Answered step by step

Verified Expert Solution

Question

1 Approved Answer

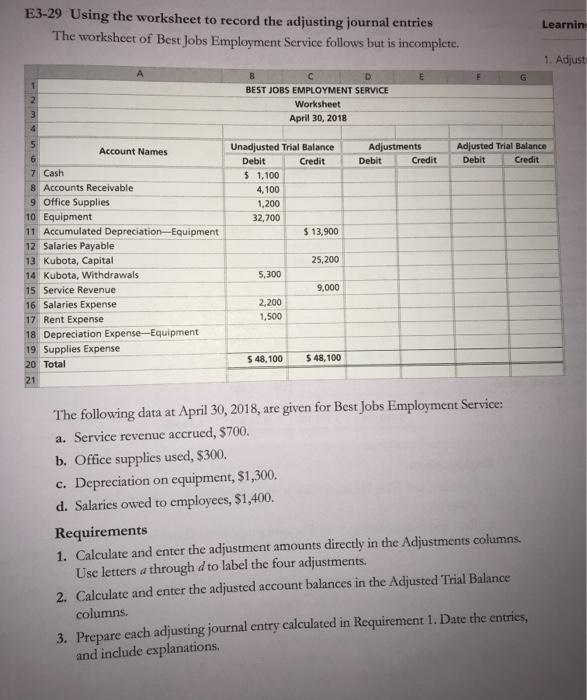

Worksheet for rush advisory service adjustments and adjusted trial only E3-29 Using the worksheet to record the adjusting journal entries The worksheet of Best Jobs

Worksheet for rush advisory service adjustments and adjusted trial only

E3-29 Using the worksheet to record the adjusting journal entries The worksheet of Best Jobs Employment Service follows but is incomplete. 1 2 3 4 5 6 7 Cash 8 Accounts Receivable 9 Office Supplies Account Names 10 Equipment 11 Accumulated Depreciation-Equipment 12 Salaries Payable 13 Kubota, Capital 14 Kubota, Withdrawals 15 Service Revenue 16 Salaries Expense 17 Rent Expense 18 Depreciation Expense-Equipment. 19 Supplies Expense 20 Total 21 8 C D BEST JOBS EMPLOYMENT SERVICE Worksheet April 30, 2018 Unadjusted Trial Balance Debit Credit $1,100 4,100 1,200 32,700 5,300 2,200 1,500 $ 13,900 25,200 9,000 $ 48,100 $ 48,100 E Adjustments Debit Credit The following data at April 30, 2018, are given for Best Jobs Employment Service: a. Service revenue accrued, $700. b. Office supplies used, $300. c. Depreciation on equipment, $1,300. d. Salaries owed to employees, $1,400, Adjusted Trial Balance Debit Credit Requirements 1. Calculate and enter the adjustment amounts directly in the Adjustments columns. Use letters a through d to label the four adjustments. 2. Calculate and enter the adjusted account balances in the Adjusted Trial Balance columns. Learnin 3. Prepare each adjusting journal entry calculated in Requirement 1. Date the entries, and include explanations. 1. Adjust

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Here are the steps to complete the worksheet and recording the adjusting journal entries 1 Calculate and enter the adjustment amounts directly in the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started