balance sheet and income statement for Double G Western Wear as of the end of 2016. The Christmas season had helped Double G earn the 2016 profit, but sales retums early in 2017 had dampened the couple's enthusiasm. Contrary to the yero returns experienced in December, post-New Year's returns had totaled $5.100 in mid-January, Gerta realized she needed to plan for the year. She and George projected Double G's 2017 financial satements under what they believed were very conservative assumptions. They assumed that sales would continue at their present rate of approximately $52.000 a month. Sales returns would run at 3%, gross margins would hold at 2016 other than owners' salaries and the store would end the year with $35.000 of inventory on hand. Operating expenses fent, depreciation and interest would be approximately $19.000 a month. Finally, they would need a new truck, which after trade-in, would cost $20,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started