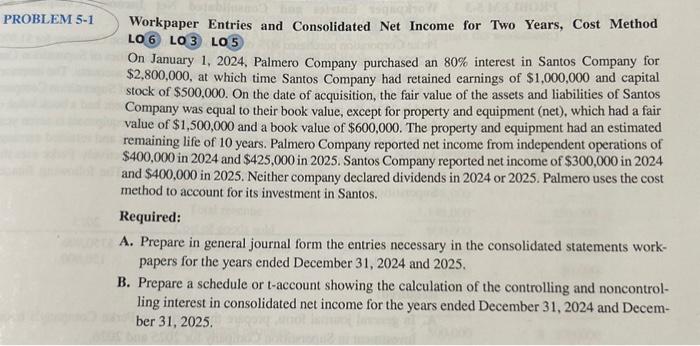

Workpaper Entries and Consolidated Net Income for Two Years, Cost Method LO 6 LO 3 LO 5 On January 1, 2024, Palmero Company purchased an 80% interest in Santos Company for $2,800,000, at which time Santos Company had retained earnings of $1,000,000 and capital stock of $500,000. On the date of acquisition, the fair value of the assets and liabilities of Santos Company was equal to their book value, except for property and equipment (net), which had a fair value of $1,500,000 and a book value of $600,000. The property and equipment had an estimated remaining life of 10 years. Palmero Company reported net income from independent operations of $400,000 in 2024 and $425,000 in 2025. Santos Company reported net income of $300,000 in 2024 and $400,000 in 2025. Neither company declared dividends in 2024 or 2025. Palmero uses the cost method to account for its investment in Santos. Required: A. Prepare in general journal form the entries necessary in the consolidated statements workpapers for the years ended December 31, 2024 and 2025. B. Prepare a schedule or t-account showing the calculation of the controlling and noncontrolling interest in consolidated net income for the years ended December 31, 2024 and December 31,2025. Workpaper Entries and Consolidated Net Income for Two Years, Cost Method LO 6 LO 3 LO 5 On January 1, 2024, Palmero Company purchased an 80% interest in Santos Company for $2,800,000, at which time Santos Company had retained earnings of $1,000,000 and capital stock of $500,000. On the date of acquisition, the fair value of the assets and liabilities of Santos Company was equal to their book value, except for property and equipment (net), which had a fair value of $1,500,000 and a book value of $600,000. The property and equipment had an estimated remaining life of 10 years. Palmero Company reported net income from independent operations of $400,000 in 2024 and $425,000 in 2025. Santos Company reported net income of $300,000 in 2024 and $400,000 in 2025. Neither company declared dividends in 2024 or 2025. Palmero uses the cost method to account for its investment in Santos. Required: A. Prepare in general journal form the entries necessary in the consolidated statements workpapers for the years ended December 31, 2024 and 2025. B. Prepare a schedule or t-account showing the calculation of the controlling and noncontrolling interest in consolidated net income for the years ended December 31, 2024 and December 31,2025