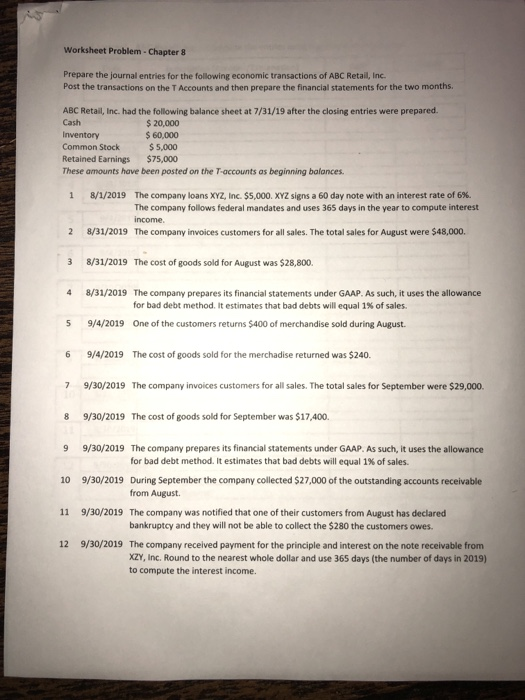

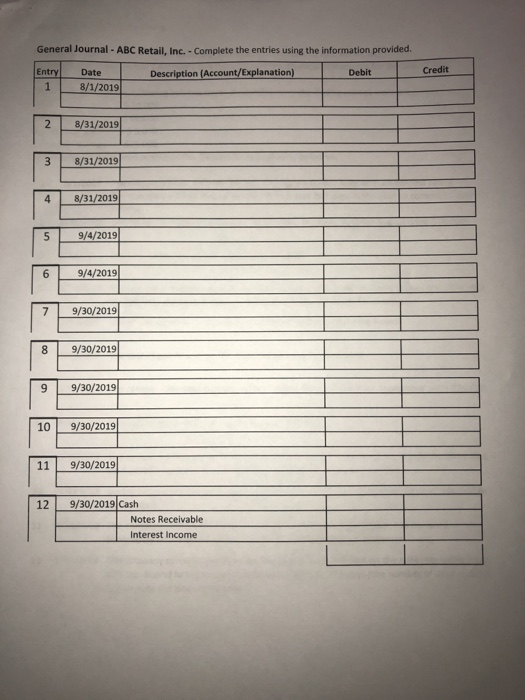

Worksheet Problem - Chapter 8 Prepare the journal entries for the following economic transactions of ABC Retail, Inc. Post the transactions on the T Accounts and then prepare the financial statements for the two months ABC Retail, Inc. had the following balance sheet at 7/31/19 after the closing entries were prepared. Cash $ 20,000 Inventory $ 60,000 Common Stock $5,000 Retained Earnings $75,000 These amounts have been posted on the T-accounts as beginning balances. 1 8/1/2019 The company loans XYZ, Inc. $5,000.XYZ signs a 60 day note with an interest rate of 6%. The company follows federal mandates and uses 365 days in the year to compute interest income. 8/31/2019 The company invoices customers for all sales. The total sales for August were $48,000. 2 3 8/31/2019 The cost of goods sold for August was $28,800. 4 8/31/2019 The company prepares its financial statements under GAAP. As such, it uses the allowance for bad debt method. It estimates that bad debts will equal 1% of sales. 5 9/4/2019 One of the customers returns $400 of merchandise sold during August 6 9/4/2019 The cost of goods sold for the merchadise returned was $240. 7 9/30/2019 The company invoices customers for all sales. The total sales for September were $29,000. 8 9/30/2019 The cost of goods sold for September was $17,400. 9 10 11 9/30/2019 The company prepares its financial statements under GAAP. As such, it uses the allowance for bad debt method. It estimates that bad debts will equal 1% of sales 9/30/2019 During September the company collected $27,000 of the outstanding accounts receivable from August 9/30/2019 The company was notified that one of their customers from August has declared bankruptcy and they will not be able to collect the $280 the customers owes 9/30/2019 The company received payment for the principle and interest on the note receivable from XZY, Inc. Round to the nearest whole dollar and use 365 days (the number of days in 2019) to compute the interest income. 12 General Journal - ABC Retail, Inc. - Complete the entries using the information provided. Entry Date Description (Account/Explanation) Debit 8/1/2019 Credit 2 8 /31/2019 8/31/2019 8/31/2019) 9/4/2019 9/4/2019 JEEEEEEEEEEEE 9 1 /4/201 HHHHHHHHHH 9/30/2019 1? 9/30/2019 9/30/2019 3,30/2019 9/30/2019 HHH 9/30/2019 9/30/2019 12 9/30/2019 Cash Notes Receivable Interest Income